EXHIBIT 99.2 EARNINGS SLIDES

Published on August 6, 2019

Exhibit 99.2 NOVELIS Q1 FISCAL 2020 EARNINGS CONFERENCE CALL August 6, 2019 Steve Fisher President and Chief Executive Officer Dev Ahuja Senior Vice President and Chief Financial Officer © 2019 Novelis

SAFE HARBOR STATEMENT Forward-looking statements Statements made in this presentation which describe Novelis' intentions, expectations, beliefs or predictions may be forward- looking statements within the meaning of securities laws. Forward-looking statements include statements preceded by, followed by, or including the words "believes," "expects," "anticipates," "plans," "estimates," "projects," "forecasts," or similar expressions. Examples of forward looking statements in this news release are statements about our expectation that the proposed Aleris acquisition will close in the fourth quarter of this year. Novelis cautions that, by their nature, forward-looking statements involve risk and uncertainty and Novelis' actual results could differ materially from those expressed or implied in such statements. We do not intend, and we disclaim any obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise. Factors that could cause actual results or outcomes to differ from the results expressed or implied by forward-looking statements include, among other things: changes in the prices and availability of aluminum (or premiums associated with such prices) or other materials and raw materials we use; the capacity and effectiveness of our hedging activities; relationships with, and financial and operating conditions of, our customers, suppliers and other stakeholders; fluctuations in the supply of, and prices for, energy in the areas in which we maintain production facilities; our ability to access financing including in connection with potential acquisitions and investments; risks relating to, and our ability to consummate, pending and future acquisitions, investments or divestitures, including the proposed acquisition of Aleris Corporation; changes in the relative values of various currencies and the effectiveness of our currency hedging activities; factors affecting our operations, such as litigation, environmental remediation and clean-up costs, labor relations and negotiations; breakdown of equipment and other events; economic, regulatory and political factors within the countries in which we operate or sell our products, including changes in duties or tariffs; competition from other aluminum rolled products producers as well as from substitute materials such as steel, glass, plastic and composite materials; changes in general economic conditions including deterioration in the global economy; changes in government regulations, particularly those affecting taxes, derivative instruments, environmental, health or safety compliance; changes in interest rates that have the effect of increasing the amounts we pay under our credit facilities and other financing agreements; and our ability to generate cash. The above list of factors is not exhaustive. Other important risk factors are included under the caption "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended March 31, 2019. © 2019 Novelis 2

FIRST QUARTER HIGHLIGHTS Trailing Twelve Month ending June 30 Adjusted EBITDA . Strong operational & financial ($ millions) $1,500 1,406 performance $1,400 $1,300 1,260 . Organic expansion projects $1,200 1,106 $1,100 1,019 $1,000 progressing on time and on budget 875 $900 $800 . Increasing focus on delivering $700 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 next-generation automotive FY16 FY17 FY18 FY19 FY20 aluminum solutions Novelis AdvanzTM 6HS-s650 potential applications . Sheet-intensive battery enclosures . High-strength, lightweight 6HS-s650 alloy for structural applications . Digital transformation underway to drive world class manufacturing operations © 2019 Novelis 3

