EXHIBIT 99.2 INVESTOR SLIDES

Published on July 26, 2018

Exhibit 99.2 POISED FOR TRANSFORMATIONAL GROWTH July 26, 2018 Steve Fisher President and Chief Executive Officer © 2018 Novelis

SAFE HARBOR STATEMENT Forward-looking statements Statements made in this presentation which describe Novelis' intentions, expectations, beliefs or predictions may be forward- looking statements within the meaning of securities laws. Forward-looking statements include statements preceded by, followed by, or including the words "believes," "expects," "anticipates," "plans," "estimates," "projects," "forecasts," or similar expressions. Examples of forward-looking statements in this presentation including statements concerning anticipated run rate cost synergies resulting from the transaction and forecasts of net debt to EBITDA ratios. Novelis cautions that, by their nature, forward-looking statements involve risk and uncertainty and that Novelis' actual results could differ materially from those expressed or implied in such statements. We do not intend, and we disclaim, any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. Factors that could cause actual results or outcomes to differ from the results expressed or implied by forward-looking statements include, among other things: changes in the prices and availability of aluminum (or premiums associated with such prices) or other materials and raw materials we use; the capacity and effectiveness of our hedging activities; relationships with, and financial and operating conditions of, our customers, suppliers and other stakeholders; fluctuations in the supply of, and prices for, energy in the areas in which we maintain production facilities; our ability to access financing for future capital requirements; changes in the relative values of various currencies and the effectiveness of our currency hedging activities; factors affecting our operations, such as litigation, environmental remediation and clean-up costs, labor relations and negotiations, breakdown of equipment and other events; the impact of restructuring efforts in the future; economic, regulatory and political factors within the countries in which we operate or sell our products, including changes in duties or tariffs; competition from other aluminum rolled products producers as well as from substitute materials such as steel, glass, plastic and composite materials; changes in general economic conditions including deterioration in the global economy, particularly sectors in which our customers operate; cyclical demand and pricing within the principal markets for our products as well as seasonality in certain of our customers’ industries; changes in government regulations, particularly those affecting taxes, environmental, health or safety compliance; changes in interest rates that have the effect of increasing the amounts we pay under our credit facilities and other financing agreements; the effect of taxes and changes in tax rates; and our ability to generate cash. The above list of factors is not exhaustive. Other important risk factors included under the caption "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended March 31, 2018 are specifically incorporated by reference into this presentation. © 2018 Novelis 2

© 2018 Novelis 3

OVERVIEW . Signed definitive agreement to purchase Aleris for ~$2.58B ($775M in cash for the equity, and the assumption of debt); expected to close in 9 to 15 months . Earn-out linked to achievement beyond base business plan during CY18-20 for North America with a cumulative cap of $50M . Aleris is poised for transformational growth with ~$900M invested over the past 5 years . Acquisition provides a number of significant strategic benefits: . Diversifies product portfolio, addition of high-end Aerospace . Enhances and complements Asia operations . Strengthens ability to meet automotive demand . 100% debt-funded deal; Net Debt/Adjusted EBITDA forecasted to peak below 4x at close; return to 3x within two years © 2018 Novelis 4

