EX-10.4

Published on June 16, 2023

Pension plan Novelis ZK Novelis Group Zusatzkasse Valid as of January 1, 2022 Provisions deviating from or supplementing the Framework Regulations Regulations GEMINI Collective Foundation manages all affiliated employers in separate pension funds. The legal relationship between the insured / affiliated employees and GEMINI Collective Foundation is governed by the Regulations. The Regulations consist of two parts: • Framework Regulations: Available for download at www.gemini.ch . • Pension plan: Governs the paragraphs for which Novelis has drawn up provisions deviating from or supplementing the Framework Regulations. The numbering relates to the paragraphs in the Framework Regulations. Approval The pension fund committee of Novelis has approved the present pension plan which shall replace all previous pension plans. Figures All figures in CHF * The figure is based on the maximum annual AHV retirement pension. As per 2022 CHF 28'680 ** The figure is based on the maximum insured salary according to UVG (Federal Law on Accident Insurance). As per 2022 CHF 148'200 Both figures are regularly reviewed by the Federal Council and automatically adjusted in the pension plan. All other figures are fixed amounts. The original German text is legally binding. Drawn up as per March 1, 2022 38 / 91015 / 515 / 2452 / carr GEMINI Collective Foundation c/o Avadis Vorsorge AG Zollstrasse 42 | P.O. Box 1077 | 8005 Zurich | T +41 58 585 33 00 | www.gemini.ch

General provisions Insured persons, entry requirements 5.1 All employees, whose annual salary exceeds the lower limit for admission are obliged to join Executives' pension fund upon commencing their employment relationship. 5.2 The lower limit for admission amounts to CHF 172'080*. 5.6 In the case of unpaid leave, the risk insurance continues as before if the employee continues paying the full contributions throughout the period of leave. The savings process also continues as before if the employee pays the full contributions throughout the duration of the unpaid leave. GEMINI Collective Foundation must be notified in writing before the unpaid leave commences. Partial months will not be included. The