EXHIBIT 10.40 MARTENS SEPARATION

Published on May 12, 2015

Exhibit 10.40

April 22, 2015

Mr. Philip Martens

Re: Separation and Release Agreement

Dear Phil:

This is a Separation and Release Agreement (“Agreement”) entered into by and between you (“Employee”) and Novelis Inc. (“Novelis”)(Employee and Novelis may be referred to collectively as the “Parties”). This Agreement provides the terms of separation of and transition from your employment with Novelis. Accordingly, in consideration of the mutual promises set forth in this Agreement, the adequacy and sufficiency of which the Parties acknowledge, Novelis and Employee agree as follows:

1.Separation Date. Employee’s employment relationship with Novelis is terminated effective April 20, 2015 (“Separation Date”).

2.Separation Incentive. Provided that before May 22, 2015 (the “Severance Payment Date”), Employee timely signs this Agreement, returns the Agreement and does not revoke the Agreement as further set forth in paragraph 4 below, and provided Employee has complied with his obligations as set forth in paragraph 5(e) below, Employee will be entitled to the following benefits (the “Separation Incentive”):

(a) |

On the Severance Payment Date, Employee will be paid a lump sum severance payment in the gross total amount of $4,830,000.00, less required taxes, deductions and withholdings; and |

(b) |

On the Severance Payment Date, Employee will be paid a lump sum medical continuation payment in the gross total amount of $31,313.00, less required taxes, deductions and withholdings; and |

(c) |

As of the Severance Payment Date, Employee’s account under the Novelis Defined Contribution Supplemental Executive Retirement Plan will be credited with a lump sum amount equal to $204,250.00; and |

(d) |

Employee’s coverage under the Novelis Group Life Insurance Plan shall continue at no cost to Employee for up to 12 months from the Separation Date at Employee’s level of coverage as of the Separation Date; and |

(e) |

On the Severance Payment Date, Employee will be paid a lump sum payment in the gross total amount of $1,678,950.00, less required taxes, deductions and withholdings, representing Employee’s Annual Incentive Plan bonus for fiscal year 2015; and |

Mr. Philip Martens

April 20, 2015

Page 9

(f) |

On the Severance Payment Date, Employee will be paid a lump sum payment in the gross total amount of $1,916,990.00, less required taxes, deductions and withholdings, representing payment for Employee’s entitlement to any restricted stock units under the Long-Term Incentive Plans for 2015 and earlier fiscal years. |

The Parties agree and acknowledge that the Separation Incentive set forth in this paragraph 2 provides benefits to which Employee otherwise would not be entitled. The Parties further agree and acknowledge that Employee is not entitled to and shall not receive any 401(k) or other retirement plan contribution or other benefits based on the Separation Incentive. The Parties also agree that Employee is not entitled to and shall not receive any payments or benefits under the Annual Incentive Plan or the Long Term Incentive Plan for fiscal year 2016.

3.Release. As consideration for the Separation Incentive and other benefits of this Agreement, Employee does hereby voluntarily waive, fully release, hold harmless and forever discharge Novelis, its shareholders, predecessors, parents, subsidiaries and affiliated companies, successors and assigns, and the past, present and future officers, directors, employees, representatives, attorneys and agents of the foregoing (the “Released Parties”) from (i) any and all claims, charges, complaints, demands, damages, lawsuits, actions or causes of action, known or unknown, and of any kind or description whatsoever, which arose prior to the execution of this Agreement; and (ii) any and all claims arising out of or in any way related to Employee’s employment with or separation from Novelis; and (iii) any and all claims under any possible legal, equitable, tort, contract, common law, public policy or statutory theory, arising under any federal, state or local law, rule, ordinance or regulation, including but not limited to the Age Discrimination in Employment Act of 1967, the Civil Rights Act of 1866, the Civil Rights Act of 1991, Title VII of the Civil Rights Act of 1964, the Employee Retirement Income Security Act of 1974, the Americans with Disabilities Act of 1990, all as amended to the date of this Agreement, and any other legal action against the Released Parties which Employee had, has or may have against the Released Parties in any way arising out of Employee’s employment with or separation from Novelis including any claim of which Employee is not aware and those not mentioned in this paragraph 3, as of the date of this Agreement, to the fullest extent permitted by law.

Employee is not waiving any rights that cannot be waived by law, but does forever waive the right to recover any damages should any state or federal agency pursue a claim on Employee’s behalf against any or all of the Released Parties relating to any matter whatsoever, as of the date of this Agreement. Employee is not waiving any right to receive indemnification and defense from Novelis for third party claims arising out of the performance of his duties on behalf of Novelis.

