EXHIBIT 99.1

Published on October 27, 2006

Exhibit 99.1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Overview |

|

|

|

|

|

William T. Monahan, Chairman and Interim CEO |

|

|

Annual Meeting of Shareholders, Oct. 26, 2006 |

[GRAPHIC APPEARS HERE]

|

|

This presentation is available on |

|

|

our web site at www.novelis.com |

|

[LOGO OF NOVELIS] |

Statements made in this presentation which describe Novelis intentions, expectations, beliefs or predictions may be forward-looking statements within the meaning of securities laws. Forward-looking statements may include statements preceded by, followed by, or including the words believes, expects, anticipates, plans, estimates, projects, forecasts, or similar expressions. Examples of such forward-looking statements in this presentation include, among other matters, the creation of shareholder value, improving our operational efficiency, our expectation to timely report our financial results with the SEC, proactively implement tax initiatives, appoint a new CEO, eliminate or reduce remaining metal price ceiling exposure, continue de-leveraging, focus on our cost position, align assets to our high-value portfolio, achieve our projected levels of Shipments, Regional Income (including both Regional Income before Can Ceiling and Regional Income Less Corporate Costs), Earnings Before Taxes, Capital Expenditures, Free Cash Flow and other financial targets for the remainder of 2006 and 2007 and achieve the long term financial targets for Regional Income less Corporate Costs, Annual Free Cash Flow, Return on Invested Capital and Debt to EBITDA. Novelis cautions that, by their nature, forward-looking statements involve risk and uncertainty and that Novelis actual results could differ materially from those expressed or implied in such statements. These statements are based on beliefs and assumptions of Novelis management, which in turn are based on currently available information. These assumptions could prove inaccurate. We do not intend, and we disclaim any obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise. Factors that could cause actual results or outcomes to differ from the results expressed or implied by forward-looking statements include, among other things: the level of our indebtedness and our ability to generate cash; relationships with, and financial and operating conditions of, our customers and suppliers; changes in the prices and availability of aluminum (or premiums associated with such prices) or other raw materials we use; the effect of metal price ceilings in certain of our sales contracts; our ability to successfully negotiate with our customers to remove or limit metal price ceilings in our contracts; the effectiveness of our hedging activities, including our internal used beverage can and smelter hedges; fluctuations in the supply of, and prices for, energy in the areas in which we maintain production facilities; our ability to access financing for future capital requirements; continuing obligations and other relationships resulting from our spin-off from Alcan; changes in the relative values of various currencies; factors affecting our operations, such as litigation, labor relations and negotiations, breakdown of equipment and other events; economic, regulatory and political factors within the countries in which we operate or sell our products, including changes in duties or tariffs; competition from other aluminum rolled products producers as well as from substitute materials such as steel, glass, plastic and composite materials; changes in general economic conditions; our ability to improve and maintain effective internal control over financial reporting and disclosure controls and procedures in the future; changes in the fair market value of derivatives; cyclical demand and pricing within the principal markets for our products as well as seasonality in certain of our customers industries; changes in government regulations, particularly those affecting environmental, health or safety compliance; changes in interest rates that have the effect of increasing the amounts we pay under our principal credit agreements and other financing arrangements; the continued cooperation of certain debtholders and regulatory authorities with respect to extensions of our 2006 filing deadlines; the development of the most efficient tax structure for the Company; and the payment of special interest due to our failure to timely file our SEC reports and the payment of fees in connection with any related waivers or amendments to our principal debt agreements. The above list of factors is not exhaustive. Other important risk factors are included under the caption Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2005, as amended and filed with the SEC, and may be discussed in subsequent filings with the SEC. Further, the risk factors included in our Annual Report on Form 10-K for the year ended December 31, 2005, as amended, are specifically incorporated by reference into this presentation.