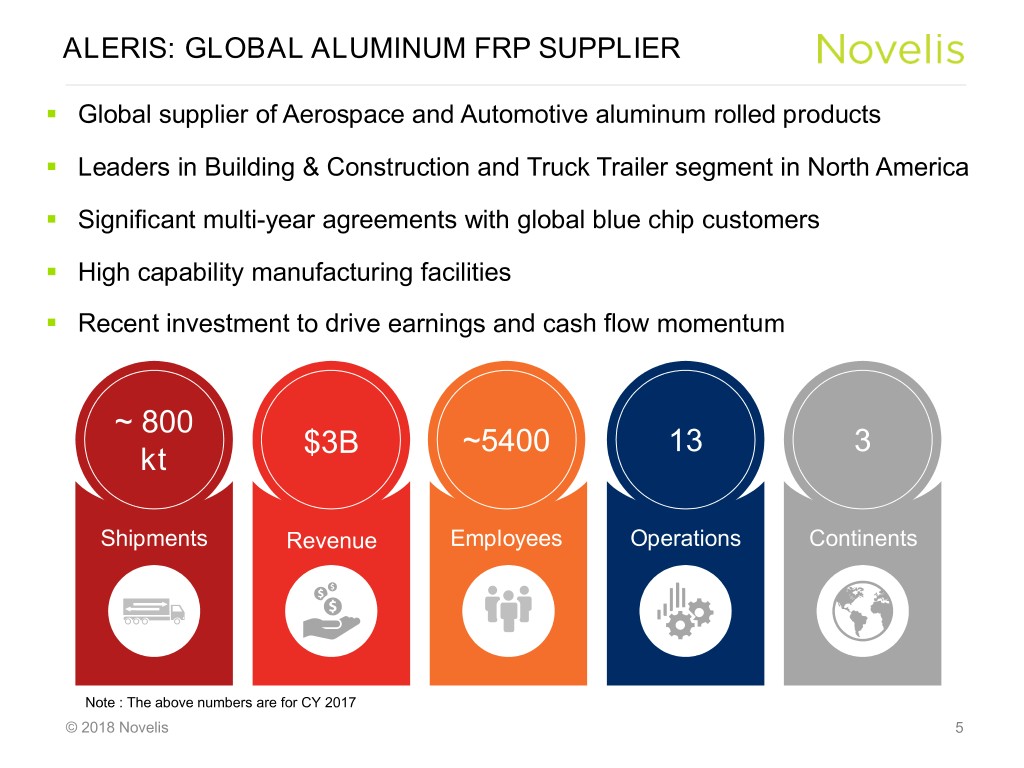

ALERIS: GLOBAL ALUMINUM FRP SUPPLIER . Global supplier of Aerospace and Automotive aluminum rolled products . Leaders in Building & Construction and Truck Trailer segment in North America . Significant multi-year agreements with global blue chip customers . High capability manufacturing facilities . Recent investment to drive earnings and cash flow momentum ~ 800 $3B ~5400 13 3 kt Shipments Revenue Employees Operations Continents Note : The above numbers are for CY 2017 © 2018 Novelis 5

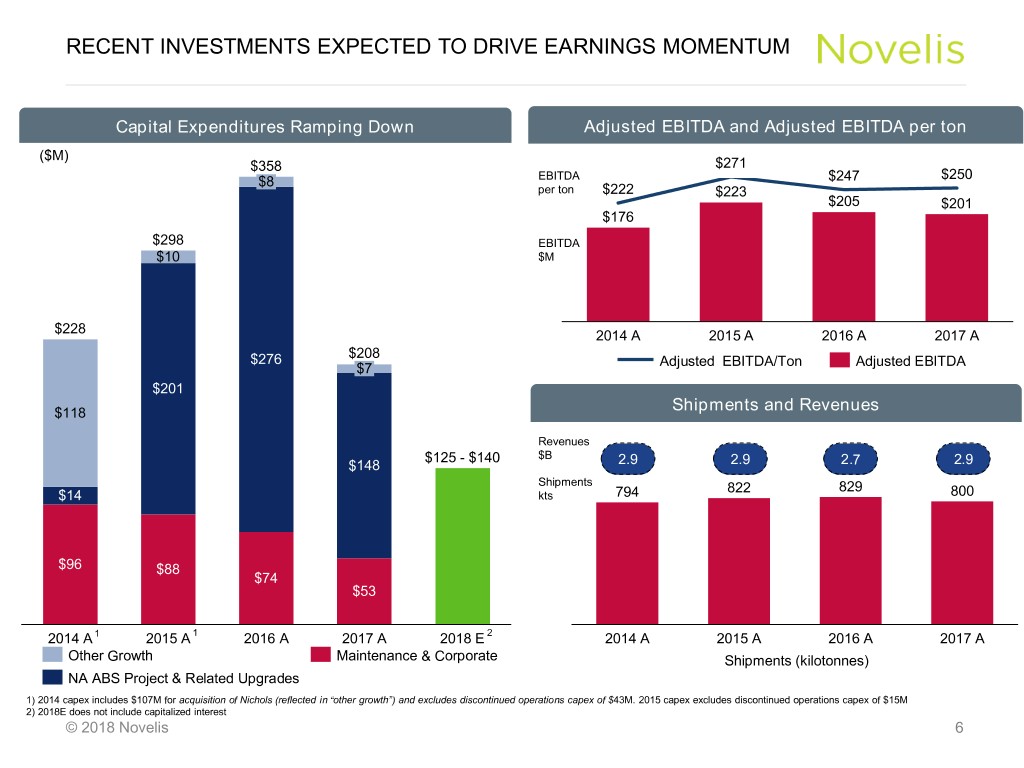

RECENT INVESTMENTS EXPECTED TO DRIVE EARNINGS MOMENTUM Capital Expenditures Ramping Down Adjusted EBITDA and Adjusted EBITDA per ton ($M) $358 $271 $250 $8 EBITDA $247 per ton $222 $223 $205 $201 $176 4 5 $298 EBITDA $10 $M $228 2014 A 2015 A 2016 A 2017 A $208 $276 Adjusted EBITDA/Ton Adjusted EBITDA $7 $201 $118 Shipments and Revenues Revenues $125 - $140 $B $148 2.9 2.9 2.7 2.9 Shipments 822 829 $14 kts 794 800 $96 $88 $74 $53 1 1 2 2014 A 1 2015 A 1 2016 A 2017 A 2018 E 2 2014 A 2015 A 2016 A 2017 A Other Growth Maintenance & Corporate Shipments (kilotonnes) NA ABS Project & Related Upgrades 1) 2014 capex includes $107M for acquisition of Nichols (reflected in “other growth”) and excludes discontinued operations capex of $43M. 2015 capex excludes discontinued operations capex of $15M 2) 2018E does not include capitalized interest © 2018 Novelis 6

