EX-99.3

Published on January 13, 2020

senior Unsecured notes offering Dev Ahuja Senior Vice President and Chief Financial Officer January 13, 2020 14 41 97 29 66 138 95 188 35 0 173 251 Exhibit 99.3

Disclaimers Statements made in this presentation which describe Novelis' intentions, expectations, beliefs or predictions may be forward-looking statements within the meaning of securities laws. Forward-looking statements include statements preceded by, followed by, or including the words "believes," "expects," "anticipates," "plans," "estimates," "projects," "forecasts," or similar expressions. Examples of forward-looking statements in this presentation including statements concerning Novelis’ expectation to grow shipments and drive continued operational efficiencies. Novelis cautions that, by their nature, forward-looking statements involve risk and uncertainty and that Novelis' actual results could differ materially from those expressed or implied in such statements. We do not intend, and we disclaim, any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. Factors that could cause actual results or outcomes to differ from the results expressed or implied by forward-looking statements include, among other things: relationships with, and financial and operating conditions of, Novelis’ customers, suppliers and other stakeholders; changes in the prices and availability of aluminum (or premiums associated with aluminum prices) or other materials and raw materials we use; fluctuations in the supply of, and prices for, energy in the areas in which we maintain production facilities; Novelis’ ability to access financing, repay existing debt or refinance existing debt to fund current operations and for future capital requirements; the level of Novelis’ indebtedness and its ability to generate cash to service its indebtedness; lowering of Novelis’ ratings by a credit rating agency; changes in the relative values of various currencies and the effectiveness of Novelis’ currency hedging activities; union disputes and other employee relations issues; factors affecting Novelis’ operations, such as litigation (including product liability claims), environmental remediation and clean-up costs, breakdown of equipment and other events; changes in general economic conditions, including deterioration in the global economy; the capacity and effectiveness of Novelis’ hedging activities; impairment of Novelis’ goodwill, other intangible assets, and long-lived assets; loss of key management and other personnel, or an inability to attract such management and other personnel; risks relating to future acquisitions or divestitures, including risks relating to Novelis’ ability to consummate and realize anticipated benefits from the merger with Aleris Corporation; Novelis’ inability to successfully implement its growth initiatives; changes in interest rates that have the effect of increasing the amounts we pay under Novelis’ senior secured credit facilities, other financing agreements and its defined benefit pension plans; risks relating to certain joint ventures and subsidiaries that we do not entirely control; the effect of derivatives legislation on Novelis’ ability to hedge risks associated with its business; competition from other aluminum rolled products producers as well as from substitute materials such as steel, glass, plastic and composite materials; demand and pricing within the principal markets for Novelis’ products as well as seasonality in certain of its customers’ industries; economic, regulatory and political factors within the countries in which we operate or sell its products, including changes in duties or tariffs; and changes in government regulations, particularly those affecting taxes and tax rates, health care reform, climate change, environmental, health or safety compliance. The above list of factors is not exhaustive. Other important risk factors included under the caption "Risk Factors" in Novelis’ Annual Report on Form 10-K for the fiscal year ended March 31, 2019, as such factors may be updated from time to time in its periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov, are specifically incorporated by reference into this presentation. Any reference to potential synergies is a forward looking statement. Synergies are based on a number of assumptions, certain of which are beyond our control. There can be no assurance if or when we will realize any such synergies, and differences could be material. You should not place undue reliance on any reference to synergies and efforts to integrate the combined businesses may be more difficult than we expect. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this presentation and in Novelis’ filings with the SEC. Any forward-looking statement, including any contained herein, speaks only as of the time of this presentation and we do not undertake any obligation to update or revise them as more information becomes available or to disclose any facts, events, or circumstances after the date of this presentation that may affect the accuracy of any forward-looking statement, except as required by law. This presentation includes certain non-GAAP financial measures, including Adjusted EBITDA, Adjusted EBITDA, Free Cash Flow and Net Leverage. These metrics have important limitations and should not be considered in isolation or as a substitute for measures of the Company’s financial performance or liquidity prepared in accordance with GAAP. In addition, these metrics, as presented by the Company may not be comparable to similarly titled measures of other companies due to varying methods of calculations. Please refer to the Appendix of this presentation for a reconciliation of the non-GAAP financial measures included in this presentation to the most directly comparable financial measures prepared in accordance with GAAP. The notes have not been and will not be registered under the Securities Act of 1933, as amended (the "Securities Act") or the securities laws of any other jurisdiction. The notes are being offered and sold only to persons reasonably believed to be "qualified institutional buyers" in accordance with Rule 144A under the Securities Act ("Rule 144A") and outside the United States in accordance with Regulation S under the Securities Act. Prospective purchasers are hereby notified that the seller of the notes may be relying on Rule 144A. Novelis is not, and the initial purchasers are not, making an offer to sell the notes in any jurisdiction except where an offer or sale is permitted. This presentation shall not constitute an offer to sell or the solicitation of an offer to buy securities nor shall there be any sale of these securities in any state in which such solicitation or sale would be unlawful prior to registration or qualification of these securities under the laws of any such state.

Agenda 1 Transaction Overview 2 Novelis Overview 3 Acquisition of Aleris 4 Questions

Transaction Overview 29 66 138 95 188 35 0 173 251 14 41 97

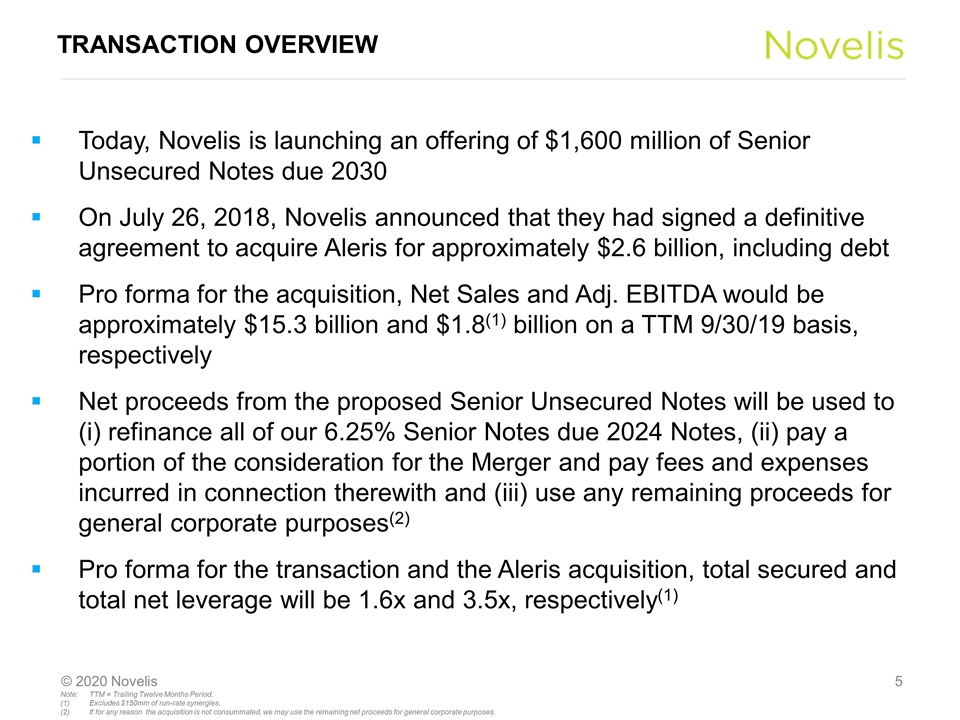

Transaction Overview Today, Novelis is launching an offering of $1,600 million of Senior Unsecured Notes due 2030 On July 26, 2018, Novelis announced that they had signed a definitive agreement to acquire Aleris for approximately $2.6 billion, including debt Pro forma for the acquisition, Net Sales and Adj. EBITDA would be approximately $15.3 billion and $1.8(1) billion on a TTM 9/30/19 basis, respectively Net proceeds from the proposed Senior Unsecured Notes will be used to (i) refinance all of our 6.25% Senior Notes due 2024 Notes, (ii) pay a portion of the consideration for the Merger and pay fees and expenses incurred in connection therewith and (iii) use any remaining proceeds for general corporate purposes(2) Pro forma for the transaction and the Aleris acquisition, total secured and total net leverage will be 1.6x and 3.5x, respectively(1) Note:TTM = Trailing Twelve Months Period. Excludes $150mm of run-rate synergies. If for any reason the acquisition is not consummated, we may use the remaining net proceeds for general corporate purposes.