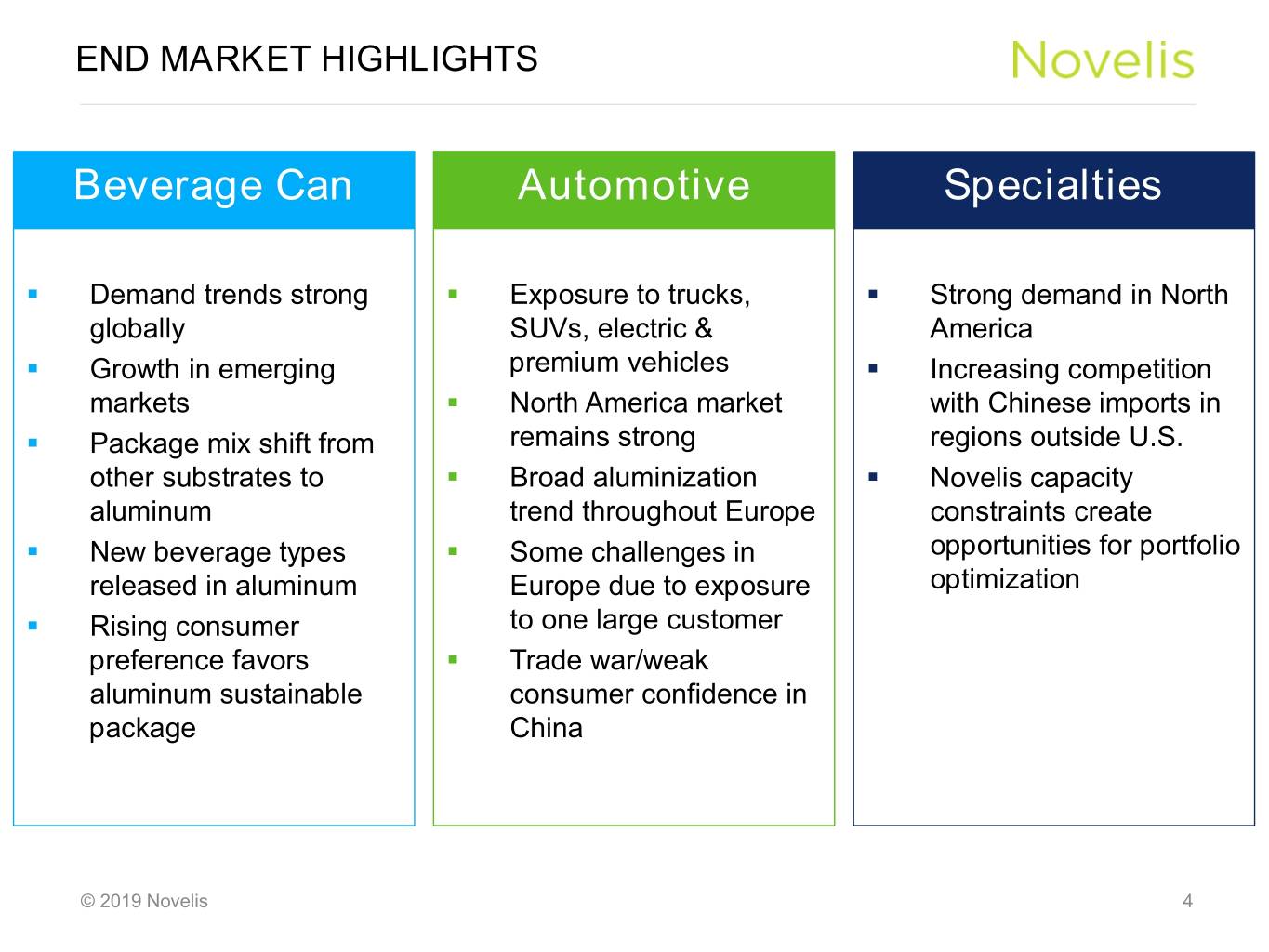

END MARKET HIGHLIGHTS Beverage Can Automotive Specialties . Demand trends strong . Exposure to trucks, . Strong demand in North globally SUVs, electric & America . Growth in emerging premium vehicles . Increasing competition markets . North America market with Chinese imports in . Package mix shift from remains strong regions outside U.S. other substrates to . Broad aluminization . Novelis capacity aluminum trend throughout Europe constraints create . New beverage types . Some challenges in opportunities for portfolio released in aluminum Europe due to exposure optimization . Rising consumer to one large customer preference favors . Trade war/weak aluminum sustainable consumer confidence in package China © 2019 Novelis 4

ALERIS ACQUISITION UPDATE . Continue to work through regulatory and closing process . Expected to close the transaction in the fourth quarter of calendar 2019, subject to customary closing conditions and regulatory approvals . Commitment to Net Debt/Adjusted EBITDA forecasted to peak below 4x at close; return to 3x within two years © 2019 Novelis 5

