EX-99.2

Published on February 8, 2012

Novelis Third Quarter 2012

Earnings Conference Call

Philip Martens

President and Chief Executive Officer

Steve Fisher

Senior Vice President and Chief Financial Officer

Brighter Ideas with Aluminum

February 8, 2012

Exhibit 99.2 |

2

Forward-Looking Statements

Statements

made

in

this

presentation

which

describe

Novelis'

intentions,

expectations,

beliefs

or

predictions

may

be

forward-looking

statements

within

the

meaning

of

securities

laws.

Forward-looking

statements

include

statements

preceded

by,

followed

by,

or

including

the

words

"believes,"

"expects,"

"anticipates,"

"plans,"

"estimates,"

"projects,"

"forecasts,"

or

similar

expressions.

Examples

of

forward-looking

statements

in

this

presentation

are

our

stated

view

regarding

our

ability

to

generate

free

cash

flows

this

fiscal

year,

the

projected

growth

rate

for

aluminum

flat

rolled

products

in

Asia,

the

projected

growth

rate

for

automotive

sheet

growth

in

North

America,

and

anticipated

full-year

EBITDA.

Novelis

cautions

that,

by

their

nature,

forward-looking

statements

involve

risk

and

uncertainty

and

that

Novelis'

actual

results

could

differ

materially

from

those

expressed

or

implied

in

such

statements.

We

do

not

intend,

and

we

disclaim

any

obligation,

to

update

any

forward-looking

statements,

whether

as

a

result

of

new

information,

future

events

or

otherwise.

Factors

that

could

cause

actual

results

or

outcomes

to

differ

from

the

results

expressed

or

implied

by

forward-looking

statements

include,

among

other

things:

changes

in

the

prices

and

availability

of

aluminum

(or

premiums

associated

with

such

prices)

or

other

materials

and

raw

materials

we

use;

the

capacity

and

effectiveness

of

our

metal

hedging

activities;

relationships

with,

and

financial

and

operating

conditions

of,

our

customers,

suppliers

and

other

stakeholders;

fluctuations

in

the

supply

of,

and

prices

for,

energy

in

the

areas

in

which

we

maintain

production

facilities;

our

ability

to

access

financing

for

future

capital

requirements;

changes

in

the

relative

values

of

various

currencies

and

the

effectiveness

of

our

currency

hedging

activities;

factors

affecting

our

operations,

such

as

litigation,

environmental

remediation

and

clean-up

costs,

labor

relations

and

negotiations,

breakdown

of

equipment

and

other

events;

the

impact

of

restructuring

efforts

in

the

future;

economic,

regulatory

and

political

factors

within

the

countries

in

which

we

operate

or

sell

our

products,

including

changes

in

duties

or

tariffs;

competition

from

other

aluminum

rolled

products

producers

as

well

as

from

substitute

materials

such

as

steel,

glass,

plastic

and

composite

materials;

changes

in

general

economic

conditions

including

deterioration

in

the

global

economy,

particularly

sectors

in

which

our

customers

operate;

changes

in

the

fair

value

of

derivative

instruments;

cyclical

demand

and

pricing

within

the

principal

markets

for

our

products

as

well

as

seasonality

in

certain

of

our

customers

industries;

changes

in

government

regulations,

particularly

those

affecting

taxes,

environmental,

health

or

safety

compliance;

changes

in

interest

rates

that

have

the

effect

of

increasing

the

amounts

we

pay

under

our

principal

credit

agreement

and

other

financing

agreements;

the

effect

of

taxes

and

changes

in

tax

rates;

and

our

indebtedness

and

our

ability

to

generate

cash.

The

above

list

of

factors

is

not

exhaustive.

Other

important

risk

factors

included

under

the

caption

"Risk

Factors"

in

our

Annual

Report

on

Form

10-K

for

the

fiscal

year

ended

March

31,

2011

are

specifically

incorporated

by

reference

into

this

presentation.

Non-GAAP Financial Measures

This

presentation

contains

non-GAAP

financial

measures

as

defined

by

SEC

rules.

We

think

that

these

measures

are

helpful

to

investors

in

measuring

our

financial

performance

and

liquidity

and

comparing

our

performance

to

our

peers.

However,

our

non-GAAP

financial

measures

may

not

be

comparable

to

similarly

titled

non-GAAP

financial

measures

used

by

other

companies.

These

non-GAAP

financial

measures

have

limitations

as

an

analytical

tool

and

should

not

be

considered

in

isolation

or

as

a

substitute

for

GAAP

financial

measures.

We

have

included

reconciliations

of

each

of

these

measures

to

the

most

directly

comparable

GAAP

measure.

