DRS/A: Draft registration statement submitted by Emerging Growth Company under Securities Act Section 6(e) or by Foreign Private Issuer under Division of Corporation Finance policy

Published on February 15, 2024

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

Confidential Draft Submission #4, as confidentially submitted to the United States Securities and Exchange Commission on February 15, 2024

This draft registration statement has not been filed publicly with the Securities and Exchange Commission, and all information herein remains strictly confidential.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NOVELIS INC.

(Exact name of registrant as specified in its charter)

| Canada | 3350 | 98-0442987 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

3550 Peachtree Road NE, Suite 1100

Atlanta, GA 30326

(404) 760-4000

(Address, including zip code, and telephone number, including area code, of registrants principal executive offices)

CSC Corporation

1180 Avenue of the Americas, Suite 210

New York, NY 10036

(212) 299-5600

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Keith M. Townsend King & Spalding LLP |

Rima Ramchandani Torys LLP 79 Wellington Street West Toronto, ON M5K 1N2 (416) 865-0040 |

Richard D. Truesdell, Jr. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, NY 10017 (212) 450-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging Growth Company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| | The term new or revised financial accounting standard refers to any updated issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012 |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

The information in this preliminary prospectus is not complete and may be changed. The selling shareholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission of which the preliminary prospectus forms a part is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| SUBJECT TO COMPLETION, DATED , 2024

PRELIMINARY PROSPECTUS |

Common Shares

Novelis Inc.

This is the initial public offering of common shares, no par value per share, of Novelis Inc., or Novelis. All of the common shares being sold in this offering are being sold by the selling shareholder identified in this prospectus. We will not receive any proceeds from the sale of common shares by the selling shareholder. Prior to this offering, there has been no public market for our common shares. It is currently estimated that the initial public offering price per common share will be between $ and $ . We intend to apply to list our common shares on the New York Stock Exchange, or NYSE, under the symbol NVL. Listing on the NYSE is subject to the approval of the NYSE in accordance with its listing standards.

Following this offering, assuming no exercise of the underwriters option to purchase additional shares referred to below, Hindalco Industries Limited (Hindalco), whose wholly owned subsidiary, AV Minerals (Netherlands) N.V. (the selling shareholder), is our existing sole shareholder, will beneficially own approximately % of our outstanding share capital. Hindalco will therefore control approximately % of the voting power of our outstanding share capital following the offering, assuming no exercise of the underwriters option to purchase additional shares. As a result, we will be a controlled company within the meaning of the corporate governance standards of the NYSE. For further information, see ManagementDirector Independence and Controlled Company Exception, Principal and Selling Shareholder and Description of Share Capital.

We are a foreign private issuer under applicable Securities and Exchange Commission rules, and as a result, will be subject to reduced public company reporting requirements for this prospectus and future filings with the Securities and Exchange Commission.

Our business and an investment in our common shares involve significant risks. You should carefully consider the risks that are described under the caption Risk Factors beginning on page 35 of this prospectus before making a decision to invest in our common shares.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share |

Total | |||||||

| Initial public offering price |

||||||||

| Underwriting discounts and commissions(1) |

||||||||

| Proceeds, before expenses, to the selling shareholder |

||||||||

| (1) | The underwriters will be reimbursed for certain FINRA-related expenses, in addition to the underwriting discounts and commissions they will receive. See Underwriting for a detailed description of the compensation payable to the underwriters. |

The selling shareholder has granted the underwriters an option for a period of 30 days from the date of this prospectus to purchase up to additional common shares at the initial public offering price, less underwriting discounts and commissions.

The underwriters expect to deliver our common shares to purchasers against payment on or about , 2024.

Joint Book-Running Managers

| Morgan Stanley | BofA Securities | Citigroup |

, 2024

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

| Page | ||||

| 2 | ||||

| 35 | ||||

| 58 | ||||

| 60 | ||||

| 61 | ||||

| 62 | ||||

| 63 | ||||

| MANAGEMENTS DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

65 | |||

| 99 | ||||

| 134 | ||||

| 144 | ||||

| 167 | ||||

| 169 | ||||

| 171 | ||||

| 180 | ||||

| 181 | ||||

| 188 | ||||

| 192 | ||||

| 194 | ||||

| 195 | ||||

| 195 | ||||

| 195 | ||||

| F-1 | ||||

Neither we, the selling shareholder nor any of the underwriters have authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we may have referred you. We, the selling shareholder and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we, the selling shareholder nor any of the underwriters are making an offer to sell the common shares in any jurisdiction where the offer or sale is not permitted. This offering is being made in the United States and elsewhere solely on the basis of the information contained in this prospectus. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of the common shares. Our business, financial condition, results of operations and prospects may have changed since the date on the front cover of this prospectus.

| i |

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

BASIS OF PRESENTATION

Unless otherwise indicated or unless the context otherwise requires, (a) all references in this prospectus to the Company, Novelis, we, us, our or similar terms refer to Novelis Inc. and its subsidiaries, and (b) all references to Hindalco and Parent refer to Hindalco Industries Limited, Novelis ultimate parent, and its consolidated subsidiaries other than Novelis and Novelis subsidiaries. All references to shares or common shares in this prospectus refer to the common shares of Novelis Inc., no par value per share.

INDUSTRY AND MARKET DATA

The data included in this prospectus regarding markets and the industry in which we operate, including the size of certain markets and our position and the position of our competitors within these markets, are based on reports of government agencies, independent industry sources such as Ducker Carlisle Worldwide, LLC (Ducker Carlisle), an independent consulting and industrial research firm, Commodity Research Unit International Limited (CRU), an independent business analysis and consultancy group focused on the mining, metals, power, cables, fertilizer and chemical sectors, and other research consultants, as well as our own estimates relying on our managements knowledge and experience in the markets in which we operate. Our managements knowledge and experience is based on information obtained from our customers, distributors, suppliers, trade and business organizations and other contacts in the markets in which we operate. We believe these estimates to be accurate as of the date of this prospectus. However, the information may prove to be inaccurate because of the method by which we obtained some of the data for our estimates or because this information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. As a result, you should be aware that market, ranking and other industry data included in this prospectus, and our estimates and beliefs based on that data, may not be reliable. Neither we, the selling shareholder nor the underwriters can guarantee the accuracy or completeness of any such information contained in this prospectus.

TRADEMARKS

We own or have rights to trademarks, service marks or trade names that we use in connection with the operation of our business. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus are listed without the ® and TM symbols, but we will assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names.

PRESENTATION OF FINANCIAL INFORMATION

We prepare and report our consolidated financial statements in accordance with accounting principles generally accepted in the United States, which we refer to as U.S. GAAP. We maintain our books and records in U.S. dollars.

