CORRESP: A correspondence can be sent as a document with another submission type or can be sent as a separate submission.

Published on March 18, 2016

March 18, 2016

Mr. Terence O’Brien

Accounting Branch Chief

United States Securities and Exchange Commission

Division of Corporate Finance

100 F Street, N.E.

Washington, D.C. 20549

Re: Novelis Inc.

Form 10-K for the Year Ended March 31, 2015

Filed May 12, 2015

Response dated February 11, 2016

File No. 1-32312

Dear Mr. O’Brien:

This letter sets forth the responses of Novelis Inc. (“Novelis” or the “Company”) to the comments of the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) with regard to the Company’s Form 10-K for the Year Ended March 31, 2015, Form 10-Q for the Period Ended September 30, 2015, the Staff’s comment letter dated January 28, 2016, and the Company’s response dated February 11, 2016. The Staff’s comments were provided to the Company in a letter dated February 24, 2016. For the convenience of the Staff, the text of the comments is reproduced in its entirety followed by our responses.

Form 10-K for the Year Ended March 31, 2015

Notes to the Financial Statements

Note 1. Business and Summary of Significant Accounting Policies

Revenue Recognition, page 74

1. |

We note your response to comment 2 of our letter dated January 28, 2016. You addressed the product financing arrangements guidance of ASC 470-40 in supporting your conclusion that a liability should not be recorded for your outstanding repurchase obligations related to these arrangements in which you sell inventory to third parties and agree to repurchase the same |

1

or similar inventory over a future period. Please also tell us what other guidance you considered in accounting for these arrangements, e.g. ASC 440. Please also tell us the amounts of your estimated repurchase obligations as of December 31, 2015 and March 31, 2015.

In connection with establishing our accounting policy when these transactions originally arose, we conducted a robust analysis in fiscal year 2013 of U.S. Generally Accepted Accounting Principles that could potentially apply in determining the appropriate accounting model. We concluded that the appropriate accounting model was contained in Accounting Standards Codification ASC 470-40. The following standards were considered:

• |

We evaluated the guidance in ASC 860, Transfers and Servicing ("ASC 860"), as well as guidance in the Financial Accounting Standards Board’s (FASB) subsequent repurchase agreement guidance related to financial assets in Accounting Standards update 2014-11, Repurchase-to-Maturity Transactions, Repurchase Financings, and Disclosures. However, we noted that the inventory subject to these arrangements does not meet the definition of a financial asset1.

|

Additionally, whereas the sale of a derivative would meet the definition of a financial asset under ASC 860, the option or obligation to repurchase does not exist until after the inventory is transferred to the counterparties. Therefore, there is no “sale” of these options/obligations as they arise as a result of the completed sale. As such, the ASC 860 guidance is not applicable to these transactions.

• |

Our accounting policy for these types of transactions prohibits the Company's participation in any of our counterparty’s hedging activities related to the acquired inventory. This procedure is to ensure that under ASC 470-40, we are not directly or indirectly protecting the counterparty from base aluminum market risk related to the acquired inventory. (See also discussion below in response number 4 confirming that Novelis never covers the counterparty's base aluminum market variability risk or guarantees a return to the counterparty for the acquired inventory.) |

As the repurchase price for repurchase transactions that do not meet the criteria to be considered product financing arrangements under ASC 470-40 are predominantly based on market prices, any potential losses on these inventory purchase commitments under ASC 330-10-35-17 through 330-10-35-18 would be insignificant.

_________________________

1 A financial asset per ASC 860 is defined as, "Cash, evidence of an ownership interest in an entity, or a contract that conveys to one entity a right to do either of the following: a. Receive cash or another financial instrument from a second entity b. Exchange other financial instruments on potentially favorable terms with the second entity. A financial asset exists if and when two or more parties agree to payment terms and those payment terms are reduced to a contract. To be a financial asset, an asset must arise from a contractual agreement between two or more parties, not by an imposition of an obligation by one party on another.”

2

However, we do in some cases recognize losses upon sale to the counterparty to these arrangements within “Cost of goods sold (exclusive of depreciation and amortization),” as discussed below.

