EXHIBIT 99.2 EARNINGS SLIDES

Published on November 2, 2018

Exhibit 99.2 NOVELIS Q2 FISCAL 2019 EARNINGS CONFERENCE CALL November 2, 2018 Steve Fisher President and Chief Executive Officer Dev Ahuja Senior Vice President and Chief Financial Officer © 2018 Novelis

SAFE HARBOR STATEMENT Forward-looking statements Statements made in this presentation which describe Novelis' intentions, expectations, beliefs or predictions may be forward- looking statements within the meaning of securities laws. Forward-looking statements include statements preceded by, followed by, or including the words "believes," "expects," "anticipates," "plans," "estimates," "projects," "forecasts," or similar expressions. Examples of forward-looking statements in this presentation include statements about our ability to close the pending Aleris acquisition in nine to fifteen months from date of announcement. Novelis cautions that, by their nature, forward-looking statements involve risk and uncertainty and that Novelis' actual results could differ materially from those expressed or implied in such statements. We do not intend, and we disclaim, any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. Factors that could cause actual results or outcomes to differ from the results expressed or implied by forward-looking statements include, among other things: changes in the prices and availability of aluminum (or premiums associated with such prices) or other materials and raw materials we use; the capacity and effectiveness of our hedging activities; relationships with, and financial and operating conditions of, our customers, suppliers and other stakeholders; fluctuations in the supply of, and prices for, energy in the areas in which we maintain production facilities; our ability to access financing, including in connection with potential acquisitions and investments; risks relating to, and our ability to consummate, pending and future acquisitions, investments or divestitures, including the pending acquisition of Aleris Corporation; changes in the relative values of various currencies and the effectiveness of our currency hedging activities; factors affecting our operations, such as litigation, environmental remediation and clean-up costs, labor relations and negotiations, breakdown of equipment and other events; the impact of restructuring efforts in the future; economic, regulatory and political factors within the countries in which we operate or sell our products, including changes in duties or tariffs; competition from other aluminum rolled products producers as well as from substitute materials such as steel, glass, plastic and composite materials; changes in general economic conditions including deterioration in the global economy, particularly sectors in which our customers operate; changes in government regulations, particularly those affecting taxes, environmental, health or safety compliance; changes in interest rates that have the effect of increasing the amounts we pay under our credit facilities and other financing agreements; the effect of taxes and changes in tax rates; and our ability to generate cash. The above list of factors is not exhaustive. Other important risk factors are included under the caption "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended March 31, 2018. © 2018 Novelis 2

