EXHIBIT99.2 EARNINGS SLIDES

Published on February 10, 2014

©2014Novelis Inc. 1 February 10, 2014 Philip Martens President and Chief Executive Officer Steve Fisher Senior Vice President and Chief Financial Officer Novelis Q3 Fiscal Year 2014 Earnings Conference Call Exhibit 99.2

©2014Novelis Inc. 2 Safe Harbor Statement Forward-Looking Statements Statements made in this presentation which describe Novelis' intentions, expectations, beliefs or predictions may be forward-looking statements within the meaning of securities laws. Forward-looking statements include statements preceded by, followed by, or including the words "believes," "expects," "anticipates," "plans," "estimates," "projects," "forecasts," or similar expressions. Examples of forward-looking statements in this presentation are statements about expected FRP industry growth. Novelis cautions that, by their nature, forward-looking statements involve risk and uncertainty and that Novelis' actual results could differ materially from those expressed or implied in such statements. We do not intend, and we disclaim any obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise. Factors that could cause actual results or outcomes to differ from the results expressed or implied by forward- looking statements include, among other things: changes in the prices and availability of aluminum (or premiums associated with such prices) or other materials and raw materials we use; the capacity and effectiveness of our metal hedging activities; relationships with, and financial and operating conditions of, our customers, suppliers and other stakeholders; fluctuations in the supply of, and prices for, energy in the areas in which we maintain production facilities; our ability to access financing for future capital requirements; changes in the relative values of various currencies and the effectiveness of our currency hedging activities; factors affecting our operations, such as litigation, environmental remediation and clean-up costs, labor relations and negotiations, breakdown of equipment and other events; the impact of restructuring efforts in the future; economic, regulatory and political factors within the countries in which we operate or sell our products, including changes in duties or tariffs; competition from other aluminum rolled products producers as well as from substitute materials such as steel, glass, plastic and composite materials; changes in general economic conditions including deterioration in the global economy, particularly sectors in which our customers operate; changes in the fair value of derivative instruments; cyclical demand and pricing within the principal markets for our products as well as seasonality in certain of our customers’ industries; changes in government regulations, particularly those affecting taxes, environmental, health or safety compliance; changes in interest rates that have the effect of increasing the amounts we pay under our principal credit agreement and other financing agreements; the effect of taxes and changes in tax rates; and our indebtedness and our ability to generate cash. The above list of factors is not exhaustive. Other important risk factors included under the caption "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended March 31, 2013 are specifically incorporated by reference into this presentation.

©2014Novelis Inc. 3 Agenda Business Review and Strategy Q3FY14 Financial & Operational Review Summary & Outlook