4.Acknowledgments. By signing this Agreement and in connection with the release of any and all claims as set forth in paragraph 3 above, Employee and Novelis acknowledge, agree and represent that:

Mr. Philip Martens

April 20, 2015

Page 9

(a) |

This Agreement is being executed voluntarily and knowingly by Employee without reliance upon any statements by others or their representatives concerning the nature or extent of any claims or damages or legal liability therefor; |

(b) |

This Agreement has been written in understandable language, and all provisions are understood by Employee and Novelis; |

(c) |

No promise or inducement has been offered to Employee, except as set forth in this Agreement; |

(d) |

Employee has not assigned or transferred any claim that Employee has released under this Agreement; |

(e) |

The execution of this Agreement shall not constitute an admission by Novelis or any other Released Parties that it has or they have violated any federal, state or local statute, ordinance, rule, regulation or common law, or that Employee has any meritorious claims whatsoever against Novelis or the other Released Parties. On the contrary, Novelis and the other Released Parties deny expressly that they have violated any of Employee’s rights or that they have harmed Employee in any way; |

(f) |

Employee is advised, and has had an opportunity, to consult with an attorney of Employee’s choosing prior to executing this Agreement; |

(g) |

This Agreement provides consideration in addition to anything of value to which Employee already may be entitled; |

(h) |

Employee has 21 days from the receipt of this Agreement in which to decide whether to enter into this Agreement, sign it and return it to Kenneth L. Dobkin, Novelis Inc. Assistant General Counsel, 3560 Lenox Road, Two Alliance Center, Suite 2000, Atlanta, GA 30326; |

(i) |

Employee may sign this Agreement and return it to Kenneth L. Dobkin, Novelis Inc. Assistant General Counsel, 3560 Lenox Road, Two Alliance Center, Suite 2000, Atlanta, GA 30326, prior to the expiration of the 21-day period; |

(j) |

Employee has the right to revoke this Agreement during a 7 day period following the execution of this Agreement by delivering a signed letter of revocation to Kenneth L. Dobkin, Novelis Inc. Assistant General Counsel, 3560 Lenox Road, Two Alliance Center, Suite 2000, Atlanta, GA 30326. Such a letter must be received no later than the seventh day after the date on which Employee signed the Agreement. This Agreement shall not become effective or enforceable until the 7-day revocation period expires; |

Mr. Philip Martens

April 20, 2015

Page 9

(k) |

Employee acknowledges, understands and agrees that he has no knowledge of any actions or inactions by any of the Released Parties or by Employee that Employee believes could possibly constitute a basis for a claimed violation of any federal, state, or local law, any common law or any rule promulgated by an administrative body. |

5.Confidentiality and Restrictions. Employee and Novelis agree as follows:

a) |

For a period of twenty-four (24) months after the Separation Date or, if applicable, for as long as Employee and/or Novelis or its affiliates otherwise may be obligated to maintain confidentiality, Employee will not disclose or make use of, directly or indirectly, for himself or others, any Confidential Information Employee obtained during the course of Employee’s employment with Novelis, with the exception of using the information in connection with Employee’s efforts for Novelis and except that no provision of this Agreement shall prohibit the reporting of possible violations of federal law or regulation to the appropriate governmental agency or making other disclosures that are protected under the whistleblower provisions of federal law or regulation or require prior notice to Novelis; and |

b) |

For a period of twenty-four (24) months after the Separation Date, Employee, directly or indirectly, for himself or others, shall not: (i) be engaged actively in or by any Subject Business or any Prohibited Business; or (ii) have any financial or other interest including, without limitation, an interest by way of royalty or other compensation arrangement, in or in respect of any Subject Business or any Prohibited Business, excluding the ownership of not more than 5% of the issued shares of any such Subject Business or Prohibited Business, the shares of which are listed on a recognized stock exchange or traded in the over-the-counter market; or (iii) advise, lend money to or guarantee the debts or obligations of any Subject Business or any Prohibited Business; and |

c) |

For a period of twenty-four (24) months after the Separation Date, Employee shall not, directly or indirectly, in any manner or by any means, approach, solicit, or contact any customers or suppliers of Novelis or its subsidiaries and affiliated companies who have actively done business with Novelis or its subsidiaries or affiliated companies in the preceding 24 months, or any prospective customer or supplier that Novelis or its subsidiaries or affiliated companies approached, solicited or contacted in the preceding 24 months, or attempt to do any of the foregoing, in order to offer or obtain services or products that compete with Novelis or its subsidiaries or affiliated companies in the Subject Business. |

d) |

For a period of twenty-four (24) months after the Separation Date, Employee shall not, directly or indirectly, in any manner or by any means, induce or solicit, or attempt to induce or solicit, or assist any person to induce or solicit, any management or higher-level employee, contractor or advisor of Novelis or its subsidiaries or affiliated companies, or assist or encourage any management or higher-level |

