EXHIBIT 99.2 PRESENTATION SLIDES

Published on May 8, 2019

Exhibit 99.2 NOVELIS Q4 AND FISCAL 2019 EARNINGS CONFERENCE CALL May 8, 2019 Steve Fisher President and Chief Executive Officer Dev Ahuja Senior Vice President and Chief Financial Officer © 2019 Novelis

SAFE HARBOR STATEMENT Forward-looking statements Statements made in this presentation which describe Novelis' intentions, expectations, beliefs or predictions may be forward- looking statements within the meaning of securities laws. Forward-looking statements include statements preceded by, followed by, or including the words "believes," "expects," "anticipates," "plans," "estimates," "projects," "forecasts," or similar expressions. Examples of forward looking statements in this news release are statements about our expectation that the pending Aleris acquisition will close in the third quarter of this year. Novelis cautions that, by their nature, forward-looking statements involve risk and uncertainty and Novelis' actual results could differ materially from those expressed or implied in such statements. We do not intend, and we disclaim any obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise. Factors that could cause actual results or outcomes to differ from the results expressed or implied by forward- looking statements include, among other things: changes in the prices and availability of aluminum (or premiums associated with such prices) or other materials and raw materials we use; the capacity and effectiveness of our hedging activities; relationships with, and financial and operating conditions of, our customers, suppliers and other stakeholders; fluctuations in the supply of, and prices for, energy in the areas in which we maintain production facilities; our ability to access financing including in connection with potential acquisitions and investments; risks relating to, and our ability to consummate, pending and future acquisitions, investments or divestitures, including the pending acquisition of Aleris Corporation; changes in the relative values of various currencies and the effectiveness of our currency hedging activities; factors affecting our operations, such as litigation, environmental remediation and clean-up costs, labor relations and negotiations; breakdown of equipment and other events; economic, regulatory and political factors within the countries in which we operate or sell our products, including changes in duties or tariffs; competition from other aluminum rolled products producers as well as from substitute materials such as steel, glass, plastic and composite materials; changes in general economic conditions including deterioration in the global economy; changes in government regulations, particularly those affecting taxes, derivative instruments, environmental, health or safety compliance; changes in interest rates that have the effect of increasing the amounts we pay under our credit facilities and other financing agreements; and our ability to generate cash. The above list of factors is not exhaustive. Other important risk factors included under the caption "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended March 31, 2019 are specifically incorporated by reference into this news release. © 2019 Novelis 2

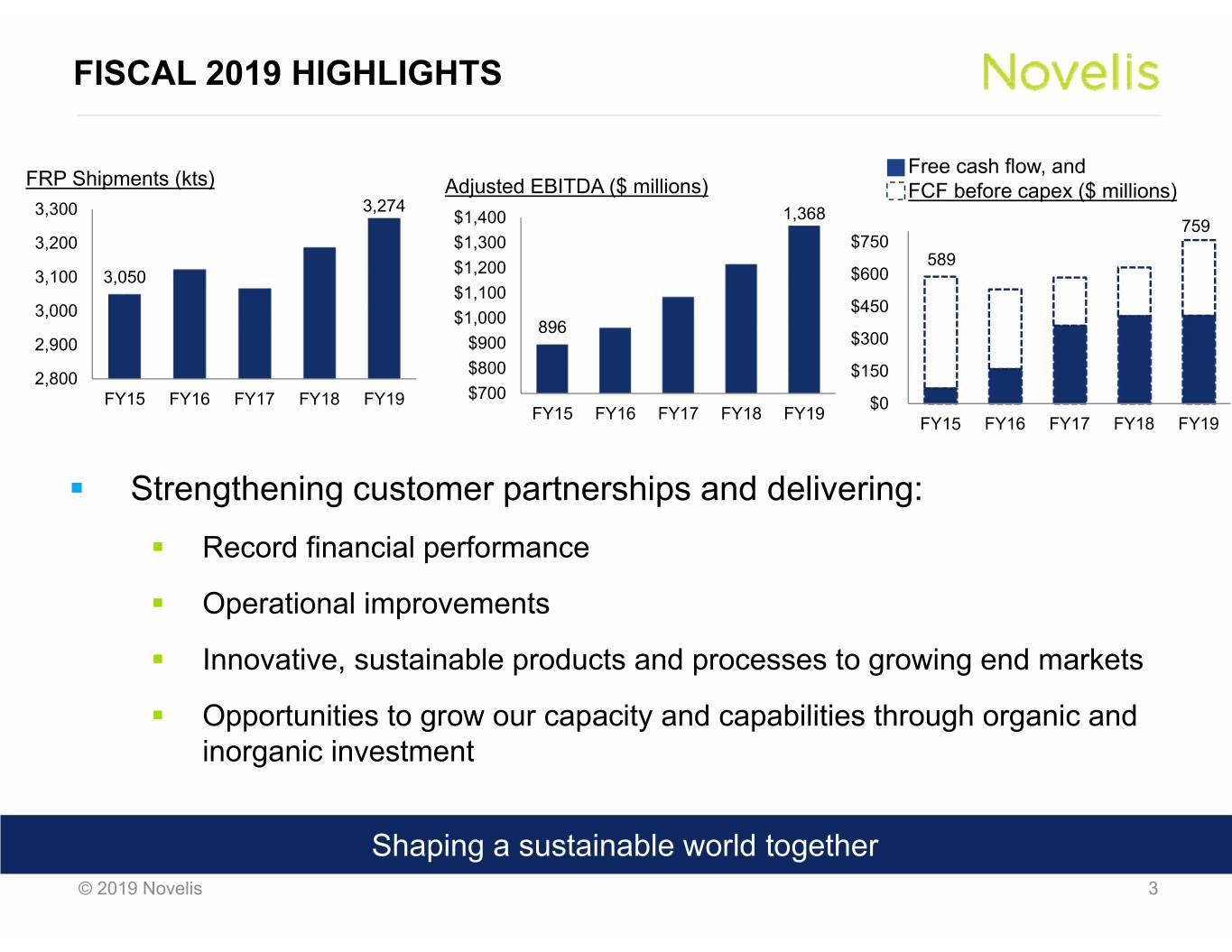

FISCAL 2019 HIGHLIGHTS Free cash flow, and FRP Shipments (kts) Adjusted EBITDA ($ millions) FCF before capex ($ millions) 3,274 3,300 $1,400 1,368 759 3,200 $1,300 $750 $1,200 589 3,100 3,050 $600 $1,100 $450 3,000 $1,000 896 2,900 $900 $300 $800 2,800 $150 $700 FY15 FY16 FY17 FY18 FY19 $0 FY15 FY16 FY17 FY18 FY19 FY15 FY16 FY17 FY18 FY19 . Strengthening customer partnerships and delivering: . Record financial performance . Operational improvements . Innovative, sustainable products and processes to growing end markets . Opportunities to grow our capacity and capabilities through organic and inorganic investment Shaping a sustainable world together © 2019 Novelis 3

