EXHIBIT 99.2 EARNINGS SLIDES

Published on February 1, 2018

© 2018 Novelis

NOVELIS Q3 FISCAL 2018

EARNINGS CONFERENCE CALL

February 1, 2018

Steve Fisher

President and Chief Executive Officer

Devinder Ahuja

Senior Vice President and Chief Financial Officer

Exhibit 99.2

© 2018 Novelis

SAFE HARBOR STATEMENT

Forward-looking statements

Statements made in this presentation which describe Novelis' intentions, expectations, beliefs or predictions may be forward-

looking statements within the meaning of securities laws. Forward-looking statements include statements preceded by, followed

by, or including the words "believes," "expects," "anticipates," "plans," "estimates," "projects," "forecasts," or similar

expressions. Examples of forward-looking statements in this presentation including statements concerning the ranges for Adjusted

EBITDA and free cash flow we expect to achieve this fiscal year. Novelis cautions that, by their nature, forward-looking statements

involve risk and uncertainty and that Novelis' actual results could differ materially from those expressed or implied in such

statements. We do not intend, and we disclaim, any obligation to update any forward-looking statements, whether as a result of

new information, future events or otherwise. Factors that could cause actual results or outcomes to differ from the results

expressed or implied by forward-looking statements include, among other things: changes in the prices and availability of aluminum

(or premiums associated with such prices) or other materials and raw materials we use; the capacity and effectiveness of our

hedging activities; relationships with, and financial and operating conditions of, our customers, suppliers and other stakeholders;

fluctuations in the supply of, and prices for, energy in the areas in which we maintain production facilities; our ability to access

financing for future capital requirements; changes in the relative values of various currencies and the effectiveness of our currency

hedging activities; factors affecting our operations, such as litigation, environmental remediation and clean-up costs, labor relations

and negotiations, breakdown of equipment and other events; the impact of restructuring efforts in the future; economic, regulatory

and political factors within the countries in which we operate or sell our products, including changes in duties or tariffs; competition

from other aluminum rolled products producers as well as from substitute materials such as steel, glass, plastic and composite

materials; changes in general economic conditions including deterioration in the global economy, particularly sectors in which our

customers operate; cyclical demand and pricing within the principal markets for our products as well as seasonality in certain of our

customers’ industries; changes in government regulations, particularly those affecting taxes, environmental, health or safety

compliance; changes in interest rates that have the effect of increasing the amounts we pay under our credit facilities and other

financing agreements; the effect of taxes and changes in tax rates; and our ability to generate cash. The above list of factors is not

exhaustive. Other important risk factors included under the caption "Risk Factors" in our Annual Report on Form 10-K for the fiscal

year ended March 31, 2017 are specifically incorporated by reference into this presentation.

2

© 2018 Novelis

HIGHLIGHTS

Financial & Operational Highlights

Achieved 20% YoY increase in Q3

Adjusted EBITDA to record $305 million

Q3 shipments increased 6% YoY

Positive product mix shift towards auto

Operating efficiencies

TTM Adjusted EBITDA $1,188 million

3

Strategically investing to grow with our customers

Strategic Activities

Strengthening our product portfolio

Expanding & securing global

automotive capabilities with

investments in North America and

Europe

Exiting European litho business

Quarterly Adjusted EBITDA ($M)