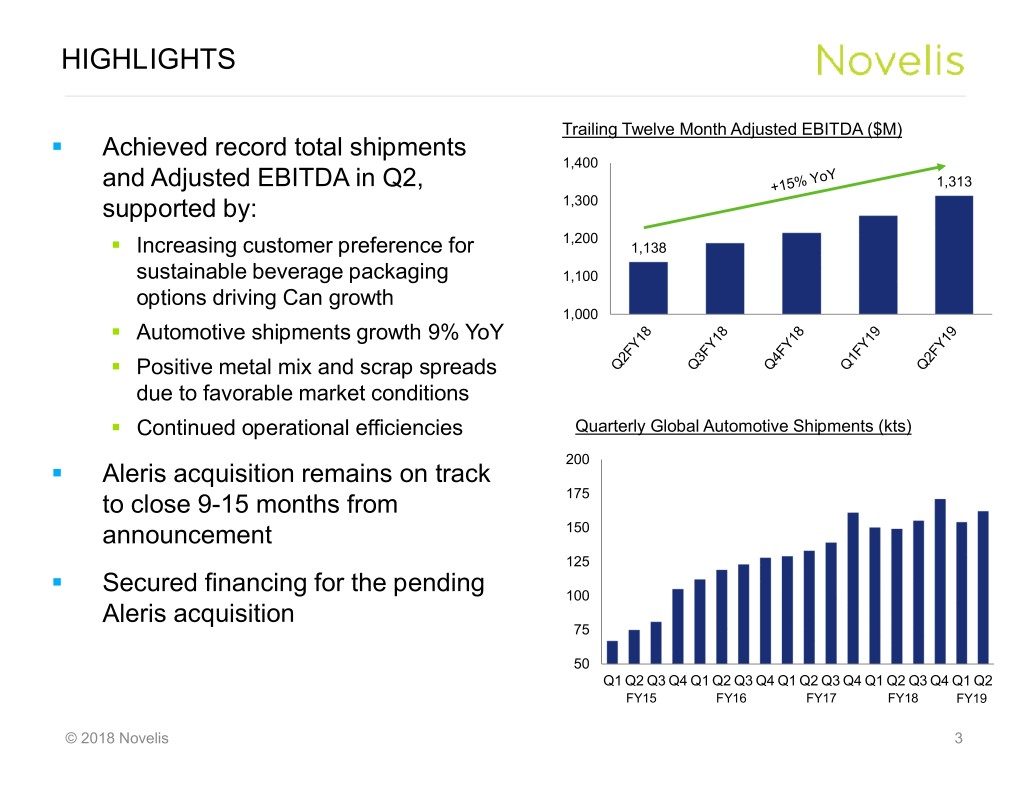

HIGHLIGHTS Trailing Twelve Month Adjusted EBITDA ($M) ° Achieved record total shipments 1,400 and Adjusted EBITDA in Q2, 1,313 supported by: 1,300 1,200 ° Increasing customer preference for 1,138 sustainable beverage packaging 1,100 options driving Can growth 1,000 ° Automotive shipments growth 9% YoY ° Positive metal mix and scrap spreads due to favorable market conditions ° Continued operational efficiencies Quarterly Global Automotive Shipments (kts) 200 ° Aleris acquisition remains on track to close 9-15 months from 175 announcement 150 125 ° Secured financing for the pending 100 Aleris acquisition 75 50 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 FY15FY16 FY17 FY18 FY19 © 2018 Novelis 3

SUPPORTING AUTOMOTIVE CUSTOMER GROWTH ° Previously announced automotive finishing line capacity expansions in North America and Asia on track Guthrie, Kentucky Changzhou, China ° Bay construction is underway ° Recently hosted ground-breaking ceremony ° Adding ~200kt of automotive finishing ° Adding ~100kt of automotive finishing capacity in North America capacity for Asian customers © 2018 Novelis 4

PROVIDING INNOVATIVE CUSTOMER SOLUTIONS ° Establishing a global network of Customer Solution Centers ° Fosters collaborative innovation between Novelis and automakers for next generation vehicle design ° Will be located in close proximity to customer manufacturing sites in North America, Asia and Europe ° Provides an environment to help customers innovate with lightweight, high- strength aluminum at the right cost ° Demonstrate product concepts ° Simulate customer processes and performance in use ° Recommend processes to allow for higher recycled content to help meet sustainability goals © 2018 Novelis 5