• |

We also confirm with the counterparties to these arrangements as a part of our accounting policy that separate legal entities are not established to transact with us in these arrangements and that the inventory subject to our repurchase does not represent greater than 50% of the value of the counterparty’s entity holding the asset. As a result, we concluded that the legal entity holding the acquired inventory is not a variable interest entity, under ASC 810-10-25-55 and 56. |

• |

Although we determined that these transactions would not be recorded as product financing transactions in accordance with ASC 470-40, the Company has a purchase option or obligation with its counterparties which it considered under the guidance of ASC 815, Derivatives and Hedging ("ASC 815"). We considered whether the option could meet the definition of a derivative: 1- has an underlying (i.e. the price of the metal inputs inventories); 2- a notional (i.e. the quantity to be purchased); and 3- a small initial net investment. However, these contracts do not allow for net settlement and can only be gross physically settled via the delivery of the inventory. The secondary market for scrap, sheet ingot, and prime aluminum would not allow for the commodity to be disposed of without incurring significant transportation and/or other costs (in excess of 10% of gross proceeds). Therefore, we concluded that these contracts should not be considered derivative arrangements under ASC 815. |

• |

We considered the applicable cash flow classification of these arrangements based on ASC 230, Statement of Cash Flows (“ASC 230”), and concluded that the cash inflows and outflows from these arrangements should be classified as operating activities. We evaluated the criteria in ASC 230-10-45-11 through 230-10-45-17 and concluded the arrangements do not meet the criteria to be classified as either investing or financing activities. ASC 230-10-45-16c and 230-10-45-17f require that all cash inflows and outflows that do not stem from transactions defined as investing or financing activities should be reported as operating activities. As discussed further below, we have disclosed the impact of these arrangements on operating activities within management’s discussion and analysis (“MD&A”). |

• |

We also evaluated the guidance contained in ASC 440, Commitments (“ASC 440”). As discussed in ASC 440-10-15-4, the guidance in the Unconditional Purchase Obligations subsections does not apply to product financing arrangements that are within the scope of section 470-40-15. Therefore, we applied the guidance in ASC 440 to transactions that are not considered financings under ASC 470-40. As a result, we evaluated the disclosure requirements for these transactions in accordance with the criteria in ASC 440-10-50-2. Although the arrangements have a term of less than |

3

one year, we have disclosed the outstanding repurchase obligations as of each balance sheet date, when material.

Our estimated repurchase obligations, using market prices as of these dates, were as follows:

December 31, 2015 $ 23 million

March 31, 2015 $206 million

In the Company’s Form 10-Q filing for the nine months ended December 31, 2015, we disclosed the following (footnote 16, page 39):

Other commitments

As of December 31, 2015 and March 31, 2015, we sold certain inventories to third parties and have agreed to repurchase the same or similar inventory back from the third parties at market prices subsequent to the balance sheet dates. Our estimated outstanding repurchase obligation for this inventory as of December 31, 2015 were $23 million and as of March 31, 2015 were approximately $206 million, based on market prices as of these dates. We sell and repurchase inventory with third parties in an attempt to better manage inventory levels and to better match the purchasing of inventory with the demand for our products. As of December 31, 2015 and March 31, 2015, there was no liability related to these repurchase obligations on our accompanying condensed consolidated balance sheets.

In the Company’s Form 10-K filing for the year ended March 31, 2015, the Company disclosed the following (footnote 20, page 128):

Other commitments

As of March 31, 2015 and 2014, we had sold certain inventories to third parties and have agreed to repurchase the same or similar inventory back from the third parties subsequent to the balance sheet dates. Our estimated outstanding repurchase obligation for this inventory as of March 31, 2015 is $206 million and as of March 31, 2014 was approximately $74 million, based on market prices as of these dates. We sell and repurchase inventory with third parties in an attempt to better manage inventory levels and to better match the purchasing of inventory with the demand for our products. As of March 31, 2015 and 2014, there was no liability related to these repurchase obligations on our accompanying consolidated balance sheets.

