EARNINGSSLIDES

Published on May 14, 2013

©2013Novelis Inc. 1 May 14, 2013 Philip Martens President and Chief Executive Officer Steve Fisher Senior Vice President and Chief Financial Officer Novelis Q4 & Fiscal Year 2013 Earnings Conference Call EXHIBIT 99.2

©2013Novelis Inc. 2 Safe Harbor Statement Forward-Looking Statements Statements made in this presentation which describe Novelis' intentions, expectations, beliefs or predictions may be forward-looking statements within the meaning of securities laws. Forward-looking statements include statements preceded by, followed by, or including the words "believes," "expects," "anticipates," "plans," "estimates," "projects," "forecasts," or similar expressions. Examples of forward-looking statements in this presentation are statements about expected FRP market growth globally and in our key product segments of beverage can, automotive and specialties. Novelis cautions that, by their nature, forward-looking statements involve risk and uncertainty and that Novelis' actual results could differ materially from those expressed or implied in such statements. We do not intend, and we disclaim any obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise. Factors that could cause actual results or outcomes to differ from the results expressed or implied by forward-looking statements include, among other things: changes in the prices and availability of aluminum (or premiums associated with such prices) or other materials and raw materials we use; the capacity and effectiveness of our metal hedging activities; relationships with, and financial and operating conditions of, our customers, suppliers and other stakeholders; fluctuations in the supply of, and prices for, energy in the areas in which we maintain production facilities; our ability to access financing for future capital requirements; changes in the relative values of various currencies and the effectiveness of our currency hedging activities; factors affecting our operations, such as litigation, environmental remediation and clean-up costs, labor relations and negotiations, breakdown of equipment and other events; the impact of restructuring efforts in the future; economic, regulatory and political factors within the countries in which we operate or sell our products, including changes in duties or tariffs; competition from other aluminum rolled products producers as well as from substitute materials such as steel, glass, plastic and composite materials; changes in general economic conditions including deterioration in the global economy, particularly sectors in which our customers operate; changes in the fair value of derivative instruments; cyclical demand and pricing within the principal markets for our products as well as seasonality in certain of our customers’ industries; changes in government regulations, particularly those affecting taxes, environmental, health or safety compliance; changes in interest rates that have the effect of increasing the amounts we pay under our principal credit agreement and other financing agreements; the effect of taxes and changes in tax rates; and our indebtedness and our ability to generate cash. The above list of factors is not exhaustive. Other important risk factors included under the caption "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended March 31, 2012, and Forms 10-Qfor the quarters ended June 30, 2012, September 30, 2012 and December 31, 2012 are specifically incorporated by reference into this presentation. Non-GAAP Financial Measures This presentation contains non-GAAP financial measures as defined by SEC rules. We think that these measures are helpful to investors in measuring our financial performance and liquidity and comparing our performance to our peers. However, our non-GAAP financial measures may not be comparable to similarly titled non-GAAP financial measures used by other companies. These non-GAAP financial measures have limitations as an analytical tool and should not be considered in isolation or as a substitute for GAAP financial measures. We have included reconciliations of each of these measures to the most directly comparable GAAP measure. In addition, a more detailed description of these non-GAAP financial measures used in this presentation, together with a discussion of the usefulness and purpose of such measures, is included as Exhibit 99.2 to our Current Report on Form 8-K furnished to the SEC with our earnings press release.

©2013Novelis Inc. 3 Agenda Business Review Novelis Strategy Detailed Financial Performance Summary & Outlook

©2013Novelis Inc. 4 Business Review

©2013Novelis Inc. 5 Fiscal Year 2013 Highlights Strong Recovery in Q4FY13 Driven by Solid Demand, Good Cost Control and Scrap Benefits Solid FY13 Results Despite Unexpected Headwinds Made Significant Progress on All Strategic Initiatives