FINANCIAL HIGHLIGHTS © 2018 Novelis

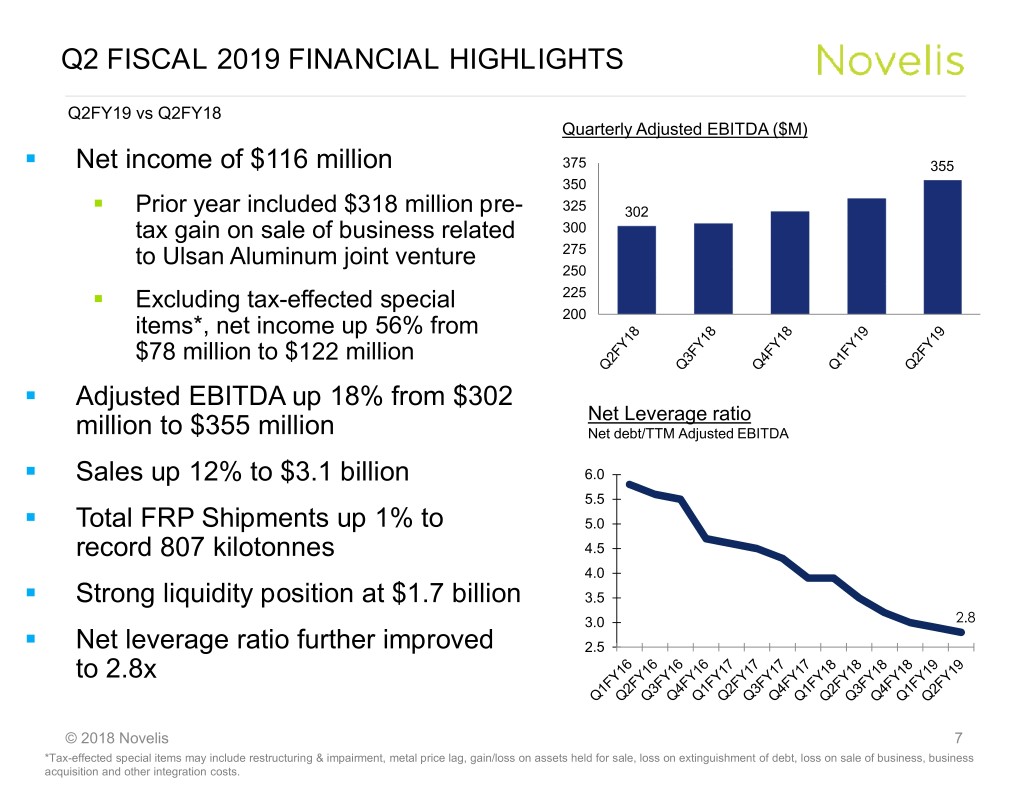

Q2 FISCAL 2019 FINANCIAL HIGHLIGHTS Q2FY19 vs Q2FY18 Quarterly Adjusted EBITDA ($M) ° Net income of $116 million 375 355 350 ° Prior year included $318 million pre- 325 302 tax gain on sale of business related 300 to Ulsan Aluminum joint venture 275 250 ° Excluding tax-effected special 225 items*, net income up 56% from 200 $78 million to $122 million ° Adjusted EBITDA up 18% from $302 Net Leverage ratio million to $355 million Net debt/TTM Adjusted EBITDA ° Sales up 12% to $3.1 billion 6.0 5.5 ° Total FRP Shipments up 1% to 5.0 record 807 kilotonnes 4.5 4.0 ° Strong liquidity position at $1.7 billion 3.5 2.8 3.0 ° Net leverage ratio further improved 2.5 to 2.8x © 2018 Novelis 7 *Tax-effected special items may include restructuring & impairment, metal price lag, gain/loss on assets held for sale, loss on extinguishment of debt, loss on sale of business, business acquisition and other integration costs.