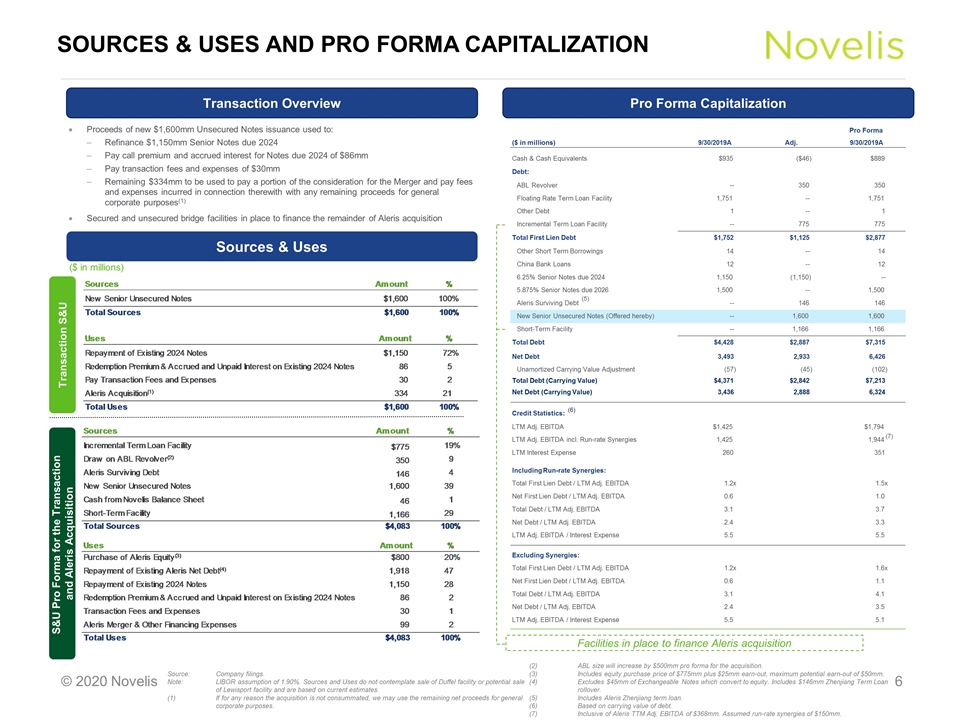

Source:Company filings. Note:LIBOR assumption of 1.90%. Sources and Uses do not contemplate sale of Duffel facility or potential sale of Lewisport facility and are based on current estimates. If for any reason the acquisition is not consummated, we may use the remaining net proceeds for general corporate purposes. ABL size will increase by $500mm pro forma for the acquisition. Includes equity purchase price of $775mm plus $25mm earn-out, maximum potential earn-out of $50mm. Excludes $45mm of Exchangeable Notes which convert to equity. Includes $146mm Zhenjiang Term Loan rollover. Includes Aleris Zhenjiang term loan. Based on carrying value of debt. Inclusive of Aleris TTM Adj. EBITDA of $368mm. Assumed run-rate synergies of $150mm. Sources & Uses and pro forma capitalization Transaction Overview Proceeds of new $1,600mm Unsecured Notes issuance used to: Refinance $1,150mm Senior Notes due 2024 Pay call premium and accrued interest for Notes due 2024 of $86mm Pay transaction fees and expenses of $30mm Remaining $334mm to be used to pay a portion of the consideration for the Merger and pay fees and expenses incurred in connection therewith with any remaining proceeds for general corporate purposes(1) Secured and unsecured bridge facilities in place to finance the remainder of Aleris acquisition ($ in millions) Sources & Uses Transaction S&U S&U Pro Forma for the Transaction and Aleris Acquisition (7) Facilities in place to finance Aleris acquisition Pro Forma Capitalization (5) (6) Pro Forma ($ in millions) 9/30/2019A Adj. 9/30/2019A Cash & Cash Equivalents $935 ($46) $889 Debt: ABL Revolver -- 350 350 Floating Rate Term Loan Facility 1,751 -- 1,751 Other Debt 1 -- 1 Incremental Term Loan Facility -- 775 775 Total First Lien Debt $1,752 $1,125 $2,877 Other Short Term Borrowings 14 -- 14 China Bank Loans 12 -- 12 6.25% Senior Notes due 2024 1,150 (1,150) -- 5.875% Senior Notes due 2026 1,500 -- 1,500 Aleris Surviving Debt -- 146 146 New Senior Unsecured Notes (Offered hereby) -- 1,600 1,600 Short-Term Facility -- 1,166 1,166 Total Debt $4,428 $2,887 $7,315 Net Debt 3,493 2,933 6,426 Unamortized Carrying Value Adjustment (57) (45) (102) Total Debt (Carrying Value) $4,371 $2,842 $7,213 Net Debt (Carrying Value) 3,436 2,888 6,324 Credit Statistics: LTM Adj. EBITDA $1,425 $1,794 LTM Adj. EBITDA incl. Run-rate Synergies 1,425 1,944 LTM Interest Expense 260 351 Including Run-rate Synergies: Total First Lien Debt / LTM Adj. EBITDA 1.2x 1.5x Net First Lien Debt / LTM Adj. EBITDA 0.6 1.0 Total Debt / LTM Adj. EBITDA 3.1 3.7 Net Debt / LTM Adj. EBITDA 2.4 3.3 LTM Adj. EBITDA / Interest Expense 5.5 5.5 Excluding Synergies: Total First Lien Debt / LTM Adj. EBITDA 1.2x 1.6x Net First Lien Debt / LTM Adj. EBITDA 0.6 1.1 Total Debt / LTM Adj. EBITDA 3.1 4.1 Net Debt / LTM Adj. EBITDA 2.4 3.5 LTM Adj. EBITDA / Interest Expense 5.5 5.1