We operate on a fiscal year calendar ending on March 31 of each year. Accordingly, any references in this prospectus to the years ended March 31, 2023, 2022 and 2021 or to the fiscal years 2023, 2022 and 2021 refer to the twelve-month periods ended March 31, 2023, 2022 and 2021, respectively. Analogous convention is used for the fiscal years prior to March 31, 2021.

We have made rounding adjustments to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that precede them.

In this prospectus, unless otherwise specified, all monetary amounts are in U.S. dollars and all references to $ mean U.S. dollars. The assets and liabilities of our foreign operations, whose functional currency is other than the

| ii |

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

U.S. dollar, are translated to U.S. dollars at the period end exchange rates, and revenues and expenses are translated at average exchange rates for the period, in each case, using the exchange rates published by the relevant central banks. Differences arising from this translation are included in the currency translation adjustment component of accumulated other comprehensive loss and noncontrolling interests, both of which are on our consolidated balance sheets. For all operations, the monetary items denominated in currencies other than the functional currency are remeasured at period-end exchange rates, and transaction gains and losses are included in other (income) expenses, net in our consolidated statements of operations. Non-monetary items are remeasured at historical rates.

NON-U.S. GAAP FINANCIAL MEASURES

We refer to the terms EBITDA, Adjusted EBITDA and Adjusted Free Cash Flow in various places in this prospectus. These are supplemental financial measures that are not prepared in accordance with U.S. GAAP. Although our management uses these non-U.S. GAAP financial measures when planning, monitoring and evaluating our performance, any analysis of non-U.S. GAAP financial measures should be used only in conjunction with results presented in accordance with U.S. GAAP.

EBITDA and Adjusted EBITDA

Novelis defines EBITDA as earnings before interest, taxes, depreciation and amortization. Novelis defines Adjusted EBITDA as earnings before (a) depreciation and amortization; (b) interest expense and amortization of debt issuance costs; (c) interest income; (d) unrealized gains (losses) on change in fair value of derivative instruments, net, except for foreign currency remeasurement hedging activities, which are included in Adjusted EBITDA; (e) impairment of goodwill; (f) gain or loss on extinguishment of debt; (g) noncontrolling interests share; (h) adjustments to reconcile our proportional share of Adjusted EBITDA from non-consolidated affiliates to income as determined on the equity method of accounting; (i) restructuring and impairment (reversal) expenses, net; (j) gains or losses on disposals of property, plant and equipment and businesses, net; (k) other costs, net; (l) litigation settlement, net of insurance recoveries; (m) sale transaction fees; (n) income tax provision (benefit); (o) cumulative effect of accounting change, net of tax; (p) metal price lag; (q) business acquisition and other related costs; (r) purchase price accounting adjustments; (s) income (loss) from discontinued operations, net of tax; and (t) (gain) loss on sale of discontinued operations, net of tax. EBITDA and Adjusted EBITDA are measures commonly used in our industry, and we present EBITDA and Adjusted EBITDA to enhance your understanding of our operating performance. We believe that EBITDA and Adjusted EBITDA are operating performance measures, and not liquidity measures, that provide you with a measure of operating results unaffected by differences in capital structures, capital investment cycles and ages of related assets among otherwise comparable companies.

Our management believes investors understanding of our performance is enhanced by including these non-U.S. GAAP financial measures as a reasonable basis for comparing our ongoing results of operations. Many investors are interested in understanding the performance of our business by comparing our results from ongoing operations from one period to the next and would ordinarily add back items that are not part of normal day-to-day operations of our business. By providing these non-U.S. GAAP financial measures, together with reconciliations, we believe we are enhancing investors understanding of our business and our results of operations, as well as assisting investors in evaluating how well we are executing strategic initiatives.

However, EBITDA and Adjusted EBITDA are not measurements of financial performance under U.S. GAAP, and our EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies. EBITDA and Adjusted EBITDA have important limitations as an analytical tool, and you should not consider them in isolation or as a substitute for analysis of our results as reported under U.S. GAAP. For example, EBITDA and Adjusted EBITDA:

| | do not reflect our cash expenditures or requirements for capital expenditures or capital commitments; |

| iii |

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

| | do not reflect changes in, or cash requirements for, our working capital needs; and |

| | do not reflect any costs related to the current or future replacement of assets being depreciated and amortized. |

Additionally, our senior secured credit facilities, 3.25% senior notes due 2026, 3.375% senior notes due 2029, 4.75% senior notes due 2030, and 3.875% senior notes due 2031 provide for adjustments to EBITDA, which may decrease or increase Adjusted EBITDA for purposes of compliance with certain covenants under such facilities and notes. We also use EBITDA and Adjusted EBITDA:

| | as measures of operating performance to assist us in comparing our operating performance on a consistent basis because it removes the impact of items not directly resulting from our core operations; |

| | for planning purposes, including the preparation of our internal annual operating budgets and financial projections; |

| | to evaluate the performance and effectiveness of our operational strategies; and |

| | to calculate incentive compensation payments for our key employees. |

We also present our financial leverage ratio in this prospectus, which represents the ratio of our total debt less cash and cash equivalents to our Adjusted EBITDA, to monitor compliance with covenants in agreements governing our outstanding indebtedness and to assess our liquidity position over time.

Adjusted Free Cash Flow

Novelis defines Adjusted Free Cash Flow as: (a) Net cash provided by (used in) operating activitiescontinuing operations, (b) plus Net cash provided by (used in) investing activitiescontinuing operations, (c) plus Net cash provided by (used in) operating activitiesdiscontinued operations, (d) plus Net cash provided by (used in) investing activitiesdiscontinued operations, (e) plus cash used in the Acquisition of assets under a finance lease, (f) plus cash used in the Acquisition of business and other investments, net of cash, (g) plus accrued merger consideration, (h) less Proceeds from sales of assets and business, net of transaction fees, cash income taxes and hedging, and (i) less proceeds from sales of assets and business, net of transaction fees, cash income taxes and hedgingdiscontinued operations.

Our management believes Adjusted Free Cash Flow is relevant to investors as it provides a measure of the cash generated internally that is available for debt service and other value creation opportunities. In addition, management uses this measure as a key consideration in determining the amounts to be paid as returns of capital to our common shareholder.

However, Adjusted Free Cash Flow is not a measurement of financial performance or liquidity under U.S. GAAP and does not necessarily represent cash available for discretionary activities, as certain debt service obligations must be funded out of Adjusted Free Cash Flow. In addition, our method of calculating Adjusted Free Cash Flow may not be consistent with that of other companies.

For more information regarding these non-U.S. GAAP financial measures and a reconciliation of such measures to the most directly comparable U.S. GAAP financial measures, see Prospectus SummarySummary Historical Condensed Consolidated Financial Information.