©2014Novelis Inc. 4 Business Review and Strategy

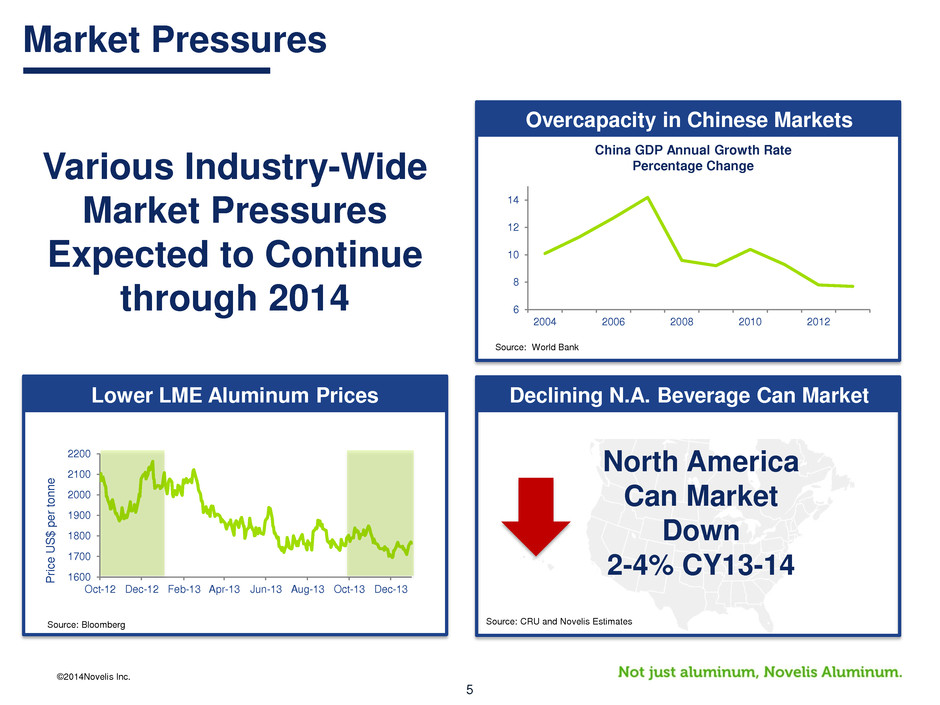

©2014Novelis Inc. 5 Market Pressures Source: CRU and Novelis Estimates Various Industry-Wide Market Pressures Expected to Continue through 2014 Overcapacity in Chinese Markets Lower LME Aluminum Prices Declining N.A. Beverage Can Market 1600 1700 1800 1900 2000 2100 2200 Oct-12 Dec-12 Feb-13 Apr-13 Jun-13 Aug-13 Oct-13 Dec-13 Pr ic e US$ p e r to n n e North America Can Market Down 2-4% CY13-14 Source: Bloomberg Source: World Bank China GDP Annual Growth Rate Percentage Change 6 8 10 12 14 2004 2006 2008 2010 2012

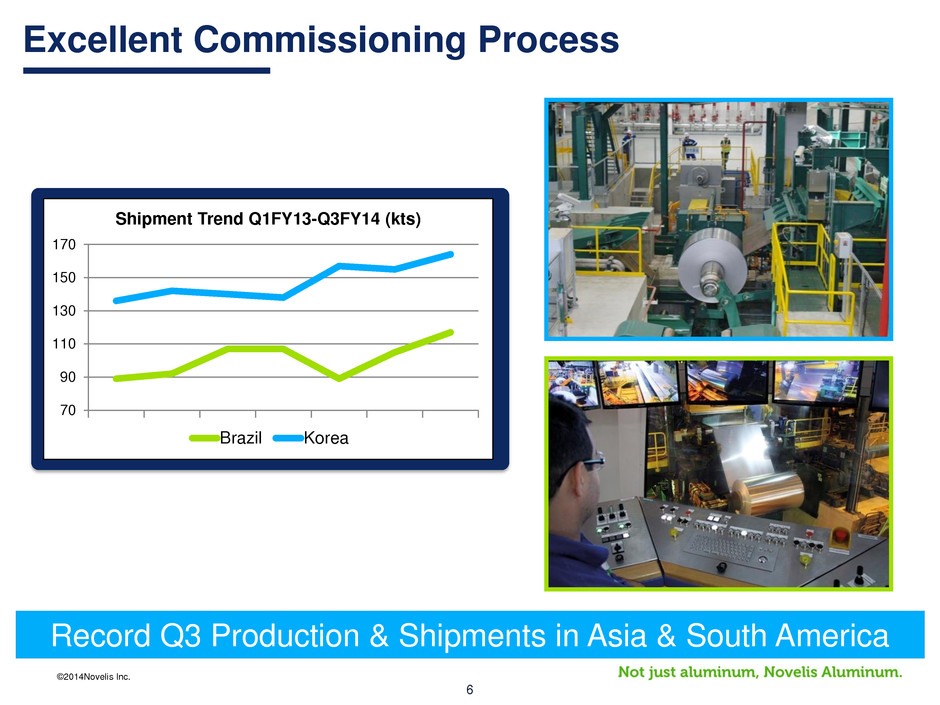

©2014Novelis Inc. 6 Excellent Commissioning Process Record Q3 Production & Shipments in Asia & South America 70 90 110 130 150 170 Shipment Trend Q1FY13-Q3FY14 (kts) Brazil Korea