In

addition,

a

more

detailed

description

of

these

non-GAAP

financial

measures

used

in

this

presentation,

together

with

a

discussion

of

the

usefulness

and

purpose

of

such

measures,

is

included

as

Exhibit

99.2

to

our

Current

Report

on

Form

8-K

furnished

to

the

SEC

with

our

earnings

press

release.

Safe Harbor Statement |

3

Agenda |

4 |

5

Business Review & Outlook

Tough Quarter: Felt Economic Impact + Seasonally Low Quarter

Fourth Quarter Recovering & Full-Year on Par with Last Years

Record EBITDA Results

While Economic Pressure Persists, Our Business Model Reduces

Exposure (EBITDA/ton flat YOY)

Expansions on Track and Budget. Continued Investments to Support

Strategy

Pressure in Q3, on Track with Strategic Expansion Plans

|

6

Novelis Business Model |

7

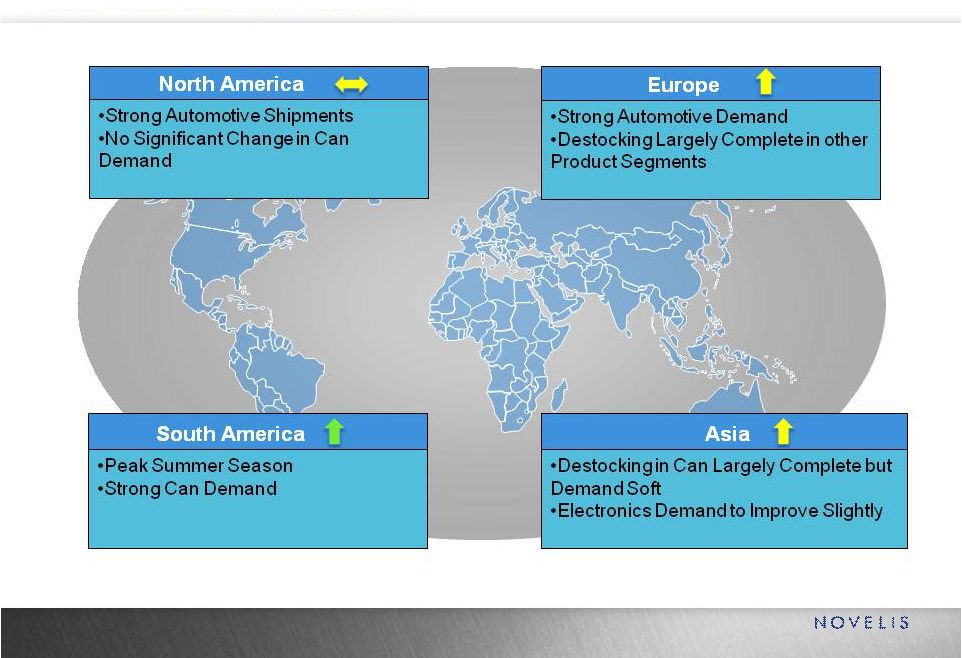

Regional Business Outlook (Q4FY12)

7 |

8 |

9

Novelis

Strategy |

10

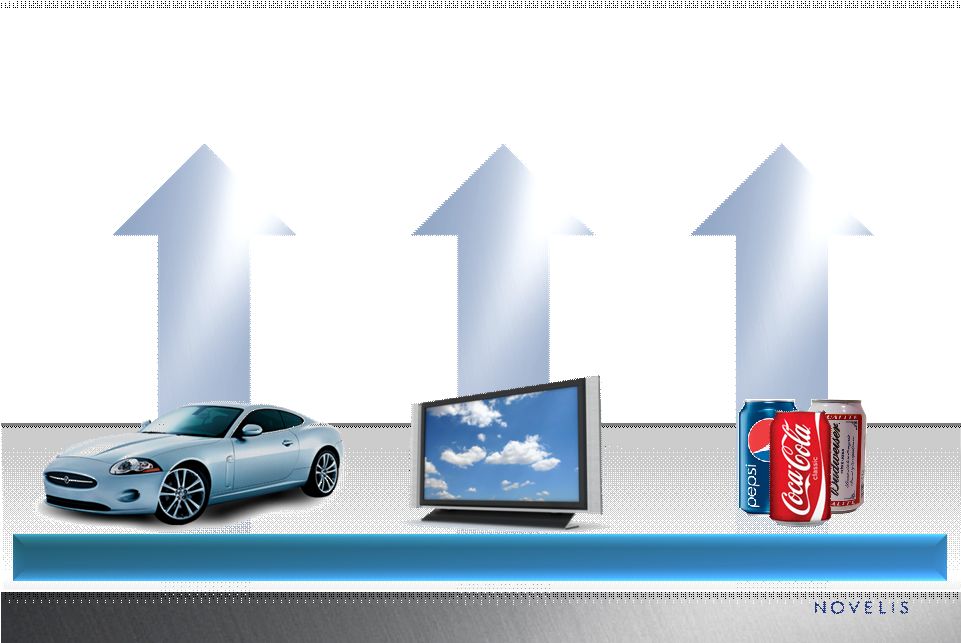

Source: Novelis Estimates and November 2011 CRU

Long-Term Global Trends in Aluminum Demand

Electronics & High-End

Specialties

Beverage Can

Automotive

Long-term

(CY11-16)