SEGMENT LEVEL PROFITABILITY

ASC 280, Segment Reporting, establishes the standards for reporting information about segments in financial statements. In applying the criteria set forth in ASC 280, we have determined that we have four reportable segments for financial reporting purposes, based on geographical areas: North America, Europe, Asia, and South

| iv |

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

America. Under ASC 280, our measure of segment profitability and financial performance of our operating segments is Adjusted EBITDA. Adjusted EBITDA by segment provides a measure of our underlying segment results that is in line with our approach to risk management. For each segment, we define Adjusted EBITDA Income as earnings before (a) depreciation and amortization; (b) interest expense and amortization of debt issuance costs; (c) interest income; (d) unrealized gains (losses) on change in fair value of derivative instruments, net, except for foreign currency remeasurement hedging activities, which are included in Adjusted EBITDA; (e) impairment of goodwill; (f) gain or loss on extinguishment of debt, net; (g) noncontrolling interests share; (h) adjustments to reconcile our proportional share of Adjusted EBITDA from non-consolidated affiliates to income as determined on the equity method of accounting; (i) restructuring and impairment (reversal) expenses, net; (j) gains or losses on disposals of property, plant and equipment and businesses, net; (k) other costs, net; (l) litigation settlement, net of insurance recoveries; (m) sale transaction fees; (n) income tax provision (benefit); (o) cumulative effect of accounting change, net of tax; (p) metal price lag; (q) business acquisition and other related costs; (r) purchase price accounting adjustments; (s) income (loss) from discontinued operations, net of tax; and (t) loss on sale of discontinued operations, net of tax. Refer to Results of OperationsSegment Review for more information on Adjusted EBITDA as a measure of our segment level profitability.

PRESENTATION OF SHIPMENT INFORMATION

We present product shipment information throughout this prospectus. As used herein, consolidated aluminum rolled product shipments, rolled products shipments or shipments refers to aluminum rolled product shipments to third parties. For our operating segments, regional aluminum rolled product shipments, rolled products shipments or shipments refers to aluminum rolled product shipments to third parties and intersegment shipments to other regions. Shipment amounts also include tolling shipments. References to total shipments include aluminum rolled product shipments as well as certain other non-rolled product shipments, primarily scrap, used beverage can scrap, ingots, billets, and primary remelt. The term aluminum rolled products is synonymous with the terms flat-rolled products and FRP, which are commonly used by manufacturers and third-party analysts in our industry. All tonnages are stated in metric tonnes. One metric tonne is equivalent to 2,204.6 pounds. One kilotonne (kt) is 1,000 metric tonnes. One megaton (mt) is 1000 kilotonnes. See the subsections titled Key Sales and Shipment Trends and Segment Review under the caption Managements Discussion and Analysis of Financial Condition and Results of Operations Results of Operations for more information. We also refer to Adjusted EBITDA per tonne (which is calculated by dividing Adjusted EBITDA by rolled product shipments (in tonnes) for the corresponding period), both on a consolidated basis and at the segment level. Adjusted EBITDA per tonne is calculated using aluminum rolled product shipments rather than total shipments because the incremental impact of non-rolled products shipments on our Adjusted EBITDA is marginal since the price of these products is generally set to cover the costs of raw materials not utilized in manufacturing products sold to beverage packaging customers, specialties and aerospace customers in our regions, and these non-rolled products are not part of our core operating business. Adjusted EBITDA reported for the Company on a consolidated basis is non-U.S. GAAP financial measure; for more information regarding this non-U.S. GAAP financial measure, see Non-U.S. GAAP Financial Measures above, and for a reconciliation of such measure to the most directly comparable U.S. GAAP financial measure, see Prospectus SummarySummary Historical Condensed Consolidated Financial Information. Adjusted EBITDA reported at the segment level is our segment level measure of profitability, and therefore a financial measure prepared in accordance with U.S. GAAP.

| v |

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before deciding to invest in our common shares, you should read this entire prospectus carefully, including the sections of this prospectus entitled Risk Factors, Special Note Regarding Forward-Looking Statements and Managements Discussion and Analysis of Financial Condition and Results of Operations, our audited annual consolidated financial statements and the related notes and our unaudited interim condensed consolidated financial statements and the related notes contained elsewhere in this prospectus.

Our Business

Our Purpose and Vision. Novelis purpose of Shaping a Sustainable World Together is at the core of who we are. Our purpose guides our strategy and the way we work, the decisions we make and the partnerships we pursue. In line with our purpose, our vision is to be the Leading Provider of Sustainable and Innovative Aluminum Solutions. Our customers around the world rely on us for sustainable solutions and products, and we make positive contributions in the communities where we live and work.