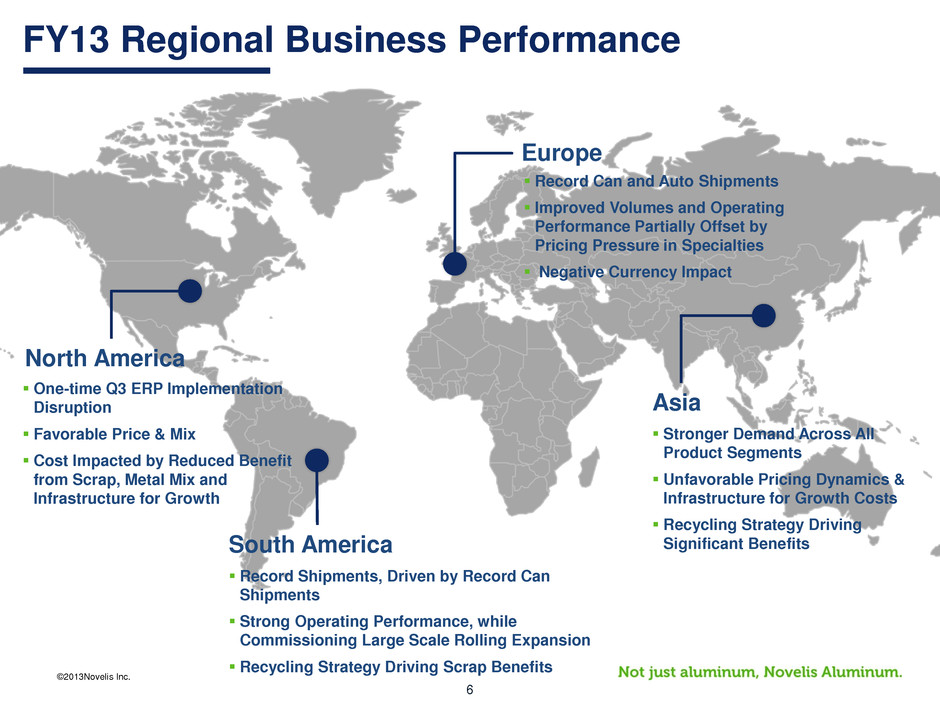

©2013Novelis Inc. 6 FY13 Regional Business Performance Europe Record Can and Auto Shipments Improved Volumes and Operating Performance Partially Offset by Pricing Pressure in Specialties Negative Currency Impact Asia North America South America Stronger Demand Across All Product Segments Unfavorable Pricing Dynamics & Infrastructure for Growth Costs Recycling Strategy Driving Significant Benefits One-time Q3 ERP Implementation Disruption Favorable Price & Mix Cost Impacted by Reduced Benefit from Scrap, Metal Mix and Infrastructure for Growth Record Shipments, Driven by Record Can Shipments Strong Operating Performance, while Commissioning Large Scale Rolling Expansion Recycling Strategy Driving Scrap Benefits

©2013Novelis Inc. 7 Novelis’ Strategy

©2013Novelis Inc. 8 Novelis’ Strategy – FY13 Actions Divested 3 Foil Plants in Europe Closed Saguenay Plant in Canada Shutdown Ouro Preto Pot Line in Brazil Implemented ERP System in 2 North American Plants Continue to Strengthen the Business Major Rolling Expansions Progressing Well Commissioned New Cold Mill at Pinda Plant in Brazil Broke Ground on Automotive Heat-Treatment Line in China Capture Growth in our FRP Markets 80% Recycled Content in our Products by 2020 Partnering with our Customers - evercan Major Recycling Expansions Progressing Well Commissioned Yeongju, the Largest Fully-Integrated Beverage Can Recycling System in Asia Broke Ground on Fully-Integrated Recycling Center in Europe Exited Evermore, Established North America UBC Procurement Organization

