EXHIBIT 10.1 COMMITMENT LETTER

Published on November 2, 2018

EXECUTION VERSION CONFIDENTIAL November 1, 2018 Novelis Inc. 3560 Lenox Road, Suite 2000 Atlanta, GA 30326 Attention: Randy Miller, Vice President & Treasurer $1,500,000,000 Senior Unsecured Short Term Loan Facility $775,000,000 Senior Secured Incremental Term Loan Facility Commitment Letter Ladies and Gentlemen: Novelis Inc., a corporation amalgamated under the Canada Business Corporations Act (the “Company” or “you”), has advised each of ABN AMRO Capital USA LLC (“ABN”), Australia and New Zealand Banking Group Limited (“ANZ”), Axis Bank Limited (“Axis”), Bank of America, N.A. (“BofA”), Barclays Bank PLC (“Barclays”), Citi (as defined below), Crédit Agricole Corporate and Investment Bank (“CACIB”), DBS Bank Ltd. (“DBS”), Deutsche Bank Securities Inc. (“DBSI”), Deutsche Bank AG New York Branch (“DBNY), Deutsche Bank AG Cayman Islands Branch (“DBCI”), First Abu Dhabi Bank USA N.V. (“FAB”), HSBC (as defined below), ICICI Bank Limited, New York Branch (“ICICI”), ING Bank N.V., Singapore Branch (“ING”), JPMorgan Chase Bank, N.A. (“JPM”), Mizuho Bank, Ltd. (“Mizuho”), MUFG Bank, Ltd. (“MUFG”), Societe Generale, Hong Kong Branch (“SocGen”), SCB (as defined below), State Bank of India (“SBI”), and Sumitomo Mitsui Banking Corporation Singapore Branch (“SMBC”; SMBC, together with ABN, ANZ, Axis, BofA, Barclays, Citi, CACIB, DBSI, DBNY, DBCI, DBS, FAB, HSBC, ICICI, ING, JPM, Mizuho, MUFG, SocGen, SCB and SBI collectively, the “Commitment Parties,” “we” or “us” and each, a “Commitment Party”), that you desire to cause your wholly owned subsidiary, the Borrower (as defined below), to acquire (the “Acquisition”) Aleris