238

255

305

150

175

200

225

250

275

300

325

© 2018 Novelis

FINANCIAL HIGHLIGHTS

© 2018 Novelis

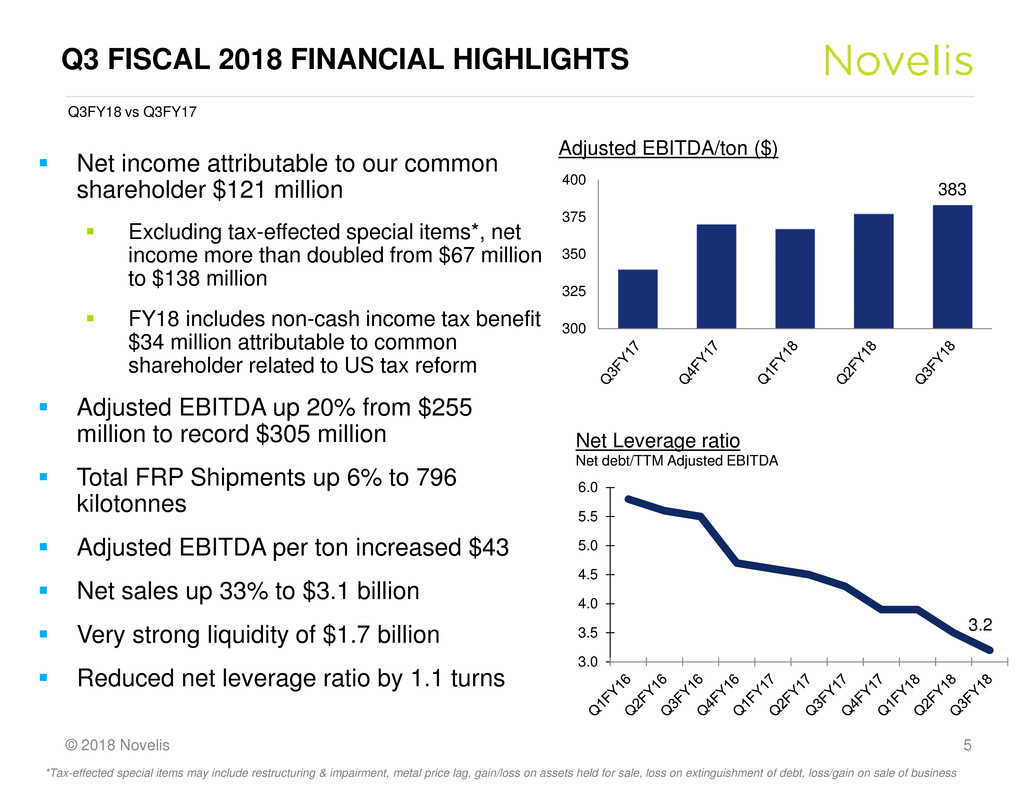

Q3 FISCAL 2018 FINANCIAL HIGHLIGHTS

Net income attributable to our common

shareholder $121 million

Excluding tax-effected special items*, net

income more than doubled from $67 million

to $138 million

FY18 includes non-cash income tax benefit

$34 million attributable to common

shareholder related to US tax reform

Adjusted EBITDA up 20% from $255

million to record $305 million

Total FRP Shipments up 6% to 796

kilotonnes

Adjusted EBITDA per ton increased $43

Net sales up 33% to $3.1 billion

Very strong liquidity of $1.7 billion

Reduced net leverage ratio by 1.1 turns

5

Q3FY18 vs Q3FY17

*Tax-effected special items may include restructuring & impairment, metal price lag, gain/loss on assets held for sale, loss on extinguishment of debt, loss/gain on sale of business

Net Leverage ratio

Net debt/TTM Adjusted EBITDA

3.2

3.0

3.5

4.0

4.5

5.0

5.5

6.0

Adjusted EBITDA/ton ($)