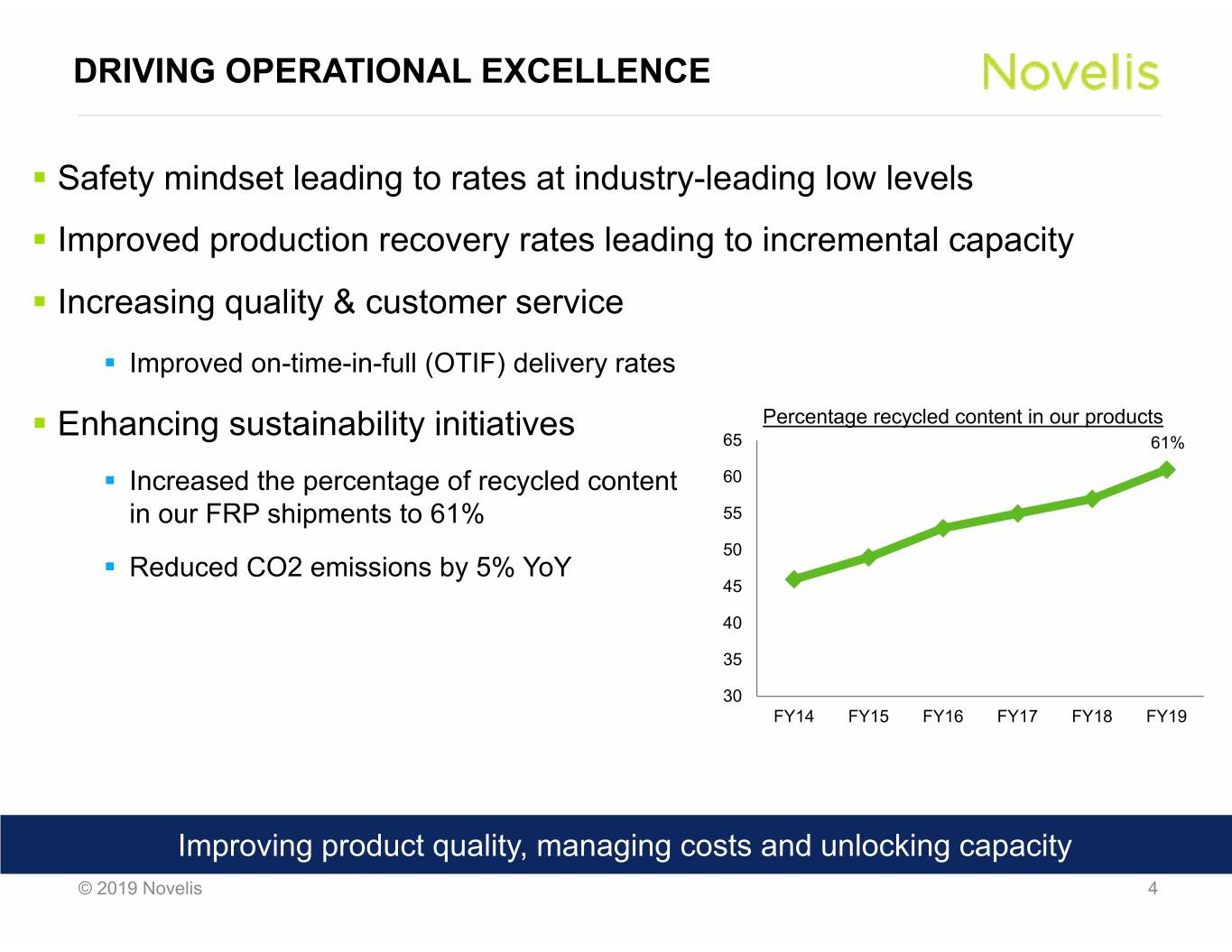

DRIVING OPERATIONAL EXCELLENCE . Safety mindset leading to rates at industry-leading low levels . Improved production recovery rates leading to incremental capacity . Increasing quality & customer service . Improved on-time-in-full (OTIF) delivery rates . Enhancing sustainability initiatives Percentage recycled content in our products 65 61% . Increased the percentage of recycled content 60 in our FRP shipments to 61% 55 50 . Reduced CO2 emissions by 5% YoY 45 40 35 30 FY14 FY15 FY16 FY17 FY18 FY19 Improving product quality, managing costs and unlocking capacity © 2019 Novelis 4

PROVIDING INNOVATIVE PRODUCTS & PROCESSES . Established automotive closed loop recycling system with Volvo Car Group in Europe . Enhanced product and process solutions to customers . Established Customer Solution Centers in the US, Europe and China . Created first aluminum sheet battery enclosure solution . Developing innovative, high-strength alloys © 2019 Novelis 5

NOVELIS PRODUCT END MARKET COMMENTARY . FY19 shipments +7% . Remains a core business . Strong global demand worldwide . Sustainability trends favoring infinitely recyclable aluminum . FY19 shipments +2% . Strong demand trends driven by continued adoption of lightweight aluminum in vehicle parts . Strong US conditions, while China impacted by short term trade driven headwinds . FY19 shipments -11% . Improving portfolio mix across regions as rolling capacity tightens . Favorable market conditions in North America driving increased demand and pricing © 2019 Novelis 6