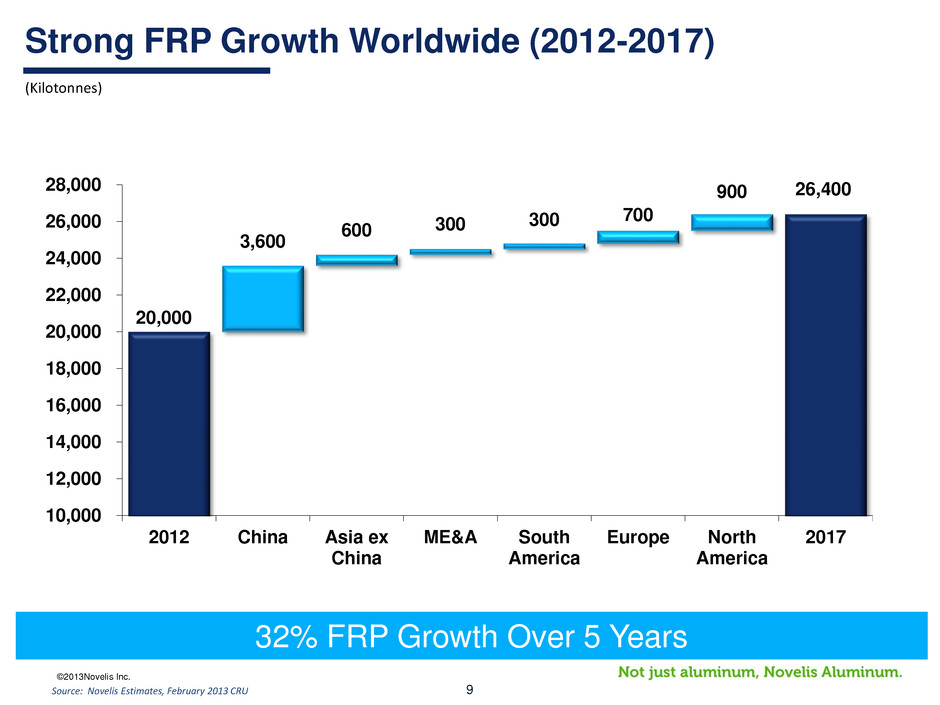

©2013Novelis Inc. 9 20,000 3,600 600 300 300 700 900 26,400 10,000 12,000 14,000 16,000 18,000 20,000 22,000 24,000 26,000 28,000 2012 China Asia ex China ME&A South America Europe North America 2017 (Kilotonnes) Strong FRP Growth Worldwide (2012-2017) Source: Novelis Estimates, February 2013 CRU 32% FRP Growth Over 5 Years

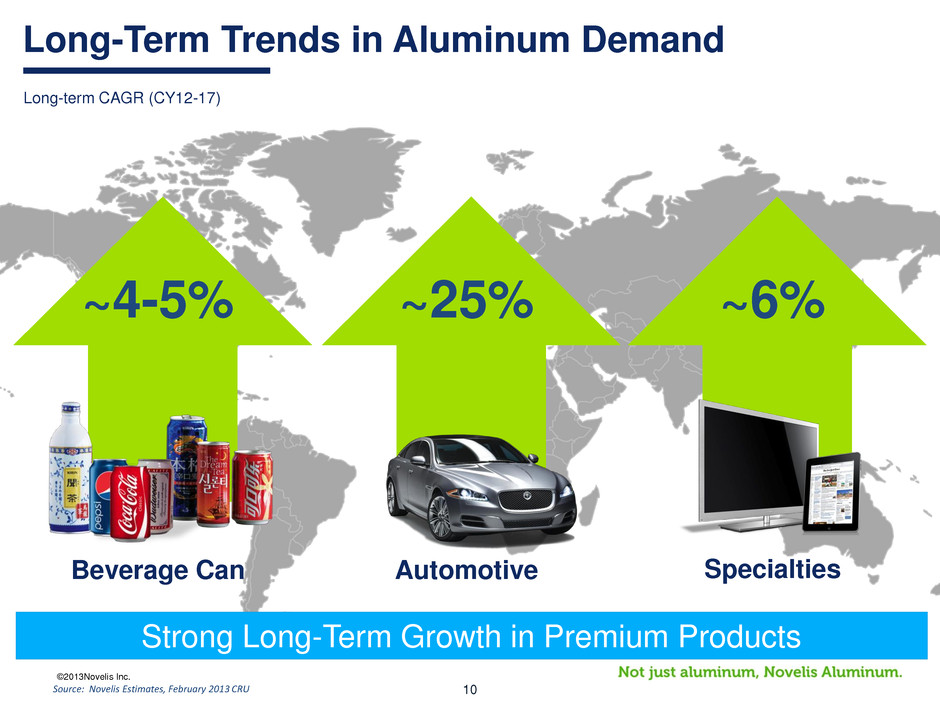

©2013Novelis Inc. 10 Long-Term Trends in Aluminum Demand Beverage Can Automotive Specialties ~4-5% ~25% ~6% Long-term CAGR (CY12-17) Source: Novelis Estimates, February 2013 CRU Strong Long-Term Growth in Premium Products

©2013Novelis Inc. 11 Global Strategic Investments Solidifying Leadership Position United States ~200kt Mid CY13 Korea ~350kt Mid CY13 China ~120kt End CY14 Brazil ~220kt Dec. 2012 Commissioned Rolling Capacity Expansion Automotive Finishing Line(s) ~190kt End CY13 ~400kt Mid CY14 ~265kt Oct. 2012 Germany Recycling Expansions