2

|

[LOGO OF NOVELIS] |

|

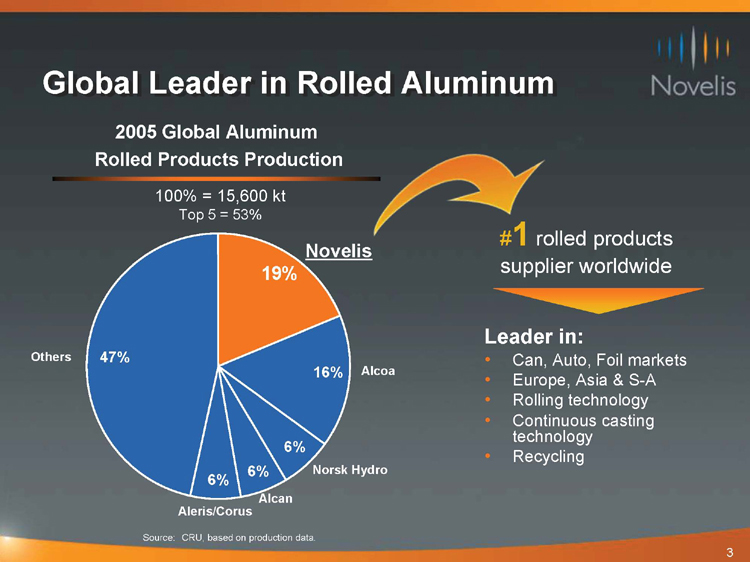

2005 Global Aluminum |

|

|

|

Rolled Products Production |

|

|

|

|

|

|

|

[CHART APPEARS HERE] |

|

|

|

#1 rolled products |

||

|

|

||

|

Leader in: |

||

|

|

Can, Auto, Foil markets |

|

|

|

Europe, Asia & S-A |

|

|

|

Rolling technology |

|

|

|

Continuous casting technology |

|

|

|

Recycling |

|

|

|

|

|

|

Source: CRU, based on production data. |

|

|

3

|

[LOGO OF NOVELIS] |

|

|

Extraordinary run-up in metal prices |

|

|

|

|

|

|

|

|

Tested the business model |

|

|

|

|

|

|

|

Required new hedging approach |

|

|

|

|

|

|

Debt structure |

|

|

|

|

|

|

|

|

Assumed lower metal prices |

|

|

|

|

|

|

Accounting review |

|

|

|

|

|

|

|

|

Delayed financial filings |

4

|

[LOGO OF NOVELIS] |

|

|

Enhanced finance team |

||

|

|

|

||

|

|

|

CFO, Rick Dobson |

|

|

|

|

|

|

|

|

|

Controller, Bob Patterson |

|

|

|

|

|

|

|

|

Expanded and strengthened Board of Directors |

||

|

|

|

||

|

|

|

Chairman, Bill Monahan |

|

|

|

|

|

|

|

|

|

New Directors: |

|

|

|

|

|

|

|

|

|

|

Kevin Twomey |

|

|

|

|

|

|

|

|

|

Edward Blechschmidt |

|

|

|

|

|

|

|

|

|

John Watson |

5

|

[LOGO OF NOVELIS] |

Employees worldwide are strengthening our competitiveness and setting the stage for creation of shareholder value by:

|

|

Improving our operational efficiency |

|

|

|

|

|

Strengthening our service to customers |

|

|

|

|

|

Enhancing our product portfolio |

|

|

|

|

|

Generating cash to de-leverage our capital structure |

[GRAPHIC APPEARS HERE]

6

|

[LOGO OF NOVELIS] |

Restructuring of manufacturing operations is a top priority.