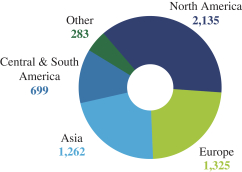

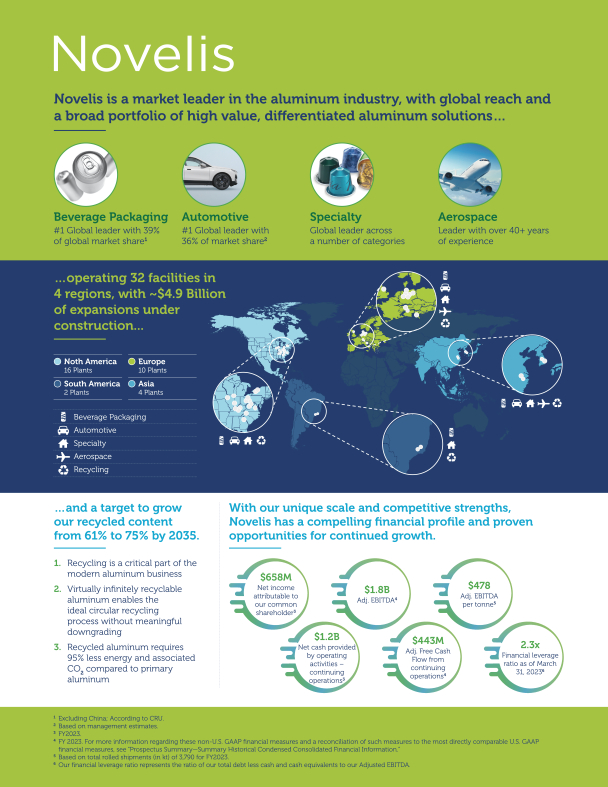

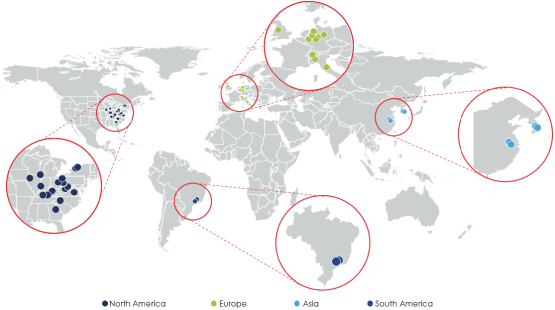

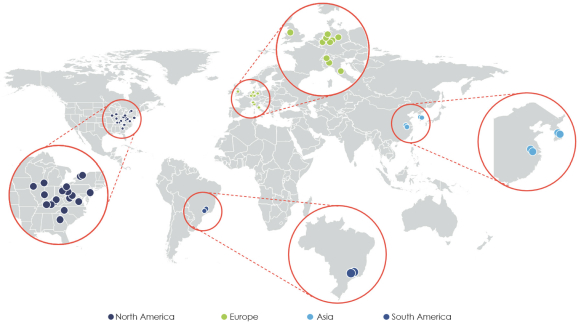

Our Company. We consider ourselves the leading producer of innovative, sustainable aluminum solutions and the worlds largest recycler of aluminum. Specifically, we believe we are the leading provider of low-carbon aluminum solutions, helping to drive a circular economy by partnering with our suppliers and customers in beverage packaging, automotive, aerospace and specialties (a diverse market including building & construction, signage, foil & packaging, commercial transportation and commercial & consumer products, among others) markets globally. Throughout North America, Europe, Asia, and South America, we have an integrated network of 32 world-class, technologically advanced facilities, including 14 recycling centers, 11 innovation centers, and 13,160 employees.

Aluminum is the sustainable material of choice for a wide range of growing end-markets that require strong, yet lightweight, sustainable solutions. The virtually infinite recyclability of aluminum is essential to our innovative circular business model. With operations on four continents in nine countries, we consider our global scale to be a distinct competitive advantage. In addition, our leading position in aluminum recycling combined with our cutting-edge operational processes provides us with an advantaged cost position, increasing our operating cash flow. For fiscal 2023, we had total flat-rolled product shipments of 3,790 kt, net sales of $18.5 billion, net income of $657 million, and Adjusted EBITDA of $1,811 million.

Our Value Proposition. We are a critical partner for the delivery of innovative, high-quality aluminum solutions that help our customers achieve their long-term growth strategies and sustainability targets. We are strategically positioned to deliver our value proposition due to the following attributes of our business model:

Global Footprint and Scale. We are the worlds largest global aluminum rolled products producer with a broad portfolio of high-value aluminum products designed to meet our customers technical, quality and sustainability requirements. We believe our scale, recycling capabilities, research and development (R&D) competencies, and global footprint across four continents underpin our highly resilient business model, which is characterized by attractive growth opportunities, the ability to add new capacity, and the capability to support our customers with innovative and sustainable solutions.

| 2 |

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

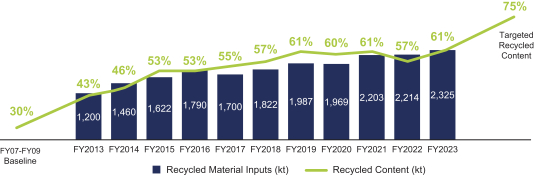

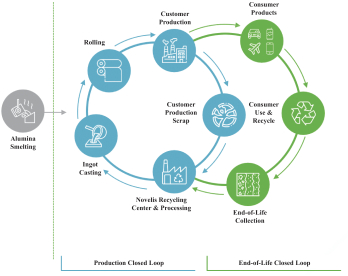

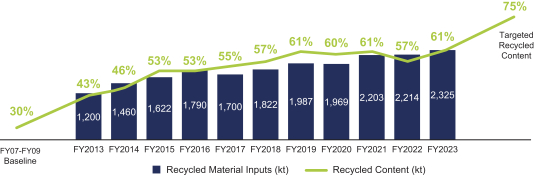

Sustainability. The virtually infinite recyclability of aluminum positions us at the focal point of the circular economy. We believe we recycle more aluminum than any other company in the world, having recycled approximately 2.3 mt in fiscal 2023, our all-time high. Since fiscal 2012, we have invested heavily to innovate and expand our aluminum recycling operations to increase the recycled content of our solutions to an industry leading level. We are an essential partner to our blue-chip customers to enable the achievement of their sustainability goals, which are being driven, in part, by end-consumers. Key components of our innovative circular business model include:

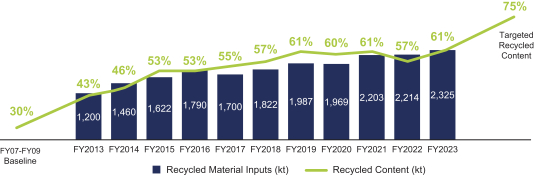

| | High Recycled Content. We have steadily increased recycled content to approximately 61% on average across our diverse portfolio. This represents approximately a 2x increase since we established a baseline in 2009. Our target is to achieve an average of 75% recycled content across our product portfolio by 2035. |

| | Recycling Capacity and Capabilities. We have invested approximately $800 million to expand our recycling capabilities since 2012, including new recycling and casting centers under construction in the U.S. and South Korea and other expansions under evaluation. |

| | End-of-Life Packaging Recycling. Today, we recycle more than 82 billion used beverage cans (UBCs) annually. Through investments such as the new recycling capacity being added in Bay Minette, Alabama, we expect to increase this to more than 95 billion at full production. |

| | Closed Loop Recycling. We have established programs with our beverage packaging customers to recycle their production scrap. Additionally, we believe we are the worlds largest closed loop aluminum recycling partner to the automotive industry, recycling production scrap of aluminum supplied to some of the worlds largest automotive original equipment manufacturers (OEMs). We have two of the worlds largest closed loop recycling programs in the U.S. and Europe. |

| | Sustainable Sourcing. We partner with suppliers that align with our values to drive sustainability throughout our value chain related to carbon reduction, limiting waste produced, and providing a positive community impact. |

| | Low CO2 Operations. We are actively developing and implementing new technologies to reduce our CO2 footprint, such as programs in Switzerland and North America with utility companies to explore new technologies to decarbonize the aluminum manufacturing process. Beyond direct manufacturing |

| 3 |

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

| emissions, we are continuously exploring options to reduce carbon emissions in logistics, such as closed loop rail systems in Europe created in collaboration with automotive customers. |

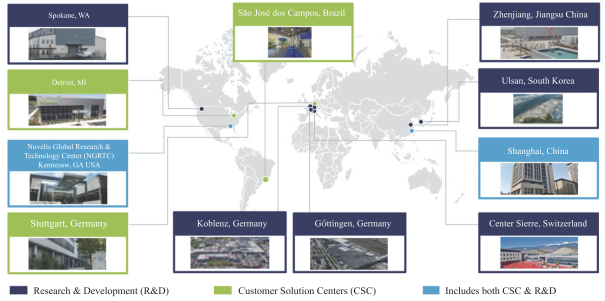

Innovation. Utilizing our industry-leading technology, we partner with customers to support market development for innovative and sustainable solutions across all end-markets. We focus our innovation efforts on pushing the limits on aluminum alloys, advancing customers product designs and improving our own process engineering and production techniques. Key components that support the needs of our customers include:

| | Customer Solution Centers (CSCs). Through our robust global network of automotive and beverage packaging CSCs, we collaborate with customers and others across the value chain to accelerate the adoption of aluminum in next-generation products. |

| | Research & Development. Leveraging our global network of R&D centers, we develop new alloys and techniques to keep aluminum at the forefront of materials and pioneer new technologies to expedite the materials innovation cycle, including artificial intelligence (AI) and machine learning. We also have a dedicated team of recycling, casting, rolling, and finishing experts who pioneer advancements in aluminum manufacturing. |