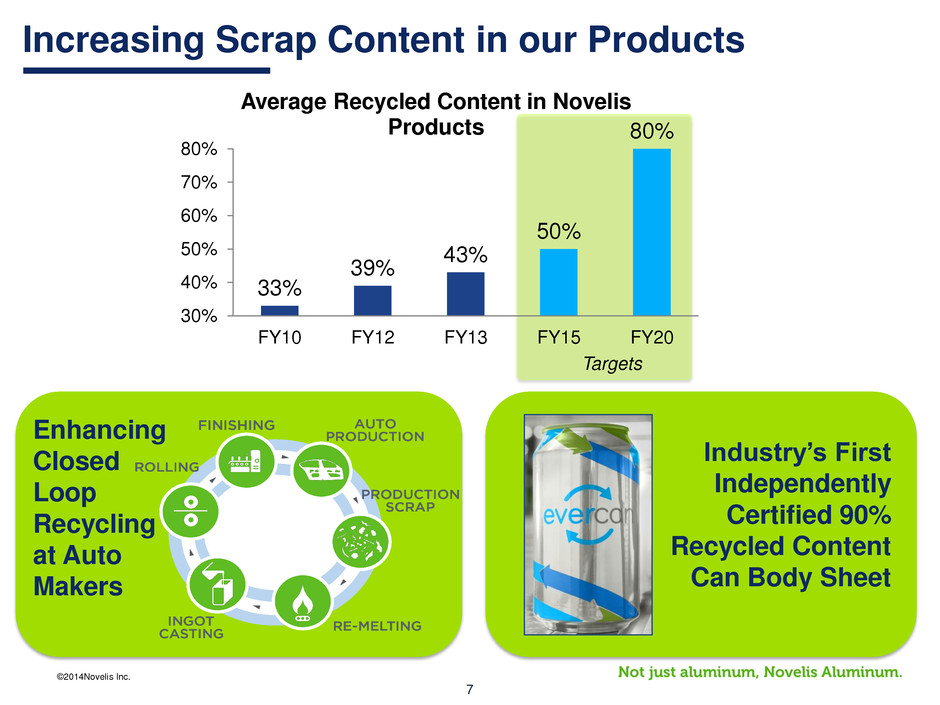

©2014Novelis Inc. 7 Increasing Scrap Content in our Products 33% 39% 43% 50% 80% 30% 40% 50% 60% 70% 80% FY10 FY12 FY13 FY15 FY20 Average Recycled Content in Novelis Products Enhancing Closed Loop Recycling at Auto Makers Industry’s First Independently Certified 90% Recycled Content Can Body Sheet Targets

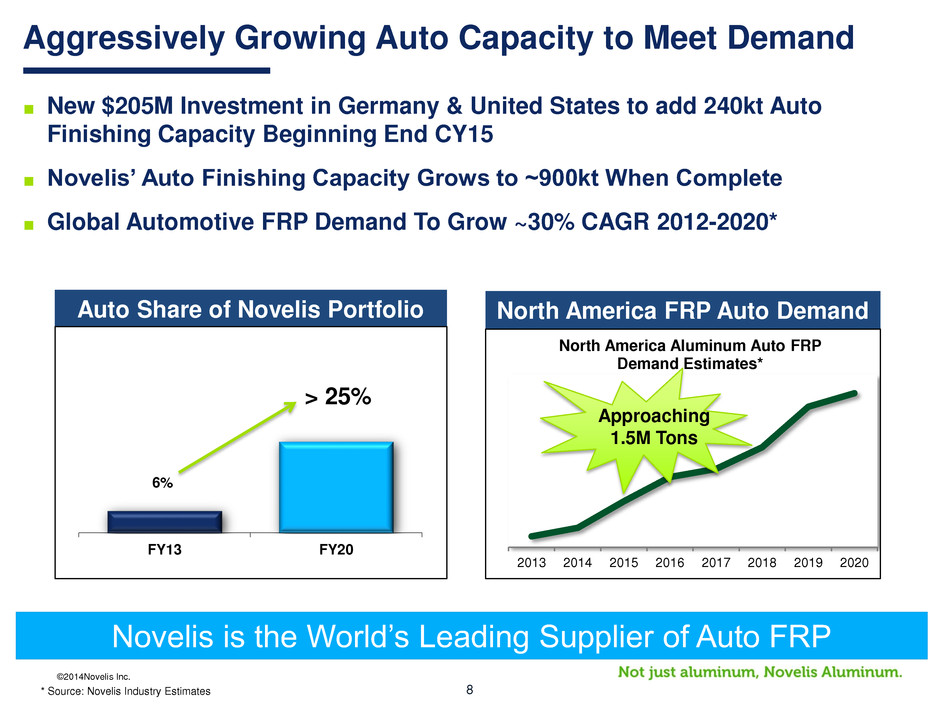

©2014Novelis Inc. 8 Aggressively Growing Auto Capacity to Meet Demand North America FRP Auto Demand Auto Share of Novelis Portfolio Novelis is the World’s Leading Supplier of Auto FRP 6% > 25% FY13 FY20 ■ New $205M Investment in Germany & United States to add 240kt Auto Finishing Capacity Beginning End CY15 ■ Novelis’ Auto Finishing Capacity Grows to ~900kt When Complete ■ Global Automotive FRP Demand To Grow ~30% CAGR 2012-2020* * Source: Novelis Industry Estimates 2013 2014 2015 2016 2017 2018 2019 2020 North America Aluminum Auto FRP Demand Estimates* Approaching 1.5M Tons

©2014Novelis Inc. 9 Operations & Financial Review

©2014Novelis Inc. 10 Third Quarter Highlights Shipments Up 11% YoY to 721 Kilotonnes, Up 1% Sequentially Despite Seasonally Low Quarter Adjusted EBITDA Up 10% YoY to $203 Million Free Cash Flow Before Capex of $96 Million, Up $212 Million YoY Net Income of $13 Million; Excluding Certain Items, Net Income $23 Million Excellent Operational Performance