©2013Novelis Inc. 12 Detailed Financial Performance

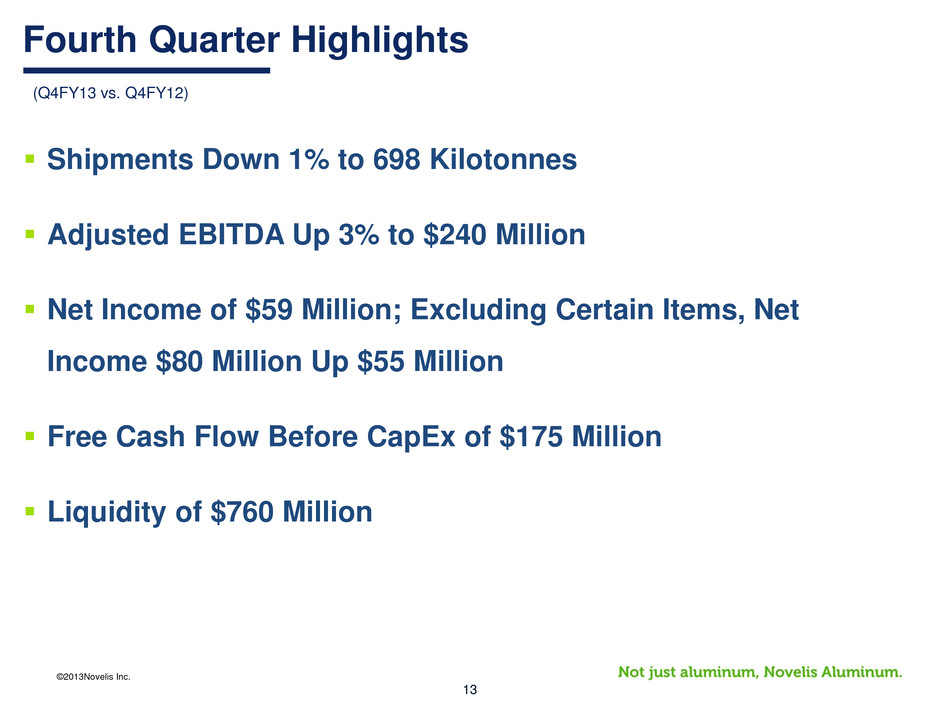

©2013Novelis Inc. 13 Fourth Quarter Highlights Shipments Down 1% to 698 Kilotonnes Adjusted EBITDA Up 3% to $240 Million Net Income of $59 Million; Excluding Certain Items, Net Income $80 Million Up $55 Million Free Cash Flow Before CapEx of $175 Million Liquidity of $760 Million (Q4FY13 vs. Q4FY12)