Customer Testimonial

| | Ball Corporation |

Aluminum beverage packaging has always been a more sustainable alternative to plastic and glass that not only benefits our customers and end consumers, but also the planet. For us at Ball Corporation, our Vision for a Perfect Circle guides our efforts to advance the circular economy for aluminum beverage packaging. Novelis is critical to our ability to achieve our sustainability ambitions and working with us to develop innovative solutions that further reduce our carbon footprint. In addition, Novelis has been a longstanding strategic supplier supporting our growth globally through investments to expand their can sheet capacity.

Dan Fisher, CEO, Ball Corporation

| | Jaguar Land Rover |

Novelis expertise in high-volume aluminum production and willingness to invest to better serve the automotive industry drove our decision to collaborate with the company when transitioning many of our marque vehicles to aluminum-intensive designs. We have benefitted from Novelis proven ability to bring innovative, circular, and long-lasting quality products to market. Jaguar led the way as an earlier adopter of aluminum in the automotive industry, so it was critical for us to select the right partner as our primary aluminum sheet supplier. Thats why it was so important for our teams to

| 4 |

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

collaborate and build infrastructure with the circular economy in mind from the start ensuring JLRs aluminum process scrap is recycled directly back into automotive sheet. Together, we created a truly closed-loop-recycling system utilizing low-carbon rail that embodies JLRs vision Engage for Good and Responsible Business programmes.

Andrew Smith, Procurement Director Raw Materials, Jaguar Land Rover

| | Trane Technologies |

As a global climate innovator, Trane Technologies brings efficient and sustainable climate solutions to buildings, homes, and transportation. Novelis has been a strategic supplier of ours for many years. Building on our shared commitment to sustainability and a solid foundation of quality and reliability, Trane Technologies and Novelis are jointly developing new alloys that incorporate a higher recycled content in support of a circular economy, which helps us reduce embodied carbon in the products we provide to our customers.

Dave Regnery, Chair and CEO Trane Technologies

Our Portfolio Optimization. Since becoming a subsidiary of Hindalco Industries in 2007, we have undergone a significant transformation. We have made numerous strategic investments that we believe position us well to achieve long-term growth and profitability:

| | Breadth of Offering. We made calculated portfolio changes through M&A and organic investments to diversify and optimize our capacity across end-markets by (i) becoming, to our belief, the world leader in automotive aluminum solutions, (ii) expanding high recycled content in our specialties business and pruning the portfolio of lower margin products, and (iii) adding aerospace in key geographic regions. |

| | Operational Flexibility. We have been at the forefront of aluminum manufacturing advancements and adoption of new processes, which has enabled maximum flexibility in our operations. Our footprint and market segment positioning are continuously evaluated based on regional supply and demand dynamics with a focus on margin expansion. |

| | M&A. We acquired global aluminum producer Aleris Corporation (Aleris) in 2020, diversifying and strengthening our portfolio with entry into high-value aerospace and expansion of our high-recycled-content building and construction business. We currently have potential investments under evaluation for the integration of legacy Aleris rolling mill in China, which would enable automotive rolling and recycling in China for Novelis and allow us to offer closed-loop recycling to our customers in China. These investments would also further increase circularity in the Chinese automotive market and reduce our CO2 footprint. Additionally, increasing rolling capacity in China will free up existing rolling capacity in South Korea, enabling us to better serve the growing specialties market in the region. |

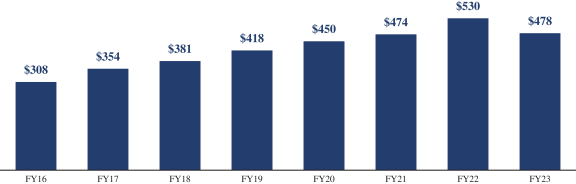

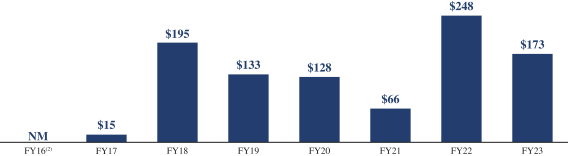

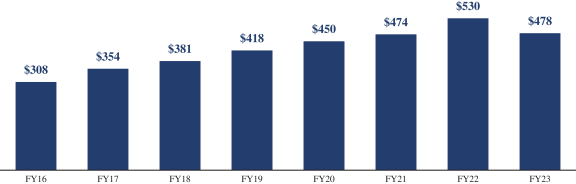

Our Track Record. We have experienced substantial growth over the last decade, driven by our own initiatives that have contributed to robust end-market growth and strong operational performance. As a result, we increased our net income from a loss of $38 million in fiscal 2016 to net income of $657 million in fiscal 2023 and increased net income per tonne from $(12) in fiscal 2016 to $173 in fiscal 2023. We also increased Adjusted EBITDA per tonne from $308 in fiscal 2016 to $478 in fiscal 2023. Key components of our historical growth and margin expansion include:

| | Transformational Organic Investment. We invested approximately $3.2 billion from fiscal 2012 through fiscal 2023 in organic growth capex, expanding our rolling and recycling capacity, as well as automotive finishing capacity, to meet market demand. Looking forward, we have approximately $4.9 billion of investments under construction through 2027 to further increase recycling and rolling capacity and profitability. Of this $4.9 billion we plan to invest through 2027, approximately $350 million was spent in fiscal 2023. The largest of these investments currently under construction is a greenfield recycling and rolling plant in Bay Minette, Alabama, to primarily serve the North American beverage packaging and |

| 5 |

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

| automotive markets. We have materially contracted or committed our beverage packaging capacity that will be available in North America through the ramp-up of operations of our Bay Minette, Alabama plant. Beyond the approximately $4.9 billion of announced investments, we continue to evaluate further opportunities based on financial returns and underlying market conditions. |

| | Proven Resilience Through Recent Macroeconomic Headwinds and Destocking. Our industry experienced an unprecedented period of short-term demand softness and increased cost pressure driven by inflation and energy volatility and supply disruptions in fiscal 2023. We also experienced end-market challenges with supply chain disruption and beverage packaging destocking actions, which negatively impacted shipment volumes and profitability, leading to a trough in net income per tonne and Adjusted EBITDA per tonne in the third quarter of fiscal 2023, as compared to highs in the first quarter of fiscal 2023. Due to the diversity of the end-markets in which we operate, our global scale, and operational excellence, we proved our resilience and sequentially improved profitability again in the second quarter of fiscal 2024. |