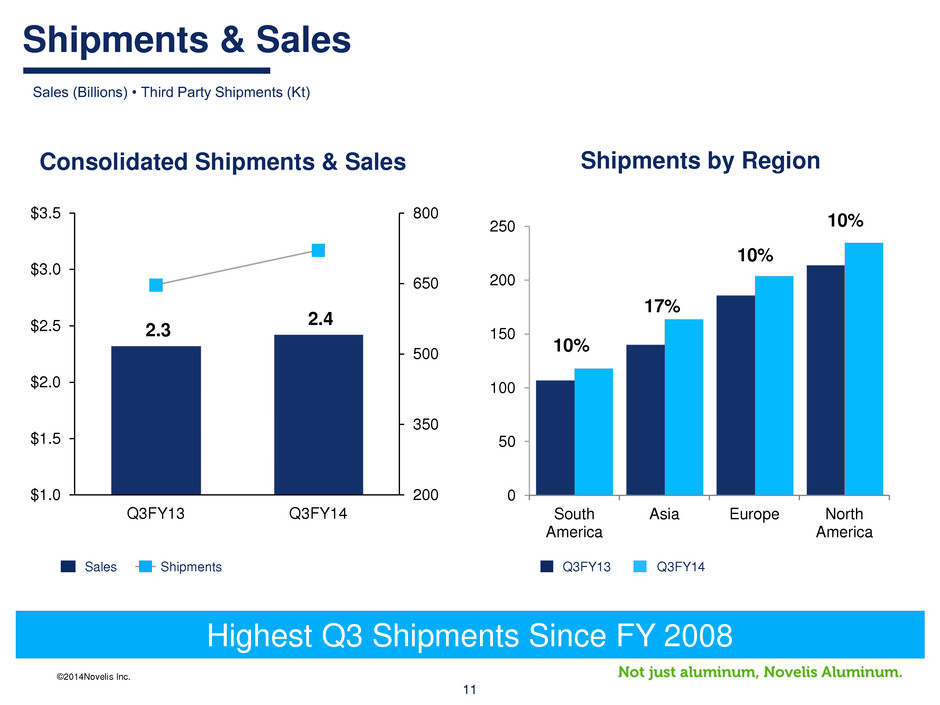

©2014Novelis Inc. 11 2.3 2.4 200 350 500 650 800 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 Q3FY13 Q3FY14 Shipments Sales 0 50 100 150 200 250 South America Asia Europe North America Q3FY14 Q3FY13 17% 10% 10% 10% Sales (Billions) • Third Party Shipments (Kt) Shipments & Sales Consolidated Shipments & Sales Shipments by Region Highest Q3 Shipments Since FY 2008

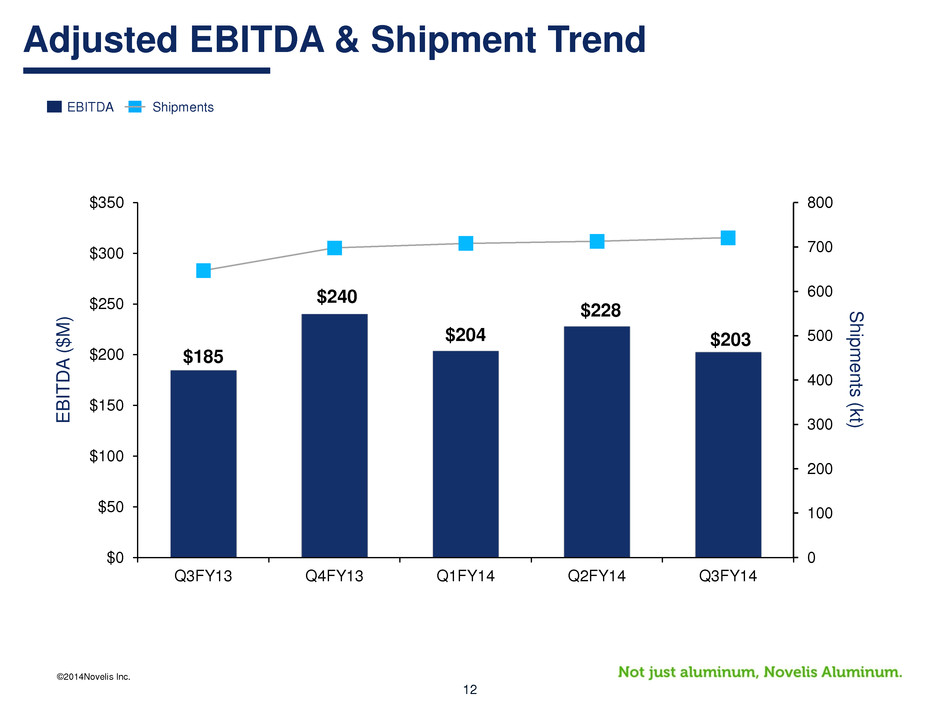

©2014Novelis Inc. 12 $185 $240 $204 $228 $203 0 100 200 300 400 500 600 700 800 $0 $50 $100 $150 $200 $250 $300 $350 Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 EB IT D A ($ M ) Ship m en ts (k t) EBITDA Adjusted EBITDA & Shipment Trend Shipments