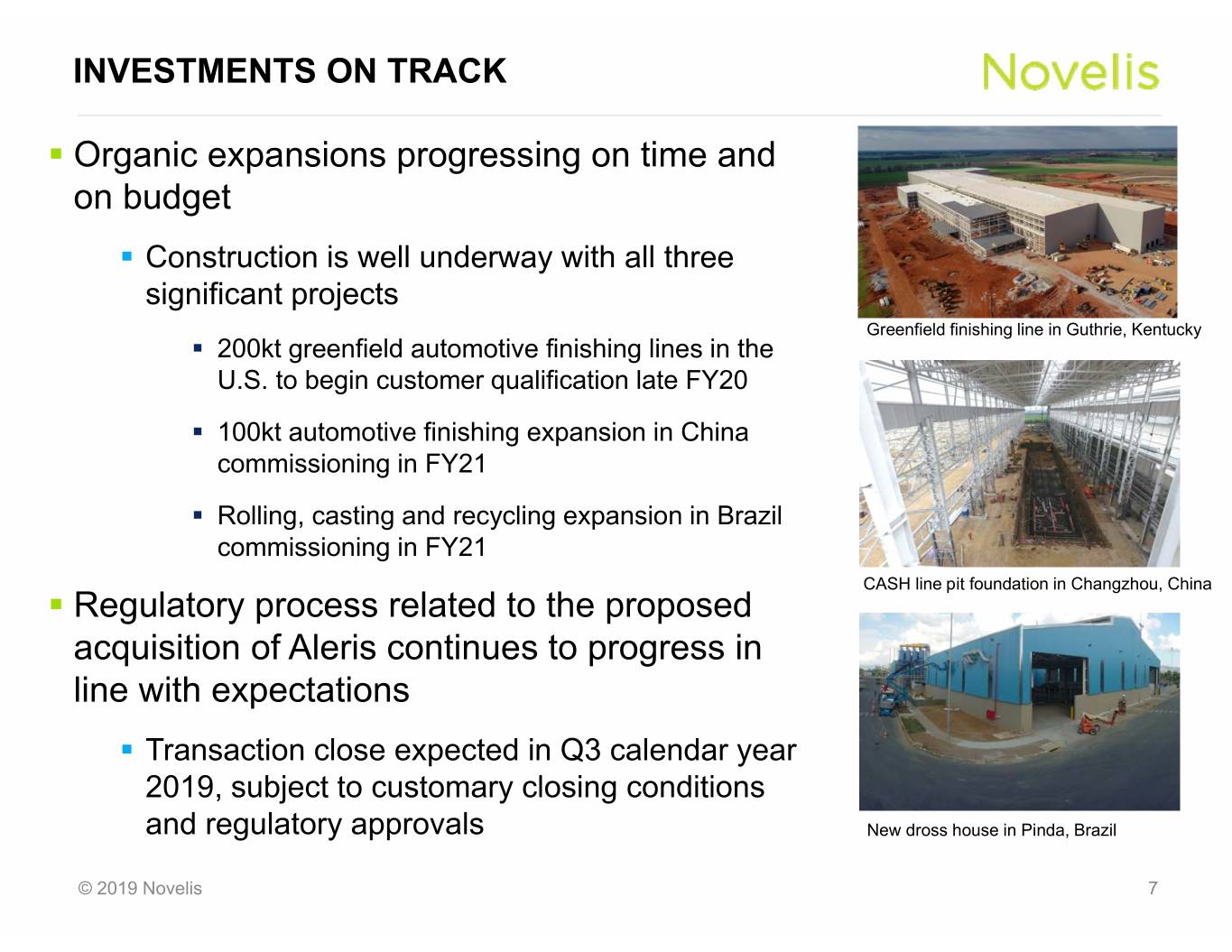

INVESTMENTS ON TRACK . Organic expansions progressing on time and on budget . Construction is well underway with all three significant projects Greenfield finishing line in Guthrie, Kentucky . 200kt greenfield automotive finishing lines in the U.S. to begin customer qualification late FY20 . 100kt automotive finishing expansion in China commissioning in FY21 . Rolling, casting and recycling expansion in Brazil commissioning in FY21 CASH line pit foundation in Changzhou, China . Regulatory process related to the proposed acquisition of Aleris continues to progress in line with expectations . Transaction close expected in Q3 calendar year 2019, subject to customary closing conditions and regulatory approvals New dross house in Pinda, Brazil © 2019 Novelis 7