FINANCIAL HIGHLIGHTS © 2019 Novelis

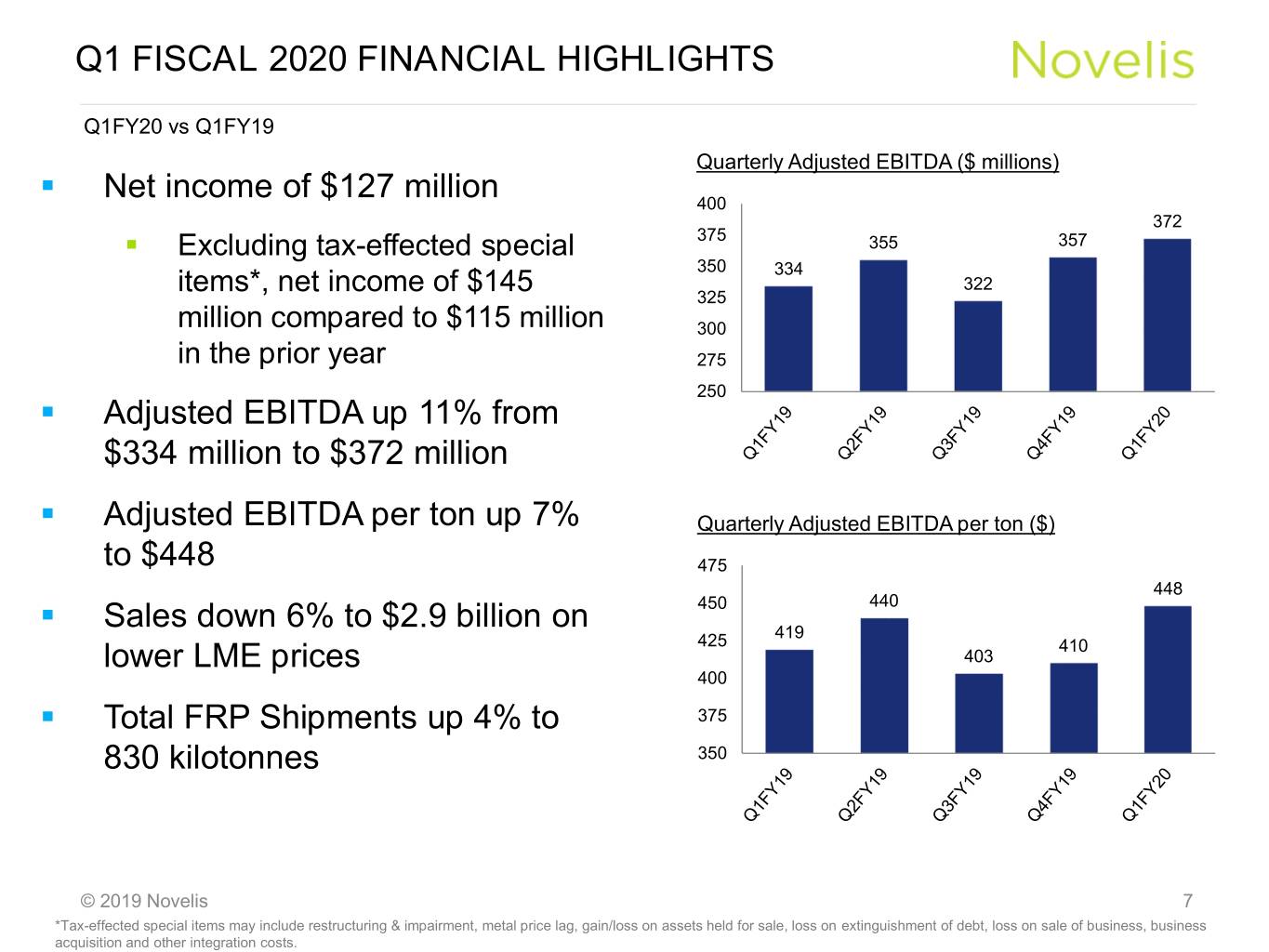

Q1 FISCAL 2020 FINANCIAL HIGHLIGHTS Q1FY20 vs Q1FY19 Quarterly Adjusted EBITDA ($ millions) . Net income of $127 million 400 372 . Excluding tax-effected special 375 355 357 350 334 items*, net income of $145 322 325 million compared to $115 million 300 in the prior year 275 250 . Adjusted EBITDA up 11% from $334 million to $372 million . Adjusted EBITDA per ton up 7% Quarterly Adjusted EBITDA per ton ($) to $448 475 448 450 440 . Sales down 6% to $2.9 billion on 419 425 410 lower LME prices 403 400 . Total FRP Shipments up 4% to 375 830 kilotonnes 350 © 2019 Novelis 7 *Tax-effected special items may include restructuring & impairment, metal price lag, gain/loss on assets held for sale, loss on extinguishment of debt, loss on sale of business, business acquisition and other integration costs.