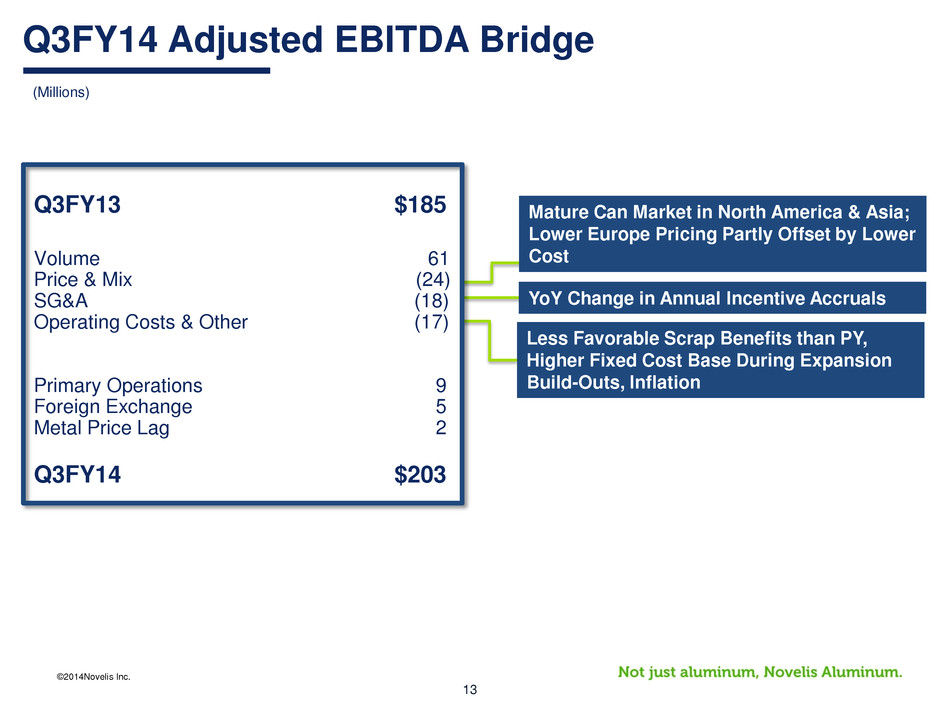

©2014Novelis Inc. 13 Q3FY14 Adjusted EBITDA Bridge (Millions) Q3FY13 $185 Volume 61 Price & Mix (24) SG&A (18) Operating Costs & Other (17) Primary Operations 9 Foreign Exchange 5 Metal Price Lag 2 Q3FY14 $203 Mature Can Market in North America & Asia; Lower Europe Pricing Partly Offset by Lower Cost YoY Change in Annual Incentive Accruals Less Favorable Scrap Benefits than PY, Higher Fixed Cost Base During Expansion Build-Outs, Inflation