| | M&A. The acquisition of Aleris in 2020 has been highly accretive both in terms of market positioning and synergies, with cost synergies exceeding expectations. |

| | End-Market Growth. We believe our strategic initiatives have shaped the global aluminum flat-rolled products (FRP) industry and enabled robust growth as FRP consumption grew more than 70% over the past 15 years to approximately 30 million tonnes in 2023, per CRU.2 Aluminum FRP consumption is forecasted to grow at a 4% compound annual growth rate from 2023 to 2028, which Novelis is well positioned to capture. |

| | Advantaged Recycling Cost Position. We believe our efficiencies in recycling operations, industry-leading technology and buying power will position us well to the extent scrap prices fluctuate. Our vast footprint provides us the ability to benefit from economies of scale when procuring scrap, expertise to develop and implement best practices to reduce costs, and the ability to influence scrap generation. |

| | Production Efficiencies. We have implemented digital technologies and advanced analytics to improve recovery, throughput, and quality, driving operational efficiencies and improving profitability. We are implementing a Plant of the Future model that will further utilize digital technologies, AI, and robotics in new and existing plants. |

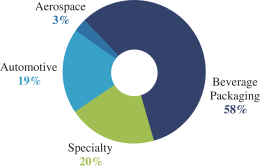

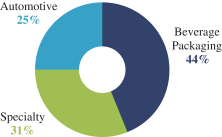

Our Business Segments

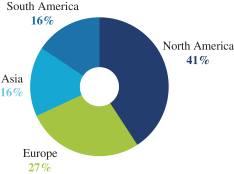

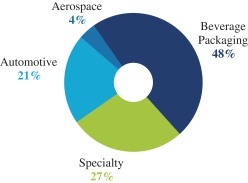

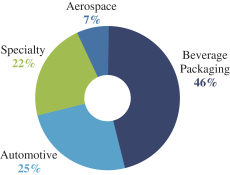

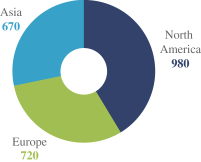

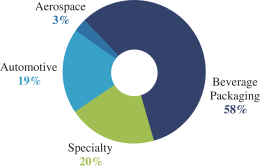

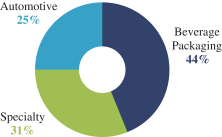

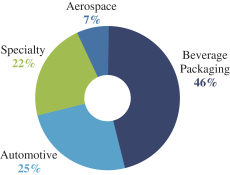

We report our results of operations in four segments: North America, Europe, Asia, and South America. Due in part to the regional nature of supply and demand for aluminum solutions and to best serve our customers, we manage our activities based on geographic areas. The following charts show net sales by geography and net sales and shipments by end-product market for fiscal 2023.

| Novelis Global Net Sales by Geographic Region

|

Novelis Global Net Sales by End-Market

|

| 2 | Source: CRU Aluminium Rolled Products Market Outlook, November 2023. All CRU references to the broader aluminum rolled products market are derived from this report. |

| 6 |

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

Novelis Global Shipments by End-Market

North America Segment

Headquartered in Atlanta, Georgia, Novelis North America consists of 16 plants, including recycling operations, across two countries. We consider ourselves the leader in aluminum recycling and production in North America. In North America, we generated $7,550 million in net sales, $673 million in Adjusted EBITDA, and 1,515 kt in rolled product shipments, resulting in $444 in Adjusted EBITDA per tonne for fiscal 2023. Compared to fiscal 2016, our fiscal 2023 performance saw increases of $335 million in Adjusted EBITDA, 483 kt in rolled product shipments, and $116 in Adjusted EBITDA per tonne across our North American segment.

We believe we hold the number one position in the beverage packaging and automotive markets in North America. Beverage packaging represents our largest market within North America, selling 672 kt in fiscal 2023. The specialties segment is the second largest end-market in the region, selling 463 kt in fiscal 2023. The balance of the portfolio is from our leading position in the automotive market, selling 380 kt in fiscal 2023.

Across our 16 plants, our aluminum rolling capacity is approximately 1.5 mt. In addition, we have both R&D centers and CSCs strategically located across North America. Our global casting, engineering and technology center in Spokane, Washington, specializes in molten metal processing. This group seeks to ensure Novelis is always developing and adopting best practices related to recycling and molten aluminum processing, globally. Our global research and technology center in Kennesaw, Georgia, offers state of the art research and development capabilities to help us meet the global long-term demand for aluminum used across all our product markets and geographies. Kennesaw, Georgia is also home to our beverage packaging CSC and can-making pilot line, where we test our products on pre-production lines similar to those used by our beverage packaging customers. We also operate an automotive CSC in Detroit, Michigan.

Due to strong consumer demand for sustainable aluminum products, particularly beverage packaging and automotive sheet, we currently have various debottlenecking, recycling, and new capacity capital investment projects under construction, including projects to expand rolling capacity in Oswego, New York, and Logan, Kentucky, and to construct a highly advanced automotive recycling facility in Guthrie, Kentucky. We have also broken ground on an investment of approximately $4.1 billion to build a fully integrated, greenfield rolling and recycling plant in Bay Minette, Alabama, with an annual rolled aluminum production capacity of 600 kt. We have materially contracted or committed our beverage packaging capacity that will be available in North America through the ramp-up of operations of our Bay Minette, Alabama plant, including with decades-long customer partners such as Ball Corporation, Coca-Cola and Ardagh Metal Packaging, underscoring the strong demand for high-recycled-content beverage packaging sheet.

| 7 |

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

Novelis North America End-Market Shipment Mix

Europe Segment

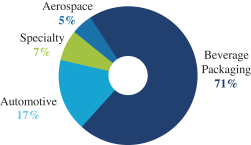

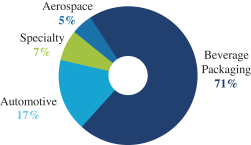

Headquartered near Zurich, Switzerland, Novelis Europe operates 10 plants across four countries, including recycling operations. We consider ourselves the leader in aluminum recycling and rolling in Europe. We generated $5,059 million in net sales, $286 million in Adjusted EBITDA, and 1,030 kt in rolled product shipments, resulting in $278 in Adjusted EBITDA per tonne in Europe for fiscal 2023. Compared to fiscal 2016, our fiscal 2023 performance saw increases of $83 million in Adjusted EBITDA, 52 kt in rolled product shipments, and $70 in Adjusted EBITDA per tonne across our European segment. We hold a leading position within the European beverage packaging and automotive end-markets.

The beverage packaging end-market represents our largest market within Europe, selling 476 kt in fiscal 2023. The second largest end-market is the automotive market, selling 255 kt in fiscal 2023. The specialties market is the third largest end-market, selling 232 kt in fiscal 2023. The remainder of sales are from the aerospace industry, selling 67 kt in fiscal 2023.