~25%

~25%

~6%

~6%

~4-5%

~4-5%

Strong Long-Term Outlook |

11

Asia

Invested $350M to Acquire Minority Interest

Completed purchase of minority stake in Korean Operations

Provides greater control of our manufacturing assets

Drives our ongoing initiatives for globally integrated operations

|

12

Asia

Korea Expansion Update

Total Investment of ~$400M

On Track for Incremental Capacity of ~350kt

Expect to begin commissioning by end of CY 2013

FRP CAGR of 8% for Asia over the next 5 years |

13

Brazil

Expansions Update

Rolling Expansion

Total Investment of ~$300M

Expect to begin commissioning ~220kt by end of CY 2012

Beverage Can CAGR of 7% over next 5 years

Recycling Line

Total Investment of ~$30M

Recycling Capacity of ~190 kts begins commissioning by end of CY 2013

Drives Towards 80% Recycled Content Goal, Ensures Metal Supply and

Reduces Costs

Can End Stock (CES) Coating Line

Total Investment of ~$50M

Capacity of ~100 kts begins commissioning by end of CY 2013

Captures Growth, Reduces costs and Reliability on Third Parties

Creating a World Class, Fully-Integrated Rolling System

|

14

North America

Expansion Update

Total Investment of ~$200M

On Track for Incremental Capacity of ~200kt

Expect to begin commissioning by mid CY 2013

Strong Double Digit Auto Sheet CAGR in N.A. over the next 5

years |

15 |

16

Third Quarter Financial Highlights

(Q3FY12 vs. Q3FY11)

Shipments Down 9% to 648 Kilotonnes

Net Sales Down 4% to $2.5 Billion

Adjusted EBITDA Down 11% to $213 Million

Free Cash Flow Before CapEx of $186 Million

Liquidity of $857 Million

Net Loss of $12 Million

Solid Performance in a Tough Market |

17

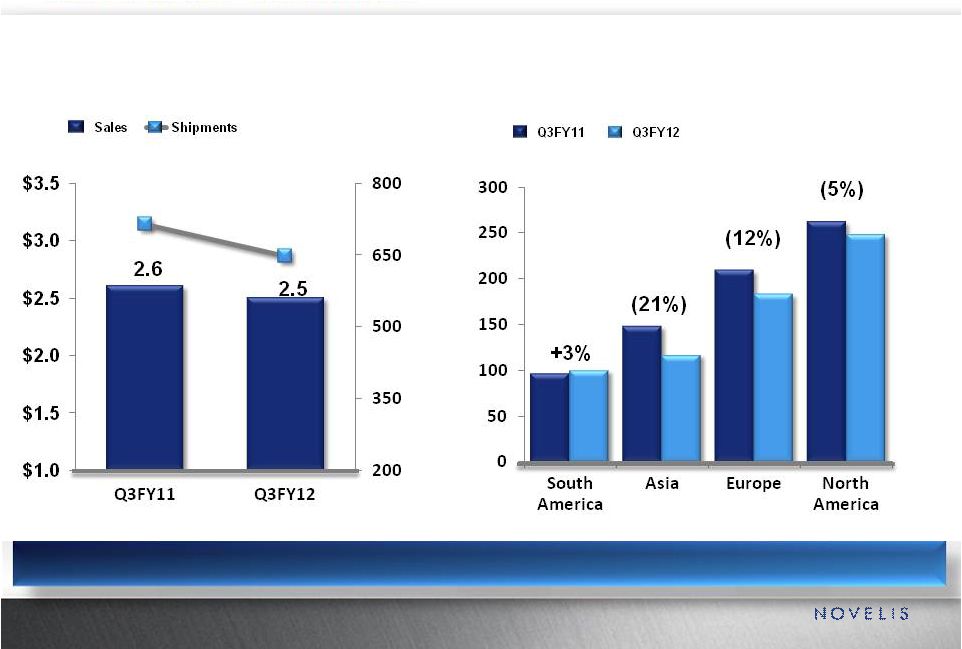

Shipments & Sales

Total Company

Sales (Billions)

Shipments (Kt)