Since the spin-off we have:

|

|

Closed plants in U.K., Belgium, Italy |

|

|

|

|

|

Sold operation in France |

|

|

|

|

|

Reorganized two facilities in Germany |

|

|

|

|

|

Streamlining European central management and R&D |

|

|

|

|

|

Reviewing strategic alternatives for Foil and Technical Products in Europe |

7

|

[LOGO OF NOVELIS] |

Lean Six Sigma will contribute over $30 million to free cash flow in 2006 through working capital initiatives alone:

|

|

N.A. consolidated ingot specifications, leading to decreased finished goods inventory |

|

|

|

|

|

Europe decreased customer lead times, improved delivery performance, and reduced inventory by 15% |

|

|

|

|

|

Asia improved recovery rates and throughput, enabling reduced inventory and shorter customer lead times |

|

|

|

|

|

S.A. streamlined sources of UBCs/scrap, leading to improved quality, reduced inventory and lower costs |

8

|

[LOGO OF NOVELIS] |

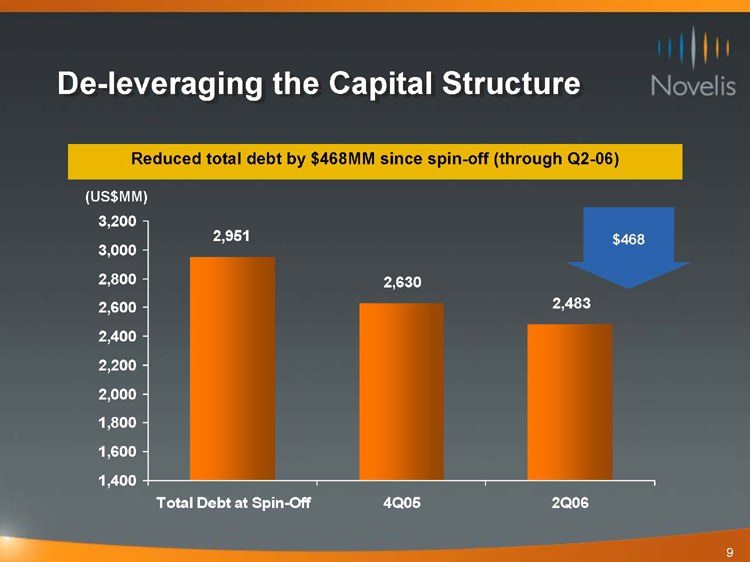

Reduced total debt by $468MM since spin-off (through Q2-06)

[CHART APPEARS HERE]

9

|

[LOGO OF NOVELIS] |

[GRAPHIC APPEARS HERE]

Yeongju, Korea

10

|

[LOGO OF NOVELIS] |

[GRAPHIC APPEARS HERE]

11

|

|

[LOGO OF NOVELIS] |

|

|

Sole supplier of aluminum sheet for the new XK |

|

|

|

|

|

|

|

|

advanced aluminum body structure and exterior panels |

[GRAPHIC APPEARS HERE]

12

|

|

[LOGO OF NOVELIS] |

|

|

Lead aluminum sheet supplier for premium SUV |

|

|

|

|

|

|

|

|

aluminum hood, front fenders and tailgate |

[GRAPHIC APPEARS HERE]