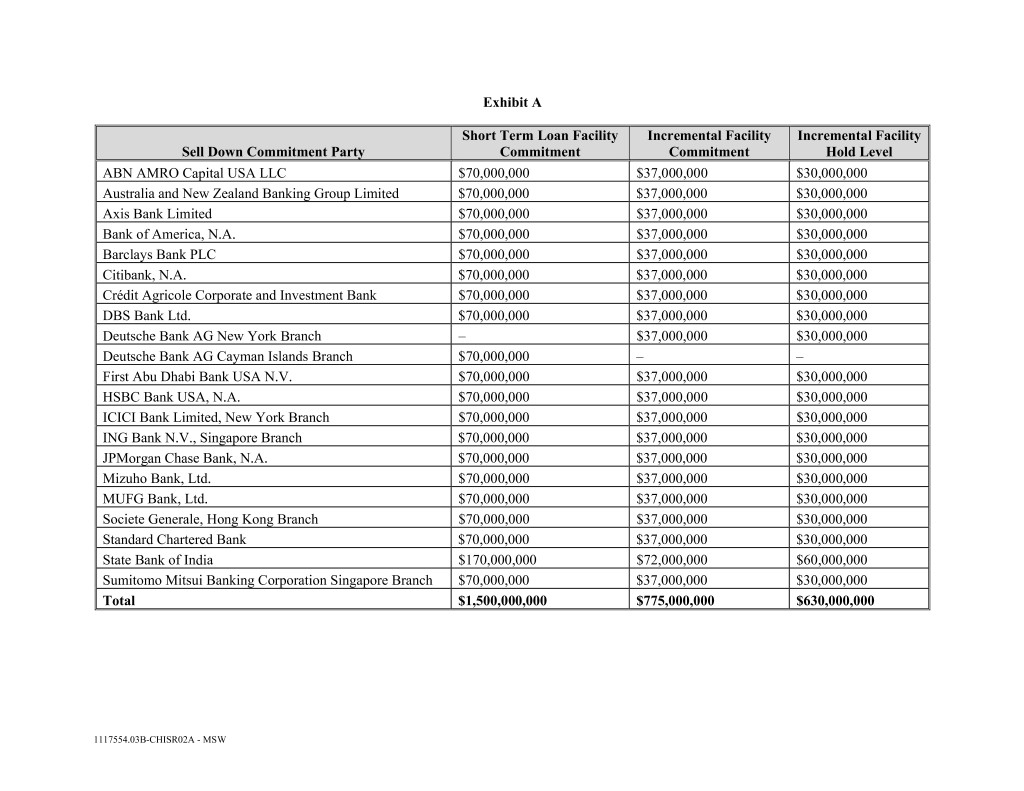

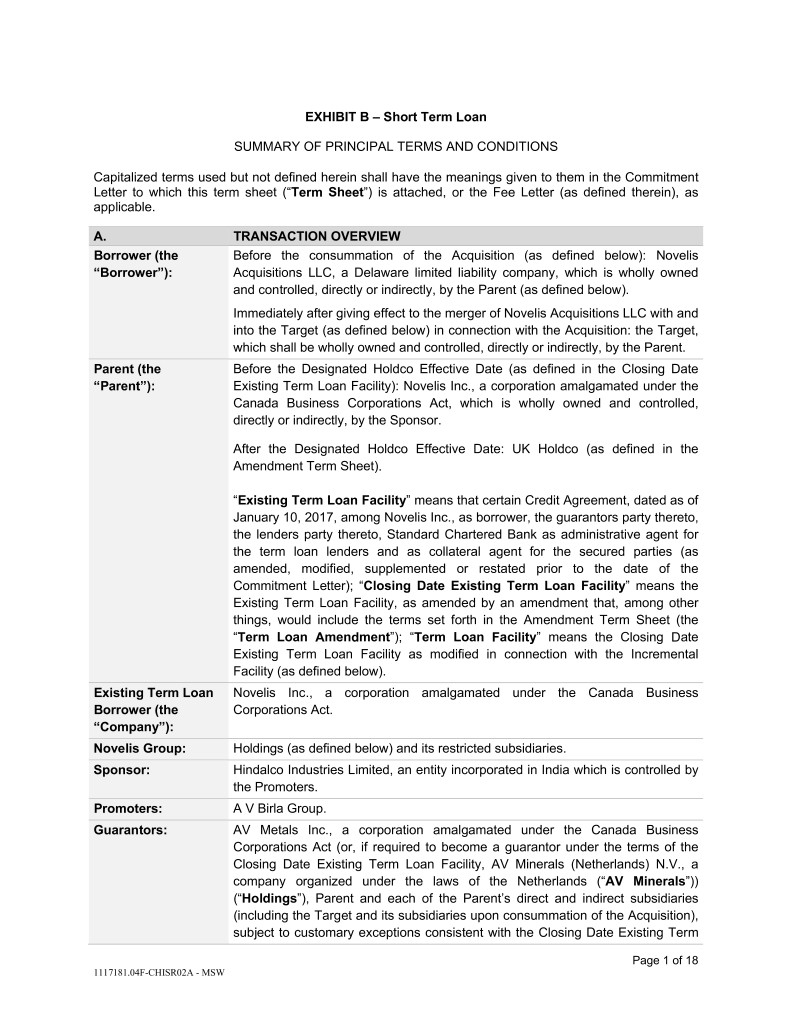

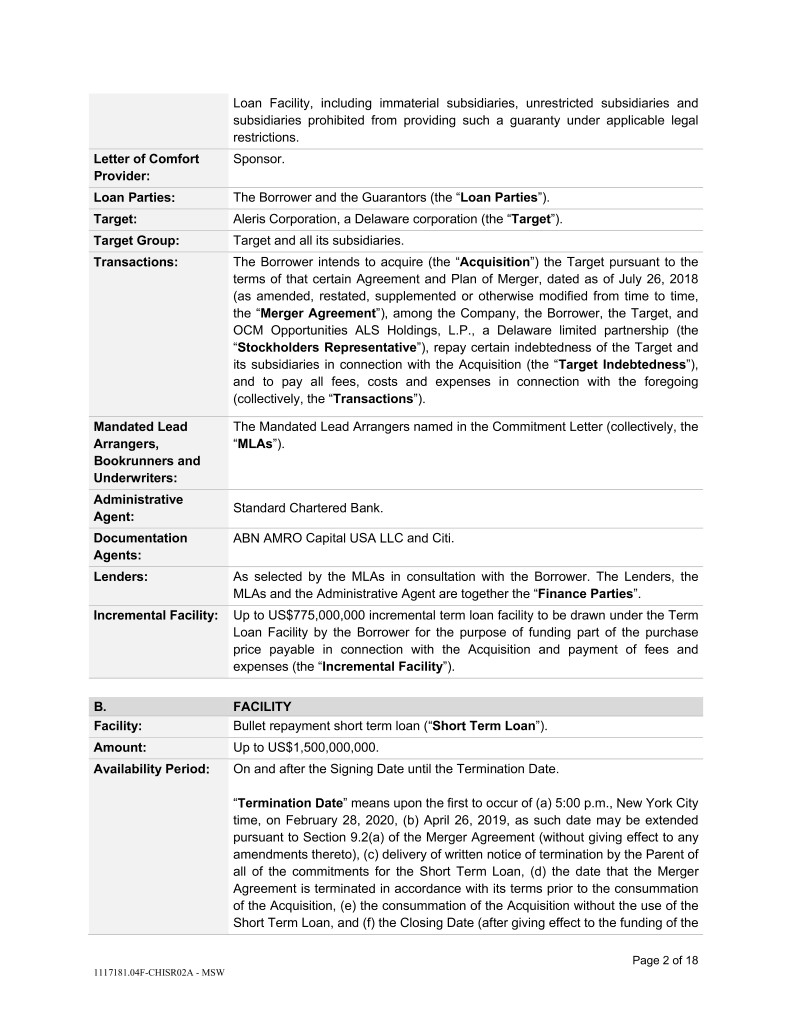

Corporation, a Delaware corporation (the “Target”), pursuant to the terms of that certain Agreement and Plan of Merger, dated as of July 26, 2018 (as amended, restated, supplemented or otherwise modified from time to time, the “Merger Agreement”), among the Company, the Borrower, the Target, and OCM Opportunities ALS Holdings, L.P., a Delaware limited partnership, repay certain indebtedness of the Target and its subsidiaries in connection with the Acquisition (the “Target Indebtedness”), and to pay all fees, costs and expenses in connection with the foregoing (collectively, the “Transactions”). “Borrower” means, (x) Novelis Acquisitions LLC, a Delaware limited liability company or (y) immediately after giving effect to the merger of Novelis Acquisitions LLC with and into the Target in connection with the Acquisition, the Target. Capitalized terms used but not defined herein shall have the meanings given to them in the Fee Letter (as defined below), the applicable Term Sheet (as defined below) or the Existing Term Loan Agreement (as defined below), as applicable. “Citi” means Citigroup Global Markets Asia Limited (“CGMAL”), Citibank, N.A. (“CBNA”), Citicorp North America, Inc. and/or any of their affiliates as may be appropriate to consummate the transactions contemplated hereby. “HSBC” means HSBC Securities (USA) Inc. (“HSBCS”), HSBC Bank USA, N.A. (“HSBCNA”) and/or any of their affiliates as may be appropriate to consummate the transactions contemplated hereby. “SCB” means Standard Chartered Bank and/or any of its affiliates as may be appropriate to consummate the transactions contemplated hereby. You have advised us that, in connection with the foregoing, the Borrower intends to (a) establish a senior unsecured short term loan facility in an aggregate principal amount of $1,500,000,000 (the “Short Term Loan Facility”), on the terms set forth in the Summary of Principal Terms and Conditions of the Short Term Loan Facility attached hereto as Exhibit B (the “Short Term Loan Term Sheet”), (b) obtain senior secured term loans in an aggregate principal amount of $775,000,000, which will be documented as Incremental Term Loan Commitments and Incremental Term Loans under and as defined in the Existing Term Loan Agreement (as defined below) (the “Incremental Facility”; the Incremental Facility, together with the Short Term Loan Facility, the “Credit Facilities”), on the terms set forth in the Summary of Principal Terms and Conditions of the Incremental Facility attached hereto as Exhibit C (the “Incremental Term Sheet”; the Incremental Term Sheet, together with the Short Term Loan Term Sheet, the “Term Sheets”; the Term Sheets, together with this commitment letter and the form of Solvency Certificate attached hereto as Exhibit E, the “Commitment Letter”), and (c) consummate the Transactions. The “Existing Term Loan Agreement” means that certain Credit Agreement, dated as of January 10, 2017 (as amended, modified, supplemented or restated prior to the date hereof), among the Company, AV Metals Inc., a corporation formed under the Canada Business Corporations Act (“Holdings”), the subsidiary guarantors from time to time party thereto, the lenders from time to time party thereto and Standard Chartered Bank, as administrative agent and as collateral agent. Subject to the terms and conditions set forth in this Commitment Letter: (a) (i) each of ABN, ANZ, Axis, BofA, Barclays, CBNA, on behalf of Citi, CACIB, DBS, FAB, HSBCNA, on behalf of HSBC, ICICI, ING, JPM, Mizuho, MUFG, SocGen, Standard Chartered Bank, on behalf of SCB, and SMBC is pleased to inform you of its respective commitment to provide $70,000,000 of the aggregate principal amount of the Short Term Loan Facility and $37,000,000 of the aggregate principal amount of the Incremental Facility, (ii) DBCI is pleased to inform you of its commitment to provide $70,000,000 of the aggregate principal amount of the Short Term Loan Facility, (iii) DBNY is pleased to inform you of its commitment to provide $37,000,000 of the aggregate principal amount of the Incremental Facility and (iv) SBI is pleased to inform you of its commitment to provide $170,000,000 of the aggregate principal amount of the Short Term Loan Facility and $72,000,000 of the aggregate principal amount of the Incremental Facility. The commitments of the Commitment Parties shall be several and not joint, and no Commitment Party shall be liable for the failure of any other Commitment Party to fund its commitment; and (b) each of each of ABN, ANZ, Axis, BofA, Barclays, CGMAL, on behalf of Citi, CACIB, DBS, DBSI, FAB, HSBCS, on behalf of HSBC, ICICI, ING, JPM, Mizuho, MUFG, SocGen, Standard Chartered Bank, on behalf of SCB, and SMBC is pleased to advise you of its willingness in connection with the 2

foregoing commitments to act as a mandated lead arranger and bookrunner (each, in such capacity, the “Mandated Lead Arranger” and collectively, the “Mandated Lead Arrangers”) for the Credit Facilities. Notwithstanding the foregoing, the aggregate principal amount of loans under the Short Term Loan Facility and the Incremental Facility and the aggregate commitment of each Commitment Party in respect of the Short Term Loan Facility and the Incremental Facility and under the terms of the definitive documentation therefor shall be automatically reduced at any time on or after the date hereof as set forth opposite the headings “Voluntary Prepayments and Commitment Reductions” and “Mandatory Prepayments” in the Short Term Loan Term Sheet and the Incremental Term Sheet. The Mandated Lead Arrangers are also pleased to agree to use commercially reasonable efforts to arrange a syndicate of Lenders (as defined below) that will participate in the Incremental Facility on the terms set forth in this Commitment Letter. The Mandated Lead Arrangers shall not syndicate the Short Term Loan Facility, regardless of whether the Closing Date occurs. The Company hereby appoints ABN and Citi as documentation agents for the Credit Facilities. Each of ABN and Citi hereby accepts such appointment. The Company hereby appoints SCB as administrative agent for the Short Term Loan Facility. SCB hereby accepts such appointment. The Company hereby appoints SCB as administrative agent for the Incremental Facility. SCB hereby accepts such appointment. You agree that, except as provided above, no other agents, co-agents or arrangers will be appointed and no other titles will be awarded in connection with the Credit Facilities unless you and the Mandated Lead Arrangers shall agree in writing. 1. Conditions Precedent The commitments and agreements of the Commitment Parties hereunder and the agreement of the Mandated Lead Arrangers to provide the services described herein are subject to the satisfaction (or waiver in writing by the Mandated Lead Arrangers and the Commitment Parties) of each of the following conditions precedent by the applicable date set forth below in a manner reasonably acceptable to the Mandated Lead Arrangers and the Commitment Parties: (a) prior to the date of the initial funding of either or both of the Credit Facilities and the consummation of the Acquisition (the “Closing Date”), the execution and delivery of an amendment to, or amendment and restatement of, the Revolving Credit Agreement that, among other things, permits the Acquisition and the Credit Facilities (and, if necessary in connection with the foregoing, the Permitted Reorganization) (the “Revolver Amendment”); (b) on or prior to the Signing Date, the execution and delivery of an amendment to, or amendment and restatement of, the Existing Term Loan Credit Agreement that, among other things, permits the Acquisition and the Credit Facilities (and, if necessary in connection with the foregoing, the Permitted Reorganization) (the “Term Loan Amendment”), on terms in all material respects consistent with the terms set forth in the Summary of Proposed Amendments to the Existing Term Loan Agreement attached hereto as Exhibit D (the “Amendment Term Sheet”); (c) any amendments to the Existing Term Loan Agreement from the date this Commitment Letter is signed through and including the Closing Date shall be satisfactory to each of the Mandated Lead Arrangers; (d) with respect to the Short Term Loan Facility, the satisfaction of the conditions precedent under the section titled “Conditions Precedent to Signing Date” on or prior to the Signing Date (as defined in the Short Term Loan Term Sheet), and the satisfaction of the conditions precedent under the section titled “Conditions Precedent to Drawdown” on or prior to the Closing Date; 3