Mr. Philip Martens

April 20, 2015

Page 9

employee, contractor or advisor of Novelis or its subsidiaries or affiliated companies, to accept employment or engagement elsewhere that participates in the Subject Business or is a Prohibited Business.

e) |

Employee represents, warrants, and covenants that he has returned all Novelis property, including, but not limited to, automobiles, Blackberries, iPhones, iPads, tablets, cell phones, computers, hard copy and electronically stored information/documents (including emails, spreadsheets, etc.), records, notebooks and similar repositories of or containing Confidential Information or Trade Secrets, including copies thereof, then in Employee’s possession, whether prepared by Employee or others. Employee further agrees that Novelis shall have the right to verify that all such property and information has been returned. Employee understands that access or use of Novelis’s computer network and electronically stored information is for Novelis’s benefit only and that any use of Novelis’s computer network or removal or use of information for any other purpose is unauthorized and prohibited. |

f) |

The term “Confidential Information” shall mean and include any information, data and know-how relating to the business of Novelis and its subsidiaries and affiliated companies or third parties that is disclosed to Employee by Novelis or known to Employee as a result of Employee’s relationship with Novelis and not generally within the public domain (whether constituting a Trade Secret or not), including without limitation: business and manufacturing operations and methods, including but not limited to administrative procedures and training and operations material; business proposals, both internal and external; product research and development information and technical, chemical or scientific data; sales and/or marketing information, including, but not limited to, strategies, plans, designs and creative ideas; partner, supplier and vendor information, including but not limited to contractual and business relationships; customer and prospective customer information, including but not limited to contacts, requirements, contracts, service agreements, purchase histories, payment plans, account records, pricing information, and contractual and business relationships; compilations of information and records, including, but not limited to, memoranda and personnel records and policies; and financial information, including but not limited to historical, current and prospective financial goals, budgets and results concerning or relating to Novelis’s business, the Subject Business and/or the customers, employees and affairs of Novelis or its subsidiaries or affiliated companies. The definition of Confidential Information in this Agreement shall not limit any definition of “confidential information” or any equivalent term under any applicable law. |

g) |

The term “Trade Secrets” means any and all information of Novelis or its subsidiaries or affiliated companies or of third parties in the possession of Novelis or its subsidiaries or affiliated companies that would be considered to be or be recognized as a trade secret under the laws of the State of Georgia, U.S.A. |

Mr. Philip Martens

April 20, 2015

Page 9

h) |

The term “Subject Business” shall mean and include the production, marketing and sale of aluminum, alumina, and rolled aluminum products, the recycling of aluminum, research and development related to the foregoing, and all activities related to any of the foregoing. |

i) |

The term “Prohibited Business” shall mean any individual, partnership, corporation, limited liability company, joint venture, association, or other group, however organized, that competes with Novelis or its subsidiaries or affiliated companies in the Subject Business. Prohibited Businesses include any entity whose major business operations consist of manufacturing or recycling of aluminum, alumina or downstream rolled aluminum products, and include but are not limited to the following entities and each of their affiliates: Alcoa Inc. (including but not limited to Alcoa Bohai Aluminum Industries Company Limited), Aleris International, Inc., Asia Aluminum Holdings Ltd., Aluminum Corporation of China Limited (including but not limited to Chalco and Chinalco), Constellium, Norsk Hydro ASA, Nanshan Group, and CGXN Aluminum Material Co. Ltd. (Southwest Aluminum); however, nothing in this Agreement shall be construed to prohibit Employee from involvement with any aspect of a portion of a Prohibited Business that is not competitive to Novelis or its subsidiaries or affiliated companies or in the Subject Business unless any such employment would lead to the inevitable disclosure of Confidential Information or Trade Secrets. |

j) |

The terms and conditions of this Agreement are strictly confidential and Employee shall not disclose or publicize them to any other person other than attorneys, accountants or his immediate family, any and all of whom will be informed of and agree to be bound by this confidentiality clause, or unless such disclosure shall be required by law, in which case Employee agrees to provide advance notice to Novelis before any such disclosure. |