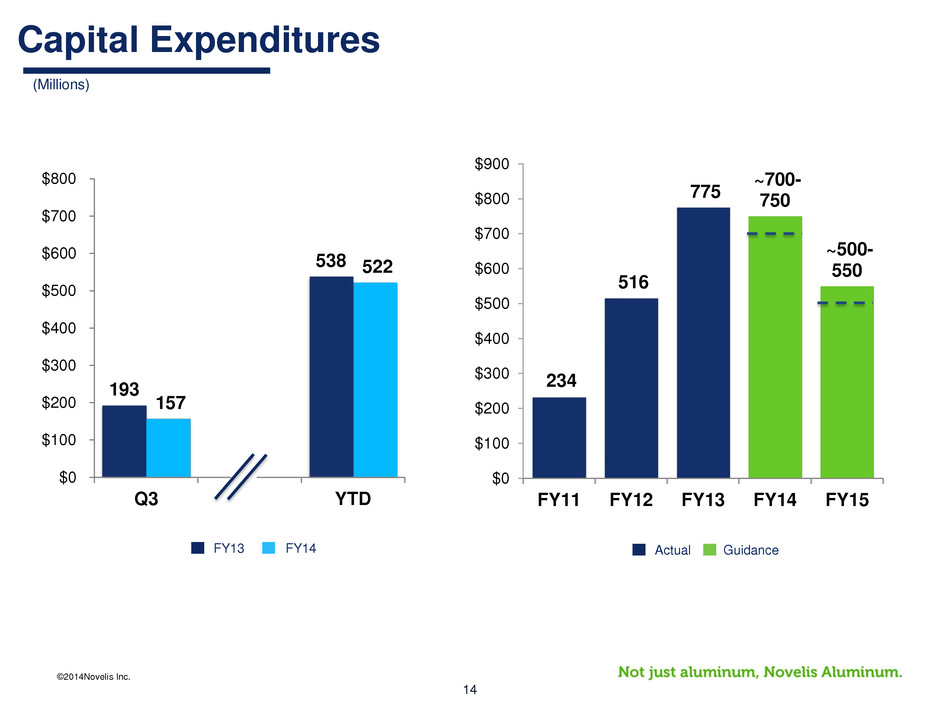

©2014Novelis Inc. 14 (Millions) Capital Expenditures FY14 FY13 193 538 157 522 $0 $100 $200 $300 $400 $500 $600 $700 $800 Q3 YTD 234 516 775 ~700- 750 ~500- 550 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 FY11 FY12 FY13 FY14 FY15 Guidance Actual

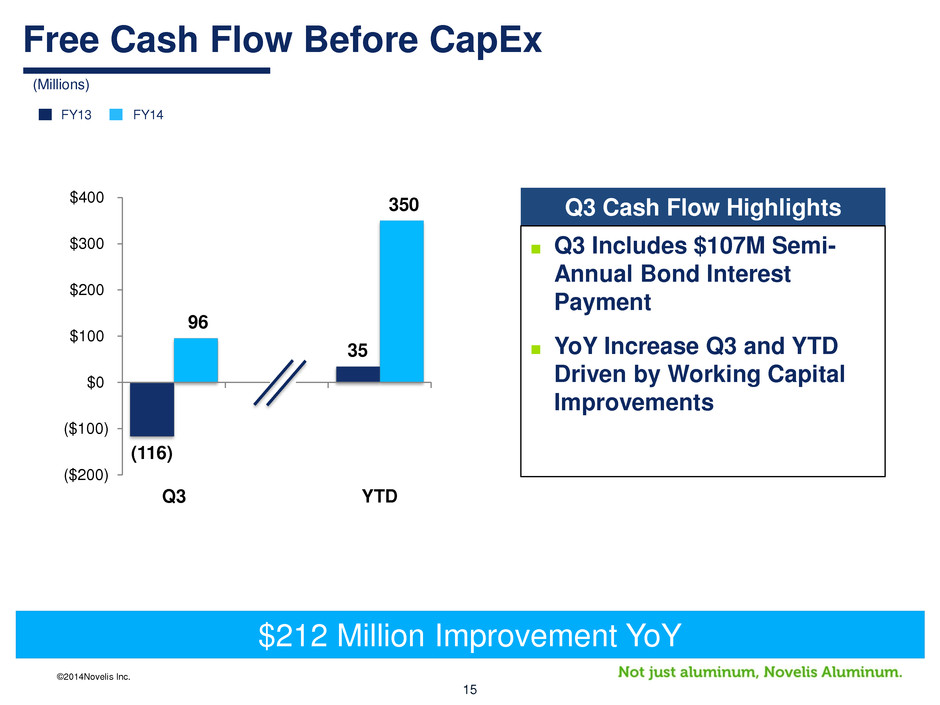

©2014Novelis Inc. 15 (Millions) Free Cash Flow Before CapEx FY14 FY13 (116) 35 96 350 ($200) ($100) $0 $100 $200 $300 $400 Q3 YTD $212 Million Improvement YoY Q3 Cash Flow Highlights ■ Q3 Includes $107M Semi- Annual Bond Interest Payment ■ YoY Increase Q3 and YTD Driven by Working Capital Improvements