13

|

|

[LOGO OF NOVELIS] |

|

|

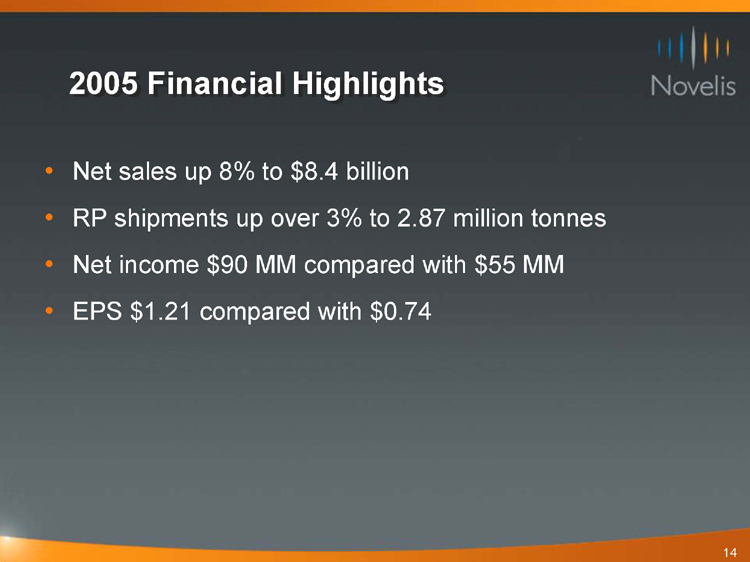

Net sales up 8% to $8.4 billion |

|

|

|

|

|

RP shipments up over 3% to 2.87 million tonnes |

|

|

|

|

|

Net income $90 MM compared with $55 MM |

|

|

|

|

|

EPS $1.21 compared with $0.74 |

14

|

|

[LOGO OF NOVELIS] |

|

|

Total rolled product shipments increased 3.5% to 1.49 million tonnes |

|

|

|

|

|

Strong cash flows enable $147 MM debt reduction for six months; total reduction of over $450 MM |

|

|

|

|

|

Expect full-year loss before taxes of $240-$285 MM |

|

|

|

|

|

All-time best performance in health and safety |

15

|

|

[LOGO OF NOVELIS] |

|

|

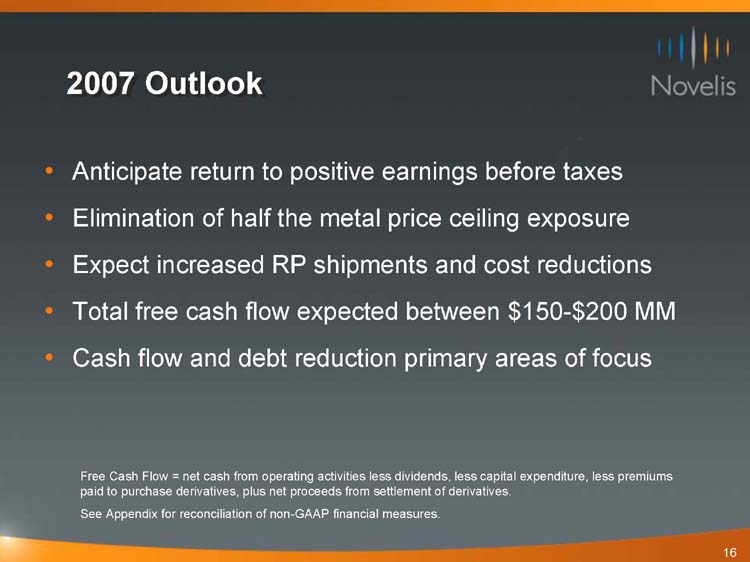

Anticipate return to positive earnings before taxes |

|

|

|

|

|

Elimination of half the metal price ceiling exposure |

|

|

|

|

|

Expect increased RP shipments and cost reductions |

|

|

|

|

|

Total free cash flow expected between $150-$200 MM |

|

|

|

|

|

Cash flow and debt reduction primary areas of focus |

|

|

|

|

|

Free Cash Flow = net cash from operating activities less dividends, less capital expenditure, less premiums paid to purchase derivatives, plus net proceeds from settlement of derivatives. |

|

|

|

|

|

See Appendix for reconciliation of non-GAAP financial measures. |

16

|

|

[LOGO OF NOVELIS] |

|

|

Annual growth of 7-10% for Regional Income less corporate costs |

|

|

|

|

|

Annual returns on invested capital above 12% |

|

|

|

|

|

Annual free cash flow surpassing $400 MM |

|

|

|

|

|

Debt-to-EBITDA ratio between 2.5x and 3x |

|

|

|

|

|

Return on Invested Capital = After Tax EBIT divided by average book capitalization. |

|

|

See Appendix for reconciliation of non-GAAP financial measures. |

17

|

|

[LOGO OF NOVELIS] |

|

|

Search for a new CEO is well under way |

|

|

|

|

|

|

|

Current with financial reporting as of Q2 |

|

|

|

|

|

|

|

Nearing the end of a difficult transition period |

|

|

|

|

|

|

|

Strategically positioned to fulfill the promise of a dynamic, independent Novelis: |