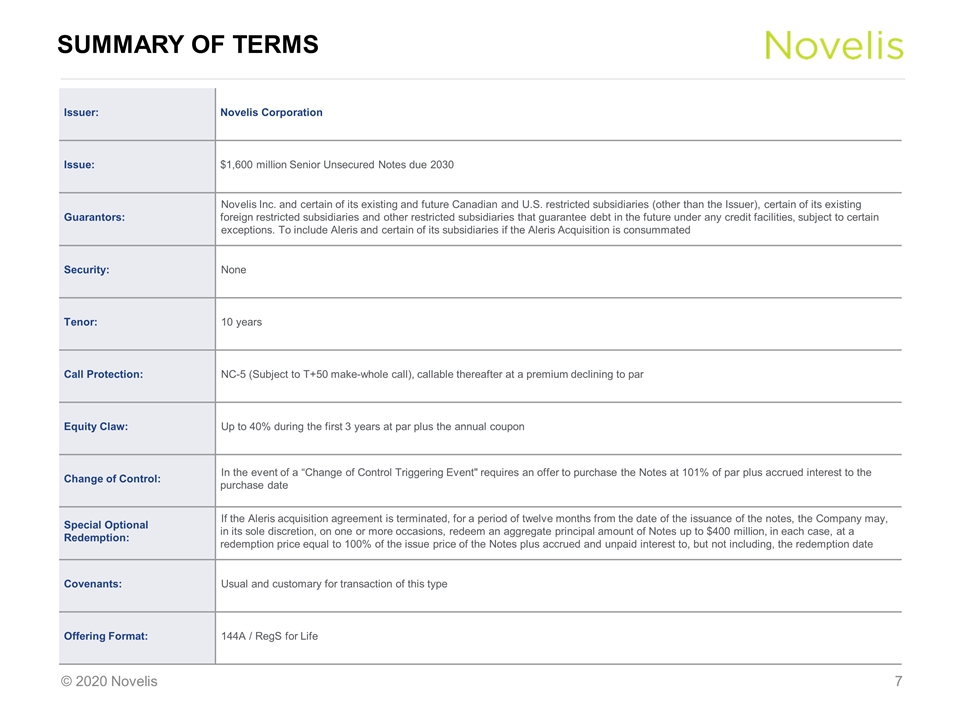

Summary of Terms Issuer: Novelis Corporation Issue: $1,600 million Senior Unsecured Notes due 2030 Guarantors: Novelis Inc. and certain of its existing and future Canadian and U.S. restricted subsidiaries (other than the Issuer), certain of its existing foreign restricted subsidiaries and other restricted subsidiaries that guarantee debt in the future under any credit facilities, subject to certain exceptions. To include Aleris and certain of its subsidiaries if the Aleris Acquisition is consummated Security: None Tenor: 10 years Call Protection: NC-5 (Subject to T+50 make-whole call), callable thereafter at a premium declining to par Equity Claw: Up to 40% during the first 3 years at par plus the annual coupon Change of Control: In the event of a “Change of Control Triggering Event" requires an offer to purchase the Notes at 101% of par plus accrued interest to the purchase date Special Optional Redemption: If the Aleris acquisition agreement is terminated, for a period of twelve months from the date of the issuance of the notes, the Company may, in its sole discretion, on one or more occasions, redeem an aggregate principal amount of Notes up to $400 million, in each case, at a redemption price equal to 100% of the issue price of the Notes plus accrued and unpaid interest to, but not including, the redemption date Covenants: Usual and customary for transaction of this type Offering Format: 144A / RegS for Life

novelis Overview 29 66 138 95 188 35 0 173 251 14 41 97

Novelis is a Global industry leader Novelis is a subsidiary of Hindalco Industries Limited, the metals flagship company of the Aditya Birla Group Novelis is the leading producer of aluminum rolled products worldwide Premium aluminum sheet supplies the beverage can, automotive and specialties product markets Novelis is also the world’s largest recycler of aluminum Global footprint with 23 operations spanning 9 countries with ~11,000 employees, TTM revenue of $11.9 billion and TTM Adjusted EBITDA of $1,425 million 29 66 138 95 188 35 0 173 251 14 41 97 Note: Information in this section refers to Novelis prior to consummation of the Merger. TTM = Trailing Twelve Months Period.

Novelis Vision and Strategy Lead the aluminum industry as the partner of choice for innovative solutions Defend the Core Protect market leading position in can & automotive Continue driving customer centricity Maintain low-cost position through recycling & productivity Broaden customer base Grow in higher margin specialties markets Explore new verticals and markets Bold yet balanced approach Pursue opportunities for growth Strengthen our Product Portfolio Invest in Growth Opportunities Shaping a sustainable world together

Key Novelis Credit highlights Global Industry Leader in Aluminum Rolled Products Attractive and Improving Product Mix Growing End Markets Innovation in Automotive Segment To Drive Growth Strategic Capacity Investments To Solidify Leadership Position Sustainability Leader - #1 Aluminum Recycler Track Record of Success Balanced Maturity Profile 1 2 3 4 5 6 7 8

Global Industry Leader in Aluminum Rolled Products 1 Leading Producer of Flat-rolled Aluminum 40+ Years of Automotive Experience Largest Beverage Can Sheet Producer Globally World’s Largest Recycler of Aluminum Novelis Aluminum can be Found in More than 225 Vehicle Models World’s Largest Supplier of Automotive Aluminum Sheet

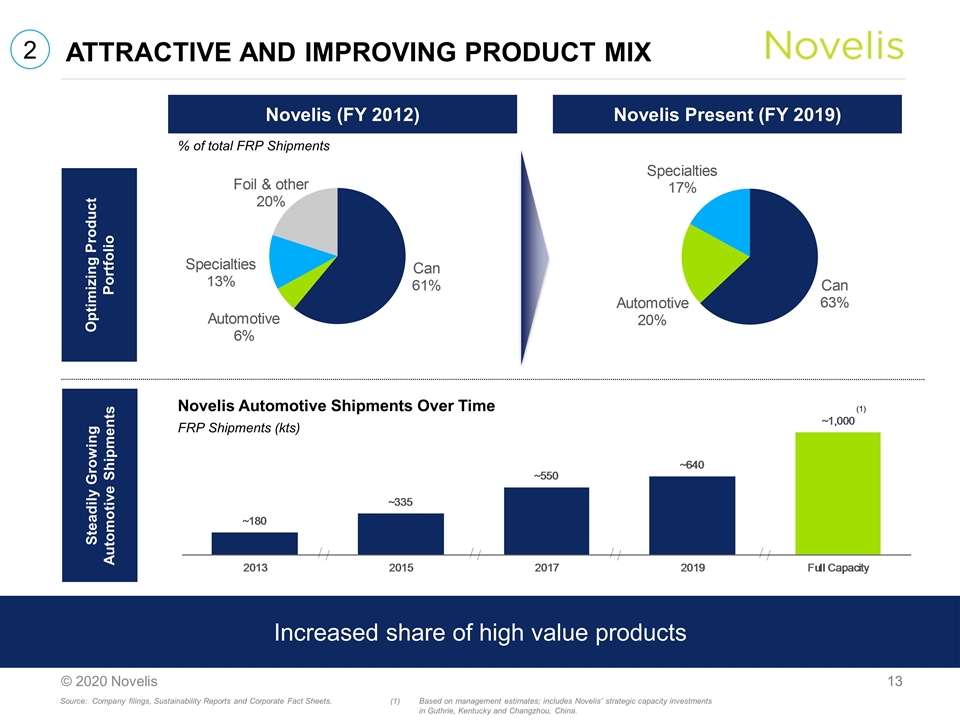

Attractive and Improving product mix Novelis (FY 2012) Novelis Present (FY 2019) Increased share of high value products % of total FRP Shipments 2 Optimizing Product Portfolio Steadily Growing Automotive Shipments Per Investor Call: “Share of auto on pro forma basis will be 22% and will further grow to 30% as our recently announced organic investments…” Novelis Automotive Shipments Over Time Source: Company filings, Sustainability Reports and Corporate Fact Sheets. Based on management estimates; includes Novelis’ strategic capacity investments in Guthrie, Kentucky and Changzhou, China. (1) FRP Shipments (kts)