383

300

325

350

375

400

© 2018 Novelis

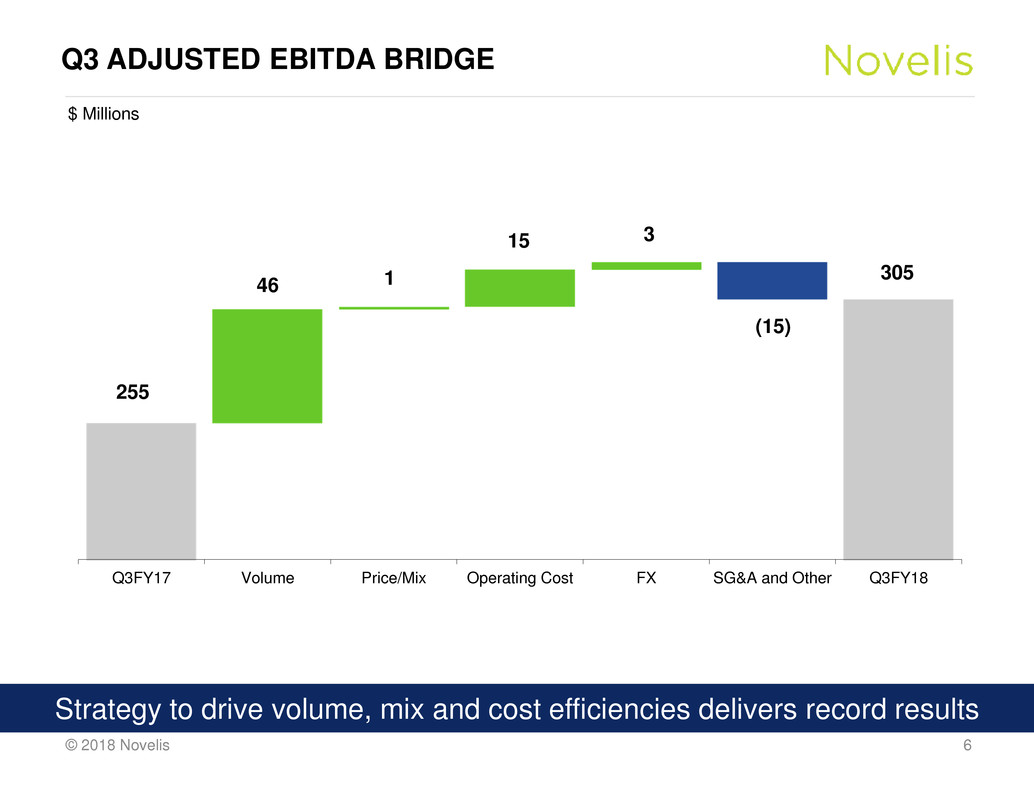

Q3 ADJUSTED EBITDA BRIDGE

6

$ Millions

255

46 1

15 3

(15)