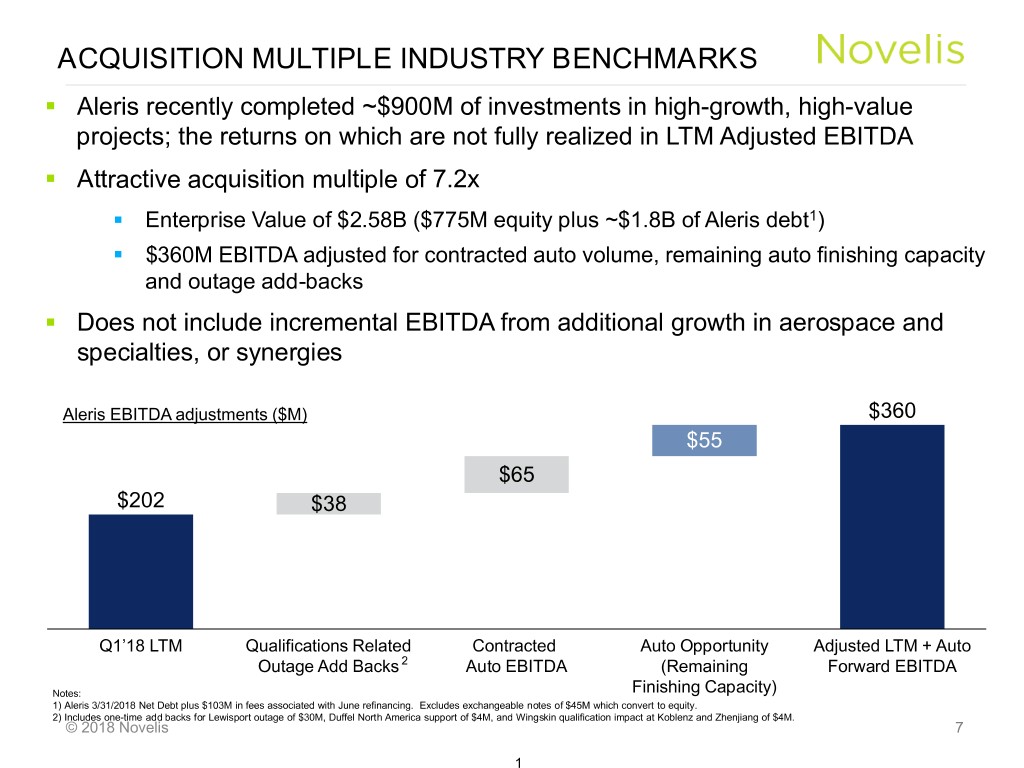

ACQUISITION MULTIPLE INDUSTRY BENCHMARKS . Aleris recently completed ~$900M of investments in high-growth, high-value projects; the returns on which are not fully realized in LTM Adjusted EBITDA . Attractive acquisition multiple of 7.2x . Enterprise Value of $2.58B ($775M equity plus ~$1.8B of Aleris debt1) . $360M EBITDA adjusted for contracted auto volume, remaining auto finishing capacity and outage add-backs . Does not include incremental EBITDA from additional growth in aerospace and specialties, or synergies Aleris EBITDA adjustments ($M) $360 $55 $65 $202 $38 Q1’18 LTM Qualifications Related Contracted Auto Opportunity Adjusted LTM + Auto Outage Add Backs 2 Auto EBITDA (Remaining Forward EBITDA Notes: Finishing Capacity) 1) Aleris 3/31/2018 Net Debt plus $103M in fees associated with June refinancing. Excludes exchangeable notes of $45M which convert to equity. 2) Includes one-time add backs for Lewisport outage of $30M, Duffel North America support of $4M, and Wingskin qualification impact at Koblenz and Zhenjiang of $4M. © 2018 Novelis 7 1

STRATEGIC RATIONALE Recently completed strategic investments complement Novelis assets and capabilities Leverage Novelis’ deep manufacturing expertise to optimize Aleris’ assets Diversify product portfolio with addition of high-value segments Enhances and complements Asia operations Strengthens ability to meet automotive customer demand Strong pro-forma financial profile © 2018 Novelis 8

STRATEGIC INVESTMENT PHASE COMPLETED NORTH AMERICA EUROPE ASIA Automotive Automotive Aerospace $425M auto body sheet $85M auto body sheet $350M aerospace investment in Lewisport investment in Duffel investment in China . Automotive readiness spend . One of the widest automotive . Built to exacting, state-of-the- complete sheet capabilities in Europe art standards . Significant customer . Working with long-standing . Western OEM Aerospace commitments / multi-year global OEM customers qualifications in place agreements . Significant new alloys with . Commercial shipments multi-year agreements underway Leverage Novelis expertise to further optimize Aleris’ assets © 2018 Novelis 9