FINANCIAL HIGHLIGHTS © 2019 Novelis

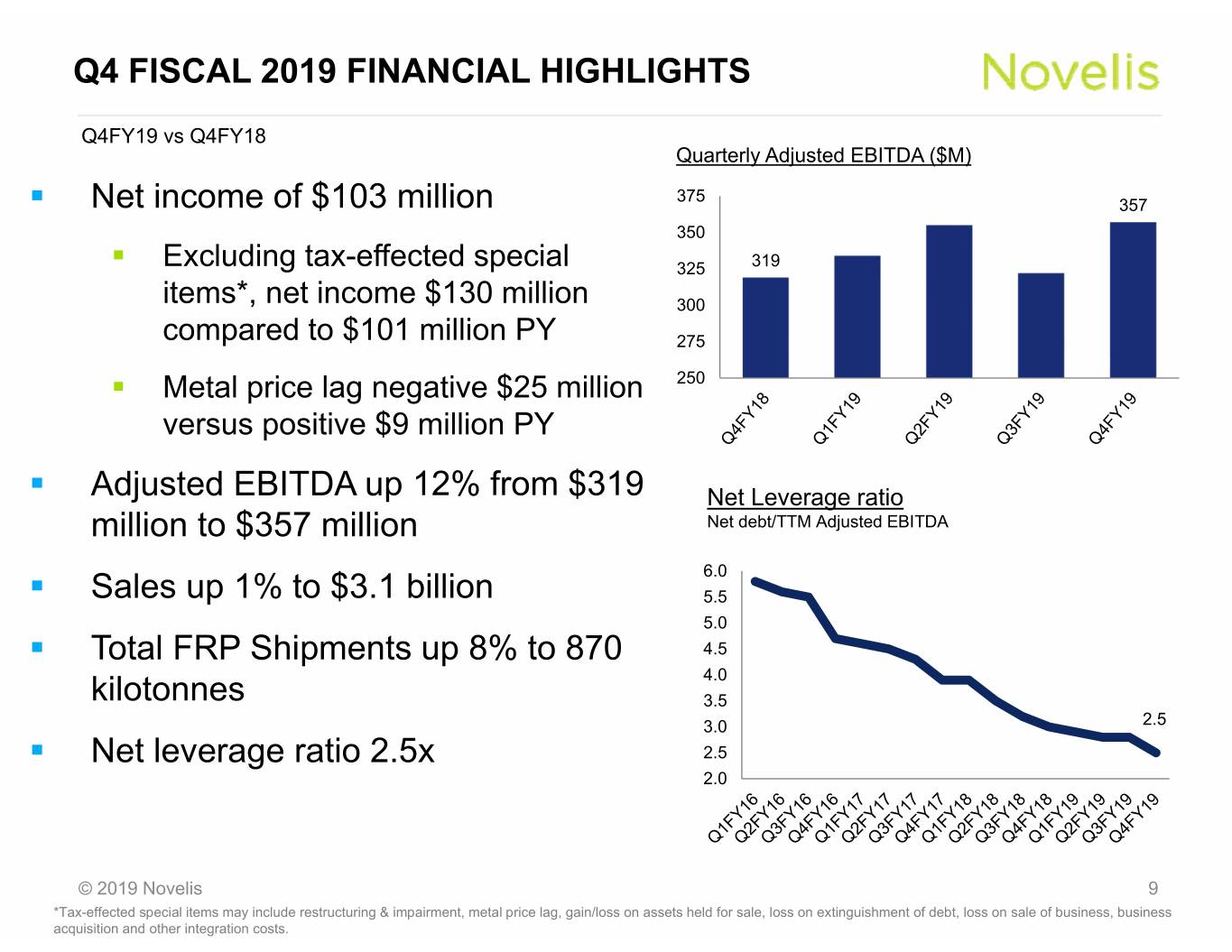

Q4 FISCAL 2019 FINANCIAL HIGHLIGHTS Q4FY19 vs Q4FY18 Quarterly Adjusted EBITDA ($M) 375 . Net income of $103 million 357 350 . Excluding tax-effected special 325 319 items*, net income $130 million 300 compared to $101 million PY 275 . Metal price lag negative $25 million 250 versus positive $9 million PY . Adjusted EBITDA up 12% from $319 Net Leverage ratio million to $357 million Net debt/TTM Adjusted EBITDA 6.0 . Sales up 1% to $3.1 billion 5.5 5.0 . Total FRP Shipments up 8% to 870 4.5 4.0 kilotonnes 3.5 3.0 2.5 . Net leverage ratio 2.5x 2.5 2.0 © 2019 Novelis 9 *Tax-effected special items may include restructuring & impairment, metal price lag, gain/loss on assets held for sale, loss on extinguishment of debt, loss on sale of business, business acquisition and other integration costs.

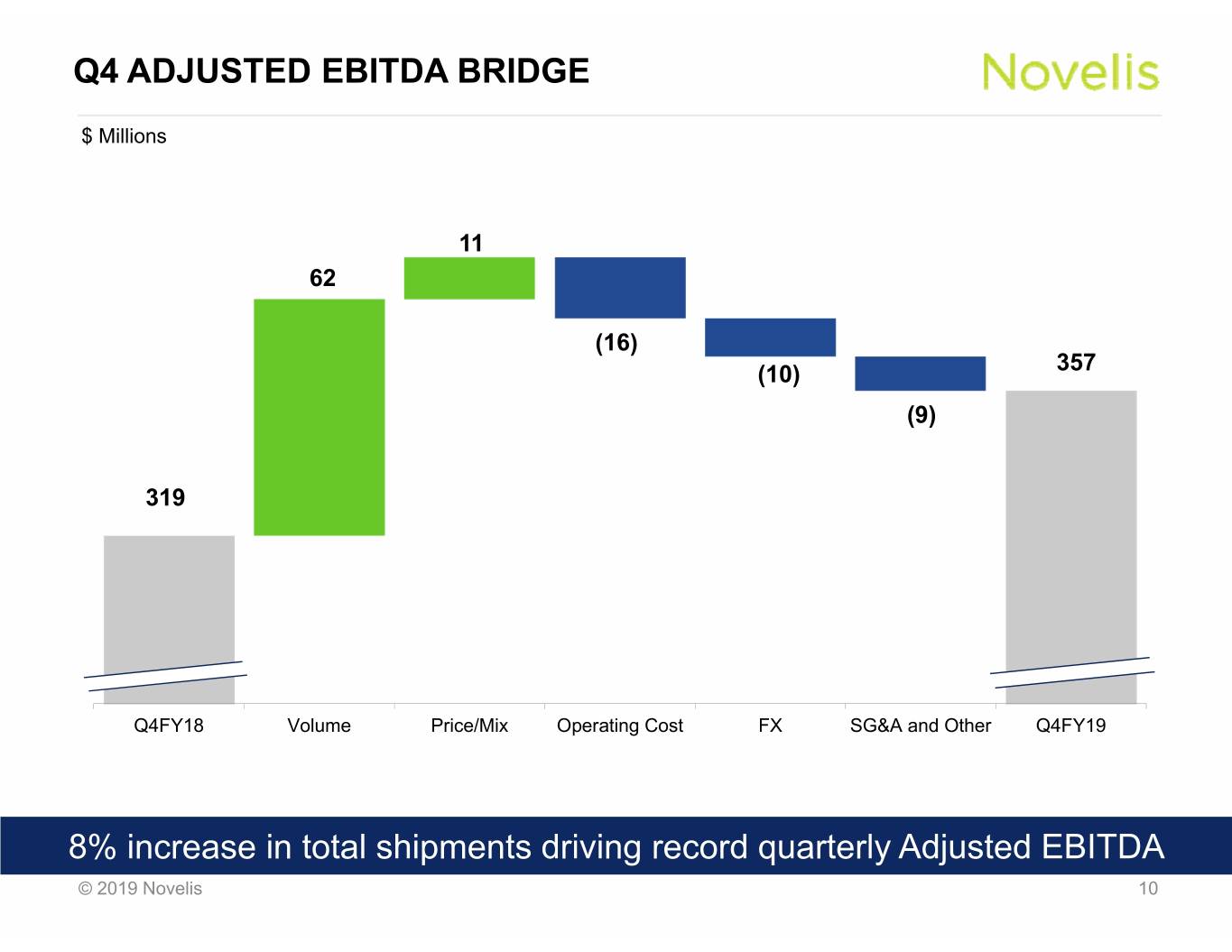

Q4 ADJUSTED EBITDA BRIDGE $ Millions 11 62 (16) (10) 357 (9) 319 Q4FY18 Volume Price/Mix Operating Cost FX SG&A and Other Q4FY19 8% increase in total shipments driving record quarterly Adjusted EBITDA © 2019 Novelis 10