305

Q3FY17 Volume Price/Mix Operating Cost FX SG&A and Other Q3FY18

Strategy to drive volume, mix and cost efficiencies delivers record results

© 2018 Novelis

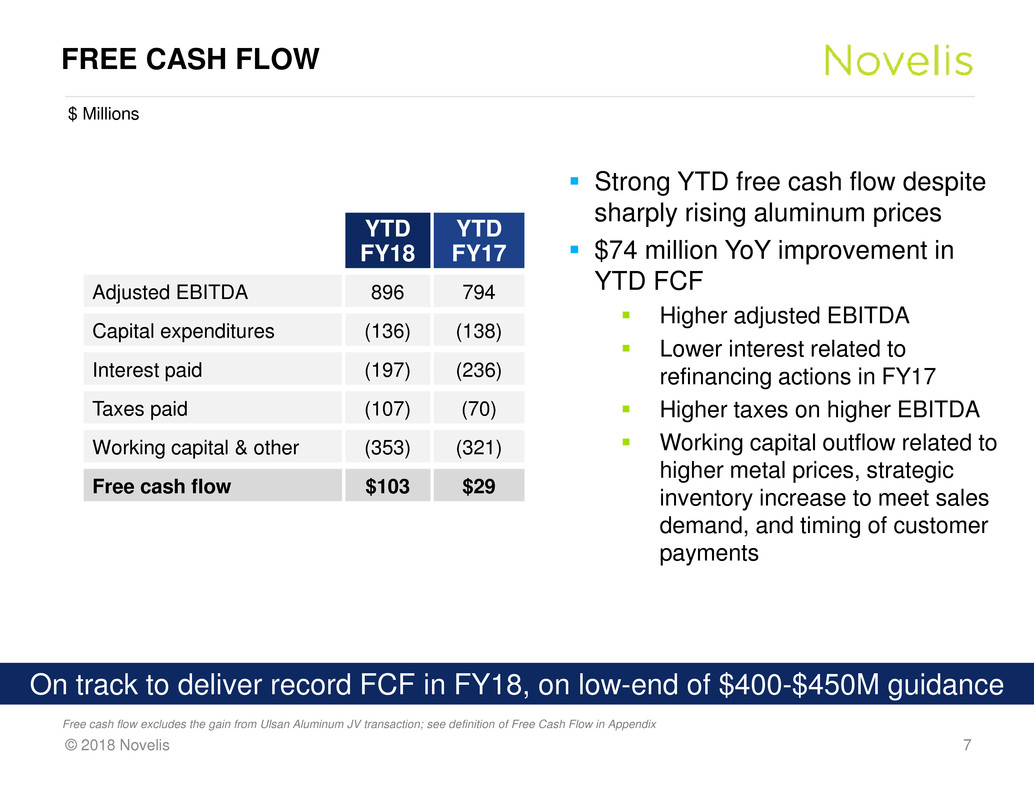

FREE CASH FLOW

7

YTD

FY18

YTD

FY17

Adjusted EBITDA 896 794

Capital expenditures (136) (138)

Interest paid (197) (236)

Taxes paid (107) (70)

Working capital & other (353) (321)

Free cash flow $103 $29

Strong YTD free cash flow despite

sharply rising aluminum prices

$74 million YoY improvement in

YTD FCF

Higher adjusted EBITDA

Lower interest related to

refinancing actions in FY17

Higher taxes on higher EBITDA

Working capital outflow related to

higher metal prices, strategic

inventory increase to meet sales

demand, and timing of customer

payments

$ Millions

Free cash flow excludes the gain from Ulsan Aluminum JV transaction; see definition of Free Cash Flow in Appendix