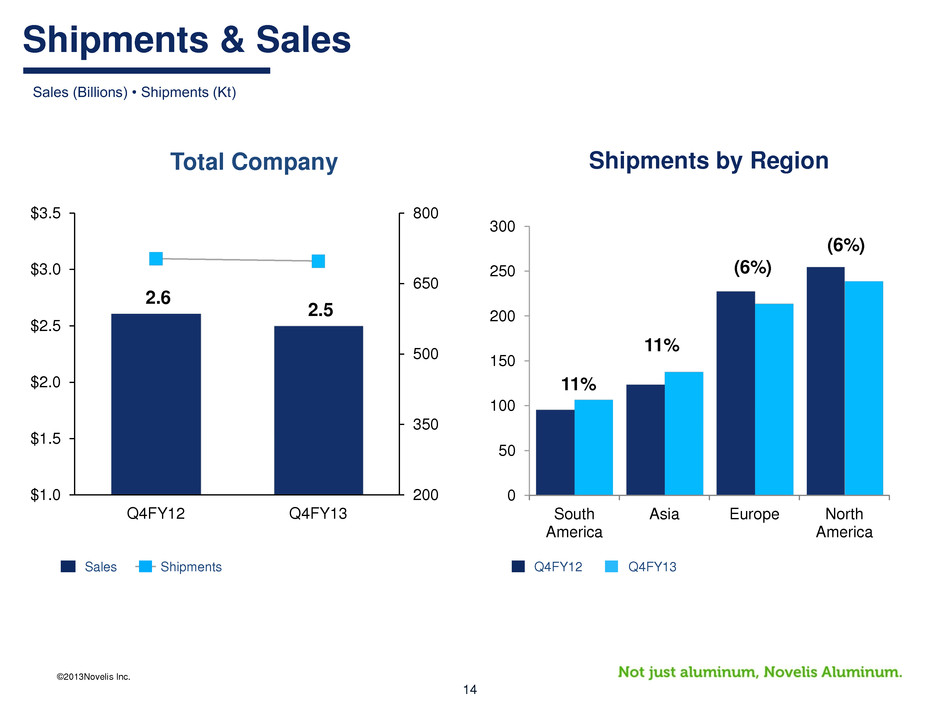

©2013Novelis Inc. 14 2.6 2.5 200 350 500 650 800 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 Q4FY12 Q4FY13 Shipments Sales 0 50 100 150 200 250 300 South America Asia Europe North America Q4FY13 Q4FY12 11% (6%) (6%) 11% Sales (Billions) • Shipments (Kt) Shipments & Sales Total Company Shipments by Region

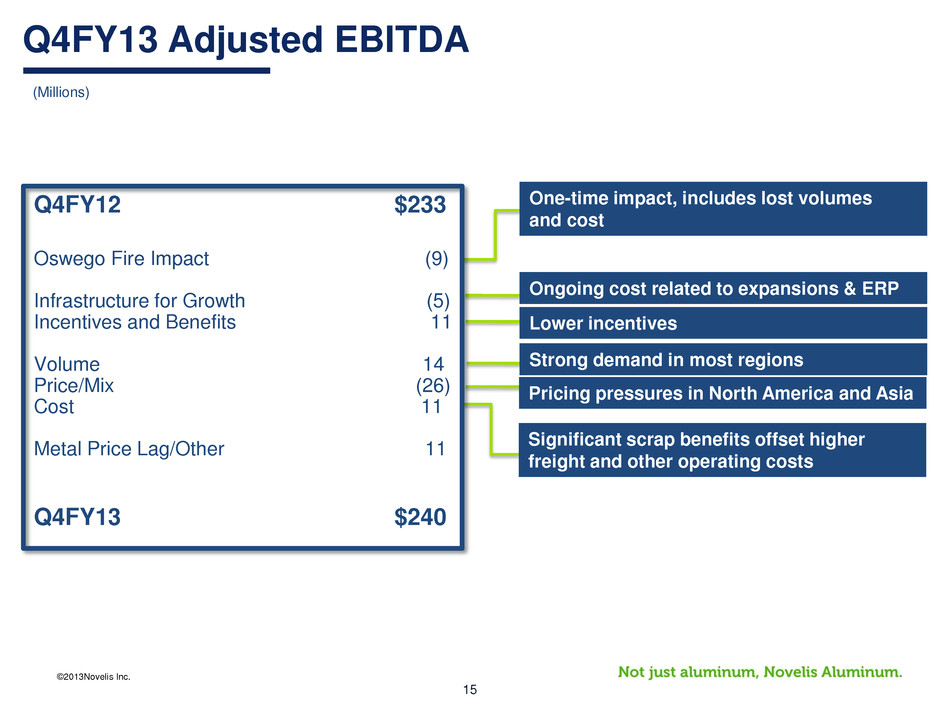

©2013Novelis Inc. 15 Q4FY13 Adjusted EBITDA (Millions) Q4FY12 $233 Oswego Fire Impact (9) Infrastructure for Growth (5) Incentives and Benefits 11 Volume 14 Price/Mix (26) Cost 11 Metal Price Lag/Other 11 Q4FY13 $240 One-time impact, includes lost volumes and cost Lower incentives Strong demand in most regions Ongoing cost related to expansions & ERP Pricing pressures in North America and Asia Significant scrap benefits offset higher freight and other operating costs