Shipments by Region

Short-term Softness in Most Regions |

18

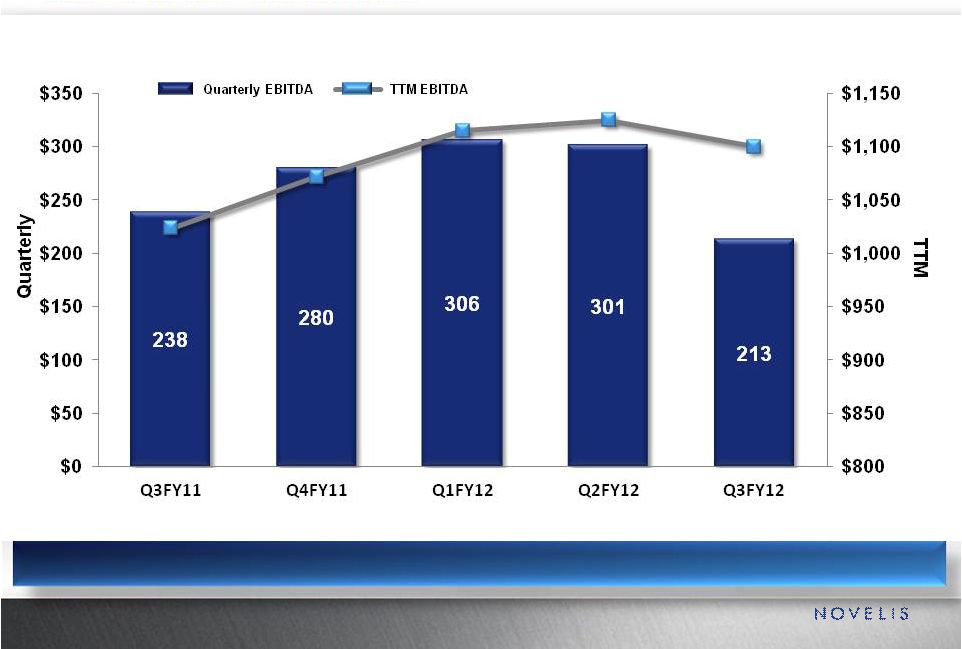

(Millions)

Adjusted EBITDA Trend

Short-term Softness Impacting EBITDA |

EBITDA

& Shipments EBITDA (Millions)

Shipments (Kt)