(e) with respect to the Incremental Facility, the satisfaction of the conditions precedent under the section titled “Conditions Precedent to Signing Date” on or prior to the Signing Date (as defined in the Incremental Term Sheet), and the satisfaction of the conditions precedent under the section titled “Conditions Precedent to Drawdown” on or prior to the Closing Date (as defined in the Incremental Term Sheet); (f) on or prior to February 28, 2019, the negotiation, execution and delivery by the Company, Holdings, Borrower, the Guarantors, the Commitment Parties, the Mandated Lead Arrangers and, to the extent applicable, the other lenders party thereto, of (i) the definitive documentation in respect of the Short Term Loan Facility (the “Short Term Loan Credit Documentation”) on terms and subject to conditions consistent with this Commitment Letter and the Short Term Loan Term Sheet or otherwise reasonably satisfactory to the Mandated Lead Arrangers, and (ii) the definitive documentation in respect of the Incremental Facility (the “Incremental Credit Documentation”; the Incremental Credit Documentation, together with the Short Term Loan Credit Documentation, the “Credit Documentation”) on terms and conditions consistent with this Commitment Letter and the Incremental Term Sheet or otherwise reasonably satisfactory to the Mandated Lead Arrangers; (g) since March 31, 2018 through and as of (i) the Signing Date and (ii) the Closing Date, there has been no event, change, circumstance or occurrence that, individually or in the aggregate, has had or could reasonably be expected to result in a Material Adverse Effect on Holdings and its subsidiaries (in the case of the Closing Date, after giving effect to the Acquisition); and (h) the payment in full of all fees, expenses and other amounts required to be paid under this Commitment Letter, the Fee Letter and the Credit Documentation on the date such fees, expenses or other amounts are due and payable hereunder or thereunder (it being understood that such payment may be made by netting such payments in respect of each Credit Facility against amounts borrowed under such Credit Facility on the Closing Date). There are no conditions (implied or otherwise) to the commitments hereunder, other than those that are expressly referred to in the immediately preceding sentence, which (for the avoidance of doubt) shall include the conditions precedent referenced in the Short Term Loan Term Sheet under the sections titled “Conditions Precedent to Signing Date” and “Conditions Precedent to Drawdown”, and the conditions precedent referenced in the Incremental Term Sheet under the sections titled “Conditions Precedent to Signing Date” and “Conditions Precedent to Drawdown”. 2. Syndication of the Incremental Facility The Mandated Lead Arrangers reserve the right to syndicate all or a portion of the commitments or loans under the Incremental Facility to one or more other banks, financial institutions and institutional lenders in consultation with you that will become parties to the applicable Credit Documentation (the banks, financial institutions and institutional lenders becoming parties to the applicable Credit Documentation being collectively referred to herein as the “Lenders”); provided that the Mandated Lead Arrangers agree not to syndicate the commitments or loans under the Incremental Facility to certain banks, financial institutions and other institutional lenders and any competitors (or Known Affiliates (as defined below) of competitors) of the Loan Parties, in each case, that have been designated by you and approved by us in writing (which approval shall not be unreasonably withheld), prior to the Closing Date (collectively, “Disqualified Lenders”); provided, further, upon reasonable notice to the Mandated Lead Arrangers after the ninetieth day following the Closing Date, you shall be permitted to supplement in writing the list of persons that are Disqualified Lenders to the extent such supplemented person is or becomes a competitor or a Known Affiliate of a competitor of Holdings or its subsidiaries, which supplement shall be in the form of a list provided to the Mandated Lead Arrangers and become effective upon delivery to the Mandated Lead Arrangers, but which supplement shall not apply retroactively to 4

disqualify any parties that have previously acquired an assignment in the commitments or loans under the Incremental Facility. As used herein, “Known Affiliates” of any person means, as to such person, known affiliates readily identifiable by name, but excluding any affiliate (i) that is a bona fide debt fund or investment vehicle that is primarily engaged in, or that advises funds or other investment vehicles that are engaged in, making, purchasing, holding or otherwise investing in commercial loans, bonds or similar extensions of credit or securities in the ordinary course and with respect to which the Disqualified Lender does not, directly or indirectly, possess the power to direct or cause the direction of the investment policies of such entity or (ii) that is a banking or lending institution engaged in the business of making loans. Without limiting your obligations to assist with syndication efforts as set forth herein, it is understood that each Commitment Party’s commitment hereunder is not conditioned upon the syndication of, or receipt of commitments or participations in respect of, the Credit Facilities and in no event shall the commencement or successful completion of syndication of the Credit Facilities constitute a condition to the availability of the Credit Facilities on the Closing Date; provided that the effectiveness of the Term Loan Amendment and the Revolver Amendment is a condition to the availability of the Credit Facilities on the Closing Date. If (and only if) any loans are advanced on the Closing Date under the Incremental Facility, the Mandated Lead Arrangers intend to commence the syndication of the Incremental Facility promptly following the Closing Date. You hereby authorize the Mandated Lead Arrangers to download copies of the Company’s and the Target’s (provided that, prior to the Closing Date, you shall only be required to, and hereby agree to, use commercially reasonable efforts to cause the Target to authorize such Persons to download copies of the Target’s) trademark logos from its website and post copies thereof on IntraLinks, SyndTrak, DebtDomain or another similar electronic system established by the Mandated Lead Arrangers to syndicate the Incremental Facility (the “Platform”) and use such logos on any confidential information memoranda, presentations and other marketing materials and correspondence prepared in connection with the syndication of the Incremental Facility, or in any advertisements that we may place after the Closing Date in financial and other newspapers, journals, the World Wide Web, home pages or otherwise, at our own expense describing our services to the Company hereunder. You also understand and acknowledge that, subject to Section 5 hereof, we may provide to market data collectors, such as league table, or other service providers to the lending industry, information regarding the closing date, size, type, purpose of, and parties to, the Credit Facilities. It is understood and agreed that the Mandated Lead Arrangers will manage, subject to the terms of this Commitment Letter, all aspects of the syndication of the Incremental Facility in consultation with the Company, including the timing of all offers to potential Lenders, the determination of all amounts offered to potential Lenders, the selection of Lenders, the allocation of commitments or loans among the Lenders, and the assignment of any titles and the compensation to be provided to the Lenders. Until the Syndication Termination Date (as defined in the Incremental Term Sheet), the Company shall, shall cause its subsidiaries (including for all purposes under this Commitment Letter, on and after the Closing Date, the Target and its subsidiaries) to, and shall use commercially reasonable efforts to cause its affiliates to, cooperate in the syndication process, and use commercially reasonable efforts to take all actions to assist the Mandated Lead Arrangers in forming a syndicate acceptable to the Mandated Lead Arrangers and completing the syndication of the Incremental Facility. Such assistance shall include, but not be limited to, the following: (i) making senior management, representatives and advisors of the Company and its subsidiaries (and using commercially reasonable efforts to make senior management, representatives and advisors of the Company’s affiliates) available to participate in meetings with Lenders at such times and places mutually agreed upon and otherwise providing direct contact with, and information to, existing and prospective Lenders; (ii) using commercially reasonable efforts to ensure that the syndication benefits from your and your affiliates’, and the Target and its subsidiaries’, existing lending and investment banking relationships; (iii) assisting (including using your commercially reasonable efforts to cause your affiliates and advisors to assist) in the preparation of a customary confidential information memorandum for the Incremental Facility and other customary marketing 5

materials to be used in connection with the syndication, it being agreed that the Company shall approve such confidential information memorandum before the Mandated Lead Arrangers distribute it to potential Lenders on the Company’s behalf; (iv) providing the Mandated Lead Arrangers with customary Projections (as defined in Section 6), including updated Projections, from time to time reasonably requested by the Mandated Lead Arrangers; and (v) promptly providing the Mandated Lead Arrangers with other customary and reasonably available information (including financial information and Projections) with respect to Holdings and its subsidiaries, and the transactions contemplated hereby to the extent reasonably requested by the Mandated Lead Arrangers and reasonably deemed necessary or advisable by them to successfully complete the syndication of the Incremental Facility. During the period from the Closing Date until the Syndication Termination Date, the Company shall not, and shall ensure that none of its subsidiaries shall, raise or attempt to raise financing from commercial banks in the U.S. or international loan markets without the prior written consent of the Mandated Lead Arrangers (it being agreed that (v) (1) indebtedness of any subsidiary of the Company or the Target organized in China in an aggregate amount not to exceed $100,000,000, so long as such indebtedness is raised solely in the Chinese loan market, and (2) any amendment, restatement, replacement or refinancing of indebtedness incurred by (A) any subsidiary of the Target organized in China under the “China Loan Facility” described in the Target’s Form 10-Q filed with the U.S. Securities and Exchange Commission on August 6, 2018, so long as such indebtedness is raised solely in the Chinese loan market (the indebtedness under this clause (2)(A), the “Surviving Target Indebtedness”) and (B) any subsidiary of the Parent organized in China under the “China credit facilities” described in the Company’s Form 10-Q filed with the U.S. Securities and Exchange Commission on August 7, 2018, so long as such indebtedness is raised solely in the Chinese loan market; provided that the aggregate principal amount of such indebtedness under clauses (A) and (B) (including all undrawn commitments in respect thereof) shall not exceed $300,000,000 at any time, (w) any financing in any international or domestic loan market to refinance all or any portion of the Short Term Loan Facility, (x) the Term Loan Amendment, (y) any restatement, replacement or refinancing of the Revolving Credit Agreement with an asset-based revolving credit agreement (provided that, to the extent required by, or in order for the secured parties subject to such agreement to become subject to, the terms of the Intercreditor Agreement, each of the administrative agent and the collateral agent under such credit agreement shall execute a joinder to the Intercreditor Agreement on or prior to the date that such credit agreement becomes effective), the Revolver Amendment, borrowings under the Revolving Credit Agreement (including as amended by the Revolver Amendment) and borrowing under any revolving credit facilities of Target or any of its subsidiaries, and (z) any receivables, equipment, inventory or other secured or unsecured working capital financings, shall not be prohibited). The Company acknowledges that (i) the Mandated Lead Arrangers may make available any Information (as defined in Section 6) and Projections (collectively, the “Company Materials”) to potential Lenders by posting the Company Materials on the Platform and (ii) certain of the potential Lenders may be public side Lenders (i.e., Lenders that do not wish to receive material non-public information within the meaning of the United States federal or foreign securities laws with respect to you, your subsidiaries, the Target, its subsidiaries, or your or their respective securities (collectively, “MNPI”)) (each, a “Public Lender”). Each Lender that is not a Public Lender is referred to herein as a “Private Lender”). The Company agrees that (A) it will prepare a version of the information package and presentation to be provided to potential Lenders that does not contain MNPI (such version, the “Public-Side Version”); (B) all Company Materials that are to be made available to Public Lenders will be clearly and conspicuously marked “PUBLIC” which, at a minimum, will mean that the word “PUBLIC” will appear prominently on the first page thereof; (C) by marking Company Materials “PUBLIC,” the Company will be deemed to have authorized the Mandated Lead Arrangers, the Commitment Parties and the proposed Lenders to treat such Company Materials as not containing any MNPI (although they may be confidential or proprietary); (D) all Company Materials marked “PUBLIC” are permitted to be made available through a portion of the Platform designated for “Public Lenders,” and (E) the Mandated Lead Arrangers will be entitled to treat any Company Materials that are not marked “PUBLIC” as being suitable only for posting on a portion of the Platform not designated for “Public Lenders.” Notwithstanding the foregoing, prior to 6