respective contributions are listed in paragraph 11.8. Age, retirement age 7.2 The retirement age for men is 65, for women 64. Early retirement is possible from age 58 onwards. Beginning and end of insurance 8.1 Pre-insurance in respect of the risks of disability and death commences on the 1st of January of the 17th year of age. The pension savings process commences on the 1st of January of the 24th year of age. 8.3 The entry requirements have been defined in paragraph 5. Insured annual salary 10.2 In addition to the list in the Framework Regulations, the following salary components are not included in the annual salary: a) Family bonuses b) Child allowances 10.4 The maximum insurable annual salary is defined in the individual paragraphs. 10.5 The coordination offset has been defined in the individual paragraphs. 10.6 The definition of salary applicable to the insurance benefits is stated for each type of benefit. Financing Contributions 11.3 The waiting period relating to exemption from contributions amounts to 3 months. 38 / 91015 / 515 / 2452 1

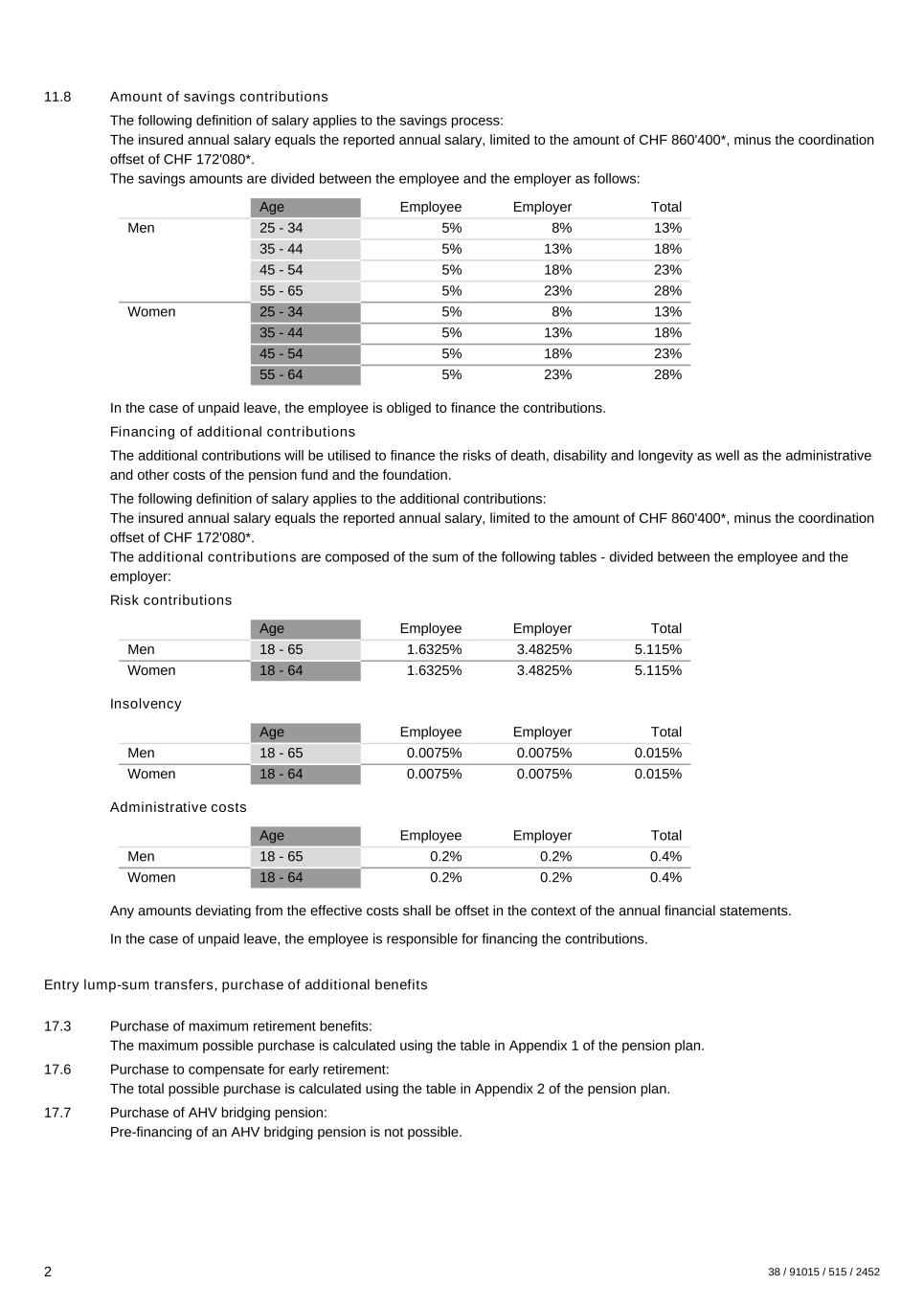

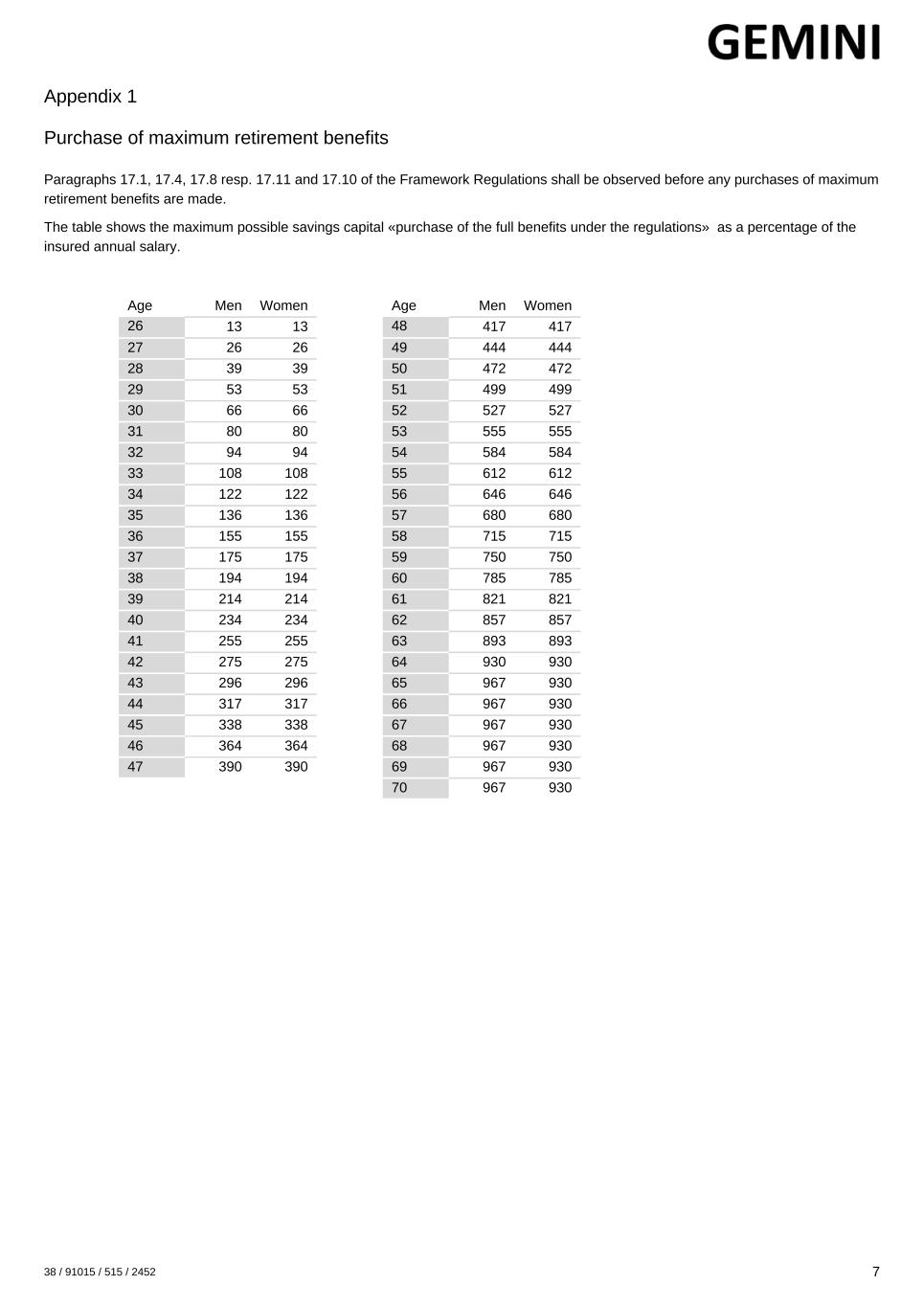

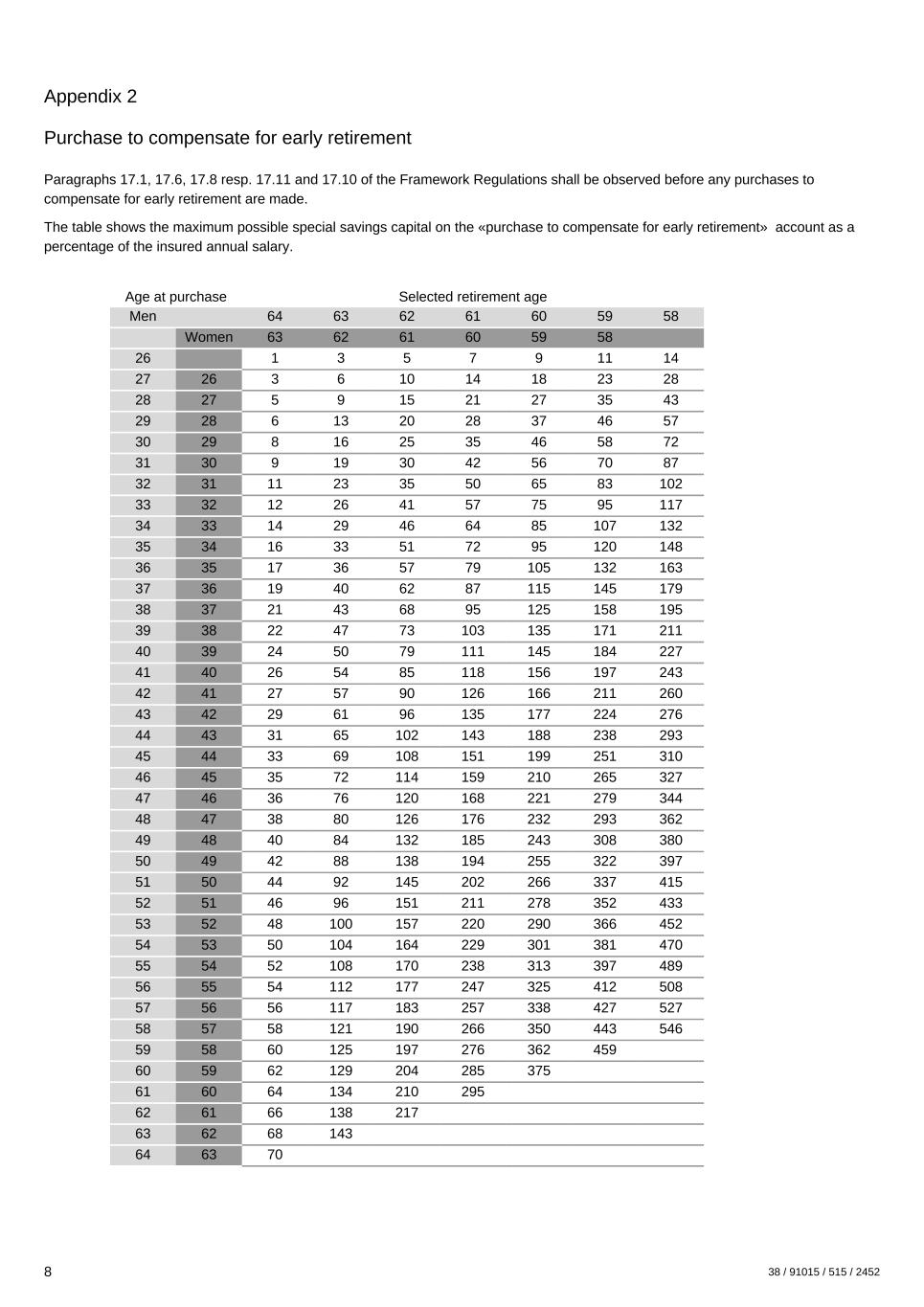

11.8 Amount of savings contributions The following definition of salary applies to the savings process: The insured annual salary equals the reported annual salary, limited to the amount of CHF 860'400*, minus the coordination offset of CHF 172'080*. The savings amounts are divided between the employee and the employer as follows: Age Employee Employer Total Men 25 - 34 5% 8% 13% 35 - 44 5% 13% 18% 45 - 54 5% 18% 23% 55 - 65 5% 23% 28% Women 25 - 34 5% 8% 13% 35 - 44 5% 13% 18% 45 - 54 5% 18% 23% 55 - 64 5% 23% 28% In the case of unpaid leave, the employee is obliged to finance the contributions. Financing of additional contributions The additional contributions will be utilised to finance the risks of death, disability and longevity as well as the administrative and other costs of the pension fund and the foundation. The following definition of salary applies to the additional contributions: The insured annual salary equals the reported annual salary, limited to the amount of CHF 860'400*, minus the coordination