19

Business Model Drives Performance

$128

$200

$238

$213

0

100

200

300

400

500

600

700

$100

$125

$150

$175

$200

$225

$250

$275

Q3FY09

Q3FY10

Q3FY11

Q3FY12

Shipments

Adjusted EBITDA |

20

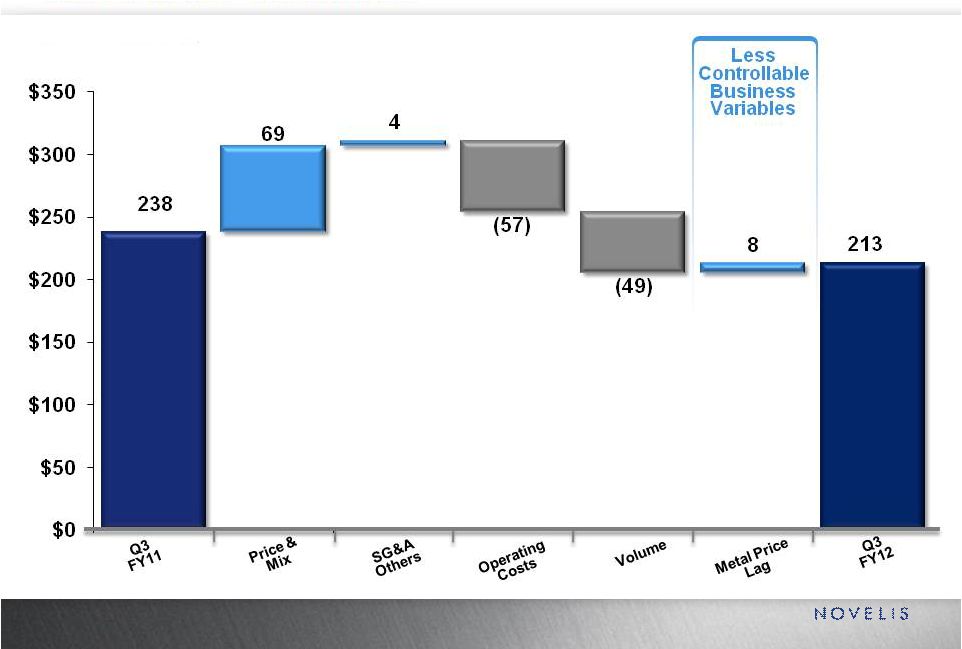

Adjusted EBITDA

Q3FY11 vs. Q3FY12 (Millions) |

21

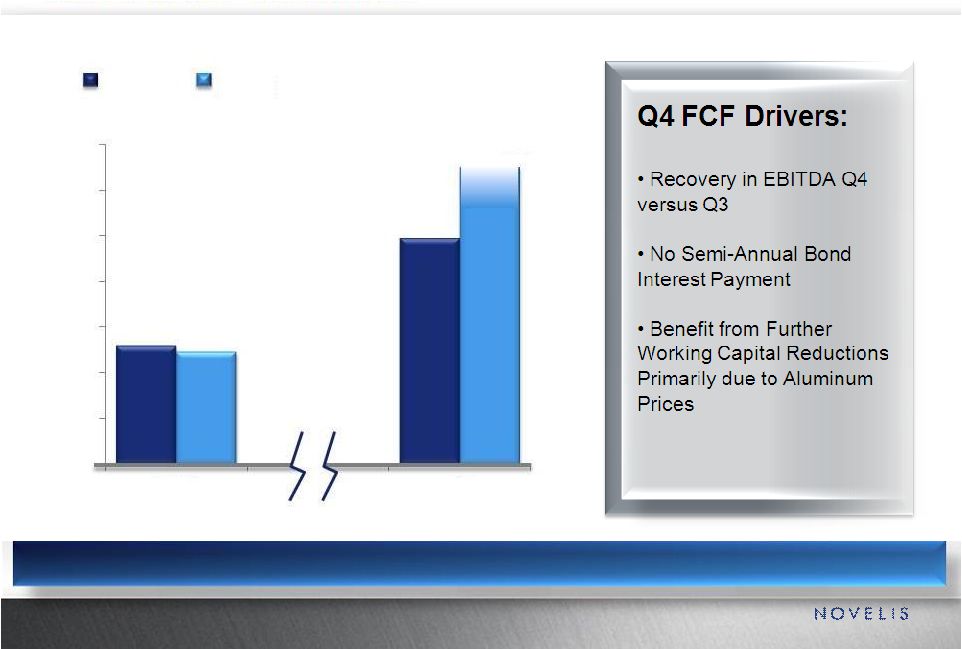

Free Cash Flow Before CapEx

On Track to Generate ~$600-700 Million for FY12

308

544

296

$50

$150

$250

$350

$450

$550

$650

$750

YTD

FY

FY11

FY12

(Millions)

~600-700 |

22

(Millions)

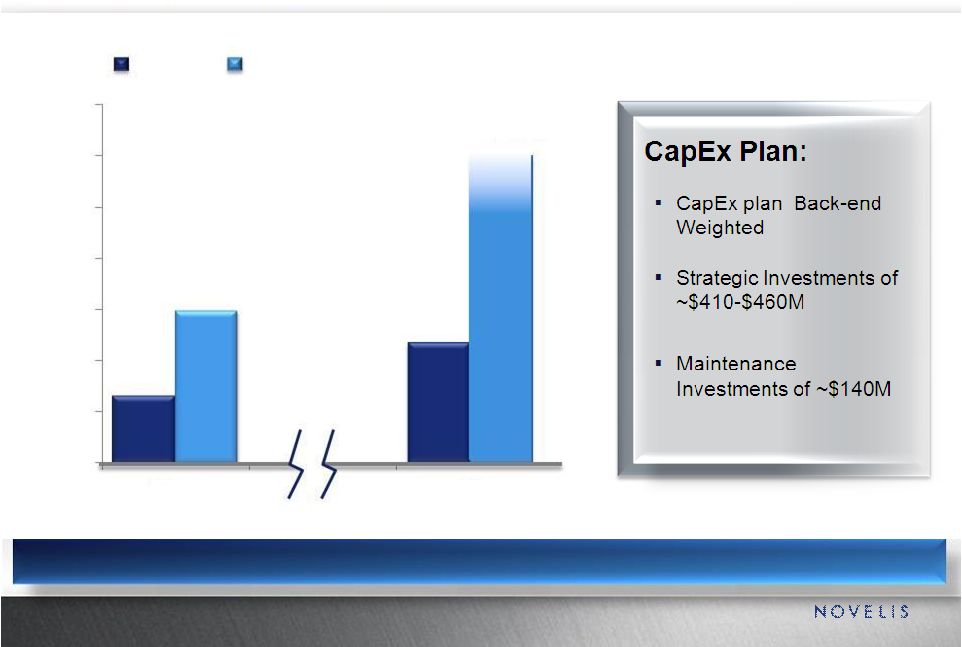

Capital Expenditures

Focused on Strategic Investments

132

234

297

$0

$100

$200

$300

$400

$500

$600

$700

YTD

FY

FY11

FY12

~550-600 |

23 |

Summary & Outlook

While Economic Pressure Persists, Our Business Model

Reduces Exposure (EBITDA/ton flat YOY)