On track to deliver record FCF in FY18, on low-end of $400-$450M guidance

© 2018 Novelis

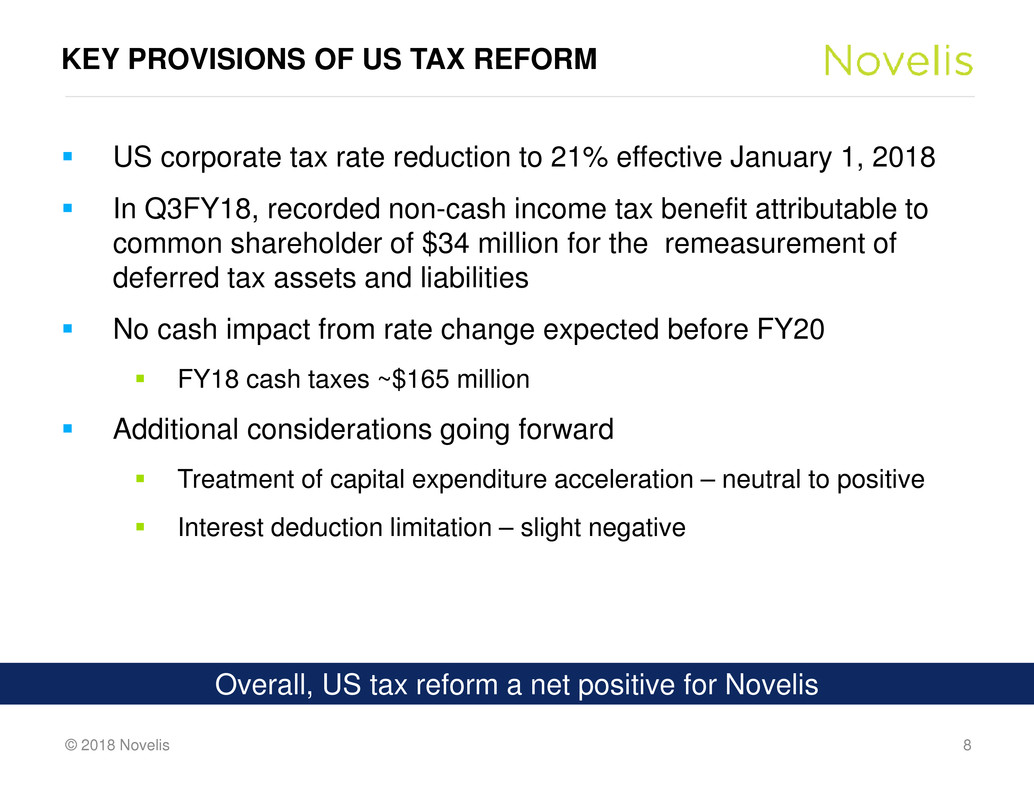

KEY PROVISIONS OF US TAX REFORM

US corporate tax rate reduction to 21% effective January 1, 2018

In Q3FY18, recorded non-cash income tax benefit attributable to

common shareholder of $34 million for the remeasurement of

deferred tax assets and liabilities

No cash impact from rate change expected before FY20

FY18 cash taxes ~$165 million

Additional considerations going forward

Treatment of capital expenditure acceleration – neutral to positive

Interest deduction limitation – slight negative

8

Overall, US tax reform a net positive for Novelis

© 2018 Novelis

AUTOMOTIVE INVESTMENTS

© 2018 Novelis

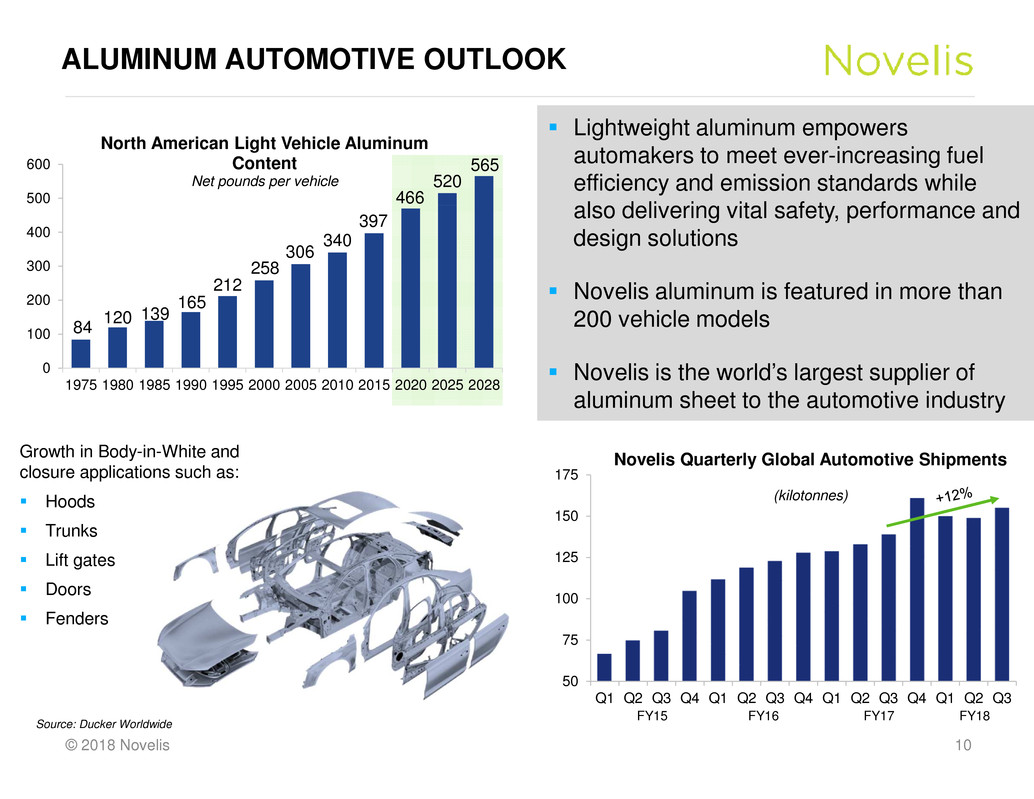

ALUMINUM AUTOMOTIVE OUTLOOK

10

Source: Ducker Worldwide

84 120

139 165

212

258

306 340

397

466

520

565

0

100

200

300

400

500

600

1975 1980 1985 1990 1995 2000 2005 2010 2015 2020 2025 2028

North American Light Vehicle Aluminum

Content

Net pounds per vehicle

Lightweight aluminum empowers

automakers to meet ever-increasing fuel

efficiency and emission standards while

also delivering vital safety, performance and

design solutions

Novelis aluminum is featured in more than

200 vehicle models

Novelis is the world’s largest supplier of

aluminum sheet to the automotive industry

Growth in Body-in-White and

closure applications such as:

Hoods

Trunks

Lift gates

Doors

Fenders

50

75

100

125

150

175

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

Novelis Quarterly Global Automotive Shipments

(kilotonnes)

FY15 FY17FY16 FY18

© 2018 Novelis

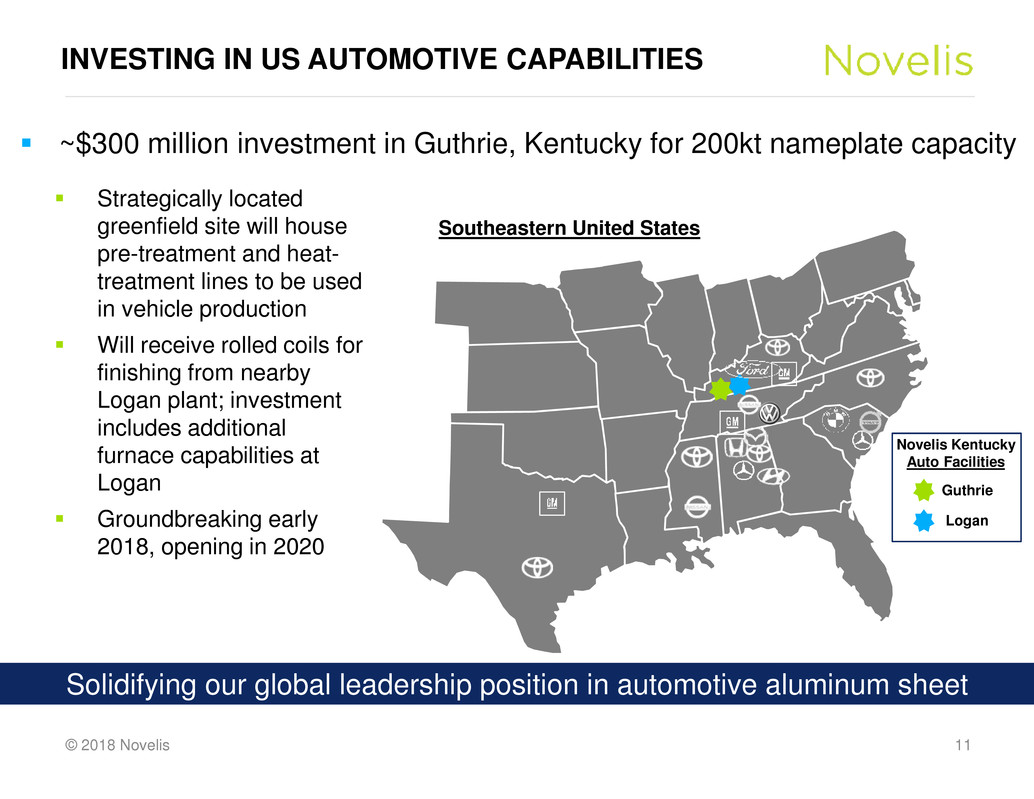

INVESTING IN US AUTOMOTIVE CAPABILITIES

11

Strategically located

greenfield site will house

pre-treatment and heat-

treatment lines to be used

in vehicle production

Will receive rolled coils for

finishing from nearby

Logan plant; investment

includes additional

furnace capabilities at

Logan

Groundbreaking early

2018, opening in 2020

Solidifying our global leadership position in automotive aluminum sheet

Southeastern United States

Guthrie

Logan

Novelis Kentucky

Auto Facilities

~$300 million investment in Guthrie, Kentucky for 200kt nameplate capacity

© 2018 Novelis

INVESTING IN EUROPEAN AUTOMOTIVE CAPABILITIES

12

Agreed to acquire operating facilities and manufacturing assets in Sierre,

Switzerland, for €200 million to provide security, stability and strategic flexibility