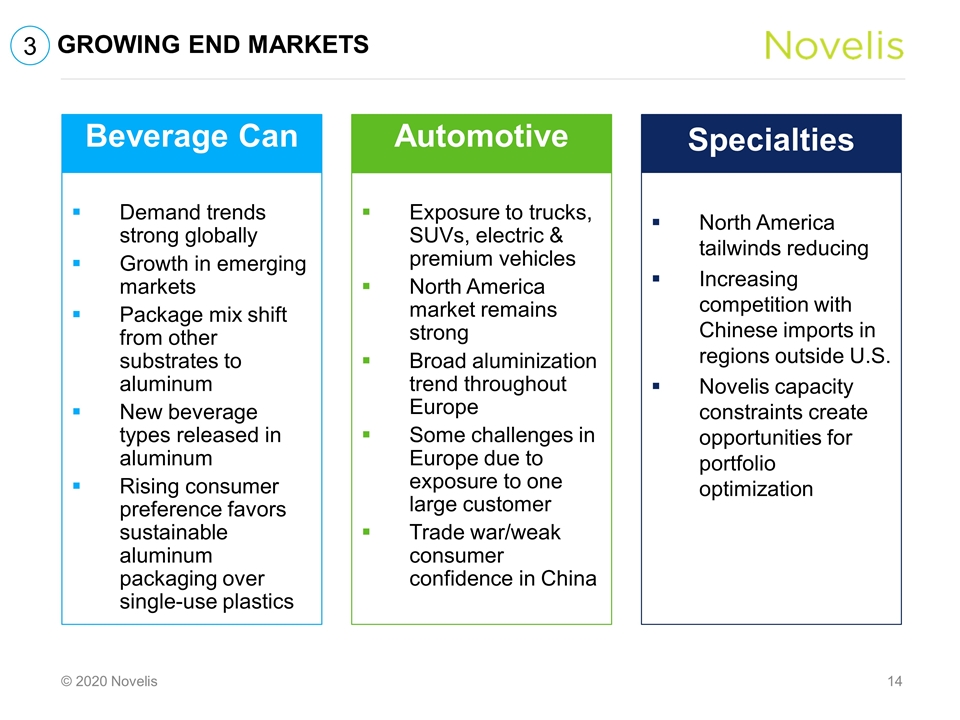

Beverage Can Demand trends strong globally Growth in emerging markets Package mix shift from other substrates to aluminum New beverage types released in aluminum Rising consumer preference favors sustainable aluminum packaging over single-use plastics Growing End Markets Automotive Exposure to trucks, SUVs, electric & premium vehicles North America market remains strong Broad aluminization trend throughout Europe Some challenges in Europe due to exposure to one large customer Trade war/weak consumer confidence in China Specialties North America tailwinds reducing Increasing competition with Chinese imports in regions outside U.S. Novelis capacity constraints create opportunities for portfolio optimization 3

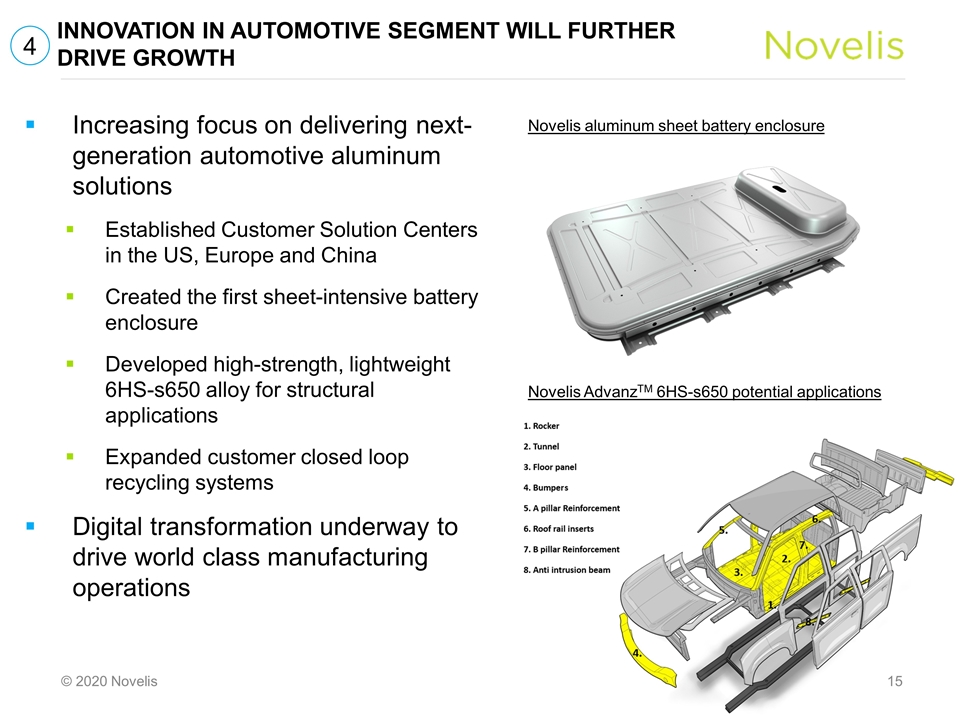

Novelis AdvanzTM 6HS-s650 potential applications Innovation in Automotive Segment will Further Drive Growth Increasing focus on delivering next-generation automotive aluminum solutions Established Customer Solution Centers in the US, Europe and China Created the first sheet-intensive battery enclosure Developed high-strength, lightweight 6HS-s650 alloy for structural applications Expanded customer closed loop recycling systems Digital transformation underway to drive world class manufacturing operations Novelis aluminum sheet battery enclosure 4

Strategic Capacity Investments Will solidify leadership position and optimize assets Construction is underway with all three significant organic projects 200kt greenfield automotive finishing lines in the U.S. to begin customer qualification late FY20 100kt automotive finishing expansion in China commissioning in FY21 100kt rolling and 60kt recycling expansion in Brazil commissioning in FY21 Guthrie, Kentucky, US Changzhou, China Pinda, Brazil Construction progress photos taken July/August 2019. 5 $175mm $180mm $300mm (Investment Amounts in USD)

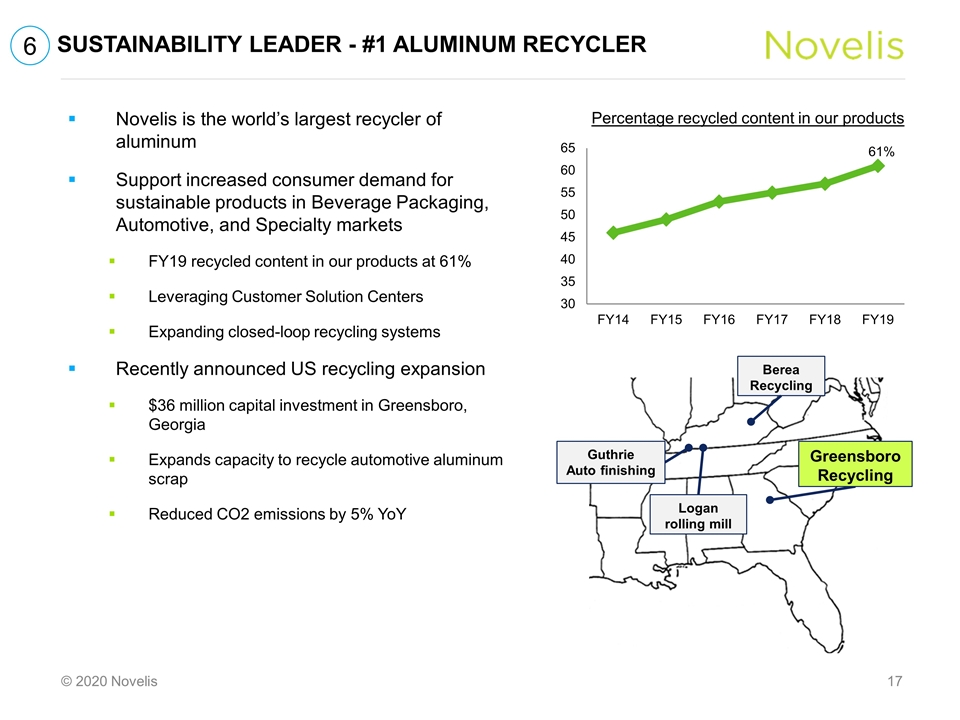

Sustainability leader - #1 aluminum recycler Novelis is the world’s largest recycler of aluminum Support increased consumer demand for sustainable products in Beverage Packaging, Automotive, and Specialty markets FY19 recycled content in our products at 61% Leveraging Customer Solution Centers Expanding closed-loop recycling systems Recently announced US recycling expansion $36 million capital investment in Greensboro, Georgia Expands capacity to recycle automotive aluminum scrap Reduced CO2 emissions by 5% YoY Berea Recycling Guthrie Auto finishing Logan rolling mill Greensboro Recycling 6 Percentage recycled content in our products