• |

As discussed in Regulation S-K 303(b), MD&A should include discussion of significant changes in internal and external sources of liquidity. We discussed the significant changes in these arrangements in our Form 10-K filing for the year ended March 31, 2015 as follows (page 48): |

4

Liquidity and Capital Resources

Operating Activities

Year Ended March 31, 2015

"Inventories" were higher due to an increase in quantities on hand, as well as higher base aluminum prices and local market premiums when compared to the fourth quarter of fiscal 2014. The higher quantities of inventory on hand at March 31, 2015 is the result of recent capacity expansions, as well as longer supply chains to support the automotive sector and expand our scrap procurement network. As of March 31, 2015, we had sold certain inventories to third parties and have agreed to repurchase the same or similar inventory back from the third parties subsequent to March 31, 2015. Our estimated repurchase obligation for this inventory as of March 31, 2015 is $206 million, based on market prices as of this date. We sell and repurchase inventory with third parties in an attempt to better manage inventory levels and to better match the purchasing of inventory with the demand for our products.

Year Ended March 31, 2014

"Inventories" declined due to lower average aluminum prices, partially offset by higher quantities on hand. The higher quantities of inventory on hand at March 31, 2014 is the result of additional capacity from our expansions that we commissioned in fiscal 2014. As of March 31, 2014, we had sold certain inventories to third parties and agreed to repurchase the same or similar inventory back from third parties subsequent to March 31 2014. Our estimated repurchase obligation for this inventory as of March 31, 2014 was approximately $74 million, based on market prices at the time of repurchase.

• |

Item 303(a)(5) of Regulation S-K requires companies to provide a tabular presentation of known contractual obligations as of the end of the most recent fiscal year. We have included a contractual obligations table in our Form 10-K filings in the MD&A. The outstanding purchase obligations in that table include outstanding repurchase obligations from these arrangements.

|

2. |

You note that you established an accounting policy based on the guidance of ASC 470-40. Please tell us how this guidance led you to determine the appropriate income statement treatment of these agreements. |

Our policy is to record the net gain or loss from the initial sale of these transactions net through “Cost of goods sold (exclusive of depreciation and amortization).”

5

Staff Accounting Bulletin Topic 13A (“SAB Topic 13A”), Revenue Recognition, states “if a transaction is within the scope of specific authoritative literature that provides revenue recognition guidance, that literature should be applied.” SAB Topic 13A provides a list of existing literature on revenue recognition guidance for certain specific transactions including, Statement of Financial Accounting Standards No. 49 (“SFAS 49”), Accounting for Product Financing Arrangements, (codified as ASC 470-40). We evaluated SFAS 49 for the appropriate derecognition accounting treatment for the asset, but noted the standard does not provide guidance on the classification within the statement of operations. SAB Topic 13A further states that “in the absence of authoritative literature addressing a specific arrangement or a specific industry, the staff will consider the existing authoritative accounting standards as well as the broad revenue recognition criteria specified in the FASB's conceptual framework that contain basic guidelines for revenue recognition.” Therefore, we considered other authoritative revenue recognition guidance.

We evaluated the definition of revenue in Statement of Financial Accounting Concepts No. 6 Elements of Financial Statements (“CON 6”) and Accounting Standards Codification 605-10-25-1, Revenue Recognition. We concluded these arrangements do not constitute our ongoing major or central operations and are not intended to fulfill our basic function of producing and distributing flat rolled aluminum products at prices that are sufficient to enable Novelis to pay for the goods and services it uses and to provide a satisfactory return to its owners. Therefore, the Company did not believe it appropriate to classify these transactions as revenue.

Based on the definition of revenue and the existence of obligations to repurchase the same or similar inventories, we concluded that recording the initial sale of inventories to the counterparty on a net basis in the statement of operations would be the most appropriate treatment. Furthermore, to ensure transparency to the readers of the financial statements related to these arrangements, we disclosed this policy in footnote 1 to the financial statements in our Form 10-K filed with the SEC for the year ended March 31, 2015.