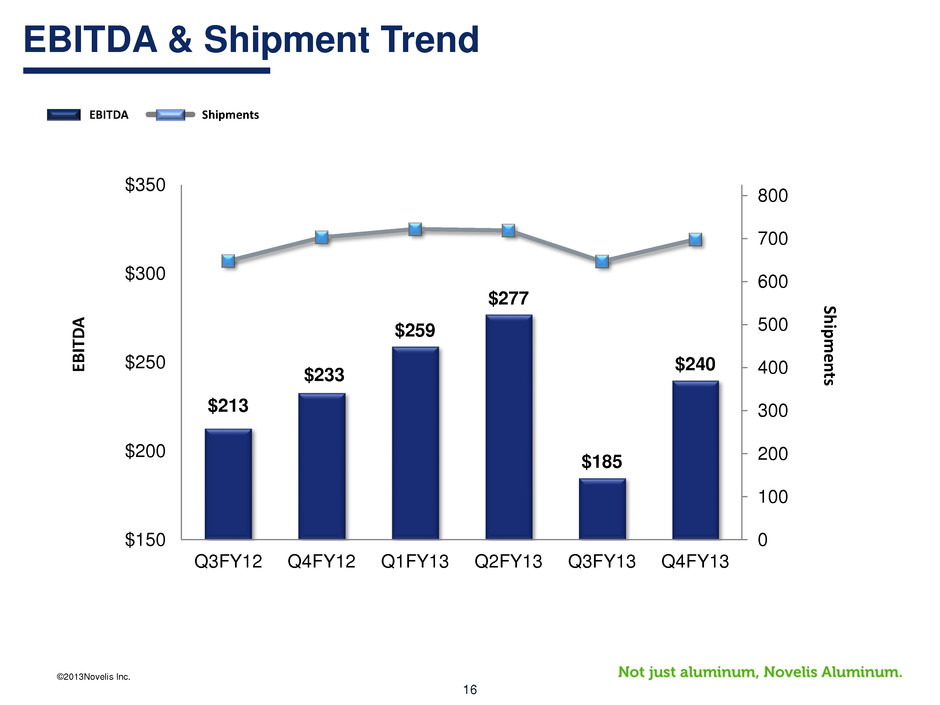

©2013Novelis Inc. 16 EBITDA & Shipment Trend $213 $233 $259 $277 $185 $240 0 100 200 300 400 500 600 700 800 $150 $200 $250 $300 $350 Q3FY12 Q4FY12 Q1FY13 Q2FY13 Q3FY13 Q4FY13 Shipme n ts EBIT D A Shipments EBITDA

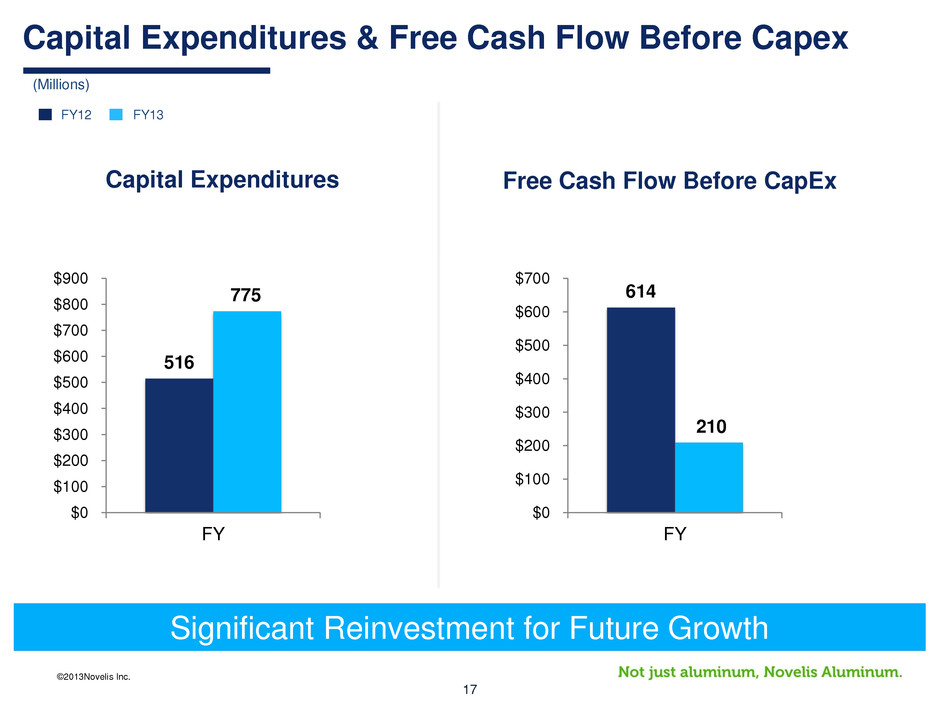

©2013Novelis Inc. 17 (Millions) Capital Expenditures & Free Cash Flow Before Capex FY13 FY12 Significant Reinvestment for Future Growth 614 210 $0 $100 $200 $300 $400 $500 $600 $700 FY 516 775 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 FY Free Cash Flow Before CapEx Capital Expenditures