distribution of any Company Materials, you agree to execute and deliver to us (x) a letter in which you authorize distribution of the Company Materials to Private Lenders and (y) a separate letter in which you authorize distribution of the Public-Side Version to Public Lenders and represent that no MNPI is contained therein. The Company agrees that the following documents may be distributed to both Private Lenders and Public Lenders, unless the Company advises the Mandated Lead Arrangers in writing within a reasonable time prior to their intended distribution (and provided the Company has a reasonable opportunity to review such materials before such distribution) that such materials should only be distributed to Private Lenders: (a) the Term Sheets and any “marketing term sheets,” (b) drafts and final Credit Documentation, (c) administrative materials prepared by the Mandated Lead Arrangers for prospective Lenders (such as a lender meeting invitation, bank allocations, if any, and funding and closing memoranda), (d) notification of changes in the terms of the Credit Facilities, and (e) other materials intended for prospective Lenders after the initial distribution of Information Materials. If you advise us in advance that any of the foregoing should be distributed only to Private Lenders, then we will not distribute such materials to Public Lenders without your prior consent. Except as set forth herein and in the Fee Letter, each of the Mandated Lead Arrangers and the Commitment Parties agrees and acknowledges, with respect to the Incremental Facility, that (a) it shall not, and shall procure that none of its affiliates shall, engage in any Front Running; (b) if it or any of its affiliates engages in any Front Running, the other Mandated Lead Arrangers may suffer loss or damage and its position in future financings with the other Mandated Lead Arrangers and the Company may be prejudiced; (c) if it or any of its affiliates engages in any Front Running the other Mandated Lead Arrangers retain the right not to allocate to it a commitment under the Incremental Facility; provided that, the aggregate principal amount of the Incremental Facility shall not be reduced as a result of the exercise of such right; and (d) it confirms that neither it nor any of its affiliates has engaged in any Front Running. When each of the Commitment Parties signs the applicable Credit Documentation and any assignment under the applicable Credit Documentation (in the case of any assignment agreement, only if signed within six months after the Closing Date), it shall, if the Mandated Lead Arrangers and the other Commitment Parties so request, confirm to them in writing that neither it nor any of its affiliates has breached the terms of this paragraph. Any arrangement, upfront fee or similar fee which may be payable to a Mandated Lead Arranger or Commitment Party in connection with the Incremental Facility is only payable on the condition that neither it nor any of its affiliates has breached the terms of this Commitment Letter. This condition is in addition to any other conditions agreed between the Mandated Lead Arrangers and the Commitment Parties in relation to the entitlement of each Mandated Lead Arranger and each Commitment Party to any such fee. For the purposes of the immediately preceding paragraph: a “Facility Interest” means a legal, beneficial or economic interest acquired or to be acquired expressly and specifically in or in relation to the Incremental Facility, whether as initial Lender or by way of assignment, transfer, novation, sub- participation (whether disclosed, undisclosed, risk or funded) or any other similar method; “Front Running” means undertaking any of the following activities after the date hereof and prior to the date that is six months after the Closing Date unless the Mandated Lead Arrangers otherwise agree in writing, which is intended to or is reasonably likely to encourage any person to take a Facility Interest except as a Lender pursuant to the syndication described in this Section 2, and pursuant to and in accordance with the Sell Down (as defined below) principles set forth in the three immediately succeeding paragraphs (the terms of the three immediately succeeding paragraphs, the “Principles”): (a) communication with any person or the disclosure of any information to any person in relation to a Facility Interest; (b) making a price (whether firm or indicative) with a view to buying or selling a Facility Interest; or (c) entering into (or agreeing to enter into) any agreement, option or other arrangement, whether legally binding or not, giving rise to the assumption of any risk or participation in any exposure in relation to a Facility Interest, excluding where any of the foregoing is: (i) made to or entered into with an affiliate, (ii) an act of a Mandated Lead Arranger or a Commitment Party (or any of their respective affiliates) who is operating as a Public Lender, unless such person is acting on the instructions of a person who has received Confidential 7

Information and is aware of the proposed Incremental Facility, (iii) any communication, discussion, arrangement of agreement made or entered into by a Mandated Lead Arranger or a Commitment Party (or any of their respective affiliates) with an insurance or reinsurance company for the purpose of obtaining insurance in respect of an interest in the Incremental Facility, or (iv) made to or entered into with another Mandated Lead Arranger (or its affiliate), in connection with the facilitation of either syndication or initial drawdown under the Incremental Facility. Notwithstanding anything to the contrary herein or in the applicable Credit Documentation, (a) any transfer of commitments or loans under the Incremental Facility by a Commitment Party to its affiliates (each, an “Affiliate Transferee”), shall not constitute a Sell Down or be subject to the Principles, unless such Affiliate Transferee is an investment fund, proprietary trading group or desk organized for the purpose of investing in, trading or managing debt obligations similar to those of the Company (except for any such investment fund, proprietary trading group or desk that agrees, in writing in a form acceptable to the Mandated Lead Arrangers to be bound by the Principles as if such transferee was the transferring Commitment Party) (an “Investment Affiliate Transferee”), and (b) (i) overnight sale-and-repurchase agreements entered into for financing purposes and (ii) overnight pledges or assignments of a security interest in a Commitment Party’s rights under the commitments or loans in respect of the Incremental Facility to secure such Commitment Party’s obligations incurred for financing purposes, including any pledge or assignment to a Federal Reserve Bank, shall not constitute a Sell Down or be subject to the Principles. Each Affiliate Transferee (other than an Investment Affiliate Transferee) shall be bound by the Principles in connection with each Sell Down by it with respect to the Incremental Facility prior to the Syndication Termination Date. Any transferee participant in a Sell Down and each Affiliate Transferee participating in such Sell Down shall enter into an assignment agreement or a participation agreement or any other relevant agreement. Notwithstanding anything herein or in the Credit Documentation to the contrary, but subject to the terms of the immediately preceding paragraph, prior to the earlier of the Syndication Termination Date and the date that each Sell Down Commitment Party’s (as defined below) commitments and loans under the Incremental Facility have been reduced to its Hold Level (as defined below), all Sell Downs under the Incremental Facility shall be applied to the commitments and loans under the Incremental Facility held by all Sell Down Commitment Parties on a pro rata basis (for each Sell Down Commitment Party, in accordance with such Sell Down Commitment Party’s percentage of the aggregate commitments for the Incremental Facility as of the date hereof) when received to reduce the amount of commitments and loans held by the Sell Down Commitment Parties under the Incremental Facility; provided that no Sell Down shall reduce the amount of any Sell Down Commitment Party’s commitments or loans under the Incremental Facility below the Hold Level of such Sell Down Commitment Party until each Sell Down Commitment Party’s commitments and loans have been reduced to its Hold Level, and any amounts that would breach such Sell Down Party’s Hold Level prior to such time shall be applied to the commitments and loans under the Incremental Facility of the remaining Sell Down Commitment Parties under the Incremental Facility on a ratable basis among the remaining Sell Down Commitment Parties; provided, further, that each Sell Down Commitment Party retains the right to decline to participate in each Sell Down in its sole discretion. If one or more Sell Down Commitment Parties does not participate in a Sell Down, then the remaining Sell Down Commitment Parties may elect to have their commitments and loans under the Incremental Facility reduced further on a ratable basis among such electing Sell Down Commitment Parties, subject to the first proviso above. “Sell Down Commitment Parties” means each Commitment Party. “Sell Down” (and correlative terms) refers to any sale, assignment, participation, syndication of or other transfer of any kind whatsoever, including, without limitation, by means of credit default, total return or other swaps or other synthetic transfers of risk, or agreement to do any of the foregoing, with respect to any commitment or loan under the Incremental Facility, by any Sell Down Commitment Party. The “Hold Level” of each Sell Down Commitment Party means the amount set forth opposite such Sell Down Commitment Party’s name on Exhibit A under the heading “Incremental Facility Hold Level.” The four immediately preceding paragraphs and this paragraph are for the benefit of the Mandated Lead Arrangers and the Commitment 8