3. |

You note that these arrangements enable you to better manage inventory levels and better match the timing of inventory purchases with the demand. Please help us better understand the business purposes of entering into these arrangements from both your perspective and the perspective of the third party. It would appear that one of the primary benefits from your perspective would be the additional liquidity that these arrangements provide on a short-term basis. |

From the Company’s perspective, we enter into these arrangements to better manage inventory levels and to better match the timing of inventory purchases (i.e., metal inputs in the form of scrap metals, prime metals and sheet ingots) with customer demand for flat rolled aluminum products. Over the past several years, the Company has been pursuing two

6

primary commercial strategies: (1) increasing the use of recycled metal inputs across our portfolio of flat rolled aluminum products; and (2) increasing sales to the automotive sector. Our pursuit of these strategies has involved significant capital investments in scrap handling equipment, internal sheet ingot casting capabilities and automotive heat treatment finishing capabilities across our global manufacturing footprint, which in turn has fundamentally impacted our supply chain. In order to support the commissioning and ramp-up of our new recycling operations, we expanded our global network of scrap suppliers to support higher levels of scrap purchases across a more diverse range of scrap categories, building inventories months in advance of those commissioning efforts. Furthermore, our newly commissioned automotive finishing operations generate significant runaround scraps which can be processed internally and re-melted to produce new sheet ingots. These changes to our supply chain, in combination with operational start-up issues we experienced as new capacity was brought on line, led to periods where we held significant excess starter stock inventories relative to planned production levels.

In order to balance the Company’s supply of metal inputs with customer demand, we entered into these arrangements to monetize excess inventory quantities and provide for additional liquidity on a short-term basis, while rescheduling our acquisition of the same or similar metal inputs in the future when the inventory would be needed. These arrangements resulted in the Company transferring title and the market risk and rewards of base aluminum prices for excess metal inputs, as quoted on the LME, to the counterparty and then reacquiring the same or similar inventory at market prices in a future period when the metal inputs were expected to be consumed to produce flat rolled aluminum products. We believe the arrangements provided more effective operational management of inventory starter stocks.

We do not have full visibility into our counterparties’ business purposes for entering into these transactions. However, we understand some of our counterparties are managing a portfolio of assets and may have had an interest in increasing their aluminum commodity exposure. We also understand the counterparties may have been interested in obtaining a net profit by acquiring the physical inventory at spot market prices and then entering into forward sale agreements to take advantage of market conditions where the aluminum forward price curve was in contango (i.e. the forward sales price of aluminum was greater than spot price). Lastly, in many of the arrangements we pay the counterparty a transaction fee, which includes interest charges and other holding costs. See our response to comment number 4 below for further discussion of repurchase price components.

4. |

Please provide us with a summary of the key terms of these agreements. Please ensure that your summary includes the following: |

• |

Your response indicates that there are multiple components of the repurchase price though the predominant component is market based. Please clearly identify each of the |

7

components of the repurchase price and tell us how each of these components is determined. Please also provide us with an excerpt from an example agreement which describes the purchase price. Please specifically address if any of the components are related to holding or interest costs;

The arrangements result in the Company transferring significant risks and rewards of inventory ownership to the counterparty, including base aluminum market price volatility, and then reacquiring the same or similar inventory at market prices in the future. The Company’s policy requires that the inventory be transferred for a minimum of 30 days and that at least 70% of the estimated repurchase price at the initial sale date be based on market-based pricing as quoted on the London Metal Exchange (“LME”). Our policy was established to ensure the Company transfers substantial price risk associated with the inventory to the counterparty, in accordance with ASC 470-40. For the arrangements Novelis entered into during the periods covered by the Staff’s comment letter, the weighted average base aluminum LME component represented 88% of the estimated repurchase price on the date of initial sale and the weighted average period between the date of the initial sale and repurchase was 80 days.