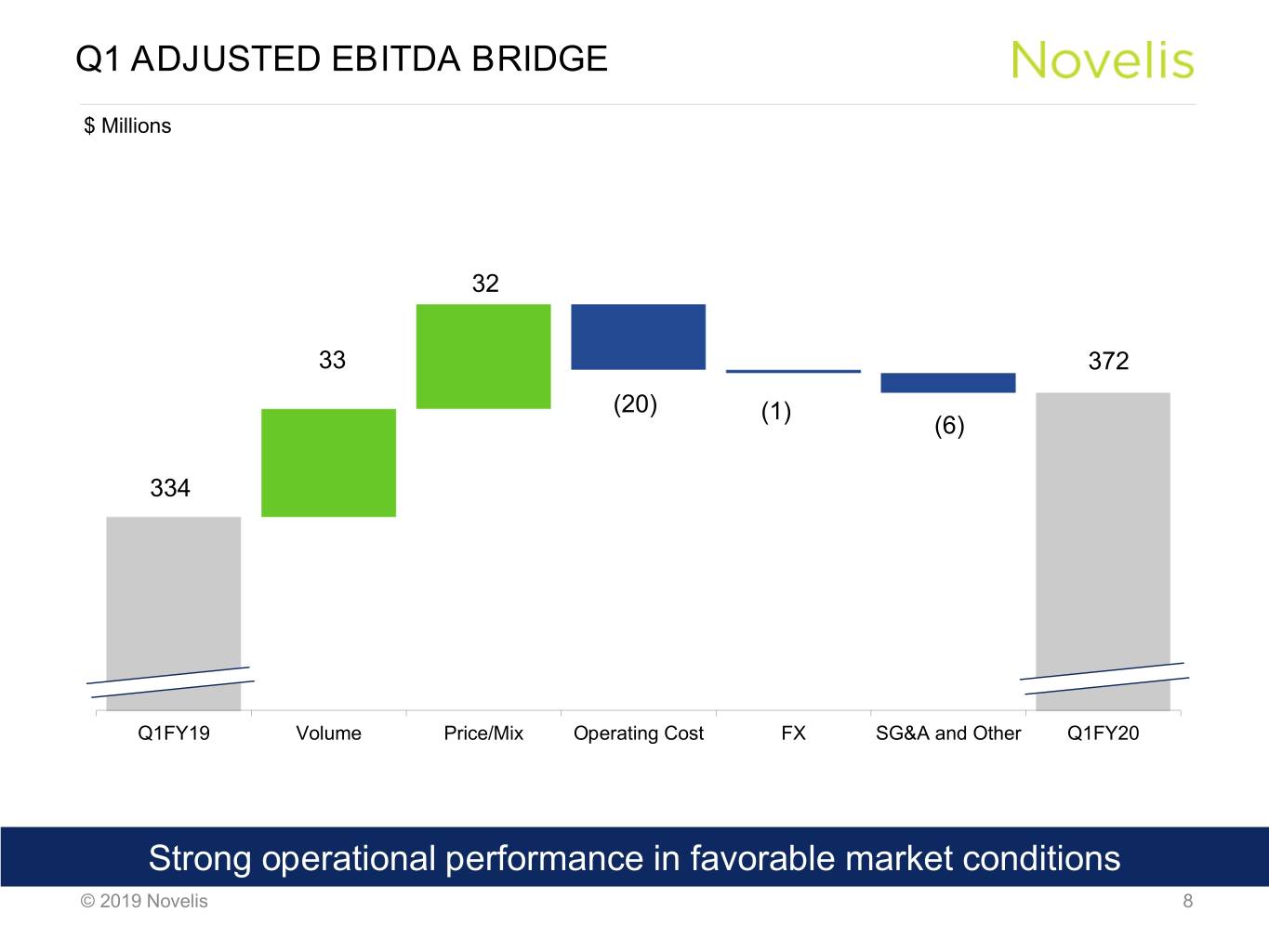

Q1 ADJUSTED EBITDA BRIDGE $ Millions 32 33 372 (20) (1) (6) 334 Q1FY19 Volume Price/Mix Operating Cost FX SG&A and Other Q1FY20 Strong operational performance in favorable market conditions © 2019 Novelis 8