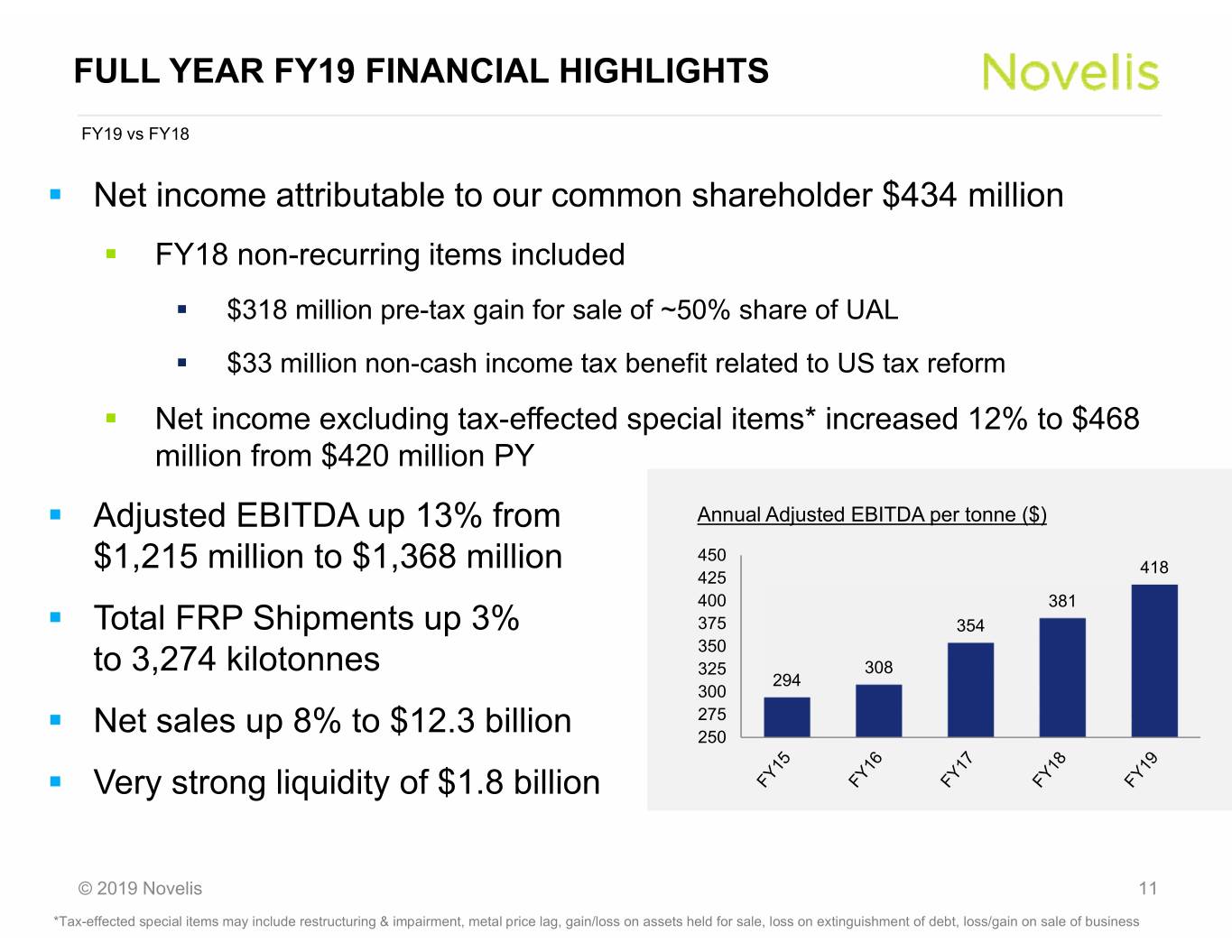

FULL YEAR FY19 FINANCIAL HIGHLIGHTS FY19 vs FY18 . Net income attributable to our common shareholder $434 million . FY18 non-recurring items included . $318 million pre-tax gain for sale of ~50% share of UAL . $33 million non-cash income tax benefit related to US tax reform . Net income excluding tax-effected special items* increased 12% to $468 million from $420 million PY . Adjusted EBITDA up 13% from Annual Adjusted EBITDA per tonne ($) 450 $1,215 million to $1,368 million 418 425 400 381 . Total FRP Shipments up 3% 375 354 350 to 3,274 kilotonnes 325 308 294 300 275 . Net sales up 8% to $12.3 billion 250 . Very strong liquidity of $1.8 billion © 2019 Novelis 11 *Tax-effected special items may include restructuring & impairment, metal price lag, gain/loss on assets held for sale, loss on extinguishment of debt, loss/gain on sale of business