Fourth Quarter Recovering & Full-Year on Par with Last

Years Record EBITDA Results

FY12 Adjusted EBITDA between $1.05-1.08B

Long-Term Outlook Supports Significant Global Expansion

Projects

Three Large Mill Expansions on Track & Budget

24 |

25 |

26 |

27

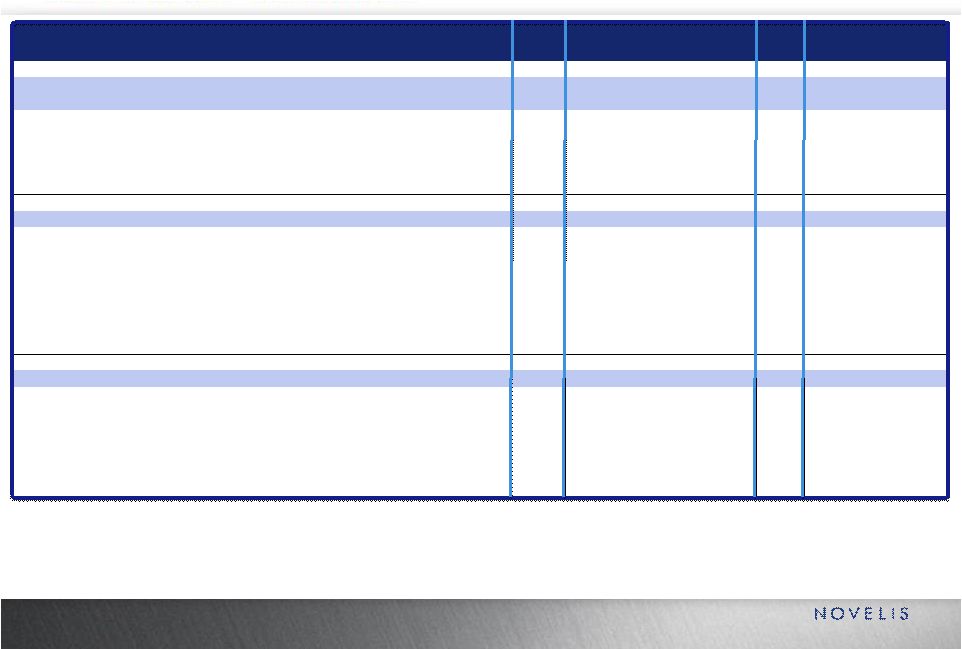

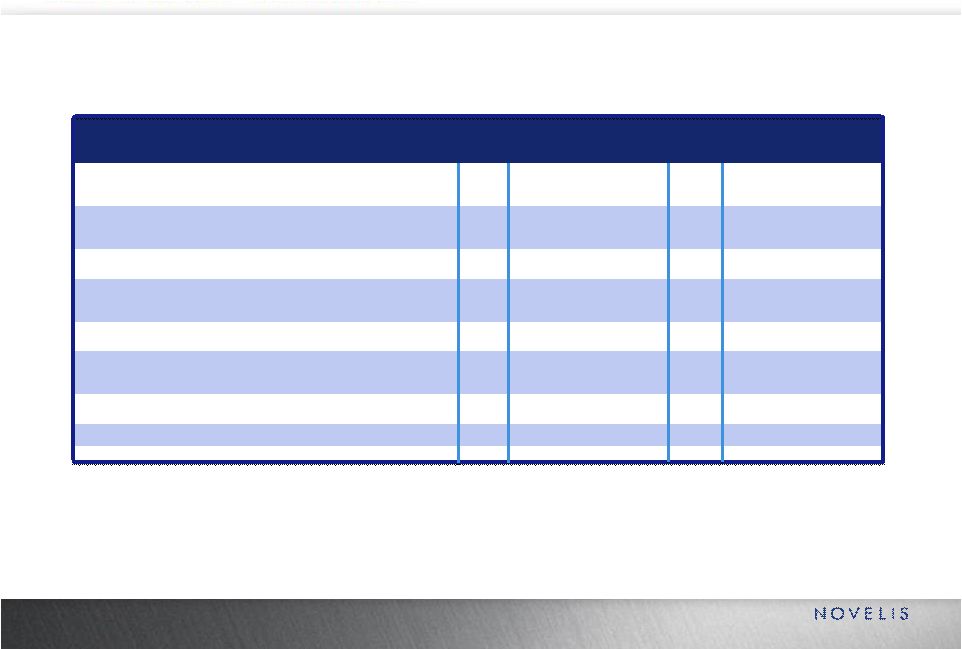

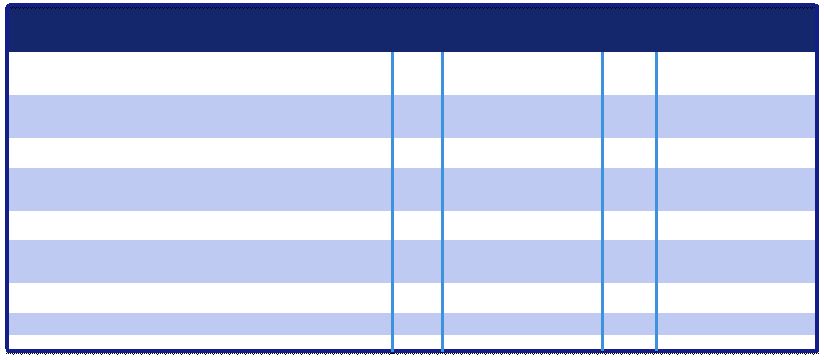

(in $ m)

Q1

FY10

Q2

FY10

Q3

FY10

Q4

FY10

FY 10

Q1

FY11

Q2

FY11

Q3

FY11

Q4

FY11

FY11

Q1

FY12

Q2

FY12

Q3

FY12

Net Income (loss) Attributable to Our

Common Shareholder

143

195

68

(1)

405

50

62

(46)

50

116

62

120

(12)

-

Interest, net

(40)

(41)

(42)

(41)

(164)

(36)

(37)

(42)

(79)

(194)

(73)

(73)

(71)

-

Income tax (provision) benefit

(112)

(87)

(48)

(15)

(262)

(15)

(56)

(33)

21

(83)

(59)

7

10

-

Depreciation and amortization

(100)

(92)

(93)

(99)

(384)

(103)

(104)

(100)

(97)

(404)

(89)

(81)

(79)

-

Noncontrolling interests

(18)

(19)

(13)

(10)

(60)

(9)

(11)

(11)

(13)

(44)

(15)

(10)

(1)

EBITDA

413

434