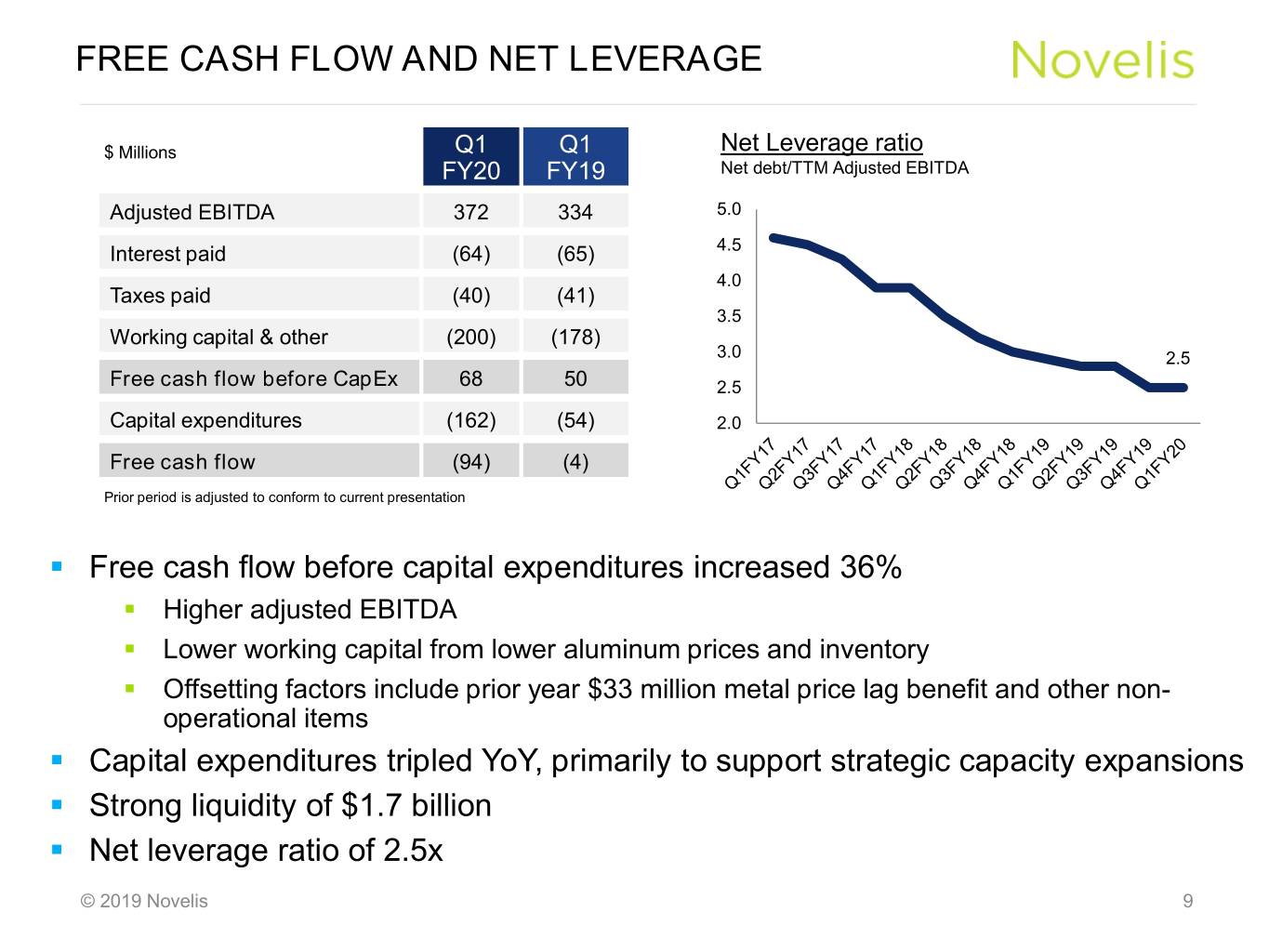

FREE CASH FLOW AND NET LEVERAGE $ Millions Q1 Q1 Net Leverage ratio FY20 FY19 Net debt/TTM Adjusted EBITDA Adjusted EBITDA 372 334 5.0 Interest paid (64) (65) 4.5 4.0 Taxes paid (40) (41) 3.5 Working capital & other (200) (178) 3.0 2.5 Free cash flow before CapEx 68 50 2.5 Capital expenditures (162) (54) 2.0 Free cash flow (94) (4) Prior period is adjusted to conform to current presentation . Free cash flow before capital expenditures increased 36% . Higher adjusted EBITDA . Lower working capital from lower aluminum prices and inventory . Offsetting factors include prior year $33 million metal price lag benefit and other non- operational items . Capital expenditures tripled YoY, primarily to support strategic capacity expansions . Strong liquidity of $1.7 billion . Net leverage ratio of 2.5x © 2019 Novelis 9

STRATEGIC CAPACITY INVESTMENTS ON TRACK . Organic expansions progressing on time and on budget . Construction is well underway with all three significant projects Guthrie, Kentucky, US Kentucky, Guthrie, . 200kt greenfield automotive finishing lines in the U.S. to begin customer qualification late FY20 . 100kt automotive finishing China Changzhou, expansion in China commissioning in FY21 . 100kt rolling and 60kt recycling expansion in Brazil Brazil , commissioning in FY21 Pinda © 2019 Novelis 10

SUMMARY © 2019 Novelis

SUMMARY . Delivering high-quality, sustainable, innovative products to customers in broadly positive market conditions for the near and long term . Continued focus on optimizing manufacturing operations and product portfolio to maximize existing capacity in favorable market conditions . Strategic investments to diversify our product portfolio and strengthen our business for the long term are on track . Continue working with regulatory agencies to close the Aleris transaction in a timely manner © 2019 Novelis 12