offset of CHF 172'080*. The additional contributions are composed of the sum of the following tables - divided between the employee and the employer: Risk contributions Age Employee Employer Total Men 18 - 65 1.6325% 3.4825% 5.115% Women 18 - 64 1.6325% 3.4825% 5.115% Insolvency Age Employee Employer Total Men 18 - 65 0.0075% 0.0075% 0.015% Women 18 - 64 0.0075% 0.0075% 0.015% Administrative costs Age Employee Employer Total Men 18 - 65 0.2% 0.2% 0.4% Women 18 - 64 0.2% 0.2% 0.4% Any amounts deviating from the effective costs shall be offset in the context of the annual financial statements. In the case of unpaid leave, the employee is responsible for financing the contributions. Entry lump-sum transfers, purchase of additional benefits 17.3 Purchase of maximum retirement benefits: The maximum possible purchase is calculated using the table in Appendix 1 of the pension plan. 17.6 Purchase to compensate for early retirement: The total possible purchase is calculated using the table in Appendix 2 of the pension plan. 17.7 Purchase of AHV bridging pension: Pre-financing of an AHV bridging pension is not possible. 2 38 / 91015 / 515 / 2452

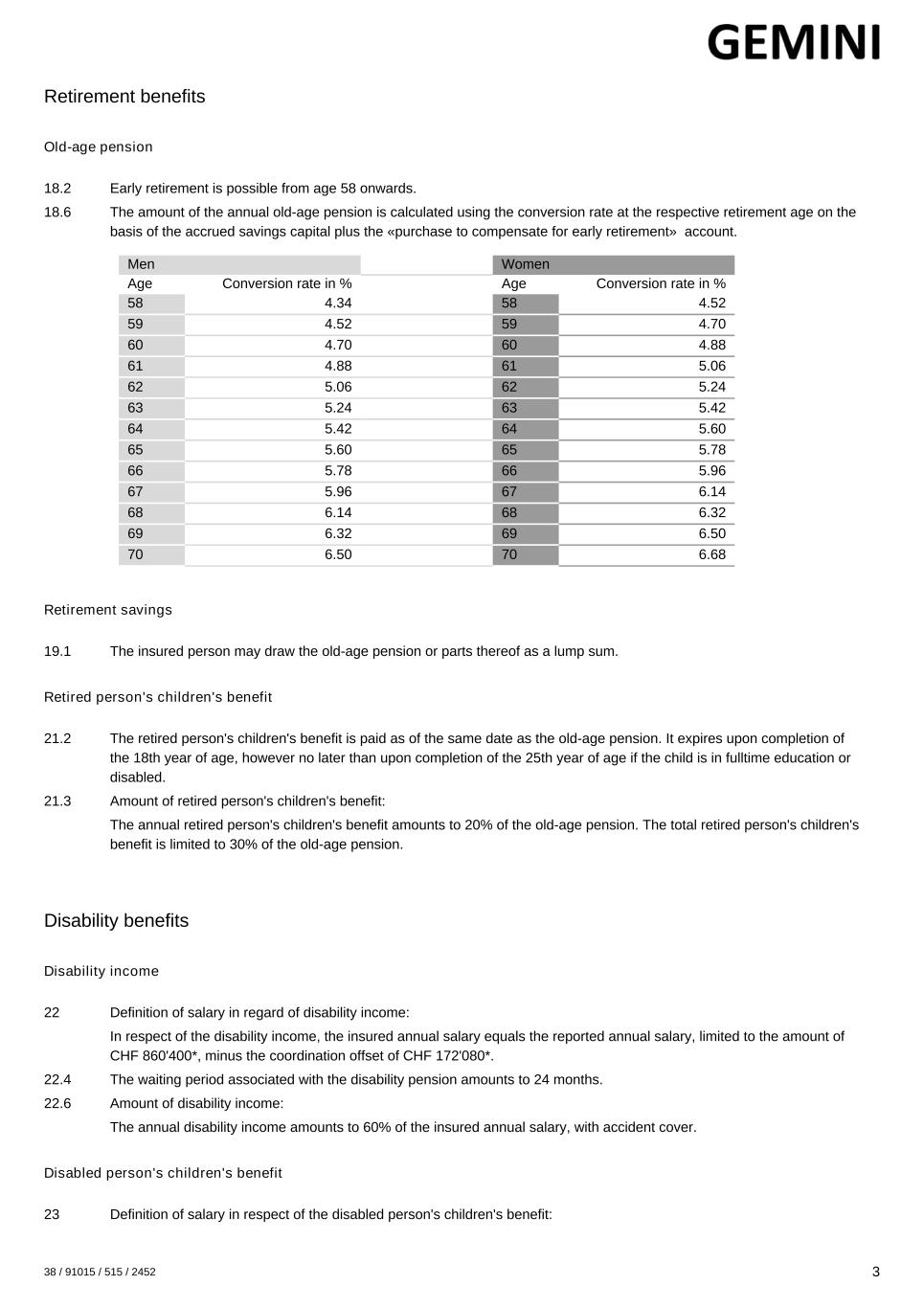

Retirement benefits Old-age pension 18.2 Early retirement is possible from age 58 onwards. 18.6 The amount of the annual old-age pension is calculated using the conversion rate at the respective retirement age on the basis of the accrued savings capital plus the «purchase to compensate for early retirement» account. Men Women Age Conversion rate in % Age Conversion rate in % 58 4.34 58 4.52 59 4.52 59 4.70 60 4.70 60 4.88 61 4.88 61 5.06 62 5.06 62 5.24 63 5.24 63 5.42 64 5.42 64 5.60 65 5.60 65 5.78 66 5.78 66 5.96 67 5.96 67 6.14 68 6.14 68 6.32 69 6.32 69 6.50 70 6.50 70 6.68 Retirement savings 19.1 The insured person may draw the old-age pension or parts thereof as a lump sum. Retired person's children's benefit 21.2 The retired person's children's benefit is paid as of the same date as the old-age pension. It expires upon completion of the 18th year of age, however no later than upon completion of the 25th year of age if the child is in fulltime education or disabled. 