©2013Novelis Inc. 18 Summary & Outlook

©2013Novelis Inc. 19 Summary Strong Recovery in Q4FY13 Driven by Solid Demand, Good Cost Control and Scrap Benefits. FY13 Results Solid Despite Unexpected Headwinds Made Significant Progress on Strategy

©2013Novelis Inc. 20 Outlook Opportunities: Solid Global Demand in Key Product Segments Good Execution on All Expansion Projects Increased Recycled Benefits from Higher Recycled Content in Products Challenges: Incremental Operating Costs related to Start-up and Commissioning of Expansion Projects Pricing Pressures General Inflationary Pressures

©2013Novelis Inc. 21 Questions & Answers

©2013Novelis Inc. 22 Appendix

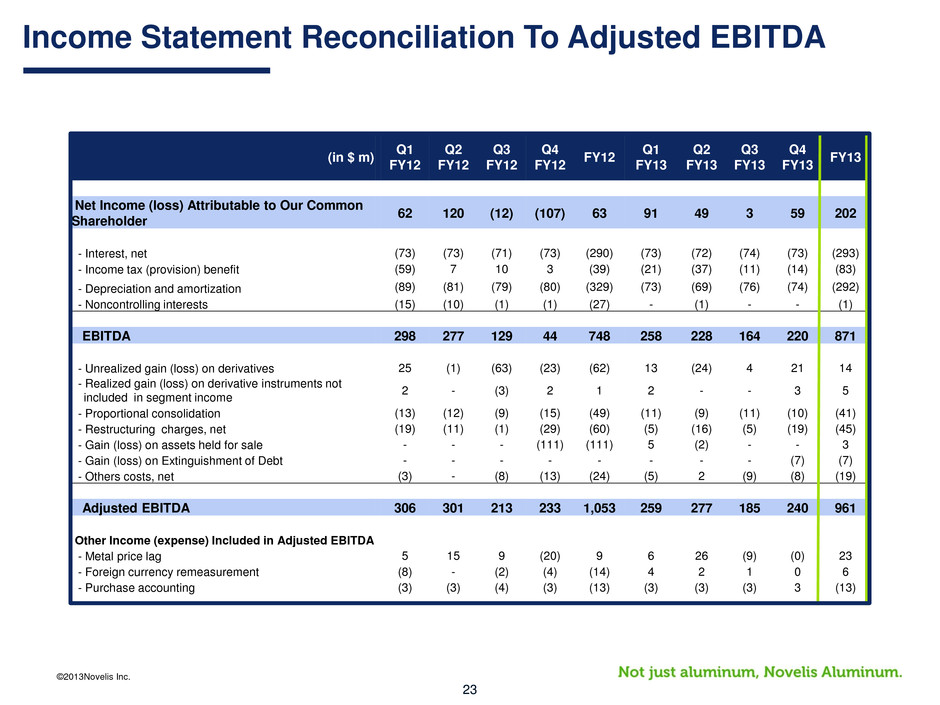

©2013Novelis Inc. 23 (in $ m) Q1 FY12 Q2 FY12 Q3 FY12 Q4 FY12 FY12 Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 FY13 Net Income (loss) Attributable to Our Common Shareholder 62 120 (12) (107) 63 91 49 3 59 202 - Interest, net (73) (73) (71) (73) (290) (73) (72) (74) (73) (293) - Income tax (provision) benefit (59) 7 10 3 (39) (21) (37) (11) (14) (83) - Depreciation and amortization (89) (81) (79) (80) (329) (73) (69) (76) (74) (292) - Noncontrolling interests (15) (10) (1) (1) (27) - (1) - - (1) EBITDA 298 277 129 44 748 258 228 164 220 871 - Unrealized gain (loss) on derivatives 25 (1) (63) (23) (62) 13 (24) 4 21 14 - Realized gain (loss) on derivative instruments not included in segment income 2 - (3) 2 1 2 - - 3 5 - Proportional consolidation (13) (12) (9) (15) (49) (11) (9) (11) (10) (41) - Restructuring charges, net (19) (11) (1) (29) (60) (5) (16) (5) (19) (45) - Gain (loss) on assets held for sale - - - (111) (111) 5 (2) - - 3 - Gain (loss) on Extinguishment of Debt - - - - - - - - (7) (7) - Others costs, net (3) - (8) (13) (24) (5) 2 (9) (8) (19) Adjusted EBITDA 306 301 213 233 1,053 259 277 185 240 961 Other Income (expense) Included in Adjusted EBITDA - Metal price lag 5 15 9 (20) 9 6 26 (9) (0) 23 - Foreign currency remeasurement (8) - (2) (4) (14) 4 2 1 0 6 - Purchase accounting (3) (3) (4) (3) (13) (3) (3) (3) 3 (13) Income Statement Reconciliation To Adjusted EBITDA