Across our European plants, our aluminum rolling capacity is approximately 1.2 mt. These manufacturing plants produce a broad range of sheet, plate, and foil products. We believe our Nachterstedt plant is one of the largest aluminum recycling plants in the world. Additionally, we have multiple centers dedicated to innovation in Europe. We have an automotive R&D center in Sierre, Switzerland and an R&D center in Göttingen, Germany, which specializes in the development of new products and processes for our beverage packaging and specialties customers. We also have an automotive CSC in Stuttgart, Germany. Due to strong consumer demand for sustainable aluminum products, we are evaluating additional rolling and recycling capacity expansion in Europe moving forward.

Novelis Europe End-Market Shipment Mix

| 8 |

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

Asia Segment

Headquartered in Seoul, South Korea, Novelis Asia operates four plants, including recycling operations, in two countries. We are a leading aluminum producer and believe we are the largest recycler of aluminum in Asia. We generated $3,014 million in net sales, $339 million in Adjusted EBITDA, and 721 kt in rolled product shipments, resulting in $470 in Adjusted EBITDA per tonne in Asia for fiscal 2023. Compared to fiscal 2016, our fiscal 2023 performance saw an increase of $197 million in Adjusted EBITDA, a decrease of 39 kt in rolled product shipments, and an increase of $283 in Adjusted EBITDA per tonne across our Asian segment.

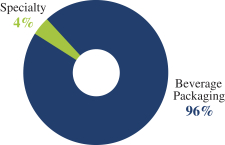

We hold a leading position within the Asian beverage packaging and automotive end-markets. Beverage packaging represents our largest market in Asia, selling 509 kt in fiscal 2023. The automotive end-market represents the second largest end-market in the region, selling 121 kt in fiscal 2023. Specialties is the third largest end-market, selling 52 kt in fiscal 2023. The remainder of sales are from the aerospace industry, selling 39 kt in fiscal 2023.

Across our plants, our rolling capacity is approximately 0.8 mt. These manufacturing plants produce a broad range of aluminum sheet, plate, and light gauge products. In fiscal 2022, we completed a 100 kt automotive finishing capacity expansion at our Changzhou, China facility. In South Korea, we are currently expanding our recycling capacity and capabilities with an approximately $65 million recycling capacity expansion as part of our Ulsan Aluminum joint venture. We also have plans under evaluation to invest in our plant in Zhenjiang, China, aimed at enabling domestic automotive rolling and recycling capabilities. We have an aerospace innovation center in Zhenjiang, an R&D center and an automotive CSC in Shanghai, China, and an R&D center as part of our joint venture in Ulsan, South Korea.

Novelis Asia End-Market Shipment Mix

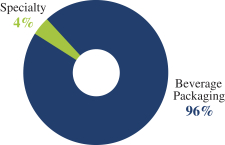

South America Segment

Headquartered in São Paulo, Brazil, Novelis South America operates two plants, including recycling operations, in one country. We consider ourselves the leader in aluminum recycling and production in South America. We hold a top position within the South American beverage packaging market. In South America, we generated $2,893 million in net sales, $522 million in Adjusted EBITDA, and 616 kt in rolled product shipments for fiscal 2023, resulting in $847 in Adjusted EBITDA per tonne. Compared to fiscal 2016, our fiscal 2023 performance saw increases of $242 million in Adjusted EBITDA, 126 kt in rolled product shipments, and $276 in Adjusted EBITDA per tonne across South America. Beverage packaging represents our largest market in the region, selling 591 kt in fiscal 2023. Additionally, we produce products to serve the specialties end-market, selling 25 kt in fiscal 2023.

| 9 |

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

Across our plants, our rolling capacity is approximately 0.7 mt. In fiscal 2022, we completed a $150 million investment to expand both rolling and recycling capacity by 100 kt each at our Pindamonhangaba facility. In March 2023, we opened our newest CSC, which is focused on supporting the South American beverage packaging market and is located in São José dos Campos, Brazil. Due to strong consumer demand for sustainable aluminum products, in fiscal 2022, we announced an approximately $50 million debottlenecking investment at our Pindamonhangaba plant to unlock approximately 70 kt of additional rolling capacity in a two-phase project, with full completion expected in fiscal 2026. We are evaluating additional rolling and recycling capacity expansions.

Novelis South America End-Market Shipment Mix

Our Industry

The aluminum market represents the global supply of, and demand for, aluminum sheet, plate and foil produced either from sheet ingot or continuously cast roll-stock in rolling mills operated by both independent aluminum rolled products producers and integrated aluminum companies. Specifically, aluminum rolled products are semi-finished aluminum products that constitute the raw material for the manufacturing of finished goods, ranging from beverage packaging, which includes cans, cups and bottles, to automotive structures and body panels.

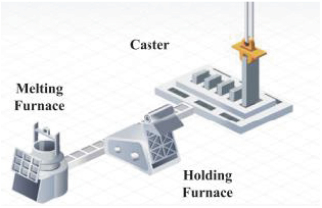

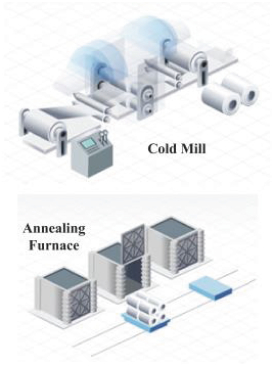

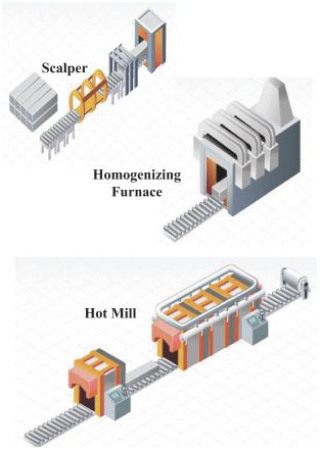

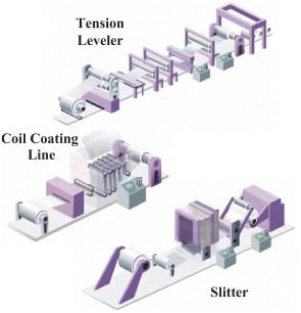

There are two major types of manufacturing processes for aluminum products, differing mainly in the process used to achieve the initial stage of processing: hot mills, which require sheet ingot, a rectangular slab of aluminum, as starter material; and continuous casting mills, which can convert molten metal directly into semi-finished sheet.

Sources of Metal

There are two sources of input material: (i) primary aluminum, produced from alumina (extracted from bauxite), processed in a smelter; and (ii) recycled aluminum, produced by remelting post-industrial and post-consumer scrap.