The products being sold in these arrangements include the following aluminum metal input inventories: prime, scrap (including used beverage cans), and sheet ingot. The pricing components in these arrangements are based on standard pricing conventions in the aluminum industry. The repurchase price in each of these arrangements is predominately based on the LME base aluminum market price. The arrangements also have one or more of the following pricing components, which are common in aluminum procurement contracts for these types of inventory: local market premium, sheet ingot product premium, scrap discount or premium, and transaction fees. The following is a description of each of these components:

• |

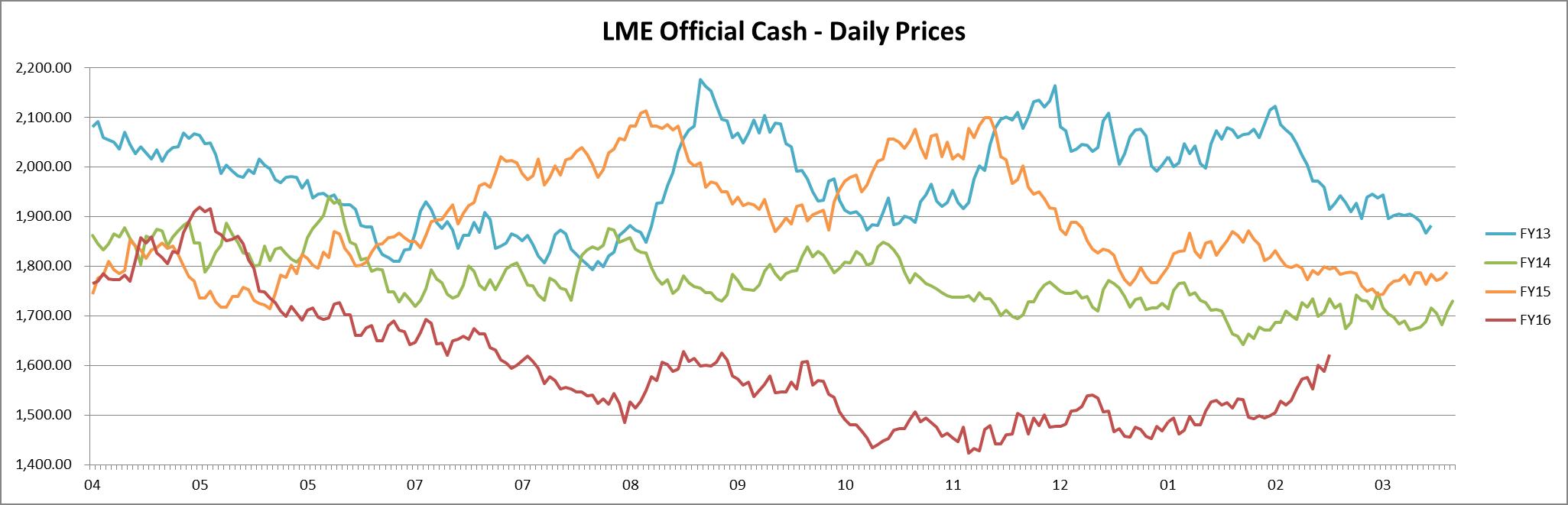

Base aluminum – As noted above, the weighted average base aluminum component represented 88% of the estimated repurchase price at the time of the initial sale for these arrangements. The base aluminum component is based on quoted market prices for high grade aluminum quoted on the LME (quoted as US dollar per metric tonne) at or near the repurchase date. The pricing of base aluminum on the LME is unpredictable and price fluctuations can be substantial within a very short time frame. During the periods presented in our response, the risks and rewards of fluctuating base aluminum prices was transferred from the Company to the counterparty for a weighted-average period of 80 days and each individual transaction was at a minimum of 30 days. For the Staff’s benefit, we have included the base aluminum prices as quoted on the LME for the applicable review periods in Attachment A.

|

• |

Local market premium – This is a regional premium generally added to the base aluminum price, which varies based on local supply and demand. The local market premium component of the repurchase price is fixed on the initial sale date and is |

8

based on published market prices at or near the initial sale date. In North America and Brazil the local market premium is based on the U.S. Midwest premium. In Europe the local market premium is based on the Rotterdam Duty Paid premium. In Asia the local market premium is based on the Major Japan Port premium.