21.3 Amount of retired person's children's benefit: The annual retired person's children's benefit amounts to 20% of the old-age pension. The total retired person's children's benefit is limited to 30% of the old-age pension. Disability benefits Disability income 22 Definition of salary in regard of disability income: In respect of the disability income, the insured annual salary equals the reported annual salary, limited to the amount of CHF 860'400*, minus the coordination offset of CHF 172'080*. 22.4 The waiting period associated with the disability pension amounts to 24 months. 22.6 Amount of disability income: The annual disability income amounts to 60% of the insured annual salary, with accident cover. Disabled person's children's benefit 23 Definition of salary in respect of the disabled person's children's benefit: 38 / 91015 / 515 / 2452 3

In respect of the disabled person's children's benefit, the insured annual salary equals the reported annual salary, limited to the amount of CHF 860'400*, minus the coordination offset of CHF 172'080*. 23.2 The disabled person's children's benefit is paid from the same date as the disability income. It expires when the underlying disability income ends or upon completion of the 18th year of age, at the latest, however, upon completion of the 25th year of age if the child is in fulltime education or disabled. 23.3 Amount of disabled person's children's benefits: The annual disability income amounts to 7% of the insured annual salary, with accident cover. Death benefits Spouse's pension 24 Definition of salary in respect of spouse's pension: In respect of the spouse's pension, the insured annual salary equals the reported annual salary, limited to the amount of CHF 860'400*, minus the coordination offset of CHF 172'080*. 24.1 The spouse of a deceased insured person or pension recipient is entitled to a spouse's pension. 24.3 Amount of spouse's pension: In the event of the death of the insured person before retirement age, the annual spouse's pension equals 30% of the insured annual salary, with accident cover. In the event of the insured person's death past the retirement age, the spouse's pension amounts to 60% of the acquired old-age pension. If