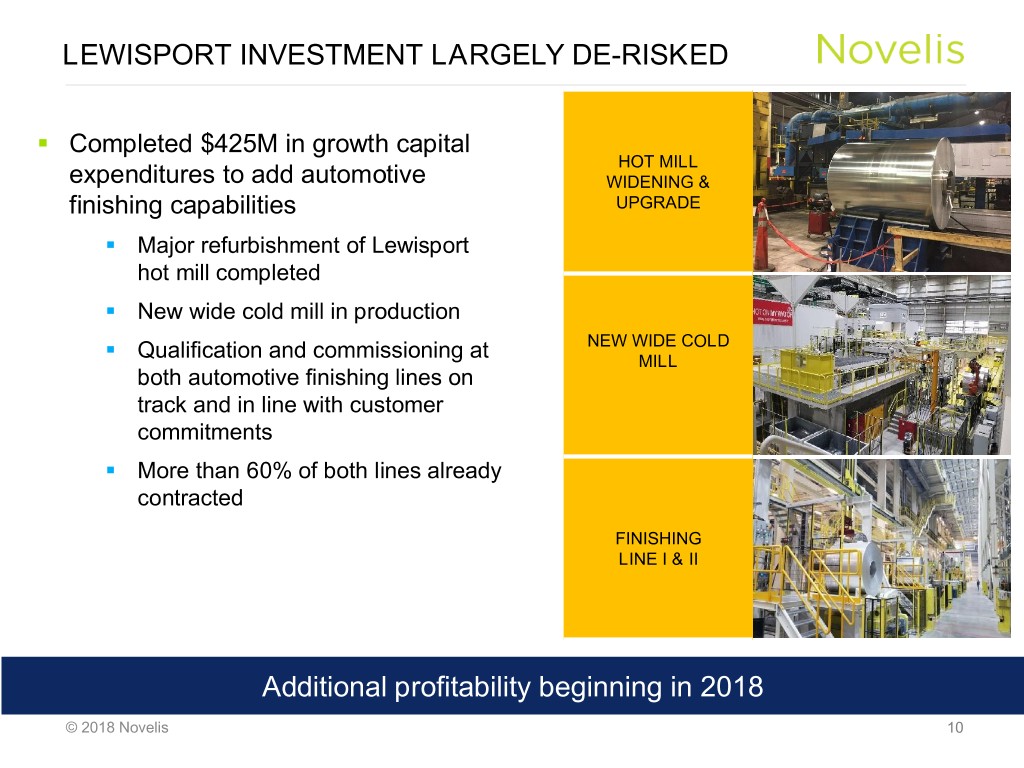

LEWISPORT INVESTMENT LARGELY DE-RISKED . Completed $425M in growth capital HOT MILL expenditures to add automotive WIDENING & finishing capabilities UPGRADE . Major refurbishment of Lewisport hot mill completed . New wide cold mill in production . NEW WIDE COLD Qualification and commissioning at MILL both automotive finishing lines on track and in line with customer commitments . More than 60% of both lines already contracted FINISHING LINE I & II Additional profitability beginning in 2018 © 2018 Novelis 10