6.Professionalism. Employee agrees to cooperate in good faith and comply with and respond to all reasonable requests from or inquiries by Novelis for assistance and information in connection with any matters or issues relating to or arising out of Employee’s working relationship with Novelis, related to Employee’s duties with Novelis or as to which Employee may have relevant knowledge or information. Employee agrees that, if he is requested or subpoenaed to provide information on any matter relating in whole or in part to Novelis or his employment or affiliation with Novelis, Employee will (unless prohibited by law or excused by the last clause of paragraph 5(a) of this Agreement) notify Novelis and also deliver a copy of such request for information or subpoena, if any, within three business days and prior to Employee responding to the request or otherwise providing any information. Employee and Novelis agree not to make or issue, or procure any person or entity to make or issue, in any form or forum (including the media, newspaper, magazines, radio, television station, publishing company, websites, chat rooms or on the internet), any statement that is harmful to or disparaging of (i) Novelis, (ii) Employee’s relationship with Novelis, (iii) Employee’s separation from Novelis, (iv) Employee, or (iv) any Released Parties.

Mr. Philip Martens

April 20, 2015

Page 9

Employee agrees to resign from all positions he may hold with Novelis or any Released Parties as of the Separation Date.

7.Forfeiture. If Employee sues or otherwise asserts or pursues legal, administrative or other claims against Novelis or any Released Parties in violation of this Agreement or otherwise breaches any provision of this Agreement, Novelis reserves the right to suspend any further payments or provision of benefits and seek reimbursement of past amounts paid under this Agreement to the extent allowed under applicable law.

8.Vacation. Employee acknowledges being paid for $76,730.77 via his last payroll payment, which Employee acknowledges as payment for the 19 days of vacation time accrued but unused by Employee in the current calendar year as of the Separation Date.

9.Medical, Dental & Vision Benefits. To continue your Novelis Medical, Dental and Vision coverage for you and your eligible family members, you must complete and return the COBRA election form to Trion. You may continue coverage for a total of 18 months under COBRA after your Separation Date. You will receive a letter outlining your COBRA rights from TRION in the coming weeks.

10.Health Savings Account. Your Health Savings Account is owned by you and you will be responsible for the Monthly Service Charge, presently $3.25, if you maintain your account. Regarding your tax preferred ACS|BNY Mellon Health Savings Account, you may either (1) keep your account open to use your checkbook or debit card to pay for Qualified Medical Expenses, or (2) close your account by requesting a distribution of funds or a rollover to a new HSA account by calling ACS|BNY Mellon HSA Solution customer service at 877-472-4200. If you opt to close your account, please be aware of any tax consequences that may occur due to taking a Health Savings Account distribution. You should consider consulting with your tax advisor in this regard and/or reviewing information on www.irs.gov.

11.Business Travel/Accident/Disability Plans. All insurance coverage not otherwise referenced herein, including insurance coverage for business travel accidents, short-term disability and long-term disability, ceases on the Separation Date.