the old-age pension recipient used the option under paragraph 18.7 at the time of retirement, the spouse's pension corresponds to 100% of the acquired old-age pension. Unmarried partner's pension 26.1 The life partner (same or opposite sex) is entitled to a partner's pension, with accident cover. The requirements and reduction stipulations are described in detail in the Framework Regulations. 26.2 The life partnership must have been established before retirement and before the retirement age has been reached. The claim to a partner's pension must be presented in writing to the Foundation within three months of the death, otherwise the claim will lapse. If a benefit claim arises, the administrative office shall carry out an assessment of whether the requirements for a life-partner pension are fulfilled. Orphan's benefit 28 Definition of salary: orphan's benefit In respect of orphan's benefit, the insured annual salary equals the reported annual salary, limited to the amount of CHF 860'400*, minus the coordination offset of CHF 172'080*. 28.1 The children of a deceased insured person or pension recipient are entitled to orphan's benefits. 28.2 Entitlement becomes effective upon the death of the insured person or pension recipient, at the earliest, however, upon termination of continued payment of the full salary. It expires upon the death of the orphan or their completion of the 18th year of age, at the latest however, upon completion of the 25th year of age, if the child is in fulltime education or disabled. 28.4 Amount of orphan's benefit The annual orphan's benefit equals 7% of the insured annual salary for each entitled child, with accident cover. The pension is doubled in the case of full orphans. In the event of the death of an insured person past the retirement age, the orphan's benefit amounts to 20% of the current old-age pension. The pension is doubled in the case of full orphans. Lump-sum death benefit 29.1 If the member or the recipient of a disability or partial disability pension dies before retirement, a claim to a lump-sum death benefit arises. 4 38 / 91015 / 515 / 2452