264

164

1,275

213

270

140

218

841

298

277

129

-

Unrealized gain (loss) on derivatives

299

254

62

(37)

578

(47)

1

9

(27)

(64)

26

(1)

(63)

-

Realized gain on derivative instruments not included

in segment income

-

-

-

-

-

-

-

4

1

5

2

-

(3)

-

Loss on early extinguishment of debt

-

-

-

-

-

-

-

(74)

(10)

(84)

-

-

-

-

Proportional consolidation

(16)

(17)

2

(21)

(52)

(10)

(11)

(10)

(14)

(45)

(13)

(12)

(9)

-

Restructuring charges, net

(3)

(3)

(1)

(7)

(14)

(6)

(9)

(20)

1

(34)

(19)

(11)

(1)

-

Others costs, net

9

1

1

(3)

8

13

(2)

(7)

(13)

(9)

(4)

-

(8)

Adjusted EBITDA

124

199

200

232

755

263

291

238

280

1,072

306

301

213

Other Income (expense) Included in Adjusted

EBITDA

-

Metal price lag

(30)

(10)

3

2

(35)

9

19

-

(3)

25

5

15

8

-

Foreign currency remeasurement

5

13

(6)

4

16

(22)

20

1

9

8

(8)

-

(2)

-

Purchase accounting

52

49

42

(2)

141

(3)

(4)

(3)

(3)

(13)

(3)

(3)

(3)

-

Can price ceiling, net

(54)

(54)

(20)

-

(128)