Parties only, and may be amended by such parties without the consent of the Company to the extent that such amendments are limited to the scope of such paragraphs, and do not otherwise adversely impact the Company, and may not be enforced by the Company. 3. Indemnification You agree to indemnify and hold harmless each of the Mandated Lead Arrangers, each of the Commitment Parties, each Lender, and each of their respective affiliates and each of the respective officers, directors, partners, employees, attorneys, agents, advisors, controlling persons and other representatives of the foregoing (each, an “Indemnified Person”) from and against (and will reimburse each Indemnified Person as the same are incurred for) any and all claims, damages, losses, liabilities, costs and expenses (including, without limitation, the reasonable and documented out-of-pocket fees, disbursements and other charges of one firm of counsel for all such Indemnified Persons, taken as a whole and, if necessary or advisable, by local counsel in each appropriate jurisdiction (which may include a single firm of special counsel acting in multiple jurisdictions) for all such Indemnified Persons, taken as a whole (and, in the case of a conflict of interest or potential conflict of interest where the Indemnified Person affected by such conflict or potential conflict notifies you of the existence of such conflict and thereafter retains its own counsel, by another firm of counsel for all such affected Indemnified Persons)) that may be incurred by or asserted or awarded against any Indemnified Person or to which any such Indemnified Person may become subject (including, without limitation, in connection with, any claim, inquiry, investigation, litigation or proceeding (a “Proceeding”) or the preparation of any defense in connection therewith) in each case arising out of or in connection with or by reason of or relating to this Commitment Letter, the Transactions, the Credit Facilities or the transactions contemplated hereby or thereby, or any use made or proposed to be made with the proceeds of the Credit Facilities (including any arising out of the comparative, contributory or sole negligence of any Indemnified Person), except to the extent such claim, damage, loss, liability, cost or expense (a) is found in a final, non-appealable judgment by a court of competent jurisdiction to have resulted from the gross negligence or willful misconduct of such Indemnified Person, (b) results from a claim brought by you against an Indemnified Person for a material breach of such Indemnified Person’s obligations hereunder if you have obtained a final and non- appealable judgment in your favor on such claim as determined by a court of competent jurisdiction, or (c) arises from a proceeding by an Indemnified Person against an Indemnified Person (or any of their respective affiliates or related parties) (other than an action involving (i) conduct by you or any of your affiliates or (ii) against an arranger or administrative agent or collateral agent or other agent in its capacity as such). In the case of a Proceeding to which the indemnity in this paragraph applies, such indemnity shall be effective, whether or not such Proceeding is brought by the Company or any of your securityholders, affiliates or creditors, an Indemnified Person or any other person, or an Indemnified Person is otherwise a party thereto and whether or not the transactions contemplated hereby are consummated, and the Company shall reimburse each Indemnified Person upon demand (with reasonable back-up) for any such legal or other expenses incurred in connection with investigating or defending any of the foregoing. The reimbursement and indemnity obligations of the Company under this paragraph will be in addition to any liability which the Company may otherwise have, will extend upon the same terms and conditions to any affiliate of the Indemnified Persons and controlling persons (if any), as the case may be, of the Indemnified Persons and any such affiliate, and will be binding upon and inure to the benefit of any successors, assigns, heirs and personal representatives of the Company, the Indemnified Persons, any such affiliate and any such person. You also agree that no Indemnified Person shall have any liability (whether direct or indirect, in contract, tort or otherwise) to the Company, your subsidiaries or affiliates or to any of their respective securityholders, affiliates or creditors arising out of, related to or in connection with the transactions contemplated hereby, except solely to you, and then solely to the extent of direct (as opposed to special, indirect, consequential or punitive) damages determined in a final, non-appealable judgment by a court of competent jurisdiction to have resulted from such Indemnified Person’s gross negligence, willful misconduct or material breach of such Indemnified Person’s obligations hereunder. 9

It is further agreed that the Mandated Lead Arrangers and the Commitment Parties shall have liability only to you and shall have no liability to any other person. Notwithstanding any other provision of this Commitment Letter, no Indemnified Person shall be liable for any damages arising from the use by others of Information (as defined below) or other materials obtained through electronic telecommunications or other information transmission systems. You shall not, without the prior written consent of an Indemnified Person (which consent shall not be unreasonably withheld), effect any settlement of any pending or threatened Proceedings in respect of which indemnity has been or may be sought hereunder by such Indemnified Person unless (a) such settlement includes an unconditional release of such Indemnified Person in form and substance reasonably satisfactory to such Indemnified Person from all liability on claims that are the subject matter of such Proceedings and (b) does not include any statement as to or any admission of fault, culpability or a failure to act by or on behalf of any Indemnified Person. In case any Proceeding is instituted involving any Indemnified Person for which indemnification is to be sought hereunder by such Indemnified Person, then such Indemnified Person shall promptly notify you of the commencement of any Proceedings; provided that any failure to provide such notification shall not impact your obligations except to the extent you have been materially prejudiced as a result of such failure to receive such notice. 4. Costs and Expenses; Fees You agree to pay the fees set forth in that certain Fee Letter, dated the date hereof (as amended, restated, supplemented or otherwise modified from time to time, the “Fee Letter”), between you and us. You shall pay or reimburse the Mandated Lead Arrangers and the Commitment Parties from time to time on demand whether or not any of the Credit Facilities is consummated for all reasonable and documented out-of-pocket costs and expenses incurred by the Mandated Lead Arrangers and the Commitment Parties (whether incurred before or after the date hereof) in connection with the Credit Facilities, the preparation, negotiation, execution and delivery of this Commitment Letter, the Fee Letter, and any other fee letters in respect hereof or thereof, the Credit Documentation, and the administration, amendment, modification or waiver of any terms or provisions thereof, including, without limitation, due diligence expenses, syndication expenses, travel expenses and the reasonable and documented out-of- pocket fees, disbursements and charges of one firm of counsel in each applicable jurisdiction to the Mandated Lead Arrangers and the Commitment Parties. The Company further agrees to pay all documented out-of-pocket costs and expenses of the Mandated Lead Arrangers and the Commitment Parties (including, without limitation, out-of-pocket fees, disbursements and charges of each counsel to the Mandated Lead Arrangers and the Commitment Parties) incurred in connection with the enforcement of any of its rights or remedies hereunder. 5. Confidentiality By accepting delivery of this Commitment Letter, the Company agrees that this Commitment Letter is for its confidential use only and that neither its existence nor the terms hereof will be disclosed by it to any person other than the officers, directors, employees, accountants, attorneys and other legal advisors of the Company and/or its direct or indirect shareholders, who are directly involved in the consideration of this matter and then only on a confidential basis in connection with the transactions contemplated hereby, provided, that, each of such persons shall be informed of the confidential nature of the terms of this Commitment Letter. Notwithstanding the foregoing, (i) following the Company’s acceptance of the provisions hereof and its return of an executed counterpart of this Commitment Letter to the Commitment Parties, as the Mandated Lead Arrangers as provided below, the Company may file a copy of any portion of this Commitment Letter in any public record in which it is required by law to be filed, (ii) the Company may make such other public disclosures of any of the terms and conditions hereof as the Company is required by law or judicial order, in the opinion of its counsel, to make and (iii) the Company may share a copy of this Commitment Letter with rating agencies in connection with obtaining ratings for the Company or the Credit Facilities; provided that nothing herein shall prevent you from 10