Beneficiaries 29.2 Irrespective of inheritance law, in the case of a member's death before retirement and before reaching the retirement age, the survivors of a deceased member are entitled to the lumpsum death benefit in the following order: a) the surviving spouse, in their absence b) natural persons who were supported by the member to a considerable degree or the person who has continuously maintained a life partnership with the deceased member in the same household for the last five years prior to the member's death or who maintained a life partnership in the same household at the time of death and is responsible for the maintenance of one or more joint children who are entitled to an orphan's pension pursuant to the Regulations, in their absence c) children, foster children and stepchildren of the deceased person, in their absence parents, in their absence brothers and sisters, in their absence d) the other legal heirs, to the exclusion of the community 29.3 Persons referred to in paragraph 29.2 letter b) are entitled to the death benefit only if they were designated by the member or the recipient of a disability or partial disability pension in a written declaration addressed to the Foundation before his/her death. Members or recipients of a disability or partial disability pension may change the order of beneficiaries referred to in paragraph 29.2 letter c) or combine them entirely or partially in groups. In addition, they may specify in a written declaration addressed to the administrative office which persons within a group of beneficiaries are to be given priority and what portions of the lump-sum death benefit they are entitled to. In the absence of such a declaration, the lump-sum death benefit will be allocated equally among the group of beneficiaries. Amount of lump-sum death benefit – premium refund and additional lump-sum death benefit 29.5 For beneficiaries according to paragraph 29.2 letter a) to c) and according to paragraph 29.4, the amount of the lump-sum death benefit corresponds to the accrued savings capital, exclusive of all deposits for buy-in into the full benefits as set out in the Regulations, after deduction of the present value of all pension benefits caused by the member's death. Additional lump-sum death benefit The following applies to insured persons entitled to a spouse's or unmarried partner's pension: The insured annual salary equals the reported annual salary, limited to the amount of CHF 860'400*. The additional lump-sum death capital corresponds to 100% of the insured annual salary. 