Expanding and securing our global automotive capabilities

Novelis Global Automotive Footprint

© 2018 Novelis

SUMMARY & OUTLOOK

Strong operating performance

drove record Q3 Adjusted EBITDA

On track to deliver a record year

FY18 Adjusted EBITDA on high end

of previously guided $1,150-$1,200

million range

Free cash flow on low end of

previously guided $400-$450

million range

Demand for automotive aluminum

sheet remains high

Strategically investing in

automotive assets to grow with our

customers and advance the

continued penetration of aluminum

sheet in the automotive market

13

TTM Adjusted EBITDA ($M)

$1,188

700

800

900

1,000

1,100

1,200

TTM shipment trend (kt)

3,172

3,000

3,050

3,100

3,150

3,200

© 2018 Novelis

THANK YOU

QUESTIONS?

THANK YOU AND QUESTIONS

© 2018 Novelis

APPENDIX

© 2018 Novelis

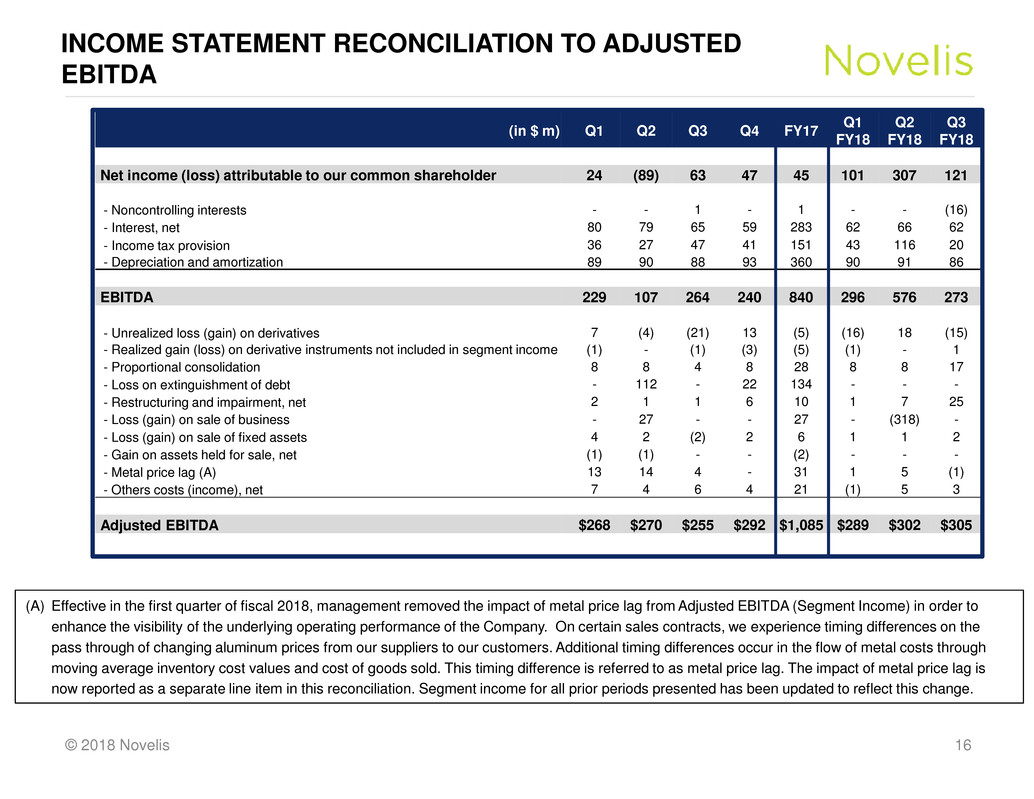

(in $ m) Q1 Q2 Q3 Q4 FY17 Q1FY18

Q2

FY18

Q3

FY18

Net income (loss) attributable to our common shareholder 24 (89) 63 47 45 101 307 121