THANK YOU QUESTIONS? © 2019 Novelis

APPENDIX © 2019 Novelis

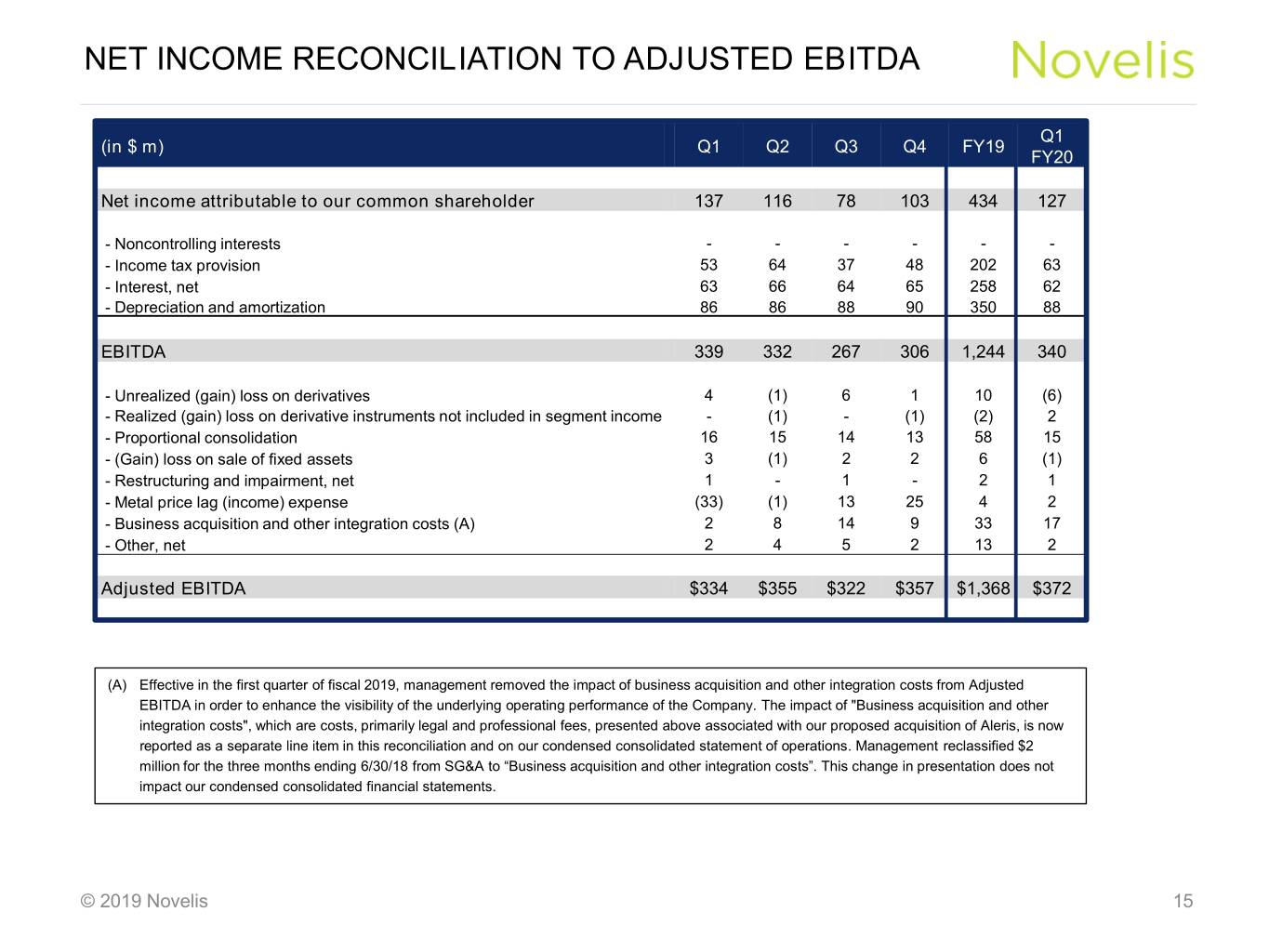

NET INCOME RECONCILIATION TO ADJUSTED EBITDA Q1 (in $ m) Q1 Q2 Q3 Q4 FY19 FY20 Net income attributable to our common shareholder 137 116 78 103 434 127 - Noncontrolling interests - - - - - - - Income tax provision 53 64 37 48 202 63 - Interest, net 63 66 64 65 258 62 - Depreciation and amortization 86 86 88 90 350 88 EBITDA 339 332 267 306 1,244 340 - Unrealized (gain) loss on derivatives 4 (1) 6 1 10 (6) - Realized (gain) loss on derivative instruments not included in segment income - (1) - (1) (2) 2 - Proportional consolidation 16 15 14 13 58 15 - (Gain) loss on sale of fixed assets 3 (1) 2 2 6 (1) - Restructuring and impairment, net 1 - 1 - 2 1 - Metal price lag (income) expense (33) (1) 13 25 4 2 - Business acquisition and other integration costs (A) 2 8 14 9 33 17 - Other, net 2 4 5 2 13 2 Adjusted EBITDA $334 $355 $322 $357 $1,368 $372 (A) Effective in the first quarter of fiscal 2019, management removed the impact of business acquisition and other integration costs from Adjusted EBITDA in order to enhance the visibility of the underlying operating performance of the Company. The impact of "Business acquisition and other integration costs", which are costs, primarily legal and professional fees, presented above associated with our proposed acquisition of Aleris, is now reported as a separate line item in this reconciliation and on our condensed consolidated statement of operations. Management reclassified $2 million for the three months ending 6/30/18 from SG&A to “Business acquisition and other integration costs”. This change in presentation does not impact our condensed consolidated financial statements. © 2019 Novelis 15