©2014Novelis Inc. 16 Summary & Outlook

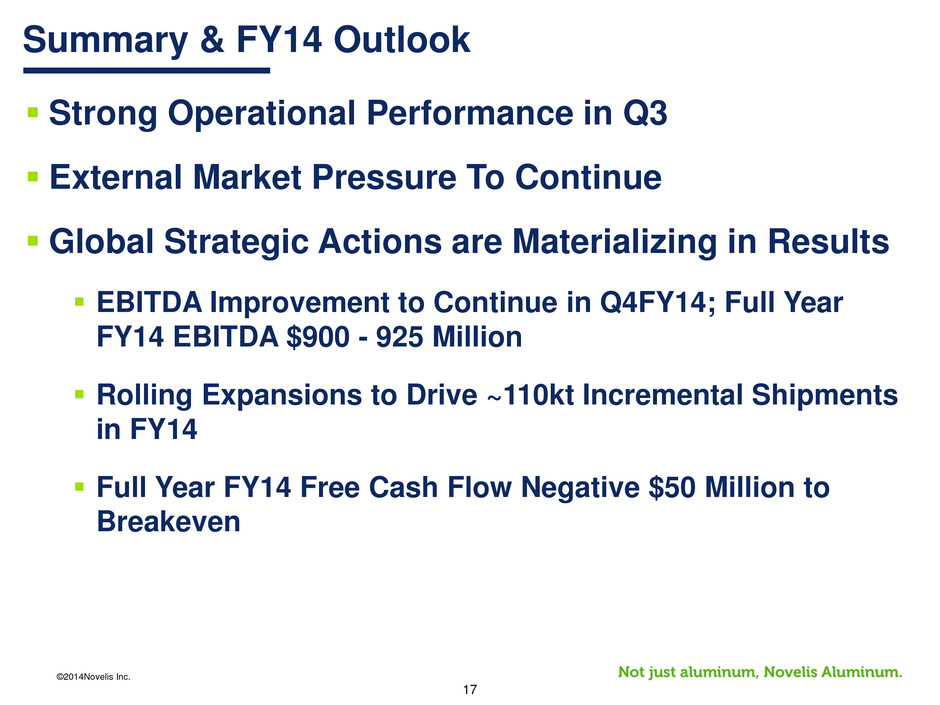

©2014Novelis Inc. 17 Strong Operational Performance in Q3 External Market Pressure To Continue Global Strategic Actions are Materializing in Results EBITDA Improvement to Continue in Q4FY14; Full Year FY14 EBITDA $900 - 925 Million Rolling Expansions to Drive ~110kt Incremental Shipments in FY14 Full Year FY14 Free Cash Flow Negative $50 Million to Breakeven Summary & FY14 Outlook