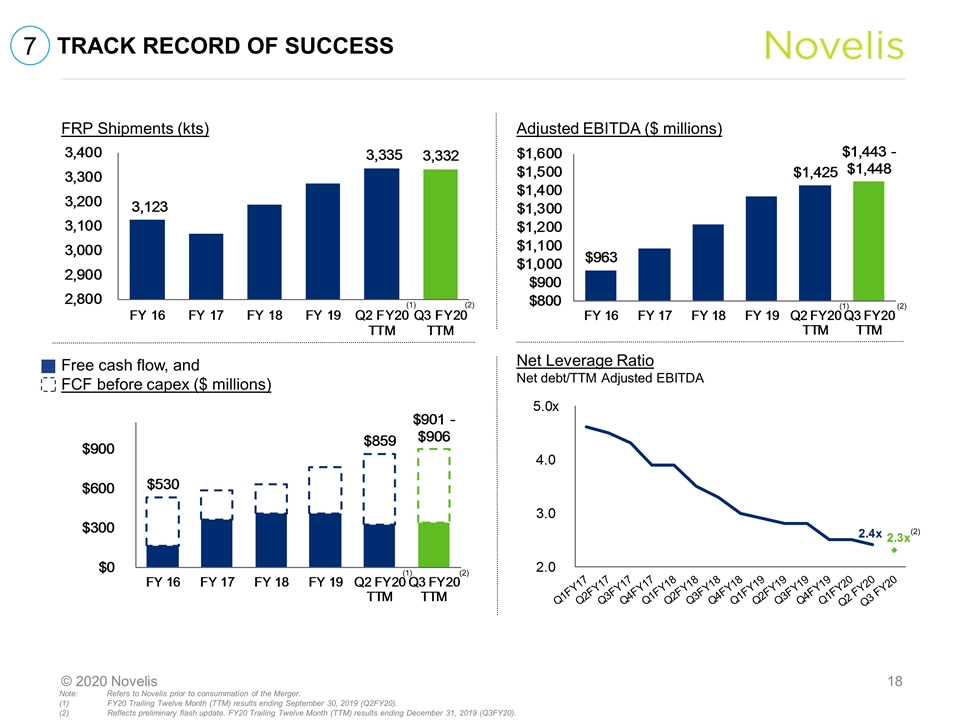

Track Record of Success FRP Shipments (kts) Free cash flow, and FCF before capex ($ millions) Adjusted EBITDA ($ millions) Net Leverage Ratio Net debt/TTM Adjusted EBITDA Note: Refers to Novelis prior to consummation of the Merger. FY20 Trailing Twelve Month (TTM) results ending September 30, 2019 (Q2FY20). Reflects preliminary flash update. FY20 Trailing Twelve Month (TTM) results ending December 31, 2019 (Q3FY20). 7 (1) (1) (1) (2) (2) (2) (2)

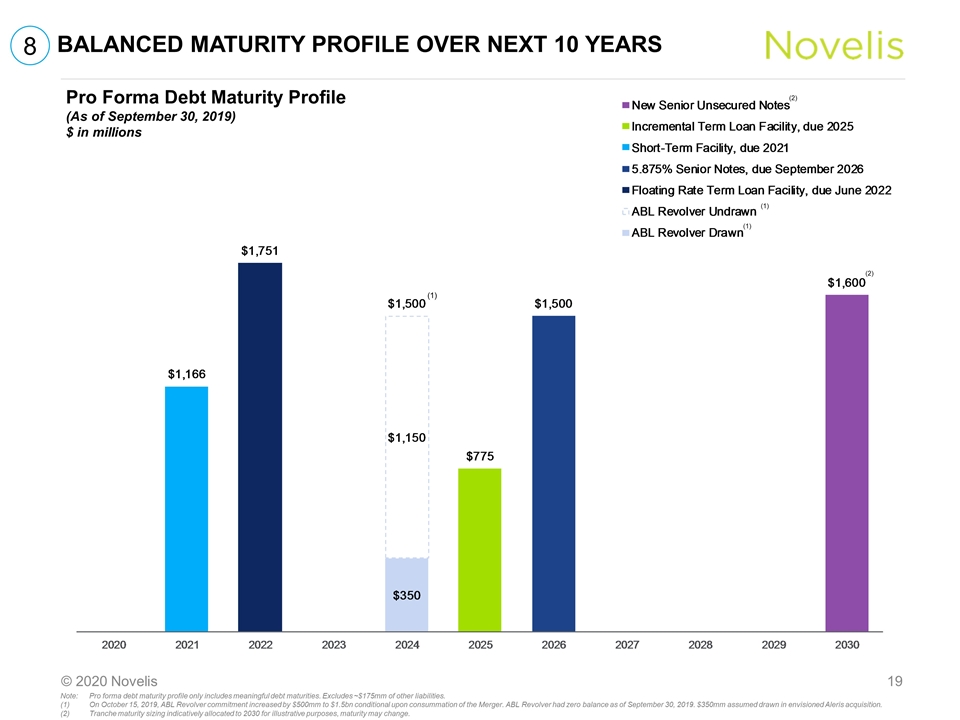

Balanced maturity profile over next 10 years Pro Forma Debt Maturity Profile (As of September 30, 2019) $ in millions Send to Lev Fin for thoughts TBD – Maturity of New Senior Unsecured Notes (2) (1) Note:Pro forma debt maturity profile only includes meaningful debt maturities. Excludes ~$175mm of other liabilities. On October 15, 2019, ABL Revolver commitment increased by $500mm to $1.5bn conditional upon consummation of the Merger. ABL Revolver had zero balance as of September 30, 2019. $350mm assumed drawn in envisioned Aleris acquisition. Tranche maturity sizing indicatively allocated to 2030 for illustrative purposes, maturity may change. 8 (1) (1) (2)

Acquisition of aleris 29 66 138 95 188 35 0 173 251 14 41 97

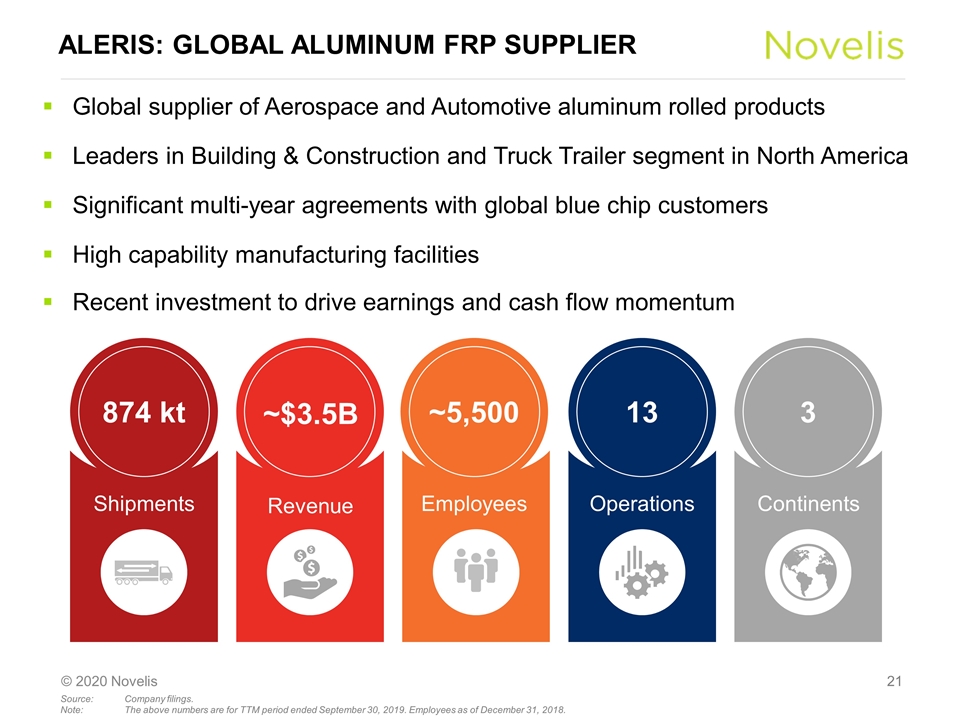

ALERIS: GLOBAL ALUMINUM FRP SUPPLIER Global supplier of Aerospace and Automotive aluminum rolled products Leaders in Building & Construction and Truck Trailer segment in North America Significant multi-year agreements with global blue chip customers High capability manufacturing facilities Recent investment to drive earnings and cash flow momentum 3 13 ~5,500 874 kt ~$3.5B Shipments Revenue Employees Operations Continents Source: Company filings. Note: The above numbers are for TTM period ended September 30, 2019. Employees as of December 31, 2018.