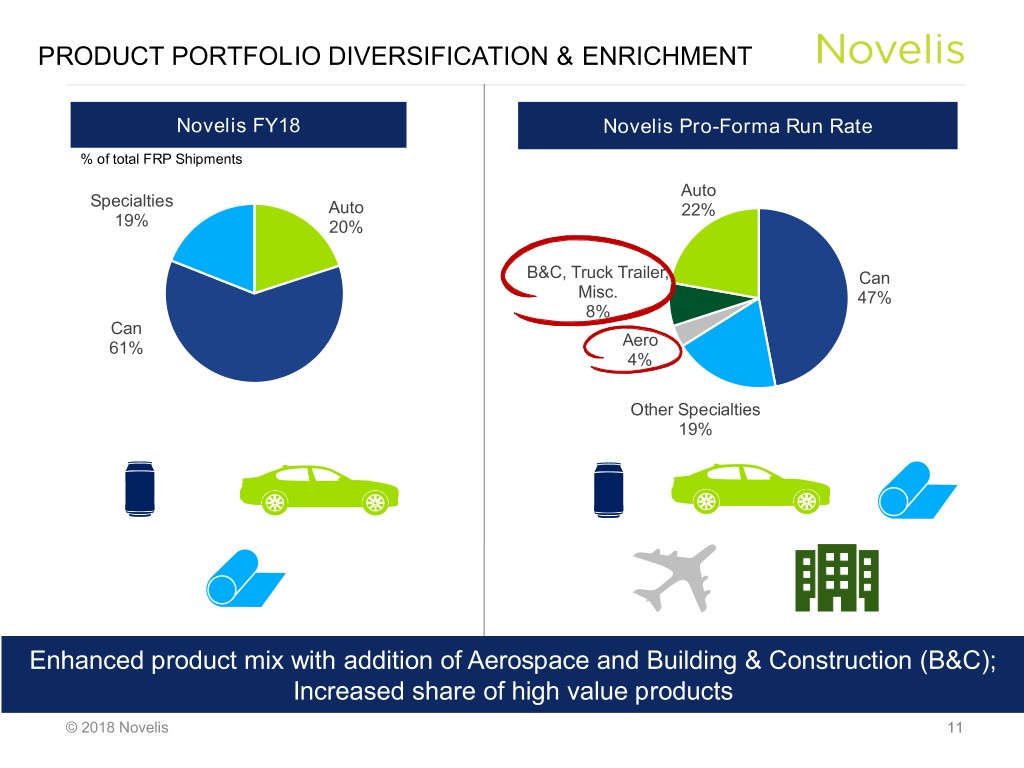

PRODUCT PORTFOLIO DIVERSIFICATION & ENRICHMENT Novelis FY18 Novelis Pro-Forma Run Rate % of total FRP Shipments Auto Specialties Auto 22% 19% 20% B&C, Truck Trailer, Can Misc. 47% 8% Can 61% Aero 4% Other Specialties 19% Enhanced product mix with addition of Aerospace and Building & Construction (B&C); Increased share of high value products © 2018 Novelis 11

ENTRY INTO NEW SEGMENT - AEROSPACE Key Customers . Novelis to enter high-end aerospace segment . Well established technological capabilities . R&D at Koblenz, Germany . Long-term contracted business with blue chip- customers . High value product mix in core Aero plate and sheet World-class Aerospace plate facilities in Europe and Asia © 2018 Novelis 12

EFFICIENT CONTINUOUS CAST BUSINESS . Leading positions in North Key Customers America Building & Construction and Truck Trailer . Advanced scrap processing capabilities . High recycled content . Cost effective business with streamlined product mix . Long standing customer relationships . Demand driven by positive trends in US market fundamentals Largest, most flexible continuous cast network serving North America © 2018 Novelis 13

GROWTH AND INTEGRATION IN ASIA . Leverage underutilized hot mill capacity at Zhenjiang to support continued aerospace and automotive growth . Invest in additional cold mill capacity and upgrades to fully integrate and supply downstream Novelis automotive finishing lines . Capture integration efficiencies . Access to lower-cost SHFE metal . Develop closed loop recycling systems . Reduced logistics cost due to proximity (~80km) between Zhenjiang and Changzhou Enhances existing Asia footprint for growth © 2018 Novelis 14

AUTO LEADERSHIP - STRENGTHENS ABILITY TO CAPTURE GROWTH . Enhances ability to innovate and compete against steel . Diversifies automotive customer base and Oswego, New York Sierre, Switzerland vehicle platforms . Larger asset base mitigates risk Novelis Kingston, Ontario Nachterstedt, Germany Guthrie, Kentucky Changzhou, China Aleris Lewisport, Kentucky Duffel, Belgium Expands asset base and diversifies customer portfolio © 2018 Novelis 15