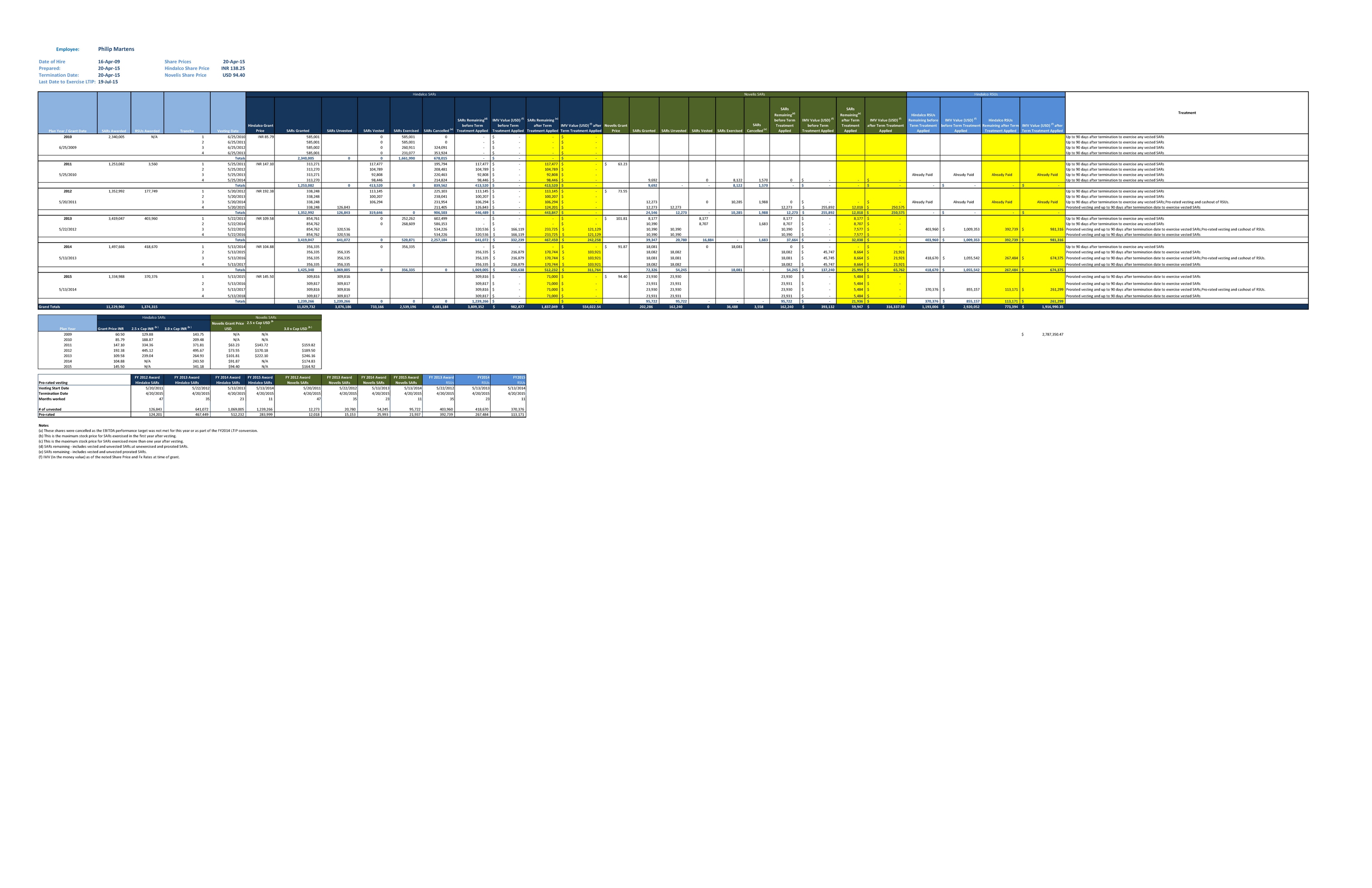

12.Long-Term Incentive Plan (“LTIP”). Except as otherwise set forth in this Agreement, including paragraph 2(f), above, Employee’s grants under the Long-Term Incentive Plan for each grant year, if any, will be treated as illustrated on Attachment A. Employee will have 90 days following the Separation Date to exercise any vested stock appreciation rights. Employee understands that the value of any vested stock appreciation rights will be determined at the time of exercise, if any, and may differ from the value in the illustration contained on Attachment A.

13.Taxes. The Parties acknowledge and agree that all payments under this Agreement shall be subject to all applicable taxes and other withholdings. The Parties further acknowledge and agree that the payments under this Agreement are intended to satisfy the short term deferral exemption under Internal Revenue Code Section 409A and the regulations and guidance

Mr. Philip Martens

April 20, 2015

Page 9

promulgated thereunder (collectively, “Section 409A”), and that, to the extent any payment under this Agreement is subject to Section 409A (after considering all applicable exemptions), this Agreement shall be interpreted and operated in accordance with Section 409A, including the six month delayed payment requirement applicable to “specified employees”. Notwithstanding the foregoing, neither Novelis nor its advisors make any representations to Employee regarding the tax treatment of any payment or benefits pursuant to this Agreement. Employee acknowledges he has been advised to consult with his own tax advisors.

14.Governing Law; Forum. This Agreement shall be governed by the laws of the State of Georgia without regard of its conflicts of law provisions. The federal and state courts in Fulton County, Georgia shall have exclusive jurisdiction of any action arising under or relating to this Agreement, and each of the Parties waives any objection to jurisdiction and venue in such courts or any objection that such courts are inconvenient.

15.Entirety of Agreement. This Agreement contains the entire agreement among the Parties hereto and supersedes any other agreements. This Agreement may not be modified, except in writing signed by Employee and Novelis.

16.Severability. If any term, condition, clause or provision of this Agreement other than paragraph 3, above, shall be determined by a court of competent jurisdiction to be void or invalid as a matter of law, or for any other reason, then only that term, condition, clause or provision as is determined to be void or invalid shall be stricken from this Agreement and the remaining portions shall remain in full force and effect in all other respects.

Your counter-signature below will reflect your free, voluntary and knowing acknowledgement of and agreement with the terms of this Agreement.

Sincerely,

/s/ Leslie J. Parrette, Jr.

Leslie J. Parrette, Jr.

Sr. Vice President, General Counsel, Secretary and Compliance Officer

ACKNOWLEDGED AND AGREED:

/s/ Philip Martens

_________________________________

Philip Martens

Date: April 23, 2015

Mr. Philip Martens

April 20, 2015

Page 9