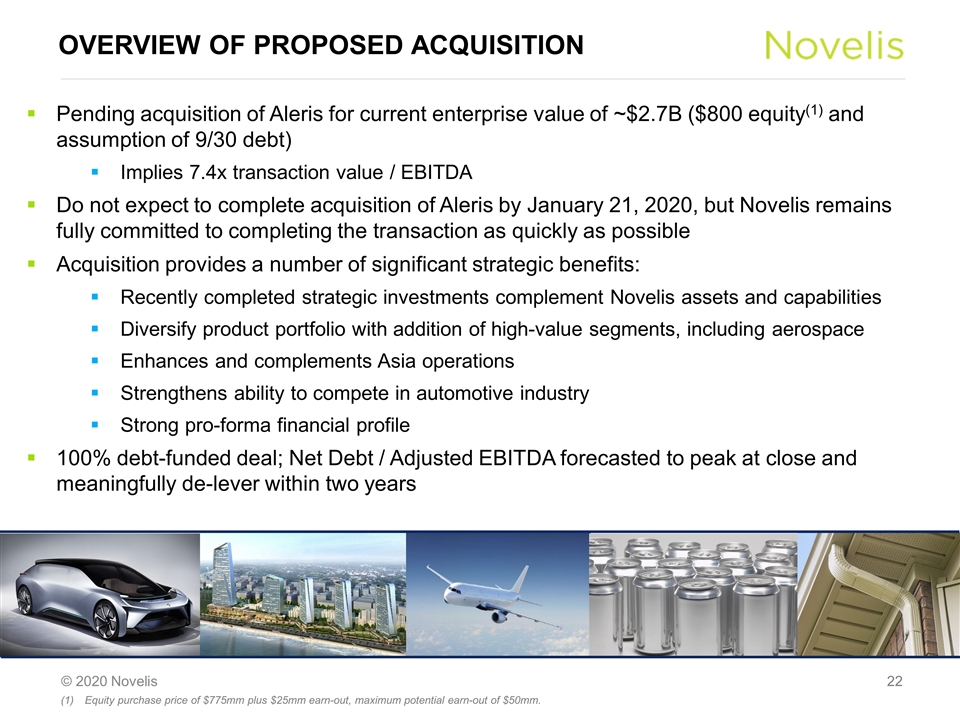

Overview of Proposed Acquisition Pending acquisition of Aleris for current enterprise value of ~$2.7B ($800 equity(1) and assumption of 9/30 debt) Implies 7.4x transaction value / EBITDA Do not expect to complete acquisition of Aleris by January 21, 2020, but Novelis remains fully committed to completing the transaction as quickly as possible Acquisition provides a number of significant strategic benefits: Recently completed strategic investments complement Novelis assets and capabilities Diversify product portfolio with addition of high-value segments, including aerospace Enhances and complements Asia operations Strengthens ability to compete in automotive industry Strong pro-forma financial profile 100% debt-funded deal; Net Debt / Adjusted EBITDA forecasted to peak at close and meaningfully de-lever within two years Equity purchase price of $775mm plus $25mm earn-out, maximum potential earn-out of $50mm.

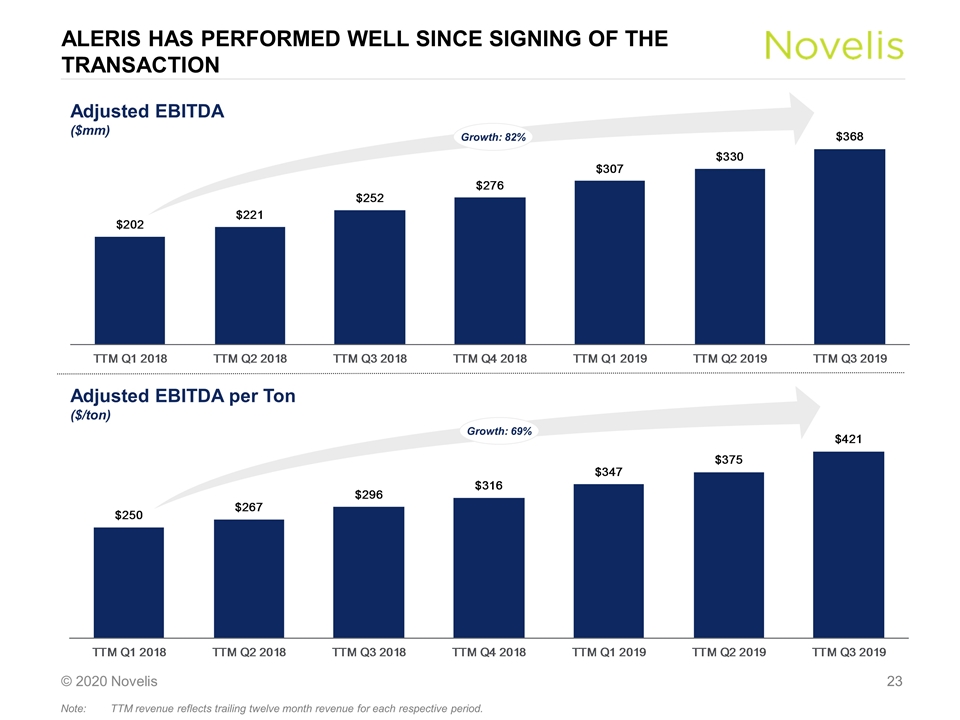

Aleris has performed well since Signing of the transaction $ $ Adjusted EBITDA ($mm) Adjusted EBITDA per Ton ($/ton) Growth: 82% Growth: 69% Note: TTM revenue reflects trailing twelve month revenue for each respective period.

Transaction Strategic Rationale Completed strategic investments complement Novelis assets and capabilities Leverage Novelis’ deep manufacturing and recycling expertise to optimize Aleris’ assets Diversity product portfolio with addition of high-value segments including aerospace Enhances and complements Asia operations Strengthens ability to compete against steel in the automotive industry Strong pro-forma financial profile