disclosing any such Confidential Information (x) as may be required by law, or compelled in a judicial or administrative proceeding or as otherwise required by law or requested by a governmental or regulatory authority and (y) with the consent of each Commitment Party and each Mandated Lead Arranger. Each Commitment Party and each Mandated Lead Arranger shall maintain the confidentiality of all Confidential Information (as defined below) provided to us by or on behalf of you hereunder, provided that nothing herein shall prevent us from disclosing any such Confidential Information (i) as may be required by law or stock exchange requirement, or compelled in a judicial or administrative proceeding or as otherwise required by law or requested by a governmental or regulatory authority (including any self- regulatory authority, such as the National Association of Insurance Commissioners), (ii) to the extent that such information becomes publicly available other than by reason of disclosure by us in violation of this paragraph or becomes available to a Commitment Party or any Mandated Lead Arranger on a non- confidential basis from a source other than the Company or any of its affiliates, (iii) to our and our affiliates’ (including head office, branch or representative offices) officers, directors, employees, affiliates, independent auditors, legal counsel and other advisors (collectively, the “Representatives”) (it being understood that the persons to whom such disclosure is made will be informed of the confidential nature of such Confidential Information and instructed to keep such Confidential Information confidential), (iv) to actual or potential Lenders, assignees or participants or sub-participants in the Credit Facilities, in each case who agree to be bound by the terms of this paragraph or substantially similar confidentiality provisions; provided that such disclosure shall be made subject to the acknowledgment and acceptance by such prospective Lender, assignee, participant or sub-participant on behalf of itself and its advisors, that such information is being disseminated on a confidential basis (on substantially the terms set forth in this paragraph or as is otherwise reasonably acceptable to you and the Commitment Parties and the Mandated Lead Arrangers, including, without limitation, as set forth in any confidential information memorandum or other marketing materials) in accordance with the standard syndication processes of the Mandated Lead Arrangers or market standards for dissemination of such type of information, which may require “click through” or other affirmative action on the part of the recipient to access such confidential information, (v) for purposes of establishing a “due diligence” defense, (vi) in connection with the exercise of any remedies hereunder or any suit, action or proceeding relating to this Commitment Letter, the Fee Letter, the applicable Credit Documentation, or the enforcement of rights hereunder or thereunder, (vii) with the consent of the Company, (viii) to any rating agency for the purpose of obtaining a credit rating applicable to the Company, any Loan Party, any Commitment Party or any Mandated Lead Arranger, or (ix) insurers, insurance brokers and other credit protection and service providers of any Commitment Party, any Mandated Lead Arranger, or any of their respective affiliates who are under a duty of confidentiality to such Commitment Party, Mandated Lead Arranger or affiliate. For purposes of this Section, “Confidential Information” means all confidential and non-public information received from or on behalf of the Company or any of its subsidiaries and relating to the Company, any of its subsidiaries, the Target or any of its subsidiaries, or any of their respective businesses, or to the Transactions, other than any such information that is available to the Commitment Parties or the Mandated Lead Arrangers on a non- confidential basis prior to disclosure by the Company from a source which is not, to the knowledge of the recipient, prohibited from disclosing such information by a confidentiality agreement or other legal or fiduciary obligation to the Company. The confidentiality obligations of the Commitment Parties and the Mandated Lead Arrangers under this paragraph shall automatically terminate and be superseded by the confidentiality provisions in the applicable Credit Documentation upon execution and effectiveness thereof and in any event shall terminate on the second anniversary of the date hereof. 6. Representations and Warranties You represent and warrant (prior to the Closing Date, with respect to information related to the Target and its subsidiaries, to the best of your knowledge) that (i) all written factual information, other than (x) Projections (as defined below), (y) information of a general economic or industry nature and (z) budgets, estimates and other forward-looking information, that has been or will hereafter be made available to the Commitment Parties and the Mandated Lead Arrangers by or on behalf of you or any of your subsidiaries, the Target or any of its subsidiaries, or any of their respective representatives in 11

connection with any aspect of the transactions contemplated hereby (the “Information”), taken as a whole, is or will be, when furnished, complete and correct in all material respects and does not or will not, when furnished, contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements contained therein not misleading in light of the circumstances under which such statements were or are made and (ii) all financial estimates, forecasts and other forward-looking information, if any, that have been or will be prepared by or on behalf of you or any of your subsidiaries, the Target and its subsidiaries, or any of their respective representatives (or on their behalf) and made available to the Commitment Parties and the Mandated Lead Arrangers (the “Projections”) have been or will be prepared in good faith based upon assumptions that are reasonable at the time made, it being understood and agreed that Projections are as to future events and are not to be viewed as facts or a guarantee of financial performance and are subject to significant uncertainties and contingencies, many of which are beyond the Company’s and its subsidiaries’ control, that no assurance can be given that such Projections will be realized, that actual results may differ significantly from the Projections and that such differences may be material. If, at any time prior to the later of the Syndication Termination Date and the Closing Date, you become aware that any of the representations and warranties in the preceding sentence would not be accurate and complete in any material respect if the Information or Projections were being furnished, and such representations and warranties were being made, at such time, then the Company will promptly supplement (and, prior to the Closing Date, in the case of Information and Projections provided by or on behalf of the Target or any of its subsidiaries, you agree to use commercially reasonable efforts to cause the Target to supplement) the Information and/or Projections so that such representations and warranties contained in this paragraph remain accurate and complete in all material respects under those circumstances. In issuing this Commitment Letter and in arranging the Credit Facilities, including the syndication of the Incremental Facility, the Commitment Parties and the Mandated Lead Arrangers will be entitled to use, and to rely on the accuracy of, the Information furnished to it by or on behalf of you or any of your representatives without responsibility for independent verification thereof. 7. No Third Party Reliance; Not a Fiduciary, Etc. The commitments and agreements of the Commitment Parties hereunder and the agreements of the Mandated Lead Arrangers hereunder, in each case are made solely for your benefit and the benefit of the Commitment Parties, the Mandated Lead Arrangers, and the other Indemnified Persons, as applicable, and may not be relied upon or enforced by any other person. Each Commitment Party and Mandated Lead Arranger may, subject to Section 8, employ the services of its respective affiliates in providing certain services hereunder and, in connection with the provision of such services, but subject to Section 5 above, may exchange with such affiliates information concerning you and the other companies that may be the subject of the transactions contemplated by this Commitment Letter and the Fee Letter, and, to the extent so employed, such affiliates shall be entitled to the benefits, and be subject to the obligations, of the applicable Commitment Party or Mandated Lead Arranger hereunder. Each Commitment Party and Mandated Lead Arranger shall be responsible for such affiliate’s failure to comply with such obligations under this Commitment Letter. You hereby acknowledge and acknowledge your affiliates’ understanding that (a) the Commitment Parties and the Mandated Lead Arrangers are acting pursuant to a contractual relationship on an arm’s- length basis between you and your affiliates, on the one hand, and the Commitment Parties and the Mandated Lead Arrangers, on the other hand, and the parties hereto do not intend that the Commitment Parties or the Mandated Lead Arrangers act or be responsible as a financial advisor or a fiduciary to or agent of you or your management, stockholders, creditors or any other person. You, the Commitment Parties and the Mandated Lead Arrangers hereby expressly disclaim and waive any fiduciary relationship and agree they are each responsible for making their own independent judgments with respect to any transactions entered into between them and you agree that you will not assert any claim against any Commitment Party or any Mandated Lead Arranger based on any breach or alleged breach of agency or fiduciary duty by such Commitment Party or such Mandated Lead Arranger in connection with this 12

Commitment Letter, the Fee Letter, or the transactions contemplated hereby or thereby. You also hereby acknowledge that (a) pursuant to the services provided herein, the Commitment Parties and the Mandated Lead Arrangers have not advised and are not advising you as to any legal, accounting, regulatory or tax matters or any other matters in any jurisdiction, and that you are consulting your own advisors concerning such matters to the extent you deem it appropriate and (b) you are capable of evaluating, and understand and accept, the terms, risks and conditions of the transactions contemplated hereby. You understand that the Commitment Parties, the Mandated Lead Arrangers, and their respective affiliates (collectively, the “Group”) are full service securities or banking firms and are engaged in securities trading and brokerage activities as well as providing a wide range of investment banking and other financial services and businesses (including investment management, financing, securities trading, corporate and investment banking and research). Members of the Group and businesses within the Group generally act independently of each other, both for their own account and for the account of clients. Accordingly, there may be situations where parts of the Group and/or their clients either now have or may in the future have interests, or take actions, that may conflict with your interests. For example, the Group may, in the ordinary course of business, engage in trading in financial products or undertake other investment businesses for their own account or on behalf of other clients, including without limitation, trading in or holding long, short or derivative positions in securities, loans or other financial products of you or your affiliates or other entities connected with the Credit Facilities or the transactions contemplated hereby. With respect to any securities and/or financial instruments so held by any Commitment Party, any Mandated Lead Arranger, or any of its or their respective customers, all rights in respect of such securities and financial instruments, including any voting rights, will be exercised by the holder of the rights, in its sole discretion. In recognition of the foregoing, you agree that the Group is not required to restrict its activities as a result of this Commitment Letter or the Fee Letter and that the Group may undertake any business activity without further consultation with or notification to you. Neither this Commitment Letter, the Fee Letter, nor the receipt by the Commitment Parties or the Mandated Lead Arrangers of confidential information nor any other matter will give rise to any fiduciary, equitable or contractual duties (including without limitation, any duty of trust or confidence) that would prevent or restrict the Group from acting on behalf of other customers or for its own account. Furthermore, you agree that neither the Group nor any member or business of the Group is under a duty to disclose to you or use on your behalf any information whatsoever about or derived from those activities or to account for any revenue or profits obtained in connection with such activities. However, consistent with the Group’s long-standing policy to hold in confidence the affairs of its customers, the Group will not use confidential information obtained from you except in connection with its services to, and its relationship with, you, provided, however, that the Group will be free to disclose information upon reasonable advance notice to you (to the extent practicable and permissible) in any manner as required by law, regulation, regulatory authority or other applicable judicial or government order. In furtherance of the foregoing, each party hereto hereby acknowledges that the Commitment Parties, the Mandated Lead Arrangers, or their respective affiliates, (i) may provide debt financing, equity capital or other services to other persons with whom the Company or its affiliates may have conflicting interests in respect of the Credit Facilities in this or other transactions, and (ii) may act in more than one capacity in relation to the transactions contemplated by this Commitment Letter and the Fee Letter and may have conflicting interests in respect of such different capacities. The Company acknowledges (on behalf of itself and its affiliates) that the Commitment Parties and the Mandated Lead Arrangers have no obligation to use any information obtained from another source for purposes of the Credit Facilities or otherwise in connection with its obligations under this Commitment Letter and the Fee Letter, or to furnish such information to the Company or its affiliates. 13