|

|

|

|

|

|

|

|

Generate stable earnings and cash flow |

|

|

|

|

|

|

|

Maximize long-term shareholder value |

18

|

|

|

|

|

|

|

|

|

|

Appendix |

|

|

[LOGO OF NOVELIS] |

|

|

|

2003 |

|

2004 |

|

2005 |

|

Q1 2005 |

|

Q1 2006 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

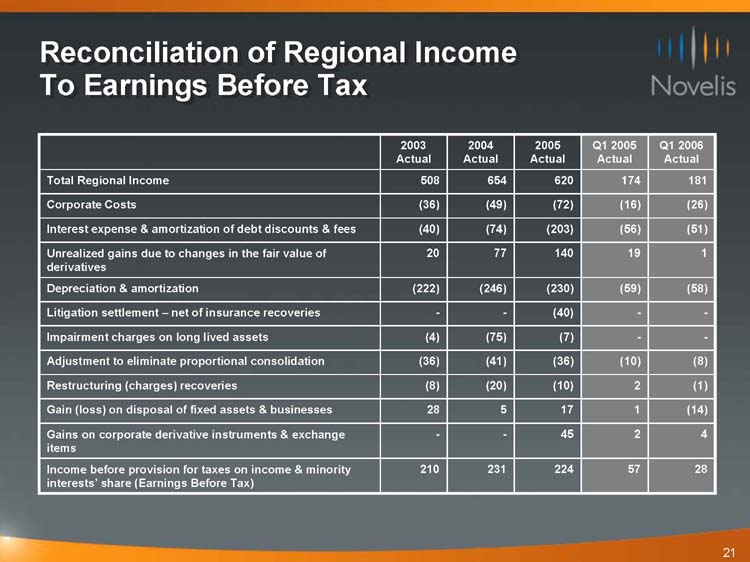

Total Regional Income |

|

|

508 |

|

|

654 |

|

|

620 |

|

|

174 |

|

|

181 |

|

|

Corporate Costs |

|

|

(36 |

) |

|

(49 |

) |

|

(72 |

) |

|

(16 |

) |

|

(26 |

) |

|

Interest expense & amortization of debt discounts & fees |

|

|

(40 |

) |

|

(74 |

) |

|

(203 |

) |

|

(56 |

) |

|

(51 |

) |

|

Unrealized gains due to changes in the fair value of derivatives |

|

|

20 |

|

|

77 |

|

|

140 |

|

|

19 |

|

|

1 |

|

|

Depreciation & amortization |

|

|

(222 |

) |

|

(246 |

) |

|

(230 |

) |

|

(59 |

) |

|

(58 |

) |

|

Litigation settlement net of insurance recoveries |

|

|

|

|

|

|

|

|

(40 |

) |

|

|

|

|

|

|

|

Impairment charges on long lived assets |

|

|

(4 |

) |

|

(75 |

) |

|

(7 |

) |

|

|

|

|

|

|

|

Adjustment to eliminate proportional consolidation |

|

|

(36 |

) |

|

(41 |

) |

|

(36 |

) |

|

(10 |

) |

|

(8 |

) |

|

Restructuring (charges) recoveries |

|

|

(8 |

) |

|

(20 |

) |

|

(10 |

) |

|

2 |

|

|

(1 |

) |

|

Gain (loss) on disposal of fixed assets & businesses |

|

|

28 |

|

|

5 |

|

|

17 |

|

|

1 |

|

|

(14 |

) |

|

Gains on corporate derivative instruments & exchange items |

|

|

|

|

|

|

|

|

45 |

|

|

2 |

|

|

4 |

|

|

Income before provision for taxes on income & minority interestsshare (Earnings Before Tax) |