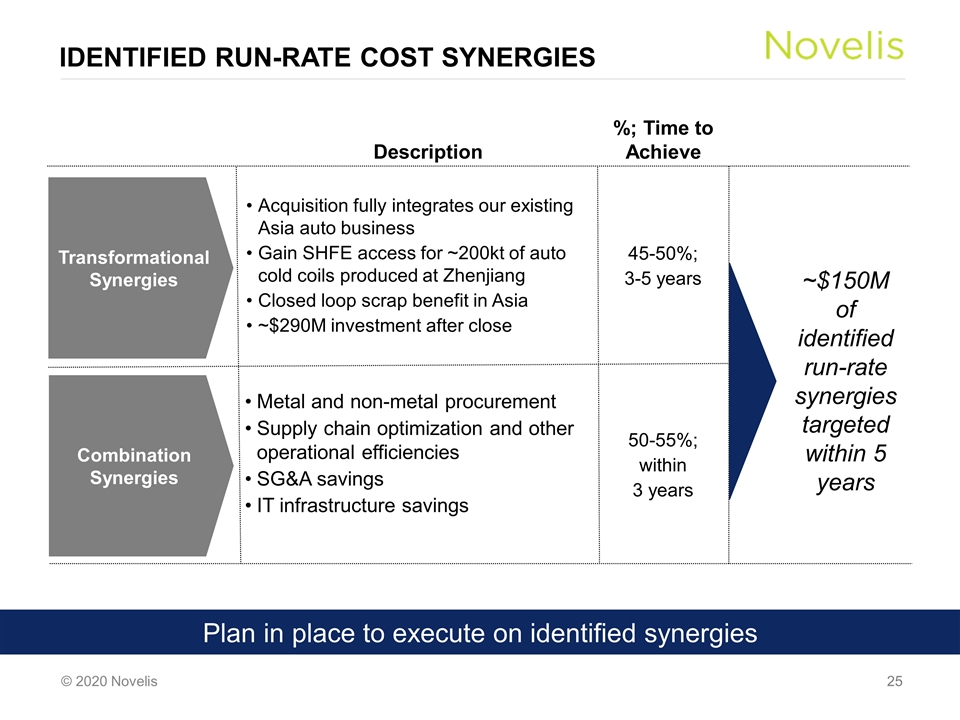

IDENTIFIED Run-rate Cost Synergies Transformational Synergies Description Metal and non-metal procurement Supply chain optimization and other operational efficiencies SG&A savings IT infrastructure savings Acquisition fully integrates our existing Asia auto business Gain SHFE access for ~200kt of auto cold coils produced at Zhenjiang Closed loop scrap benefit in Asia ~$290M investment after close Plan in place to execute on identified synergies ~$150M of identified run-rate synergies targeted within 5 years %; Time to Achieve 45-50%; 3-5 years 50-55%; within 3 years Combination Synergies

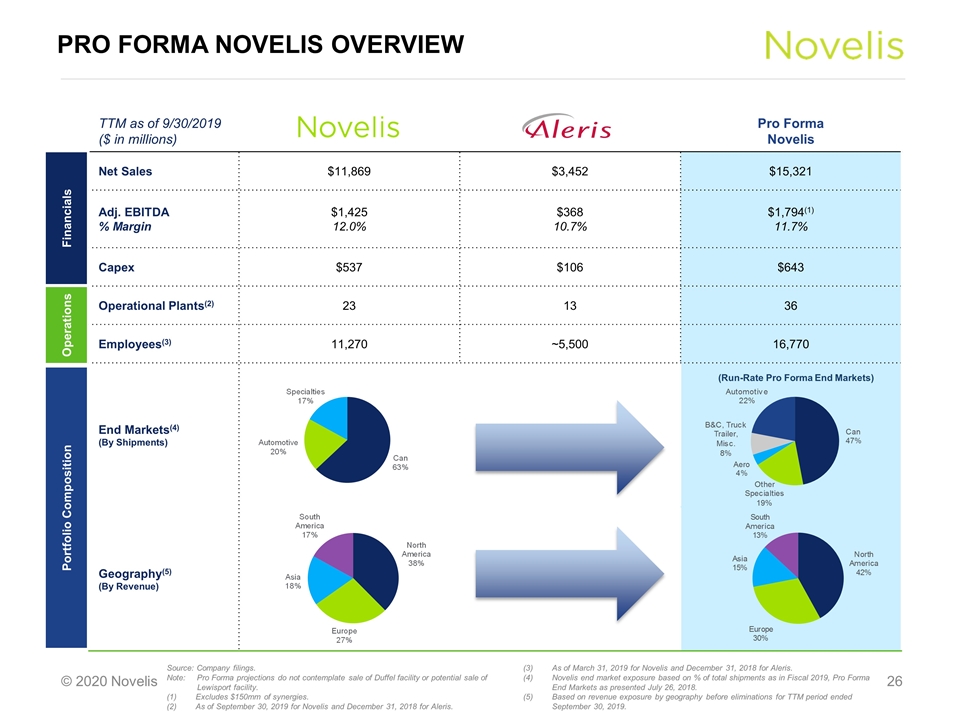

Pro Forma Novelis Overview TTM as of 9/30/2019 ($ in millions) Pro Forma Novelis Net Sales $11,869 $3,452 $15,321 Adj. EBITDA % Margin $1,425 12.0% $368 10.7% $1,794(1) 11.7% Capex $537 $106 $643 Operational Plants(2) 23 13 36 Employees(3) 11,270 ~5,500 16,770 End Markets(4) (By Shipments) Geography(5) (By Revenue) Financials Portfolio Composition Operations Source: Company filings. Note: Pro Forma projections do not contemplate sale of Duffel facility or potential sale of Lewisport facility. Excludes $150mm of synergies. As of September 30, 2019 for Novelis and December 31, 2018 for Aleris. As of March 31, 2019 for Novelis and December 31, 2018 for Aleris. Novelis end market exposure based on % of total shipments as in Fiscal 2019, Pro Forma End Markets as presented July 26, 2018. Based on revenue exposure by geography before eliminations for TTM period ended September 30, 2019. (Run-Rate Pro Forma End Markets)

Questions 29 66 138 95 188 35 0 173 251 14 41 97

Appendix 29 66 138 95 188 35 0 173 251 14 41 97

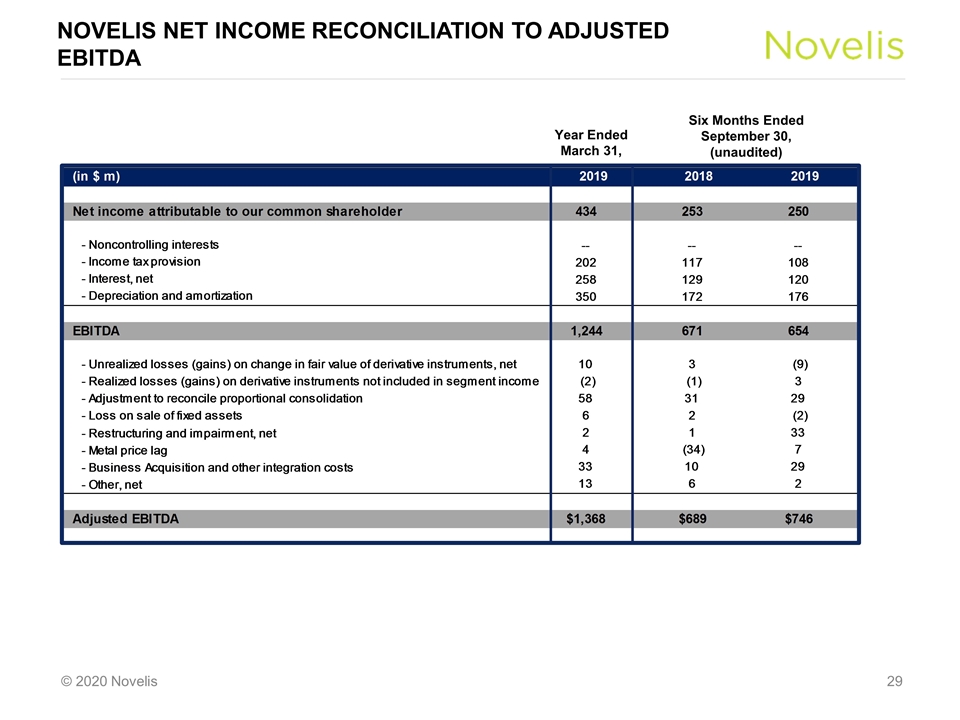

Novelis Net Income reconciliation to adjusted EBITDA Year Ended March 31, Six Months Ended September 30, (unaudited)