©2014Novelis Inc. 18 Questions & Answers

©2014Novelis Inc. 19 Appendix

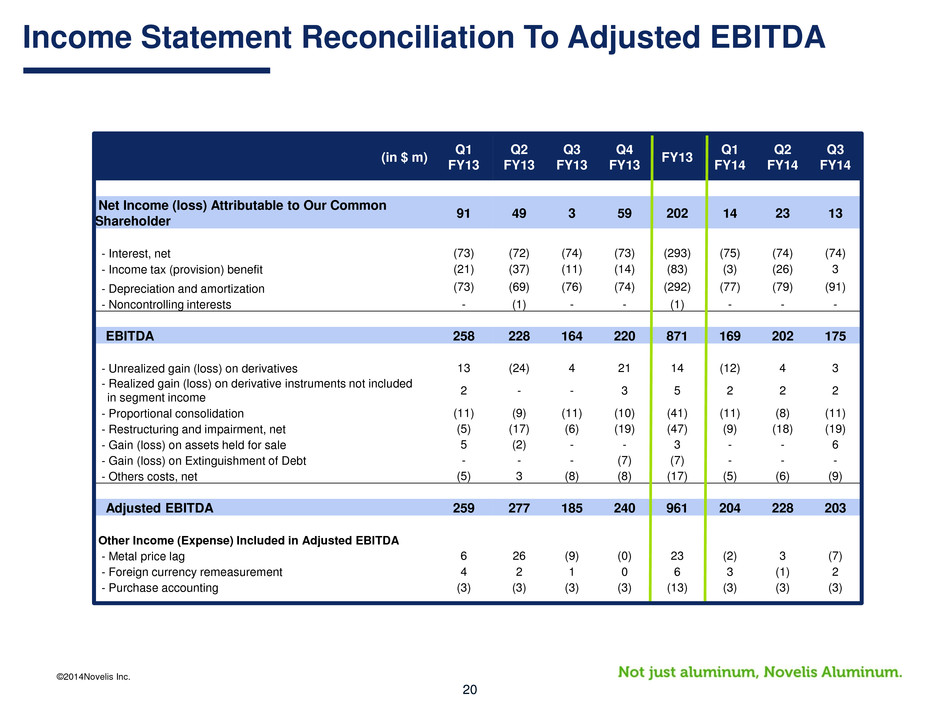

©2014Novelis Inc. 20 (in $ m) Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 FY13 Q1 FY14 Q2 FY14 Q3 FY14 Net Income (loss) Attributable to Our Common Shareholder 91 49 3 59 202 14 23 13 - Interest, net (73) (72) (74) (73) (293) (75) (74) (74) - Income tax (provision) benefit (21) (37) (11) (14) (83) (3) (26) 3 - Depreciation and amortization (73) (69) (76) (74) (292) (77) (79) (91) - Noncontrolling interests - (1) - - (1) - - - EBITDA 258 228 164 220 871 169 202 175 - Unrealized gain (loss) on derivatives 13 (24) 4 21 14 (12) 4 3 - Realized gain (loss) on derivative instruments not included in segment income 2 - - 3 5 2 2 2 - Proportional consolidation (11) (9) (11) (10) (41) (11) (8) (11) - Restructuring and impairment, net (5) (17) (6) (19) (47) (9) (18) (19) - Gain (loss) on assets held for sale 5 (2) - - 3 - - 6 - Gain (loss) on Extinguishment of Debt - - - (7) (7) - - - - Others costs, net (5) 3 (8) (8) (17) (5) (6) (9) Adjusted EBITDA 259 277 185 240 961 204 228 203 Other Income (Expense) Included in Adjusted EBITDA - Metal price lag 6 26 (9) (0) 23 (2) 3 (7) - Foreign currency remeasurement 4 2 1 0 6 3 (1) 2 - Purchase accounting (3) (3) (3) (3) (13) (3) (3) (3) Income Statement Reconciliation To Adjusted EBITDA

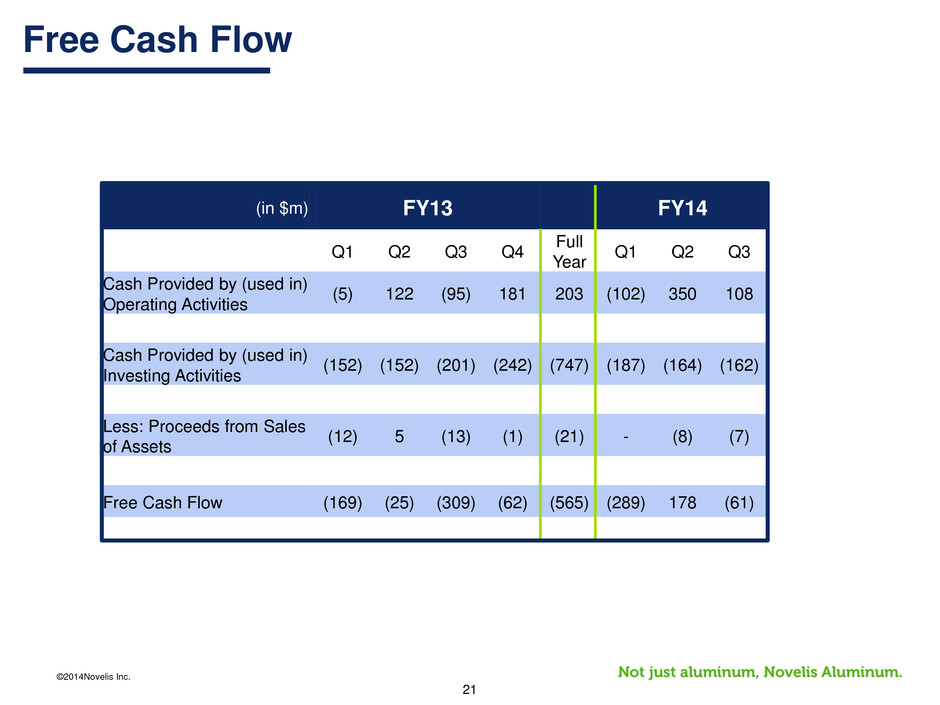

©2014Novelis Inc. 21 (in $m) FY13 FY14 Q1 Q2 Q3 Q4 Full Year Q1 Q2 Q3 Cash Provided by (used in) Operating Activities (5) 122 (95) 181 203 (102) 350 108 Cash Provided by (used in) Investing Activities (152) (152) (201) (242) (747) (187) (164) (162) Less: Proceeds from Sales of Assets (12) 5 (13) (1) (21) - (8) (7) Free Cash Flow (169) (25) (309) (62) (565) (289) 178 (61) Free Cash Flow

©2014Novelis Inc. 22 1) Metal Price Lag Net of Related Hedges: On certain sales contracts we experience timing differences on the pass through of changing aluminum prices from our suppliers to our customers. Additional timing differences occur in the flow of metal costs through moving average inventory cost values and cost of goods sold. This timing difference is referred to as Metal Price Lag. We have a risk management program in place to minimize the impact of this “lag”. 2) Foreign Currency Remeasurement Net of Related Hedges: All Balance Sheet accounts not denominated in functional currency are remeasured every period to the period end exchange rates. This impacts our profitability. Like Metal Price Lag, we have a risk management program in place to minimize the impact of such remeasurement. 3) Purchase Accounting: Following our acquisition, the consideration and transaction costs paid by Hindalco in connection with the transaction were “pushed down” to us and were allocated to the assets acquired and the liabilities assumed. These allocations are amortized over periods, impacting our profitability. Explanation of Other Income (Expense) in Adjusted EBITDA