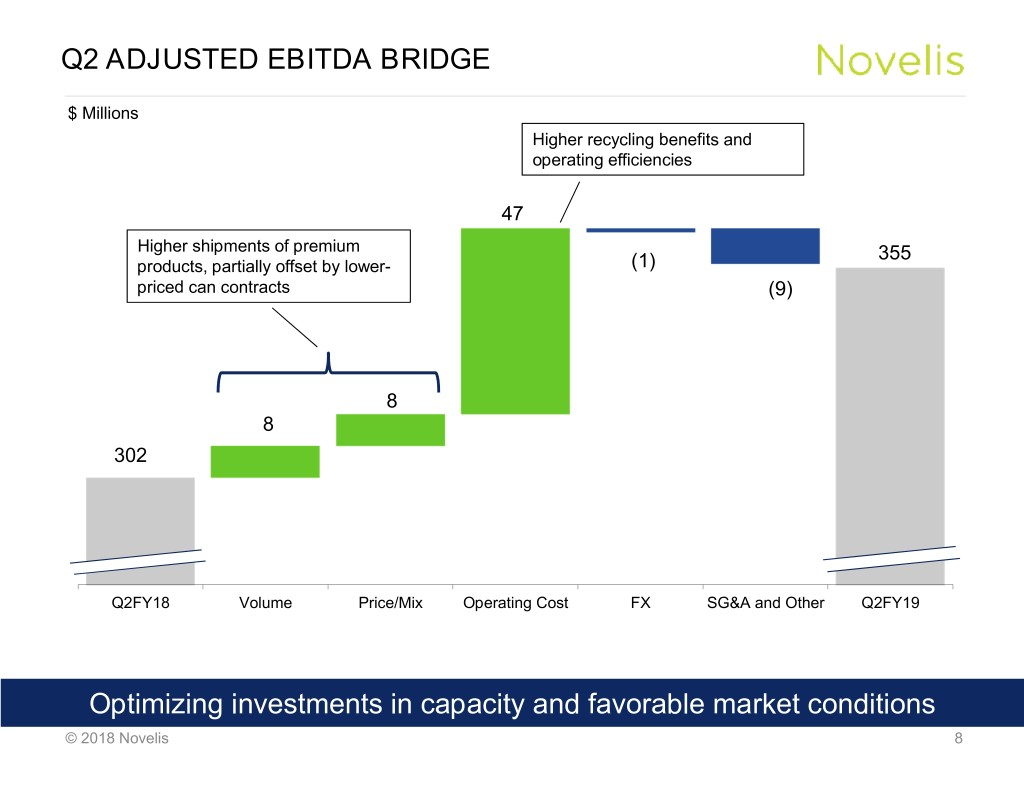

Q2 ADJUSTED EBITDA BRIDGE $ Millions Higher recycling benefits and operating efficiencies 47 Higher shipments of premium 355 products, partially offset by lower- (1) priced can contracts (9) 8 8 302 Q2FY18 Volume Price/Mix Operating Cost FX SG&A and Other Q2FY19 Optimizing investments in capacity and favorable market conditions © 2018 Novelis 8

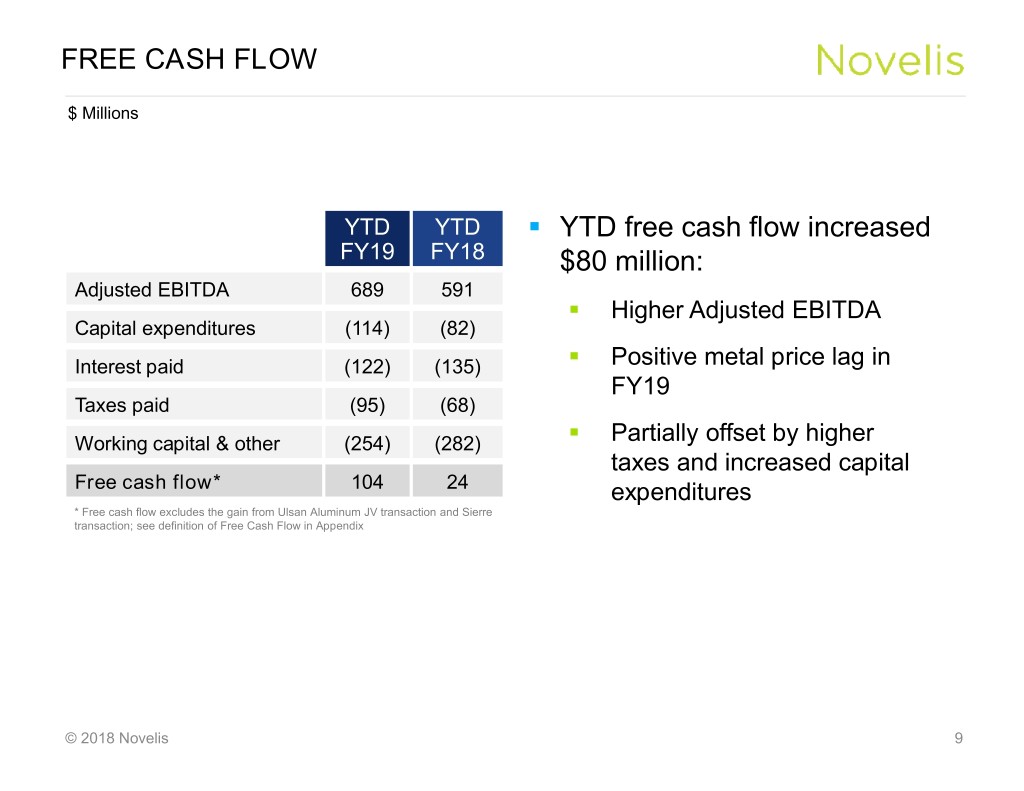

FREE CASH FLOW $ Millions YTD YTD ° YTD free cash flow increased FY19 FY18 $80 million: Adjusted EBITDA 689 591 ° Higher Adjusted EBITDA Capital expenditures (114) (82) Interest paid (122) (135) ° Positive metal price lag in FY19 Taxes paid (95) (68) Working capital & other (254) (282) ° Partially offset by higher taxes and increased capital Free cash flow* 104 24 expenditures * Free cash flow excludes the gain from Ulsan Aluminum JV transaction and Sierre transaction; see definition of Free Cash Flow in Appendix © 2018 Novelis 9

SUMMARY © 2018 Novelis

SUMMARY ° Record quarter performance ° FY19 shipments to grow, but nearing capacity constraints ° Geo-political and trade uncertainty may create short-term headwinds but end market demand outlook remains strong over the long term ° Making disciplined strategic investments to diversify our product portfolio and strengthen our business ° Pending Aleris acquisition remains on track and financing now secured © 2018 Novelis 11