• |

Sheet ingot product premium – The sheet ingot product premiums are additional charges on sheet ingot products based on specific alloy composition and other charges for producing the sheet ingot. The sheet ingot product premium component of the repurchase price is fixed on the initial sale date and is based on market rates at or near the initial sale date. |

• |

Scrap discount/premium – Scrap aluminum is a market based rate quoted as a discount from or premium to base aluminum market prices and will vary based on local supply and demand, quality and grade of the scrap. The scrap discount or premium component of the repurchase price is fixed based on market prices at the initial sale date and is specified in the arrangements as either a dollar amount per metric tonne or a fixed discount /premium percentage applied to the base aluminum component at or near the repurchase date. |

• |

Transaction fee – Transaction fees are included in many arrangements and include interest and holding costs. In many arrangements, the transaction fee is included in the fixed premium or scrap discount/premium component of the repurchase price. |

We have included excerpts of the repurchase price from example agreements in Attachment B.

• |

Please tell us how the initial sales price is determined when you make the initial sale to the counterparty; |

Initial sale prices are based on market prices at or near the date of the initial sale. The products being sold in these arrangements include the following aluminum metal input inventories: prime, scrap (including used beverage cans), and sheet ingot. There is an active market for these inventories and the initial sales prices are based on aluminum market prices quoted on the LME. The prime and sheet ingot initial sales prices also include a local market premium, which tends to vary based on supply and demand for metal in a particular region. The sheet ingot initial sales price generally also includes a product premium, which are based on specific alloy composition and other charges for producing the sheet ingot. The scrap aluminum initial sales price is generally sold at a discount off or premium to the LME price of prime aluminum.

9

• |

Please help us better understand the repurchase terms. You indicate that you transfer the risks and rewards of ownership to the counterparty for a minimum of 30 days which includes giving the ability of the counterparty to sell the inventory or obtain other benefits related to inventory ownership. Please tell us whether you are still required to repurchase comparable inventory if the original inventory is sold by the counterparty or if you are required to compensate the counterparty if the sales proceeds they receive is less than a certain predetermined amount; |

Novelis is still required to repurchase comparable inventory if the original inventory is sold by the counterparty. In no situation is Novelis ever required to compensate the counterparty if the sales proceeds they receive are less than a certain predetermined amount.

• |

Please clarify where the inventory is physically stored during these arrangements; and |

The physical location of the inventory owned by the counterparty varies by arrangement. For a majority of the arrangements, the inventory is physically stored in warehouses leased by Novelis, which are separate from our production facilities. For other arrangements the inventory is stored in Novelis owned plants, in facilities leased by counterparties, outside toller facilities, or the inventory is in-transit.

When the inventory is physically stored at a Novelis facility, the inventory owned by the counterparty is usually physically segregated from Novelis owned inventory and clearly marked as being owned by the counterparty. All arrangements, regardless of where the physical inventory is located, allow for the counterparty to audit and/or inspect their inventory. Our counterparties periodically perform physical audit procedures on inventory they own.

• |

Please describe material terms relating to risks and rewards transferred to the counterparty. |

Following are the material terms related to risks and rewards transferred to the counterparty in these arrangements:

◦ |

Risks and rewards of increasing or decreasing base aluminum market prices are transferred to the counterparty. |

▪ |

Novelis’ policy prohibits the Company from entering into derivatives with a counterparty that would compensate the counterparty for any losses on the acquired inventory. |

◦ |

Legal title is transferred to the counterparty. |

◦ |

Risk of physical loss or damage is transferred to the counterparty. |

◦ |

Insurance risks and responsibilities for the inventory are transferred to the counterparty. |

10

◦ |

The counterparty retains the right to sell the inventory to other parties provided the counterparty makes comparable inventory available to Novelis at the repurchase date. |

Please feel free to call the undersigned at (404) 760-6425 with any questions concerning our responses to the Staff’s comments.

Sincerely,

/s/ Steven E. Pohl

Vice President and

Interim Chief Financial Officer

cc: Ms. Nudrat Salik, Securities and Exchange Commission

Ms. Stephanie Rauls, Novelis Inc.

Mr. Leslie J. Parrette, Novelis Inc.

Mr. Donald Stewart, Audit Committee Chairman, Novelis Inc.