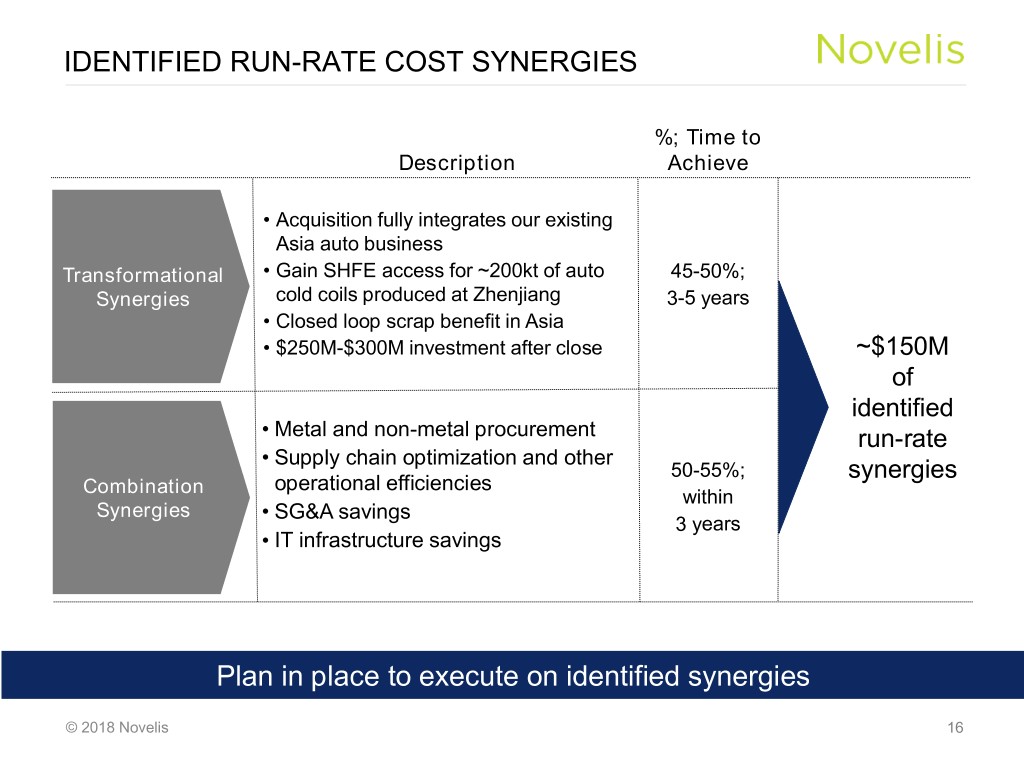

IDENTIFIED RUN-RATE COST SYNERGIES %; Time to Description Achieve • Acquisition fully integrates our existing Asia auto business Transformational • Gain SHFE access for ~200kt of auto 45-50%; Synergies cold coils produced at Zhenjiang 3-5 years • Closed loop scrap benefit in Asia • $250M-$300M investment after close ~$150M of identified • Metal and non-metal procurement run-rate • Supply chain optimization and other 50-55%; synergies Combination operational efficiencies within Synergies • SG&A savings 3 years • IT infrastructure savings Plan in place to execute on identified synergies © 2018 Novelis 16

STRONG PRO-FORMA FINANCIAL PROFILE . Expected strong financial profile and significant cash flow generation from combined company . Transformational investments at Aleris already complete, with strong earnings potential . Benefit from ~$150M in synergies . Net Debt/Adjusted EBITDA forecasted to peak below 4x at close; return to 3x within two years . Forecast net income and free cash flow accretive within one year after close . Earn-out linked to achievement beyond base business plan during CY18-20 for North America with a cumulative cap of $50M . 50/50 sharing above business plan up to maximum aligns incentives on auto ramp-up prior to close . All cost synergies effectively excluded from the earn-out and accrue to Novelis © 2018 Novelis 17