THANK YOU AND QUESTIONS THANK YOU QUESTIONS? © 2018 Novelis

APPENDIX © 2018 Novelis

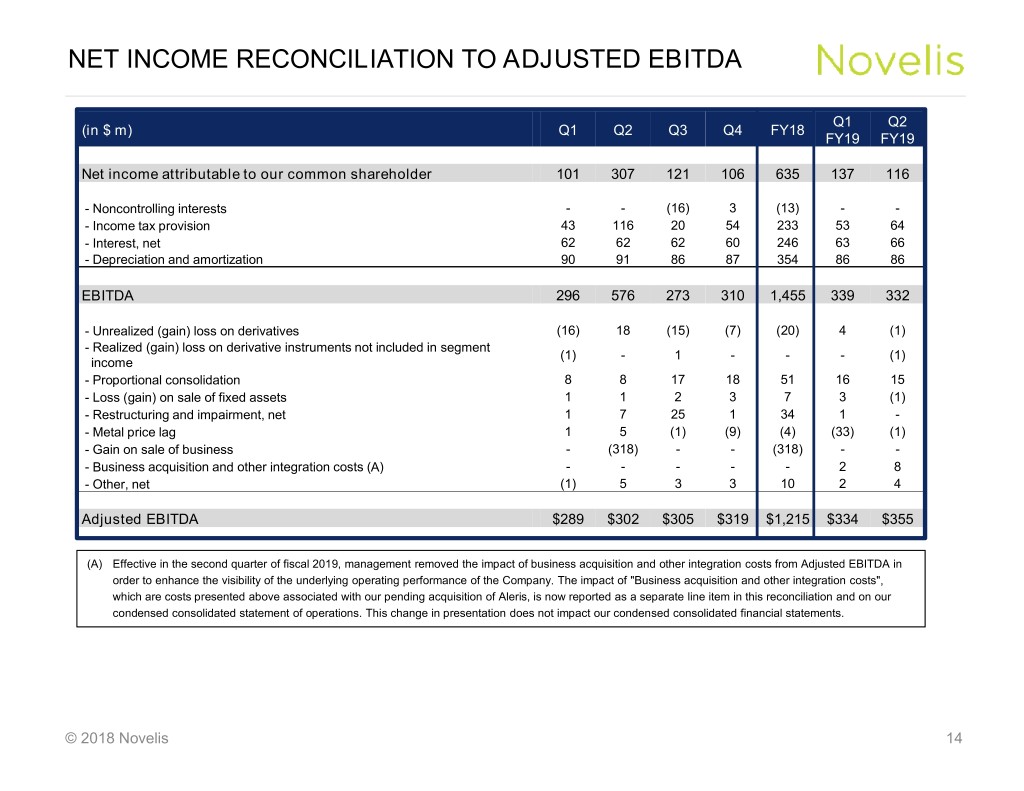

NET INCOME RECONCILIATION TO ADJUSTED EBITDA Q1 Q2 (in $ m) Q1 Q2 Q3 Q4 FY18 FY19 FY19 Net income attributable to our common shareholder 101 307 121 106 635 137 116 - Noncontrolling interests - - (16) 3 (13) - - - Income tax provision 43 116 20 54 233 53 64 - Interest, net 62 62 62 60 246 63 66 - Depreciation and amortization 90 91 86 87 354 86 86 EBITDA 296 576 273 310 1,455 339 332 - Unrealized (gain) loss on derivatives (16) 18 (15) (7) (20) 4 (1) - Realized (gain) loss on derivative instruments not included in segment (1) - 1 - - - (1) income - Proportional consolidation 8 8 17 18 51 16 15 - Loss (gain) on sale of fixed assets 1 1 2 3 7 3 (1) - Restructuring and impairment, net 1 7 25 1 34 1 - - Metal price lag 1 5 (1) (9) (4) (33) (1) - Gain on sale of business - (318) - - (318) - - - Business acquisition and other integration costs (A) - - - - - 2 8 - Other, net (1) 5 3 3 10 2 4 Adjusted EBITDA $289 $302 $305 $319 $1,215 $334 $355 (A) Effective in the second quarter of fiscal 2019, management removed the impact of business acquisition and other integration costs from Adjusted EBITDA in order to enhance the visibility of the underlying operating performance of the Company. The impact of "Business acquisition and other integration costs", which are costs presented above associated with our pending acquisition of Aleris, is now reported as a separate line item in this reconciliation and on our condensed consolidated statement of operations. This change in presentation does not impact our condensed consolidated financial statements. © 2018 Novelis 14