8. Assignments The Company may not assign or delegate any of its rights or obligations under this Commitment Letter without the prior written consent of each Mandated Lead Arranger and each Commitment Party, and any attempted assignment without such consent shall be void ab initio. The Commitment Parties and the Mandated Lead Arrangers may not assign or delegate any of their rights, commitments with respect to the Credit Facilities or other obligations under this Commitment Letter, as applicable, without the Company’s prior written consent or except (i) to its affiliates, (ii) as provided in Section 2 hereof or (iii) on or after the Closing Date, as provided in the section titled “Transfers and Assignments” in each Term Sheet, and any attempted assignment without such consent (to the extent required in accordance with this Commitment Letter) shall be void ab initio. Notwithstanding the foregoing, any and all obligations and services to be provided by each Mandated Lead Arranger and each Commitment Party hereunder (including, without limitation, each Commitment Party’s commitments), may be performed, and any and all rights of such Mandated Lead Arranger and such Commitment Party hereunder may be exercised, by or through one or more of its affiliates or branches; provided that, other than with respect to an assignment to which you otherwise consent in writing (which consent shall not be unreasonably withheld by you), such Commitment Party shall not be released from the portion of its commitment hereunder so assigned to the extent such assignee fails to fund the portion of the commitment assigned to it on the Closing Date notwithstanding the satisfaction of the conditions to funding set forth herein. 9. Amendments This Commitment Letter may not be amended or any provision hereof waived or modified except by an instrument in writing signed by each party hereto; provided that only the consent of the Commitment Parties and the Mandated Lead Arrangers shall be required to amend the last five paragraphs of Section 2. 10. Governing Law, Survival, Etc. THIS COMMITMENT LETTER, AND ALL CLAIMS OR CAUSES OF ACTION (WHETHER IN CONTRACT, TORT OR OTHERWISE) THAT MAY BE BASED UPON, ARISE OUT OF OR RELATE IN ANY WAY TO THIS COMMITMENT LETTER, OR THE NEGOTIATION, EXECUTION OR PERFORMANCE OF THIS COMMITMENT LETTER OR THE TRANSACTIONS CONTEMPLATED HEREBY, SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK. Each of the parties hereto agrees that this Commitment Letter is a binding and enforceable agreement with respect to the subject matter contained herein, including an agreement by the parties hereto to negotiate in good faith and as promptly as reasonably practicable the Credit Documentation in a manner consistent with this Commitment Letter, the Fee Letter and the Term Sheets, it being acknowledged and agreed that the commitment provided hereunder is subject to conditions precedent set forth herein and in the Term Sheets. Each of the parties hereto agrees that the Fee Letter is a binding and enforceable agreement with respect to the subject matter contained therein. This Commitment Letter sets forth the entire agreement among the parties with respect to the matters addressed herein and supersedes all prior communications, written or oral, with respect hereto. This Commitment Letter may be executed in any number of counterparts, each of which, when so executed, shall be deemed to be an original and all of which, taken together, shall constitute one and the same Commitment Letter. Delivery of an executed counterpart of a signature page to this Commitment Letter by facsimile, email or other electronic transmission (including pdf or other similar format) shall be as effective as delivery of a manually executed counterpart of this Commitment Letter. The Fee Letter and Sections 2 through 7, 10, 11 and 12 hereof shall survive the termination of the Commitment Parties’ commitments hereunder and the termination of the agreements of the Mandated Lead Arrangers hereunder, and shall remain in full force and effect regardless of whether the Credit Documentation is executed and delivered; provided that your obligations under Section 3 and the second paragraph of Section 4 shall 14

automatically terminate on the Closing Date and be superseded by the corresponding provisions of the applicable Credit Documentation upon execution thereof, solely to the extent such provisions in the Credit Documentation cover the same scope and subject matter as set forth in Section 3 and the second paragraph of Section 4; provided, further, that your obligations under Section 2 shall automatically terminate on the Termination Date if the Closing Date has not occurred. You acknowledge that information and documents relating to the Credit Facilities may be transmitted through the Platform. 11. Taxes; Payments. All payments under this Commitment Letter and the Fee Letter will, except as otherwise provided herein or therein, be made in U.S. Dollars and will be made free and clear of and without deduction for any and all present or future taxes, levies, imposts, deductions, charges or withholdings, and all liabilities with respect thereto, except as required by applicable law. If any applicable law (as determined in the good faith discretion of the Company) requires the deduction or withholding of any tax from any such payment, then the Company shall be entitled to make such deduction or withholding and shall timely pay the full amount deducted or withheld to the relevant governmental authority in accordance with applicable law and shall indemnify each Indemnified Person for and hold it harmless against any such taxes and any liability arising therefrom or with respect thereto; provided that (i) the Company shall not be liable for (a) any Excluded Taxes (as defined in the Existing Term Loan Agreement) or (b) any U.S. federal withholding taxes imposed on amounts payable to or for the account of such Indemnified Person under this Commitment Letter or the Fee Letter pursuant to a law in effect on the date of this Commitment Letter and (ii) the relevant Indemnified Party shall deliver any documentation prescribed by the applicable requirement of law as will permit payment to which such payee is entitled to be made without any, or at a reduced rate of, deduction or withholding for, or on account of, taxes; provided, however, that no Indemnified Person shall be required to provide any documentation that it is not legally entitled to provide, or that, in the relevant Indemnified Person’s reasonable judgment, would subject such Indemnified Person to any material unreimbursed costs or otherwise be disadvantageous to it in any material respect. 12. WAIVER OF JURY TRIAL, ETC. EACH PARTY HERETO IRREVOCABLY WAIVES ALL RIGHT TO TRIAL BY JURY IN ANY ACTION, PROCEEDING OR COUNTERCLAIM (WHETHER BASED ON CONTRACT, TORT OR OTHERWISE) ARISING OUT OF OR RELATING TO THIS COMMITMENT LETTER OR THE TRANSACTIONS CONTEMPLATED HEREBY OR THE ACTIONS OF THE PARTIES HERETO IN THE NEGOTIATION, PERFORMANCE OR ENFORCEMENT HEREOF. With respect to all matters relating to this Commitment Letter, you and we each hereby irrevocably and unconditionally (i) submit to the jurisdiction of the U.S. District Court for the Southern District of New York State or, if that court does not have subject matter jurisdiction, in any State court located in the City and County of New York; (ii) agree that all claims related to this Commitment Letter shall be brought, heard and determined exclusively in such courts, (iii) waive, to the fullest extent you and we may effectively do so, any objection to the laying of venue of any suit, action or proceeding brought in any court referred to in clause (i) above or any claim that any such suit, action or proceeding has been brought in an inconvenient forum, (iv) agree that a final judgment of such courts shall be conclusive and may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by law and (v) waive any immunity (sovereign or otherwise) from jurisdiction of any court or from any legal process or setoff to which you or we or your or our properties or assets may be entitled. Nothing herein will affect the right of the Commitment Parties and the Mandated Lead Arrangers to serve legal process in any other manner permitted by law. To the extent that the Company has or hereafter may acquire any immunity from jurisdiction of any court or from any legal process (whether through service or notice, attachment prior to judgment, attachment in aid of execution, execution or otherwise) with respect to itself or its property, the Company irrevocably waives such immunity in respect of its obligations under this Commitment Letter. 15

13. Patriot Act, Etc. Each Commitment Party and each Mandated Lead Arranger hereby notifies you that pursuant to the requirements of the USA Patriot Act, Title III of Pub. L. 107-56 (signed into law October 26, 2001) (as amended, the “Patriot Act”) and 31 C.F.R. §1010.230 (the “Beneficial Ownership Regulation”), the Commitment Parties, the Mandated Lead Arrangers and the Lenders and each of their respective affiliates are required to obtain, verify and record information that identifies the Company and each Guarantor, which information includes the name, address, tax identification number and other information regarding the Company and each Guarantor that will allow the Commitment Parties, the Mandated Lead Arrangers, or such Lender to identify the Company and each Guarantor in accordance with the Patriot Act and to obtain certifications regarding beneficial ownership under the Beneficial Ownership Regulation. This notice is given in accordance with the requirements of the Patriot Act and the Beneficial Ownership Regulation and is effective as to the Commitment Parties, the Mandated Lead Arrangers and the Lenders and each of their respective affiliates. 14. [Reserved]. 15. Termination If the foregoing correctly sets forth our agreement, please indicate your acceptance of the terms of this Commitment Letter and the Fee Letter by returning to the Mandated Lead Arrangers and the Commitment Parties executed counterparts hereof and thereof not later than 5:00 p.m., New York City time, on November 9, 2018. The Commitment Parties’ commitments and agreements hereunder and agreements of the Mandated Lead Arrangers contained herein will expire at such time in the event that the Mandated Lead Arrangers and the Commitment Parties have not received such executed counterparts in accordance with the immediately preceding sentence. This Commitment Letter and the commitments and agreements of the Commitment Parties, the Mandated Lead Arrangers, and the Company hereunder, if timely accepted and agreed to by the Company, shall automatically terminate upon the first to occur of (a) with respect to the Short Term Loan Facility, the execution and delivery of the definitive credit agreement in respect of the Short Term Loan Facility, (b) with respect to the Incremental Facility, the amendment or other documentation implementing the Incremental Facility, in each case by the Company, Borrower, each Guarantor, the initial lenders party thereto, and the agents party thereto, (c) 5:00 p.m., New York City time, on February 28, 2020, (d) April 26, 2019, as such date may be extended pursuant to Section 9.2(a) of the Merger Agreement, as in effect on the date hereof, (e) with respect to either or both of the Short Term Loan Facility and/or the Incremental Facility (as specified in such notice), delivery of written notice of termination by the Company to each Commitment Party and each Mandated Lead Arranger, (f) the date that the Merger Agreement is terminated in accordance with its terms prior to the consummation of the Acquisition, and (g) as to any Credit Facility, the consummation of the Acquisition without the use of such Credit Facility (the earliest date set forth in clauses (a) through (g), the “Termination Date”). [Signature pages follow.] 16