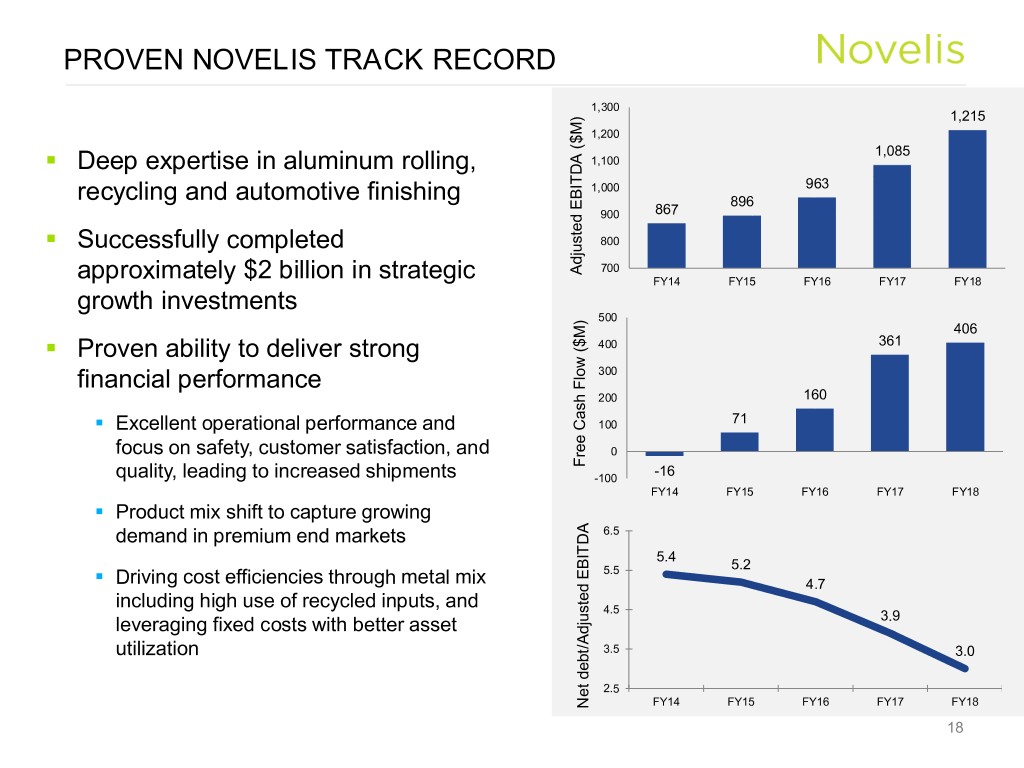

PROVEN NOVELIS TRACK RECORD 1,300 1,215 1,200 . 1,085 Deep expertise in aluminum rolling, 1,100 1,000 963 recycling and automotive finishing 896 900 867 . Successfully completed 800 700 Adjusted EBITDA ($M) EBITDA Adjusted approximately $2 billion in strategic FY14 FY15 FY16 FY17 FY18 growth investments 500 406 . Proven ability to deliver strong 400 361 financial performance 300 200 160 . 71 Excellent operational performance and 100 focus on safety, customer satisfaction, and 0 Free Cash Flow Flow ($M) Cash Free -16 quality, leading to increased shipments -100 FY14 FY15 FY16 FY17 FY18 . Product mix shift to capture growing demand in premium end markets 6.5 5.4 . 5.5 5.2 Driving cost efficiencies through metal mix EBITDA 4.7 including high use of recycled inputs, and 4.5 leveraging fixed costs with better asset 3.9 utilization 3.5 3.0 debt/Adjusted 2.5 FY14 FY15 FY16 FY17 FY18 Net Net © 2018 Novelis 18

THANK YOU AND QUESTIONS THANK YOU QUESTIONS? © 2018 Novelis

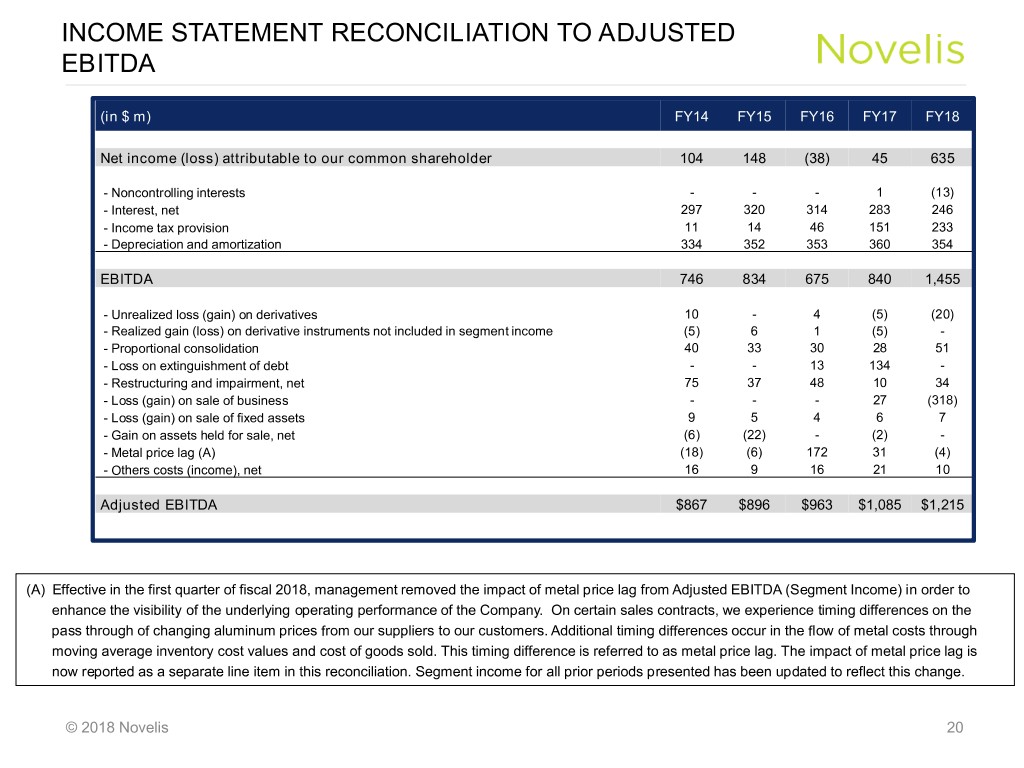

INCOME STATEMENT RECONCILIATION TO ADJUSTED EBITDA (in $ m) FY14 FY15 FY16 FY17 FY18 Net income (loss) attributable to our common shareholder 104 148 (38) 45 635 - Noncontrolling interests - - - 1 (13) - Interest, net 297 320 314 283 246 - Income tax provision 11 14 46 151 233 - Depreciation and amortization 334 352 353 360 354 EBITDA 746 834 675 840 1,455 - Unrealized loss (gain) on derivatives 10 - 4 (5) (20) - Realized gain (loss) on derivative instruments not included in segment income (5) 6 1 (5) - - Proportional consolidation 40 33 30 28 51 - Loss on extinguishment of debt - - 13 134 - - Restructuring and impairment, net 75 37 48 10 34 - Loss (gain) on sale of business - - - 27 (318) - Loss (gain) on sale of fixed assets 9 5 4 6 7 - Gain on assets held for sale, net (6) (22) - (2) - - Metal price lag (A) (18) (6) 172 31 (4) - Others costs (income), net 16 9 16 21 10 Adjusted EBITDA $867 $896 $963 $1,085 $1,215 (A) Effective in the first quarter of fiscal 2018, management removed the impact of metal price lag from Adjusted EBITDA (Segment Income) in order to enhance the visibility of the underlying operating performance of the Company. On certain sales contracts, we experience timing differences on the pass through of changing aluminum prices from our suppliers to our customers. Additional timing differences occur in the flow of metal costs through moving average inventory cost values and cost of goods sold. This timing difference is referred to as metal price lag. The impact of metal price lag is now reported as a separate line item in this reconciliation. Segment income for all prior periods presented has been updated to reflect this change. © 2018 Novelis 20