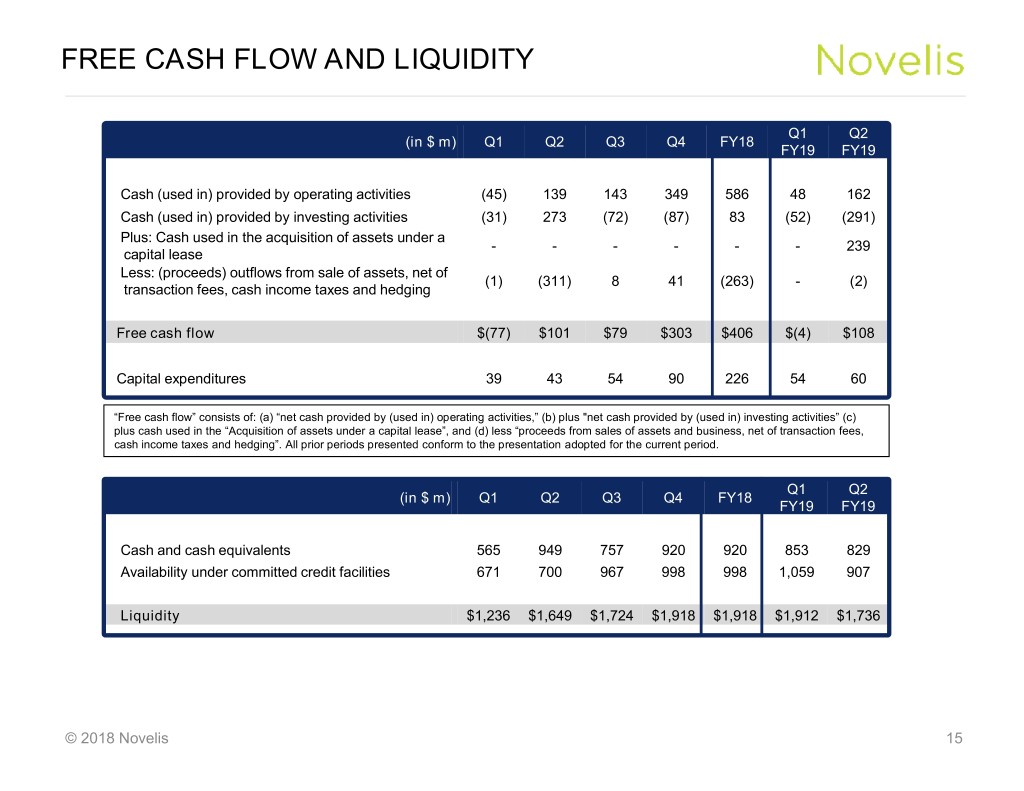

FREE CASH FLOW AND LIQUIDITY Q1 Q2 (in $ m ) Q1 Q2 Q3 Q4 FY18 FY19 FY19 Cash (used in) provided by operating activities (45) 139 143 349 586 48 162 Cash (used in) provided by investing activities (31) 273 (72) (87) 83 (52) (291) Plus: Cash used in the acquisition of assets under a - - - - - - 239 capital lease Less: (proceeds) outflows from sale of assets, net of (1) (311) 8 41 (263) - (2) transaction fees, cash income taxes and hedging Free cash flow $(77) $101 $79 $303 $406 $(4) $108 Capital expenditures 39 43 54 90 226 54 60 “Free cash flow” consists of: (a) “net cash provided by (used in) operating activities,” (b) plus "net cash provided by (used in) investing activities” (c) plus cash used in the “Acquisition of assets under a capital lease”, and (d) less “proceeds from sales of assets and business, net of transaction fees, cash income taxes and hedging”. All prior periods presented conform to the presentation adopted for the current period. Q1 Q2 (in $ m ) Q1 Q2 Q3 Q4 FY18 FY19 FY19 Cash and cash equivalents 565 949 757 920 920 853 829 Availability under committed credit facilities 671 700 967 998 998 1,059 907 Liquidity $1,236 $1,649 $1,724 $1,918 $1,918 $1,912 $1,736 © 2018 Novelis 15