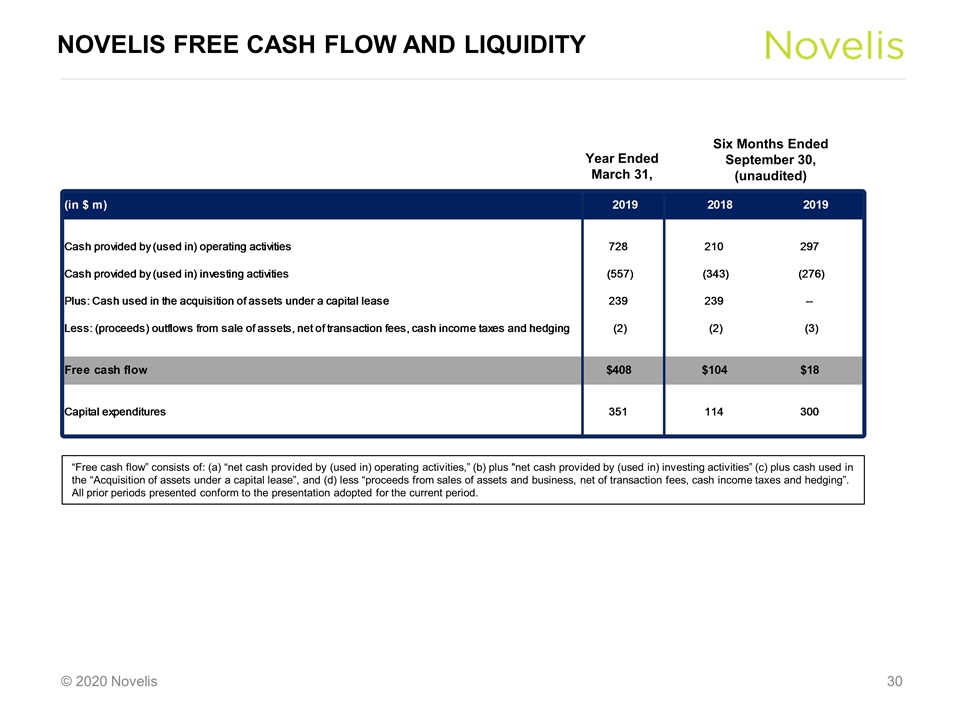

Novelis Free Cash Flow and Liquidity “Free cash flow” consists of: (a) “net cash provided by (used in) operating activities,” (b) plus "net cash provided by (used in) investing activities” (c) plus cash used in the “Acquisition of assets under a capital lease”, and (d) less “proceeds from sales of assets and business, net of transaction fees, cash income taxes and hedging”. All prior periods presented conform to the presentation adopted for the current period. Year Ended March 31, Six Months Ended September 30, (unaudited)

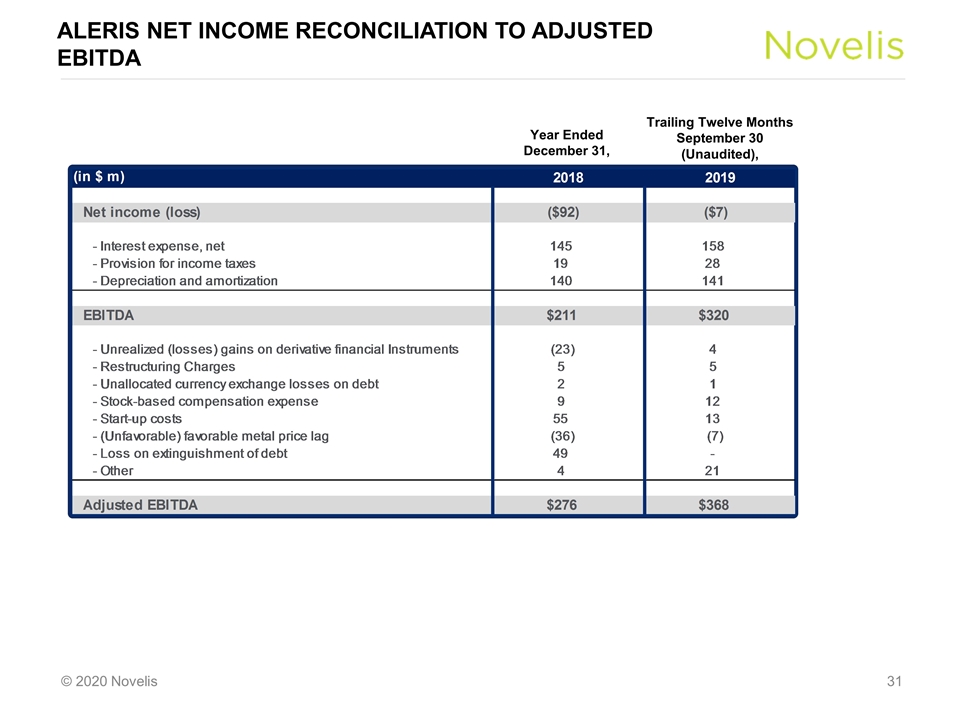

Aleris Net Income reconciliation to adjusted EBITDA Year Ended December 31, Trailing Twelve Months September 30 (Unaudited),

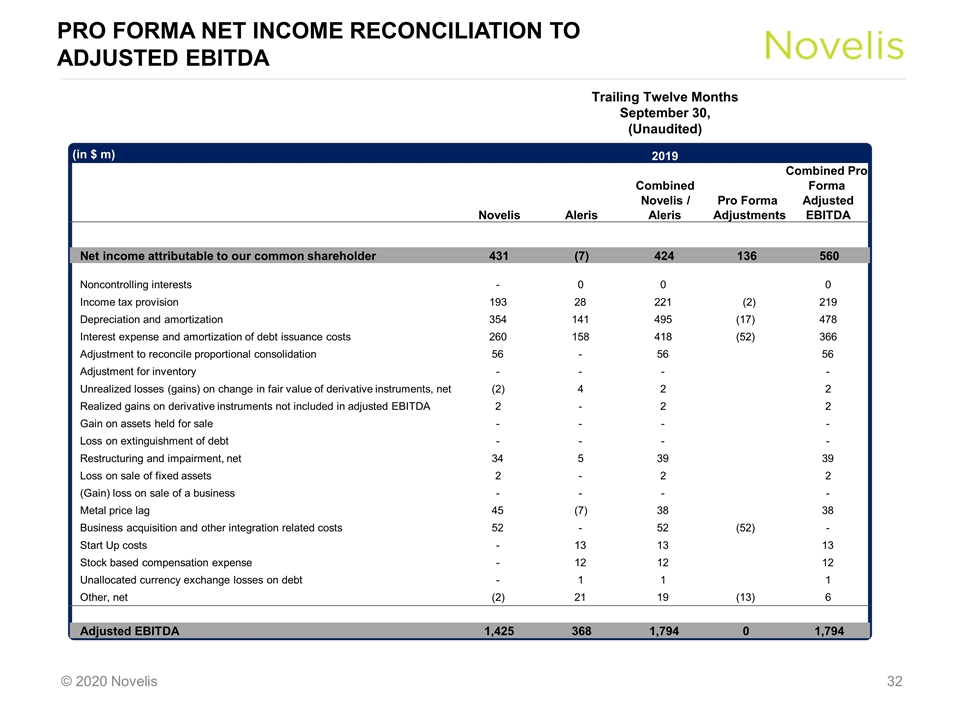

Pro Forma Net Income reconciliation to adjusted EBITDA Year Ended December 31, Trailing Twelve Months September 30, (Unaudited) (in $ m) 2019 Novelis Aleris Combined Novelis / Aleris Pro Forma Adjustments Combined Pro Forma Adjusted EBITDA Net income attributable to our common shareholder 431 (7) 424 136 560 Noncontrolling interests - 0 0 0 Income tax provision 193 28 221 (2) 219 Depreciation and amortization 354 141 495 (17) 478 Interest expense and amortization of debt issuance costs 260 158 418 (52) 366 Adjustment to reconcile proportional consolidation 56 - 56 56 Adjustment for inventory - - - - Unrealized losses (gains) on change in fair value of derivative instruments, net (2) 4 2 2 Realized gains on derivative instruments not included in adjusted EBITDA 2 - 2 2 Gain on assets held for sale - - - - Loss on extinguishment of debt - - - - Restructuring and impairment, net 34 5 39 39 Loss on sale of fixed assets 2 - 2 2 (Gain) loss on sale of a business - - - - Metal price lag 45 (7) 38 38 Business acquisition and other integration related costs 52 - 52 (52) - Start Up costs - 13 13 13 Stock based compensation expense - 12 12 12 Unallocated currency exchange losses on debt - 1 1 1 Other, net (2) 21 19 (13) 6 Adjusted EBITDA 1,425 368 1,794 0 1,794