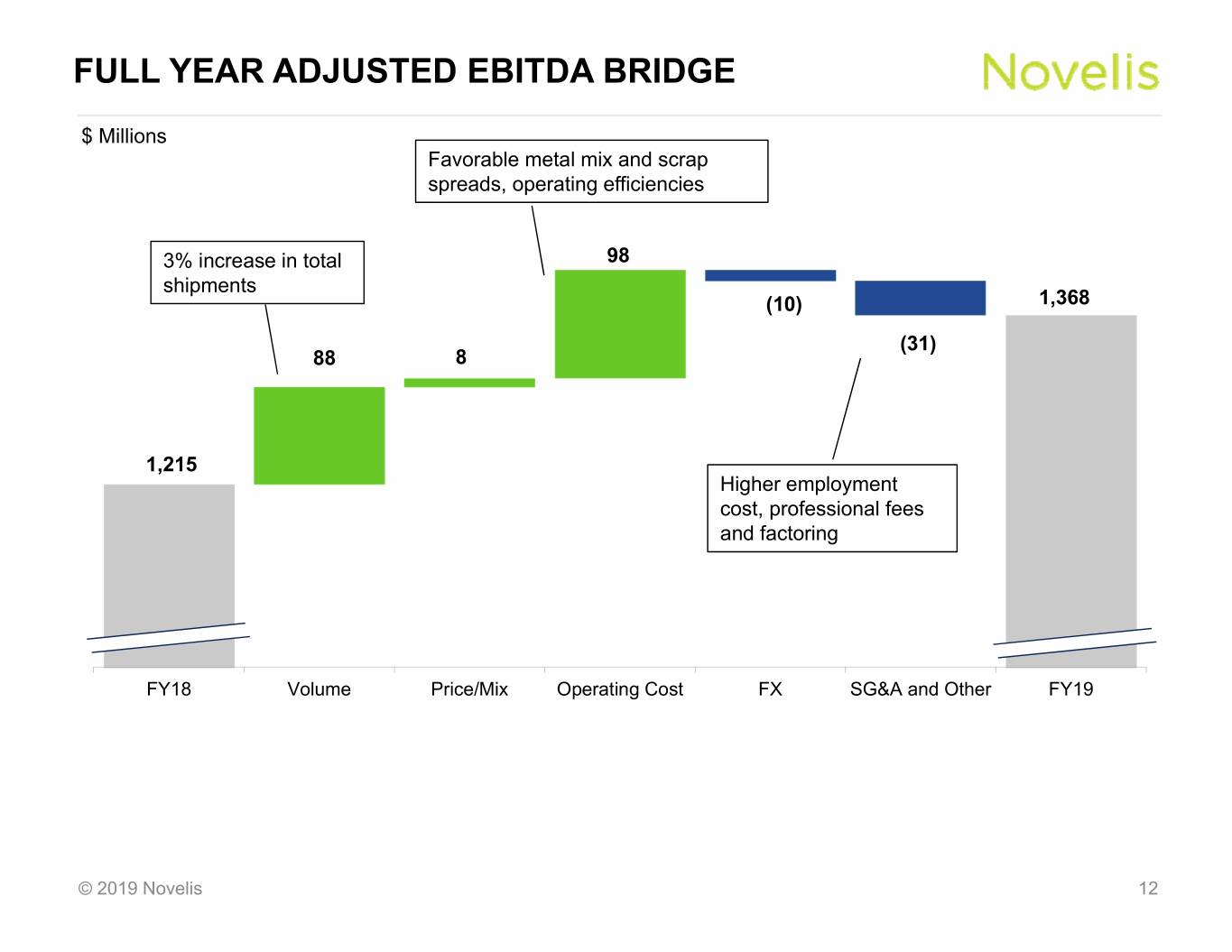

FULL YEAR ADJUSTED EBITDA BRIDGE $ Millions Favorable metal mix and scrap spreads, operating efficiencies 3% increase in total 98 shipments (10) 1,368 (31) 88 8 1,215 Higher employment cost, professional fees and factoring FY18 Volume Price/Mix Operating Cost FX SG&A and Other FY19 © 2019 Novelis 12