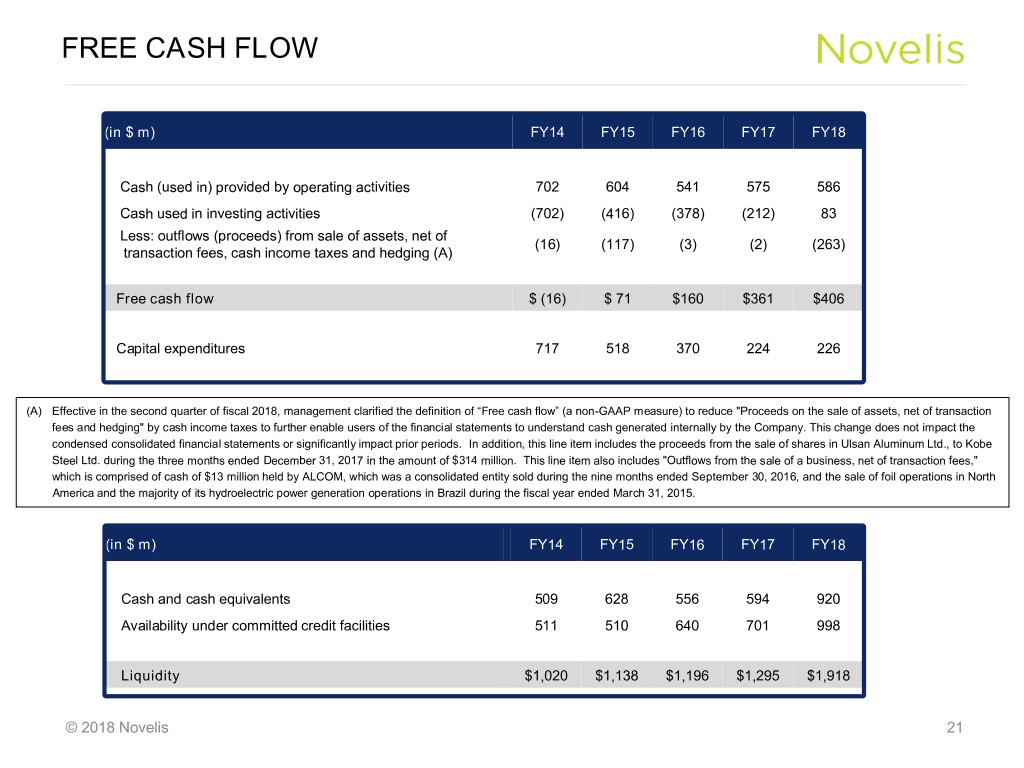

FREE CASH FLOW (in $ m) FY14 FY15 FY16 FY17 FY18 Cash (used in) provided by operating activities 702 604 541 575 586 Cash used in investing activities (702) (416) (378) (212) 83 Less: outflows (proceeds) from sale of assets, net of (16) (117) (3) (2) (263) transaction fees, cash income taxes and hedging (A) Free cash flow $ (16) $ 71 $160 $361 $406 Capital expenditures 717 518 370 224 226 (A) Effective in the second quarter of fiscal 2018, management clarified the definition of “Free cash flow” (a non-GAAP measure) to reduce "Proceeds on the sale of assets, net of transaction fees and hedging" by cash income taxes to further enable users of the financial statements to understand cash generated internally by the Company. This change does not impact the condensed consolidated financial statements or significantly impact prior periods. In addition, this line item includes the proceeds from the sale of shares in Ulsan Aluminum Ltd., to Kobe Steel Ltd. during the three months ended December 31, 2017 in the amount of $314 million. This line item also includes "Outflows from the sale of a business, net of transaction fees," which is comprised of cash of $13 million held by ALCOM, which was a consolidated entity sold during the nine months ended September 30, 2016, and the sale of foil operations in North America and the majority of its hydroelectric power generation operations in Brazil during the fiscal year ended March 31, 2015. (in $ m) FY14 FY15 FY16 FY17 FY18 Cash and cash equivalents 509 628 556 594 920 Availability under committed credit facilities 511 510 640 701 998 Liquidity $1,020 $1,138 $1,196 $1,295 $1,918 © 2018 Novelis 21