29.6 For beneficiaries according to paragraph 29.2 letter d), the lump-sum death benefit corresponds to the contributions paid by the member exclusive of all deposits for buy-in into the full benefits as set out in the Regulations, after deduction of any advance withdrawals for home ownership and divorce. However, it corresponds to at least half of the lump-sum death benefit the other beneficiaries are entitled to pursuant to paragraph 29.5, but without additional lump-sum death benefit. Refund of personal buy-ins 29.7 In addition, all beneficiaries are entitled to the accrued special savings capital as well as the deposits for buy-in into the full benefits as set out in the Regulations. 29.8 Apart from buy-ins effected with the GEMINI Collective Foundation, buy-ins according to paragraphs 29.5, 29.6 and 29.7 also include buy-ins effected with a previous insurer, on the condition that these buy-ins have been documented and reported to the GEMINI Collective Foundation in writing by the member or the previous insurer. If a cash payment was made after the buy-ins, these buy-ins shall not be considered. Transitional and final provisions Entry into force, amendments 48.1 This pension plan shall enter into force as per January 1, 2022. It shall replace all previous pension plans including all amendments. 38 / 91015 / 515 / 2452 5

Approval Approval of the pension fund committee The pension fund committee of Novelis has taken note of the Framework Regulations as of 1 January 2022 and has reviewed and approved the present pension plan. Zurich, March 1, 2022 GEMINI Collective Foundation Board of Trustees 6 38 / 91015 / 515 / 2452