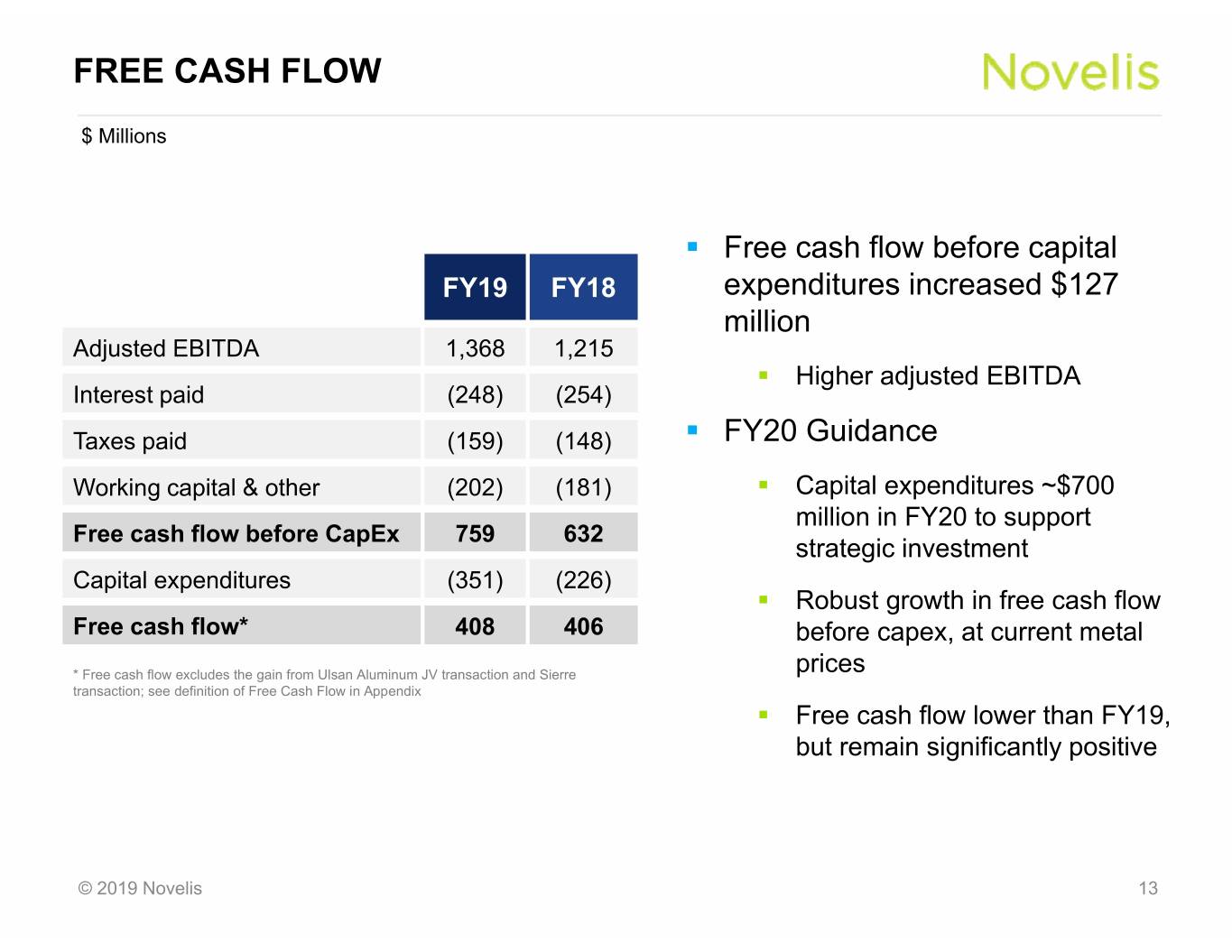

FREE CASH FLOW $ Millions . Free cash flow before capital FY19 FY18 expenditures increased $127 million Adjusted EBITDA 1,368 1,215 . Higher adjusted EBITDA Interest paid (248) (254) Taxes paid (159) (148) . FY20 Guidance Working capital & other (202) (181) . Capital expenditures ~$700 million in FY20 to support Free cash flow before CapEx 759 632 strategic investment Capital expenditures (351) (226) . Robust growth in free cash flow Free cash flow* 408 406 before capex, at current metal * Free cash flow excludes the gain from Ulsan Aluminum JV transaction and Sierre prices transaction; see definition of Free Cash Flow in Appendix . Free cash flow lower than FY19, but remain significantly positive © 2019 Novelis 13

SUMMARY © 2019 Novelis

SUMMARY . Strong operating performance and favorable market conditions driving financial growth . Positive market conditions near and long term in key end markets . Making disciplined strategic investments to diversify our product portfolio and strengthen our business . Pending Aleris acquisition continues to progress © 2019 Novelis 15