- Noncontrolling interests - - 1 - 1 - - (16)

- Interest, net 80 79 65 59 283 62 66 62

- Income tax provision 36 27 47 41 151 43 116 20

- Depreciation and amortization 89 90 88 93 360 90 91 86

EBITDA 229 107 264 240 840 296 576 273

- Unrealized loss (gain) on derivatives 7 (4) (21) 13 (5) (16) 18 (15)

- Realized gain (loss) on derivative instruments not included in segment income (1) - (1) (3) (5) (1) - 1

- Proportional consolidation 8 8 4 8 28 8 8 17

- Loss on extinguishment of debt - 112 - 22 134 - - -

- Restructuring and impairment, net 2 1 1 6 10 1 7 25

- Loss (gain) on sale of business - 27 - - 27 - (318) -

- Loss (gain) on sale of fixed assets 4 2 (2) 2 6 1 1 2

- Gain on assets held for sale, net (1) (1) - - (2) - - -

- Metal price lag (A) 13 14 4 - 31 1 5 (1)

- Others costs (income), net 7 4 6 4 21 (1) 5 3

Adjusted EBITDA $268 $270 $255 $292 $1,085 $289 $302 $305

INCOME STATEMENT RECONCILIATION TO ADJUSTED

EBITDA

16

(A) Effective in the first quarter of fiscal 2018, management removed the impact of metal price lag from Adjusted EBITDA (Segment Income) in order to

enhance the visibility of the underlying operating performance of the Company. On certain sales contracts, we experience timing differences on the

pass through of changing aluminum prices from our suppliers to our customers. Additional timing differences occur in the flow of metal costs through

moving average inventory cost values and cost of goods sold. This timing difference is referred to as metal price lag. The impact of metal price lag is

now reported as a separate line item in this reconciliation. Segment income for all prior periods presented has been updated to reflect this change.

© 2018 Novelis

FREE CASH FLOW AND LIQUIDITY

17

(in $ m) Q1 Q2 Q3 Q4 FY17 Q1FY18

Q2

FY18

Q3

FY18

Cash (used in) provided by operating activities (107) 80 178 424 575 (45) 139 143

Cash used in investing activities (39) (48) (35) (90) (212) (31) 273 (72)

Less: outflows (proceeds) from sale of assets,

net of transaction fees, cash income taxes and

hedging (A)

- 12 (12) (2) (2) (1) (311) 8

Free cash flow $(146) $44 $131 $332 $361 $(77) $101 $79

Capital expenditures 44 46 48 86 224 39 43 54

(in $ m) Q1 Q2 Q3 Q4 FY17 Q1FY18

Q2

FY18

Q3

FY18

Cash and cash equivalents 457 473 505 594 594 565 949 757

Availability under committed credit facilities 633 573 534 701 701 671 700 967

Liquidity $1,090 $1,046 $1,039 $1,295 $1,295 $1,236 $1,649 $1,724

(A) Effective in the second quarter of fiscal 2018, management clarified the definition of “Free cash flow” (a non-GAAP measure) to reduce "Proceeds on the sale of assets, net of transaction

fees and hedging" by cash income taxes to further enable users of the financial statements to understand cash generated internally by the Company. This change does not impact the

condensed consolidated financial statements or significantly impact prior periods. In addition, this line item includes the proceeds from the sale of shares in Ulsan Aluminum Ltd., to Kobe

Steel Ltd. during the three months ended December 31, 2017 in the amount of $314 million. This line item also includes "Outflows from the sale of a business, net of transaction fees,"

which is comprised of cash of $13 million held by ALCOM, which was a consolidated entity sold during the nine months ended September 30, 2016. We expect additional cash taxes and

transaction fees related to Ulsan Aluminum Ltd. of approximately $41 million and $2 million, respectively, to be paid during the remainder of fiscal 2018.