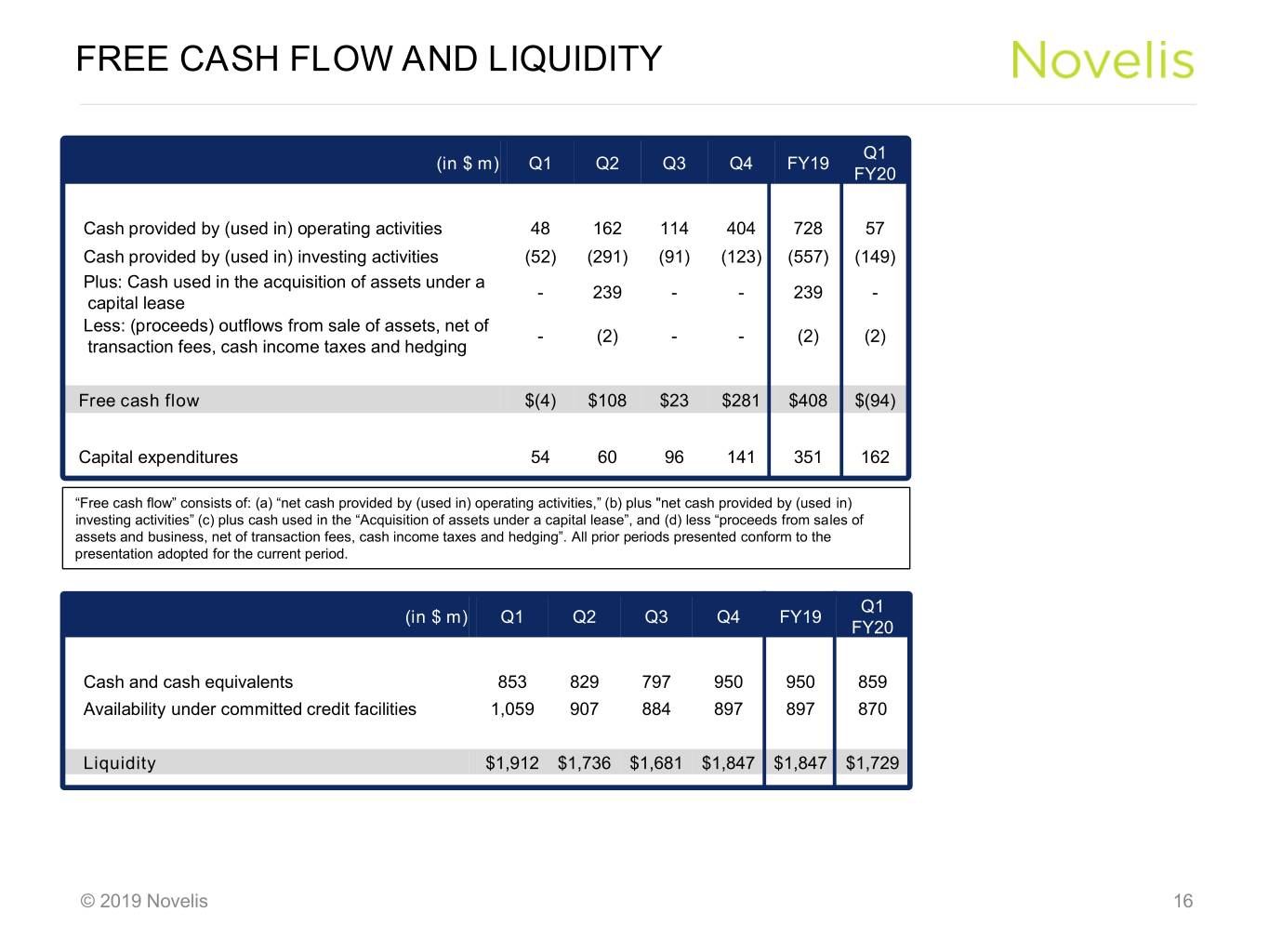

FREE CASH FLOW AND LIQUIDITY Q1 (in $ m) Q1 Q2 Q3 Q4 FY19 FY20 Cash provided by (used in) operating activities 48 162 114 404 728 57 Cash provided by (used in) investing activities (52) (291) (91) (123) (557) (149) Plus: Cash used in the acquisition of assets under a - 239 - - 239 - capital lease Less: (proceeds) outflows from sale of assets, net of - (2) - - (2) (2) transaction fees, cash income taxes and hedging Free cash flow $(4) $108 $23 $281 $408 $(94) Capital expenditures 54 60 96 141 351 162 “Free cash flow” consists of: (a) “net cash provided by (used in) operating activities,” (b) plus "net cash provided by (used in) investing activities” (c) plus cash used in the “Acquisition of assets under a capital lease”, and (d) less “proceeds from sales of assets and business, net of transaction fees, cash income taxes and hedging”. All prior periods presented conform to the presentation adopted for the current period. Q1 (in $ m) Q1 Q2 Q3 Q4 FY19 FY20 Cash and cash equivalents 853 829 797 950 950 859 Availability under committed credit facilities 1,059 907 884 897 897 870 Liquidity $1,912 $1,736 $1,681 $1,847 $1,847 $1,729 © 2019 Novelis 16