Mr. Keith M. Townsend, King & Spalding LLP

Mr. Ronald M. Cofield, PricewaterhouseCoopers LLP

11

Attachment A – Historical LME Primary Aluminum Cash Prices per metric tonne

Attachment B – Excerpts of agreements

Sheet ingot repurchase price excerpt from example contract

Quantity: |

3371 metric tons ± 2% tolerance in Seller's option |

Shipment Period(s): |

Jan2014 2735 metric tons ± 2% tolerance in Seller's option

Mar2014 636 metric tons ± 2% tolerance in Seller's option

|

Price: |

For each Shipment Period, the Official LME Cash Settlement Price for high grade primary Aluminium published 2 LME market days prior to the 3rd Wednesday of the month of shipment PLUS the Premium PLUS the Grade Premium |

Premium: |

*** United States Dollars/metric ton |

Grade Premium: |

Grade Premium

9922 Grade(s): *** United States Dollars/metric ton

5544 Grade(s): *** United States Dollars/metric ton

5362 Grade(s): *** United States Dollars/metric ton

8135 Grade(s): *** United States Dollars/metric ton

5330 Grade(s): *** United States Dollars/metric ton

3051 Grade(s): *** United States Dollars/metric ton

|

For the Staff’s benefit, the LME base aluminum price component on the initial sale in October 2013 was $1,844 per metric ton. The LME base aluminum price component on the inventory repurchased in January 2014 was $1,716 per metric ton and inventory repurchased in March 2014 was $1,684 per metric ton.

Scrap repurchase price excerpt from example contract

|

1. Material

The material supplied shall be mixed Aluminum/Hardeners in the form of scrap (the “Material”).

2. Quality

The Material supplied shall be mixed scrap as per Attachment A.

3. Origin

Any origin, in Seller’s option. In the event of substation, all materials which are replaced are to meet Novelis Specifications.

4. Quantity

The quantity of Material supplied shall be 6,849 (six thousand eight hundred forty nine) MTS plus/minus a tolerance of 0.0 percent.

The scheduled month of delivery: Delivery January 2015. Release is to be within 1 (one) business day after pricing and the receipt of funds to *** account.

5. Price

The LME primary aluminum cash settlement price on 1/21/2015 plus a premium of $*** per MT.

|

For the Staff’s benefit, the LME base aluminum price component on the initial sale in December 2014 was $1,936 per metric ton. The LME base aluminum price component on the inventory repurchased in January 2015 was $1,831 per metric ton.

Prime repurchase price excerpt from example contract

|

• Material:

Primary Aluminum P1020 – any shape – with standard specifications

• Quantity:

6,000 mts +/-15% at Seller’s option to be declared latest February 31st, 2015

• Delivery:

Estimated 2,000 mts +/-2% during March, 2015 and 4,000 mts +/-2% during April, 2015 at Gelog warehouse in Pindamonhangaba/SP. In the event Seller declare +/- 15%, parties will mutually agree on delivery date which premium should be based on Price clause below.

Buyers and Sellers can mutually agree on changing month of delivery as long as such agreement is reached latest end of M-2 (two months prior to the month of delivery).

• Price:

LME plus a premium depending on month of delivery per metric tons plus local taxes (9,25% PIS/Cofins + 4% IPI) basis delivered Gelog warehouse in Pindamonhagaba/SP

• If delivery occurs during January, LME + $***/mts + local taxes (9,25% PIS/Cofins + 4% IPI)

• If delivery occurs during February, LME + $***/tons + local taxes (9,25% PIS/Cofins + 4% IPI)

• If delivery occurs during March, LME + $***/tons + local taxes (9,25% PIS/Cofins + 4% IPI)

• If delivery occurs during April, LME + $***/tons + local taxes (9,25% PIS/Cofins + 4% IPI)

• If delivery occurs during February, LME + $***/tons + local taxes (9,25% PIS/Cofins + 4% IPI)

• Quotational Period:

The average of M-1, being M = the month of delivery

|

For the Staff’s benefit, the LME base aluminum price component on the initial sale in December 2014 was $1,888 per metric ton. The LME base aluminum price component on inventory repurchased in April 2015 was $1,773 per metric ton.