THANK YOU AND QUESTIONS THANK YOU QUESTIONS? © 2019 Novelis

APPENDIX © 2019 Novelis

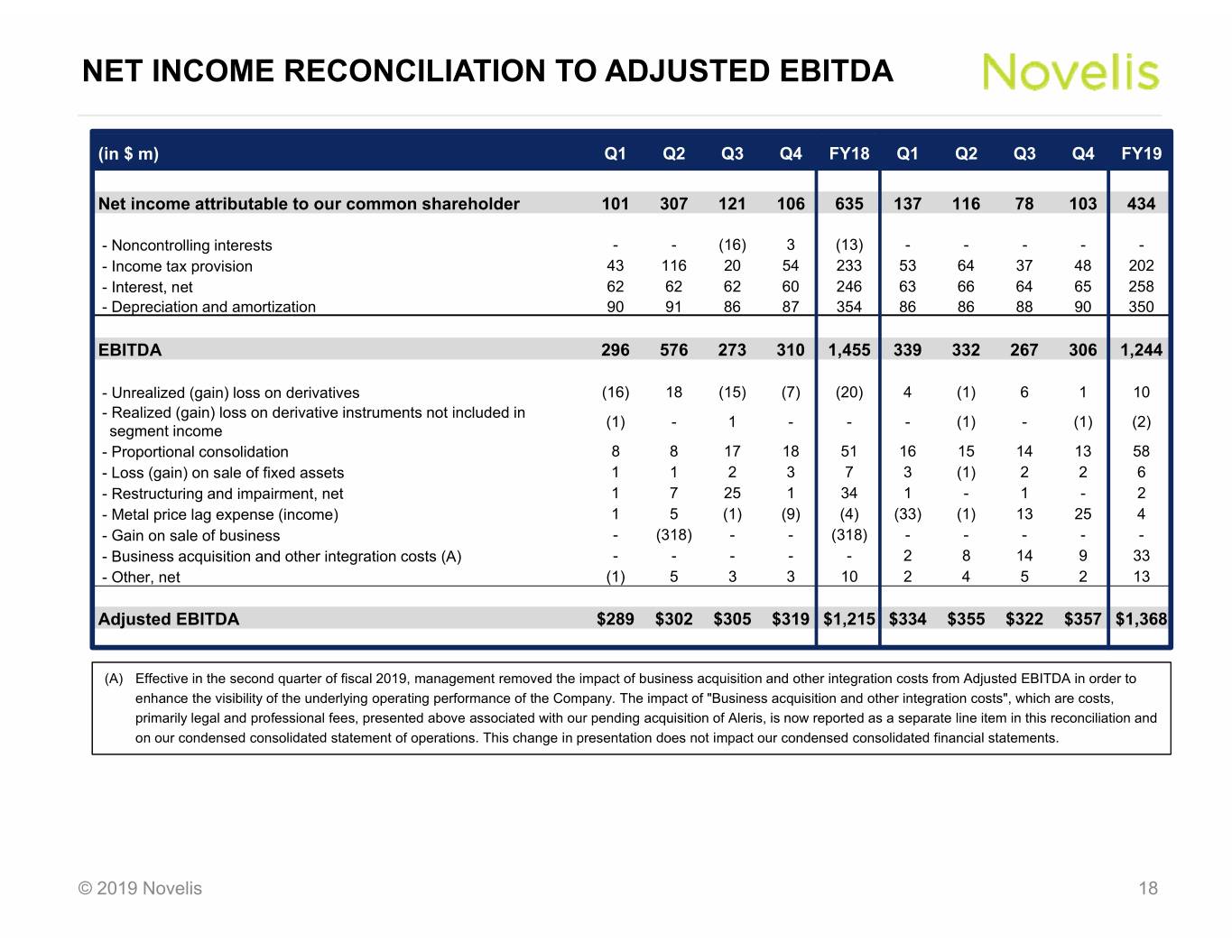

NET INCOME RECONCILIATION TO ADJUSTED EBITDA (in $ m) Q1Q2Q3Q4FY18Q1Q2Q3Q4FY19 Net income attributable to our common shareholder 101 307 121 106 635 137 116 78 103 434 - Noncontrolling interests --(16)3(13)----- - Income tax provision 43 116 20 54 233 53 64 37 48 202 - Interest, net 62 62 62 60 246 63 66 64 65 258 - Depreciation and amortization 90 91 86 87 354 86 86 88 90 350 EBITDA 296 576 273 310 1,455 339 332 267 306 1,244 - Unrealized (gain) loss on derivatives (16) 18 (15) (7) (20) 4 (1) 6 1 10 - Realized (gain) loss on derivative instruments not included in (1) - 1 - - - (1) - (1) (2) segment income - Proportional consolidation 8 8 17 18 51 16 15 14 13 58 - Loss (gain) on sale of fixed assets 112373(1)226 - Restructuring and impairment, net 17251341-1-2 - Metal price lag expense (income) 1 5 (1) (9) (4) (33) (1) 13 25 4 - Gain on sale of business - (318) - - (318) - - - - - - Business acquisition and other integration costs (A) -----2814933 - Other, net (1)53310245213 Adjusted EBITDA $289 $302 $305 $319 $1,215 $334 $355 $322 $357 $1,368 (A) Effective in the second quarter of fiscal 2019, management removed the impact of business acquisition and other integration costs from Adjusted EBITDA in order to enhance the visibility of the underlying operating performance of the Company. The impact of "Business acquisition and other integration costs", which are costs, primarily legal and professional fees, presented above associated with our pending acquisition of Aleris, is now reported as a separate line item in this reconciliation and on our condensed consolidated statement of operations. This change in presentation does not impact our condensed consolidated financial statements. © 2019 Novelis 18

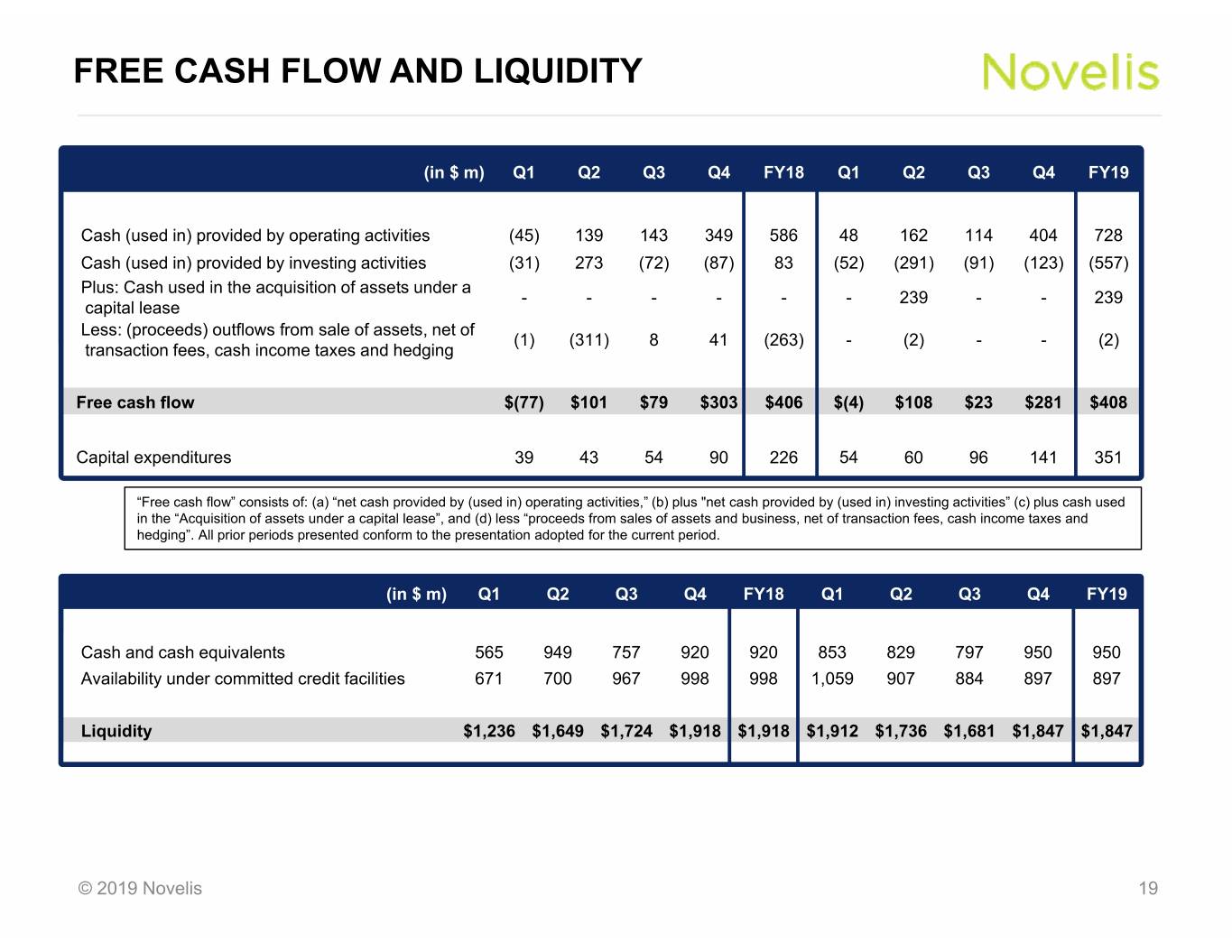

FREE CASH FLOW AND LIQUIDITY (in $ m) Q1Q2Q3Q4FY18Q1Q2Q3Q4FY19 Cash (used in) provided by operating activities (45) 139 143 349 586 48 162 114 404 728 Cash (used in) provided by investing activities (31) 273 (72) (87) 83 (52) (291) (91) (123) (557) Plus: Cash used in the acquisition of assets under a ------239--239 capital lease Less: (proceeds) outflows from sale of assets, net of (1) (311) 8 41 (263) - (2) - - (2) transaction fees, cash income taxes and hedging Free cash flow $(77) $101 $79 $303 $406 $(4) $108 $23 $281 $408 Capital expenditures 39 43 54 90 226 54 60 96 141 351 “Free cash flow” consists of: (a) “net cash provided by (used in) operating activities,” (b) plus "net cash provided by (used in) investing activities” (c) plus cash used in the “Acquisition of assets under a capital lease”, and (d) less “proceeds from sales of assets and business, net of transaction fees, cash income taxes and hedging”. All prior periods presented conform to the presentation adopted for the current period. (in $ m) Q1Q2Q3Q4FY18Q1Q2Q3Q4FY19 Cash and cash equivalents 565 949 757 920 920 853 829 797 950 950 Availability under committed credit facilities 671 700 967 998 998 1,059 907 884 897 897 Liquidity $1,236 $1,649 $1,724 $1,918 $1,918 $1,912 $1,736 $1,681 $1,847 $1,847 © 2019 Novelis 19