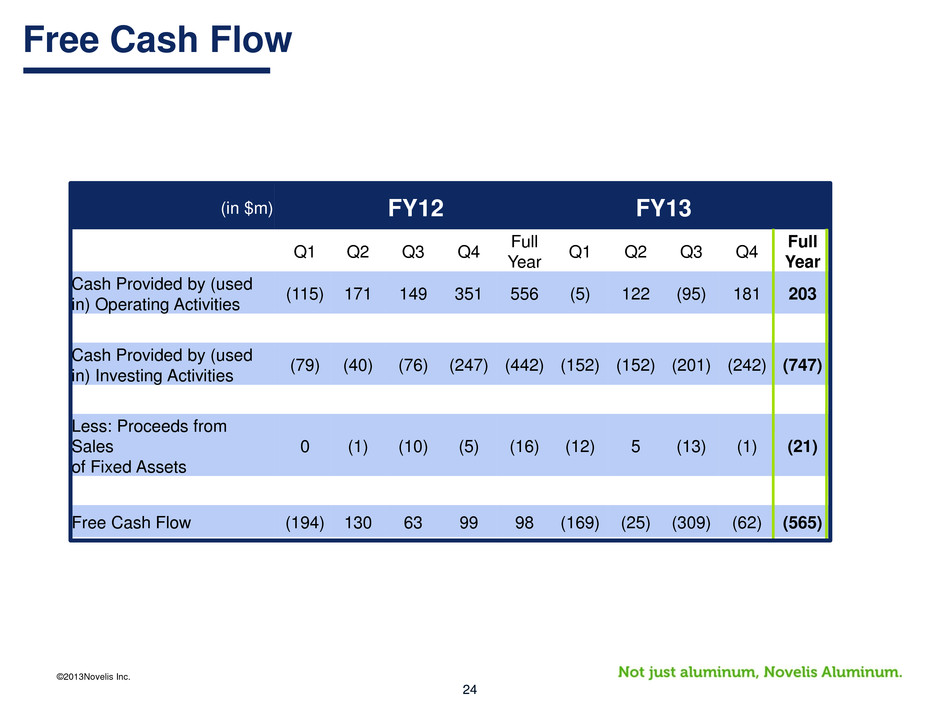

©2013Novelis Inc. 24 (in $m) FY12 FY13 Q1 Q2 Q3 Q4 Full Year Q1 Q2 Q3 Q4 Full Year Cash Provided by (used in) Operating Activities (115) 171 149 351 556 (5) 122 (95) 181 203 Cash Provided by (used in) Investing Activities (79) (40) (76) (247) (442) (152) (152) (201) (242) (747) Less: Proceeds from Sales of Fixed Assets 0 (1) (10) (5) (16) (12) 5 (13) (1) (21) Free Cash Flow (194) 130 63 99 98 (169) (25) (309) (62) (565) Free Cash Flow

©2013Novelis Inc. 25 1) Metal Price Lag Net of Related Hedges: On certain sales contracts we experience timing differences on the pass through of changing aluminum prices from our suppliers to our customers. Additional timing differences occur in the flow of metal costs through moving average inventory cost values and cost of goods sold. This timing difference is referred to as Metal Price Lag. We have a risk management program in place to minimize the impact of this “lag”. 2) Foreign Currency Remeasurement Net of Related Hedges: All Balance Sheet accounts not denominated in functional currency are remeasured every period to the period end exchange rates. This impacts our profitability. Like Metal Price Lag, we have a risk management program in place to minimize the impact of such remeasurement. 3) Purchase Accounting: Following our acquisition, the consideration and transaction costs paid by Hindalco in connection with the transaction were “pushed down” to us and were allocated to the assets acquired and the liabilities assumed. These allocations are amortized over periods, impacting our profitability. Explanation of Other Income (Expense) in Adjusted EBITDA