|

|

210 |

|

|

231 |

|

|

224 |

|

|

57 |

|

|

28 |

|

21

|

[LOGO OF NOVELIS] |

|

|

|

2006 Low |

|

2006 High |

|

2007 Low |

|

2007 High |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

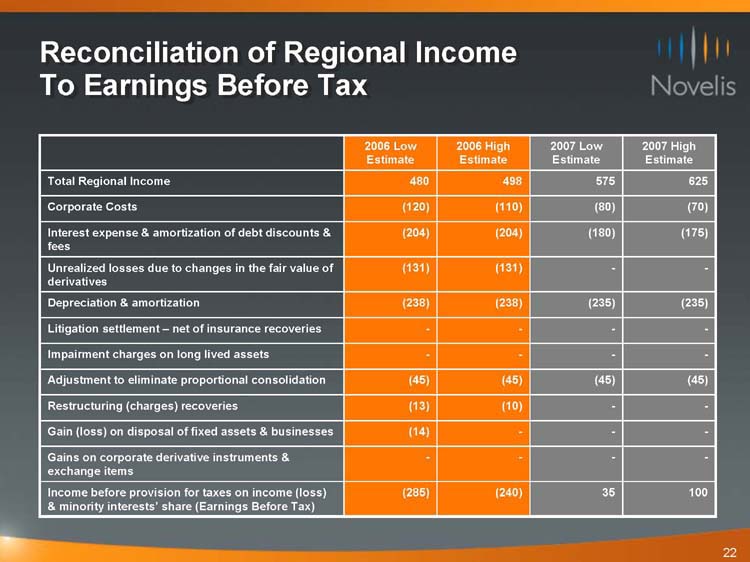

Total Regional Income |

|

|

480 |

|

|

498 |

|

|

575 |

|

|

625 |

|

|

Corporate Costs |

|

|

(120 |

) |

|

(110 |

) |

|

(80 |

) |

|

(70 |

) |

|

Interest expense & amortization of debt discounts & fees |

|

|

(204 |

) |

|

(204 |

) |

|

(180 |

) |

|

(175 |

) |

|

Unrealized losses due to changes in the fair value of derivatives |

|

|

(131 |

) |

|

(131 |

) |

|

|

|

|

|

|

|

Depreciation & amortization |

|

|

(238 |

) |

|

(238 |

) |

|

(235 |

) |

|

(235 |

) |

|

Litigation settlement net of insurance recoveries |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Impairment charges on long lived assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustment to eliminate proportional consolidation |

|

|

(45 |

) |

|

(45 |

) |

|

(45 |

) |

|

(45 |

) |

|

Restructuring (charges) recoveries |

|

|

(13 |

) |

|

(10 |

) |

|

|

|

|

|

|

|

Gain (loss) on disposal of fixed assets & businesses |

|

|

(14 |

) |

|

|

|

|

|

|

|

|

|

|

Gains on corporate derivative instruments & exchange items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before provision for taxes on income (loss) & minority interestsshare (Earnings Before Tax) |