Very truly yours, ABN AMRO CAPITAL USA LLC By: /s/ John Sullivan Name: John Sullivan Title: Managing Director ABN AMRO CAPITAL USA LLC By: /s/ Floris Jongma Name: Floris Jongma Title: Director [Signature page to 2018 Syndicate Commitment Letter]

AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED By: /s/ Carl Roberts Name: Carl Roberts Title: Head of Loan Syndications, South & South East Asia [Signature page to 2018 Syndicate Commitment Letter]

AXIS BANK LIMITED By: /s/ Raj Kumar Khosa Name: Raj Kumar Khosa Title: C.E.O. AXIS BANK LIMITED By: /s/ Niladhri Nandi Name: Niladhri Nandi Title: Head – Credit [Signature page to 2018 Syndicate Commitment Letter]

BANK OF AMERICA, N.A. By: /s/ Frances Fabello Name: Frances Fabello Title: Assistant Vice President [Signature page to 2018 Syndicate Commitment Letter]

BARCLAYS BANK PLC By: /s/ Mark Pope Name: Mark Pope Title: Assistant Vice President [Signature page to 2018 Syndicate Commitment Letter]

CITIGROUP GLOBAL MARKETS ASIA LIMITED By: /s/ Chiranjeev Kumar Name: Chiranjeev Kumar Title: Director CITIBANK, N.A. By: /s/ Siddarth Bansal Name: Siddarth Bansal Title: Director [Signature page to 2018 Syndicate Commitment Letter]

CRÉDIT AGRICOLE CORPORATE AND INVESTMENT BANK By: /s/ Akash Sen Name: Akash Sen Title: Managing Director By: /s/ Sameer Bejalwar Name: Sameer Bejalwar Title: Vice President [Signature page to 2018 Syndicate Commitment Letter]

DEUTSCHE BANK SECURITIES INC. By: /s/ Mason Parker Name: Mason Parker Title: Managing Director By: /s/ Alvin Varughese Name: Alvin Varughese Title: Director DEUTSCHE BANK AG CAYMAN ISLANDS BRANCH By: /s/ Mason Parker Name: Mason Parker Title: Managing Director By: /s/ Alvin Varughese Name: Alvin Varughese Title: Director DEUTSCHE BANK AG NEW YORK BRANCH By: /s/ Mason Parker Name: Mason Parker Title: Managing Director By: /s/ Alvin Varughese Name: Alvin Varughese Title: Director [Signature page to 2018 Syndicate Commitment Letter]

DBS BANK LTD. By: /s/ Mildred Seow Slok Eng Name: Mildred Seow Slok Eng Title: Managing Director & Head [Signature page to 2018 Syndicate Commitment Letter]

FIRST ABU DHABI BANK USA N.V. By: /s/ Husam Arabiat Name: Husam Arabiat Title: Country CEO By: /s/ Pamela Sigda Name: Pamela Sigda Title: Chief Financial Officer [Signature page to 2018 Syndicate Commitment Letter]

HSBC SECURITIES (USA) INC. By: /s/ Frederic Fournier Name: Frederic Fournier Title: Director HSBC BANK USA, N.A. By: /s/ Frederic Fournier Name: Frederic Fournier Title: Senior Vice President [Signature page to 2018 Syndicate Commitment Letter]

ICICI BANK LIMITED, NEW YORK BRANCH By: /s/ Akashdeep Sarpal Name: Akashdeep Sarpal Title: Country Head – USA [Signature page to 2018 Syndicate Commitment Letter]

ING BANK N.V., SINGAPORE BRANCH By: /s/ Paul Verwijmeren Name: Paul Verwijmeren Title: Head of Corporate Lending, South-East Asia and Taiwan By: /s/ Milly Tan Name: Milly Tan Title: Director, Corporate Lending [Signature page to 2018 Syndicate Commitment Letter]

JPMORGAN CHASE BANK, N.A. By: /s/ Tasvir Hasan Name: Tasvir Hasan Title: Executive Director [Signature page to 2018 Syndicate Commitment Letter]

MIZUHO BANK, LTD. By: /s/ Dr. Durgesh Tinaikar Name: Dr. Durgesh Tinaikar Title: Joint General Manager & Head – Corporate Banking & Financial Institutions, India [Signature page to 2018 Syndicate Commitment Letter]

MUFG BANK, LTD. By: /s/ Masashi Sakai Name: Masashi Sakai Title: Managing Director, Corporate Banking Division for EMEA MUFG Bank, Ltd. [Signature page to 2018 Syndicate Commitment Letter]

SOCIETE GENERALE, HONG KONG BRANCH By: /s/ Tapan Vaishnav Name: Tapan Vaishnav Title: Head of Advisory & Financing Group, Asia-Pacific By: /s/ Roland Riedel Name: Roland Riedel Title: Director of Loan Syndicate & Sales, Asia- Pacific [Signature page to 2018 Syndicate Commitment Letter]

STANDARD CHARTERED BANK By: /s/ Virendra Dhir Name: Virendra Dhir Title: Executive Director, Loan Syndicate & Distribution [Signature page to 2018 Syndicate Commitment Letter]

STATE BANK OF INDIA By: /s/ Prem Anup Sinha Name: Prem Anup Sinha Title: Deputy General Manager, ECBs & Syndications Department, International Banking Group, State Bank of India [Signature page to 2018 Syndicate Commitment Letter]

SUMITOMO MITSUI BANKING CORPORATION SINGAPORE BRANCH, Incorporated in Japan with limited liability, Company Registration No. T03FC6366F By: /s/ Velarie Lee Name: Velarie Lee Title: Deputy General Manager [Signature page to 2018 Syndicate Commitment Letter]

Accepted and agreed to as of the date first written above: NOVELIS INC. By /s/ Randal P. Miller Name: Randal P. Miller Title: Vice President & Treasurer [Signature page to 2018 Syndicate Commitment Letter]

Exhibit A Short Term Loan Facility Incremental Facility Incremental Facility Sell Down Commitment Party Commitment Commitment Hold Level ABN AMRO Capital USA LLC $70,000,000 $37,000,000 $30,000,000 Australia and New Zealand Banking Group Limited $70,000,000 $37,000,000 $30,000,000 Axis Bank Limited $70,000,000 $37,000,000 $30,000,000 Bank of America, N.A. $70,000,000 $37,000,000 $30,000,000 Barclays Bank PLC $70,000,000 $37,000,000 $30,000,000 Citibank, N.A. $70,000,000 $37,000,000 $30,000,000 Crédit Agricole Corporate and Investment Bank $70,000,000 $37,000,000 $30,000,000 DBS Bank Ltd. $70,000,000 $37,000,000 $30,000,000 Deutsche Bank AG New York Branch – $37,000,000 $30,000,000 Deutsche Bank AG Cayman Islands Branch $70,000,000 – – First Abu Dhabi Bank USA N.V. $70,000,000 $37,000,000 $30,000,000 HSBC Bank USA, N.A. $70,000,000 $37,000,000 $30,000,000 ICICI Bank Limited, New York Branch $70,000,000 $37,000,000 $30,000,000 ING Bank N.V., Singapore Branch $70,000,000 $37,000,000 $30,000,000 JPMorgan Chase Bank, N.A. $70,000,000 $37,000,000 $30,000,000 Mizuho Bank, Ltd. $70,000,000 $37,000,000 $30,000,000 MUFG Bank, Ltd. $70,000,000 $37,000,000 $30,000,000 Societe Generale, Hong Kong Branch $70,000,000 $37,000,000 $30,000,000 Standard Chartered Bank $70,000,000 $37,000,000 $30,000,000 State Bank of India $170,000,000 $72,000,000 $60,000,000 Sumitomo Mitsui Banking Corporation Singapore Branch $70,000,000 $37,000,000 $30,000,000 Total $1,500,000,000 $775,000,000 $630,000,000 1117554.03B-CHISR02A - MSW