-

-

-

-

-

-

-

-

Income Statement Reconciliation to Adjusted EBITDA

|

28

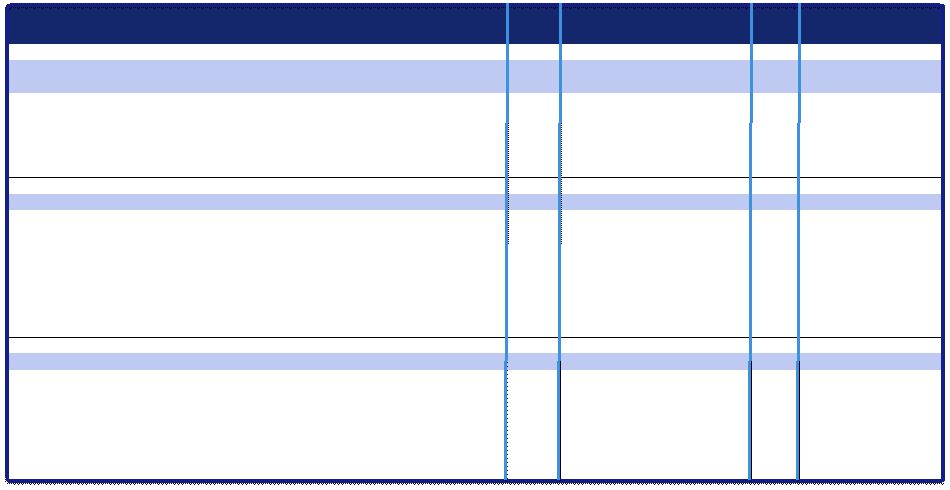

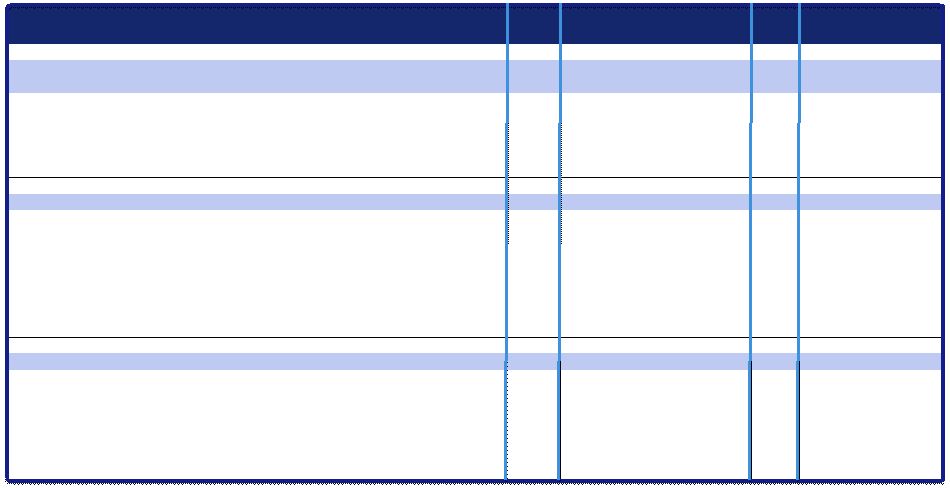

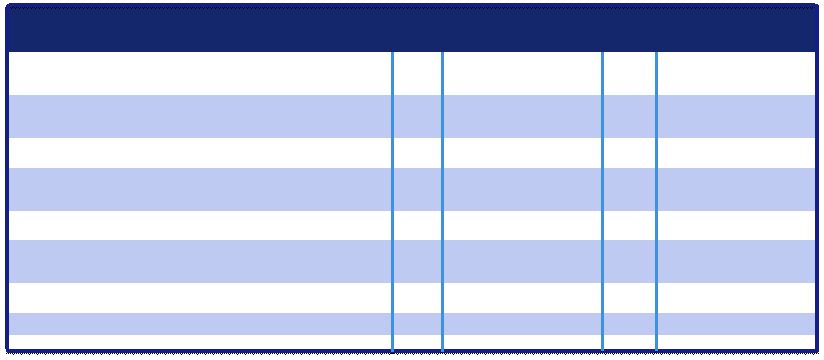

(in $m)

FY10

FY11

FY12

Q1

Q2

Q3

Q4

Full

Year

Q1

Q2

Q3

Q4

Full

Year

Q1

Q2

Q3

Cash Provided by (used in)

Operating Activities

256

195

179

214

844

22

102

94

236

454

(115)

171

145

Cash Provided by (used in)

Investing Activities)

(233)

(196)

(55)

0

(484)

27

(2)

(39)

(99)

(113)

(79)

(40)

(72)

Less: Proceeds from Sales of

Fixed Assets

(3)

(1)

0

(1)

(5)

(15)

(3)

(10)

(3)

(31)

0

1

(10)

Free Cash Flow

20

(2)

124

213

355

34

97

45

134

310

(194)

130

63

Free Cash Flow |

29

Explanation of Other Income (Expenses)

Included in our Adjusted EBITDA

1) Metal Price Lag Net of Related Hedges:

On certain sales contracts we experience timing differences on the pass through of

changing aluminum prices from our suppliers to our customers. Additional

timing differences occur in the flow of metal costs through moving average inventory

cost values and cost of goods sold. This timing difference is referred to as Metal

Price Lag. We have a risk management program in place to minimize impact of

this lag. 2) Foreign Currency Remeasurement Net of Related

Hedges: All non-functional currency denominated Working Capital and Debt

gets remeasured every period by the period end exchange rates. This impacts

our profitability. Like Metal Price Lag, we have a risk management program

in place to minimize impact of such Remeasurement.

3) Purchase Accounting:

Following our acquisition, the consideration and transaction costs paid by Hindalco

in connection with the transaction were pushed down

to us and were allocated to the assets acquired and the liabilities assumed. These

allocations are amortized over periods, impacting our profitability. A

significant portion of such amortizations pertain to ceiling

contracts. 4) Can Price Ceilings:

Some sales contracts contained a ceiling over which metal prices could not be

contractually passed through to certain customers. This negatively impacted

our margins and cash flows when the price we paid for metal was above the ceiling

price contained in these contracts. These contracts expired December 31,

2009. |