|

|

(285 |

) |

|

(240 |

) |

|

35 |

|

|

100 |

|

22

|

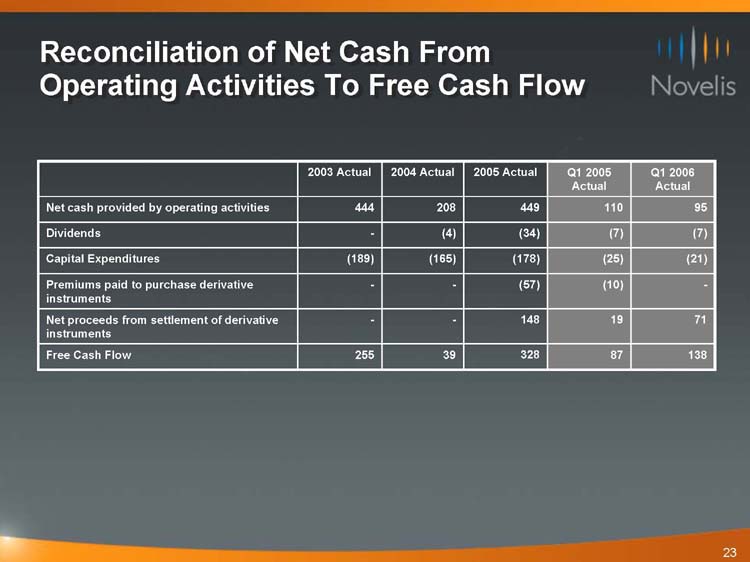

Reconciliation of Net Cash From |

[LOGO OF NOVELIS] |

|

|

|

2003 Actual |

|

2004 Actual |

|

2005 Actual |

|

Q1 2005 |

|

Q1 2006 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

|

444 |

|

|

208 |

|

|

449 |

|

|

110 |

|

|

95 |

|

|

Dividends |

|

|

|

|

|

(4 |

) |

|

(34 |

) |

|

(7 |

) |

|

(7 |

) |

|

Capital Expenditures |

|

|

(189 |

) |

|

(165 |

) |

|

(178 |

) |

|

(25 |

) |

|

(21 |

) |

|

Premiums paid to purchase derivative instruments |

|

|

|

|

|

|

|

|

(57 |

) |

|

(10 |

) |

|

|

|

|

Net proceeds from settlement of derivative instruments |

|

|

|

|

|

|

|

|

148 |

|

|

19 |

|

|

71 |

|

|

Free Cash Flow |

|

|

255 |

|

|

39 |

|

|

328 |

|

|

87 |

|

|

138 |

|

23

|

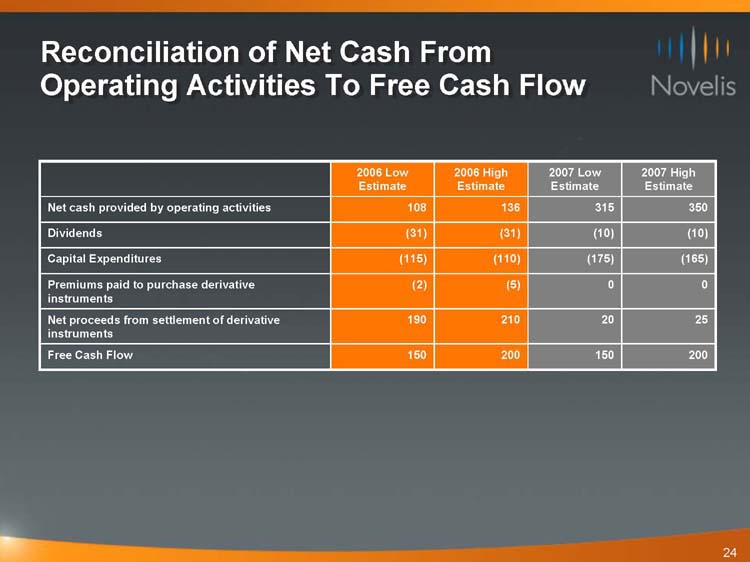

Reconciliation of Net Cash From |

[LOGO OF NOVELIS] |

|

|

|

2006 Low |

|

2006 High |

|

2007 Low |

|

2007 High |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

|

108 |

|

|

136 |

|

|

315 |

|

|

350 |

|

|

Dividends |

|

|

(31 |

) |

|

(31 |

) |

|

(10 |

) |

|

(10 |

) |

|

Capital Expenditures |

|

|

(115 |

) |

|

(110 |

) |

|

(175 |

) |

|

(165 |

) |

|

Premiums paid to purchase derivative instruments |

|

|

(2 |

) |

|

(5 |

) |

|

0 |

|

|

0 |

|

|

Net proceeds from settlement of derivative instruments |

|

|

190 |

|

|

210 |

|

|

20 |

|

|

25 |

|

|

Free Cash Flow |

|

|

150 |

|

|

200 |

|

|

150 |

|

|

200 |

|

24