Appendix 1 Purchase of maximum retirement benefits Paragraphs 17.1, 17.4, 17.8 resp. 17.11 and 17.10 of the Framework Regulations shall be observed before any purchases of maximum retirement benefits are made. The table shows the maximum possible savings capital «purchase of the full benefits under the regulations» as a percentage of the insured annual salary. Age Men Women 26 13 13 27 26 26 28 39 39 29 53 53 30 66 66 31 80 80 32 94 94 33 108 108 34 122 122 35 136 136 36 155 155 37 175 175 38 194 194 39 214 214 40 234 234 41 255 255 42 275 275 43 296 296 44 317 317 45 338 338 46 364 364 47 390 390 Age Men Women 48 417 417 49 444 444 50 472 472 51 499 499 52 527 527 53 555 555 54 584 584 55 612 612 56 646 646 57 680 680 58 715 715 59 750 750 60 785 785 61 821 821 62 857 857 63 893 893 64 930 930 65 967 930 66 967 930 67 967 930 68 967 930 69 967 930 70 967 930 38 / 91015 / 515 / 2452 7

Appendix 2 Purchase to compensate for early retirement Paragraphs 17.1, 17.6, 17.8 resp. 17.11 and 17.10 of the Framework Regulations shall be observed before any purchases to compensate for early retirement are made. The table shows the maximum possible special savings capital on the «purchase to compensate for early retirement» account as a percentage of the insured annual salary. Age at purchase Selected retirement age Men 64 63 62 61 60 59 58 Women 63 62 61 60 59 58 26 1 3 5 7 9 11 14 27 26 3 6 10 14 18 23 28 28 27 5 9 15 21 27 35 43 29 28 6 13 20 28 37 46 57 30 29 8 16 25 35 46 58 72 31 30 9 19 30 42 56 70 87 32 31 11 23 35 50 65 83 102 33 32 12 26 41 57 75 95 117 34 33 14 29 46 64 85 107 132 35 34 16 33 51 72 95 120 148 36 35 17 36 57 79 105 132 163 37 36 19 40 62 87 115 145 179 38 37 21 43 68 95 125 158 195 39 38 22 47 73 103 135 171 211 40 39 24 50 79 111 145 184 227 41 40 26 54 85 118 156 197 243 42 41 27 57 90 126 166 211 260 43 42 29 61 96 135 177 224 276 44 43 31 65 102 143 188 238 293 45 44 33 69 108 151 199 251 310 46 45 35 72 114 159 210 265 327 47 46 36 76 120 168 221 279 344 48 47 38 80 126 176 232 293 362 49 48 40 84 132 185 243 308 380 50 49 42 88 138 194 255 322 397 51 50 44 92 145 202 266 337 415 52 51 46 96 151 211 278 352 433 53 52 48 100 157 220 290 366 452 54 53 50 104 164 229 301 381 470 55 54 52 108 170 238 313 397 489 56 55 54 112 177 247 325 412 508 57 56 56 117 183 257 338 427 527 58 57 58 121 190 266 350 443 546 59 58 60 125 197 276 362 459 60 59 62 129 204 285 375 61 60 64 134 210 295 62 61 66 138 217 63 62 68 143 64 63 70 8 38 / 91015 / 515 / 2452