Primary aluminum can generally be purchased at prices set on the London Metal Exchange (LME), plus a local market premium (LMP) that varies by geographic region of delivery, alloying material, form (ingot or molten metal) and purity. Recycled aluminum is generally produced internally from procured scrap or purchased at a discount compared to the price of primary aluminum depending on type and quality of the scrap, geographic region, and other market factors. A significant amount of our business is conducted under a conversion model, which allows us to pass through increases or decreases in the price of aluminum to our customers.

We believe Novelis is a global leader in sustainable aluminum product manufacturing, recycling 2.3 mt of aluminum in fiscal 2023. We have invested approximately $800 million in our recycling capabilities since 2012,

| 10 |

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

increasing the recycled content of our products to be one of the highest levels in the industry. We have announced additional recycling investments to increase our leadership position. By utilizing recycled aluminum for much of our manufacturing, we limit the carbon intensity of our operations because using recycled aluminum is 95% less carbon intensive than making primary aluminum. Incorporating as much recycled aluminum as possible into products is one of the most impactful ways to reduce carbon emissions across the global aluminum value chain. To secure Novelis access to scrap, we design alloys with the flexibility to use multiple sources of scrap, partner with our customers and suppliers through long-term relationships including closed-loop-recycling partnerships, support the development of scrap sorting technologies, educate consumers on the value of recycling and support legislation aimed at increasing recycling rates.

Industry End-Markets

Due to aluminums lightweight characteristics, recyclability, and formability properties, aluminum product companies serve a diverse set of end-markets including beverage packaging, automotive, aerospace, and a variety of other end-markets.

Beverage Packaging. Aluminum is one of the most sustainable packaging materials for beverage brands. In addition to its recyclability, aluminum beverage cans and bottles offer advantages in fabricating efficiency and drink product shelf life. Beverage packaging manufacturers produce and fill beverage cans at very high speeds, and non-porous aluminum cans provide longer shelf life than glass or plastic containers. Aluminum beverage packaging is light and stackable and uses space efficiently, making it convenient and cost-efficient to ship.

According to CRU, global demand (excluding China) for beverage packaging is forecasted to increase at a compound annual growth rate of approximately 4% from 2023 to 20313 mainly driven by:

| | Sustainability trends. Consumers are increasingly demanding more sustainable packaging options, driving increased adoption of virtually infinitely recyclable aluminum. |

| | Growth in beverage markets. New beverage types, such as energy drinks, sparkling and flavored water, and ready-to-drink cocktails are increasingly released in aluminum packaging, with even further potential growth in aluminum-packaged water. |

| | Substitution against glass, steel and plastic. Package mix shift from other materials like glass, steel and plastic into aluminum is continuing. |

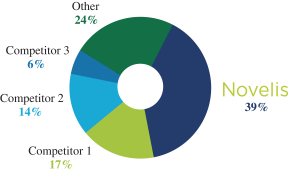

| 2023 Global Beverage Packaging Consumption (kt)

Source: CRU Aluminium Beverage Can Sheet Market Outlook October 2023 Note: Excludes China |

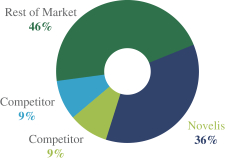

2023 Global Beverage Packaging Market Share

Source: CRU Aluminium Beverage Can Sheet Market Outlook October 2023 Note: Excludes China |

| 3 | Source: CRU Aluminium Beverage Can Market Outlook, October 2023. All CRU references to the broader aluminum beverage can market are derived from this report. |

| 11 |

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

We are the global leader in beverage packaging sheet with 39% global market share (excluding China) in the 2023 calendar year according to CRU, while also being the leading buyer and recycler of UBCs globally recycling more than 82 billion cans annually and we expect this to increase to more than 95 billion cans upon completion of the Bay Minette, Alabama plant. We view our global footprint as an advantage as we believe geopolitical instability and supply chain risk have increased beverage packaging manufacturers desire for local supply. Aluminum beverage packages are the model of sustainable packaging as the average can-to-can lifecycle enables a beverage package that is recycled today and which could be back on store shelves in just 60 days. Aluminums properties enable a circular recycling process without meaningful downgrading, which contributes to a circular economy. With aluminum being one of the most sustainable packaging materials for beverages, demand for recyclable aluminum remains strong, despite potential substitutes for our products that customers may be willing to accept, such as glass or plastics. Novelis works with its customers to develop improved and more sustainably efficient aluminum solutions at dedicated beverage packaging innovation facilities, including our global research and technology center in Kennesaw, Georgia, as well as our R&D centers in Göttingen, Germany and as part of our joint venture in Ulsan, South Korea, and our new customer solution center in São José dos Campos, Brazil. Enabled by our global manufacturing and recycling footprint, Novelis serves some of the worlds most recognizable brands including Coca-Cola, AB InBev, PepsiCo and Heineken, as well as leading beverage packaging manufacturers Ball Corporation, Crown, Ardagh Metal Packaging and CanPack.

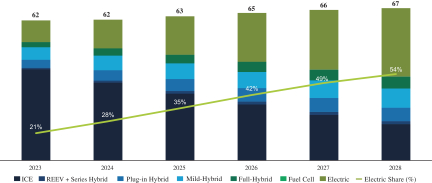

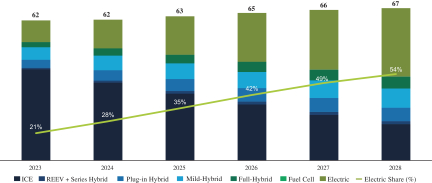

Automotive. Aluminum utilization is positioned for continued growth through increased adoption of electric vehicles (EVs), which require higher amounts of aluminum. This is compounded by government regulations requiring improved emissions for internal combustion engine (ICE) vehicles, while also maintaining and improving vehicle performance and safety through lightweighting. Aluminum products are used in vehicle structures (also known as body-in-white) as well as automotive body panel applications, including hoods, doors, deck lids, fenders, and lift gates. Aluminum sheet is also used in battery enclosures for the growing EV market and aluminum foil is used in the batteries themselves.

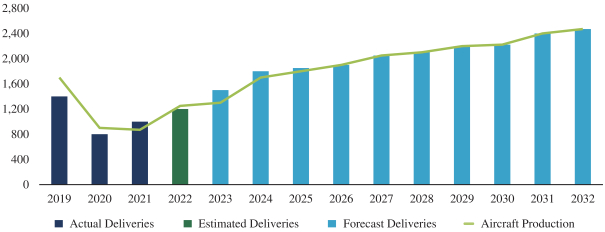

Global Light Vehicle Production

North America, Europe, and Greater China (millions of vehicles)

Source: S&P Global Mobility, Global Light Vehicle Production based Powertrain Forecast for Europe, Greater China and North America, December 2023

Based on management estimates, we believe that global automotive aluminum sheet demand is set to grow at a compound annual growth rate of 7% from calendar year 2023 to calendar year 2028. Further, based on our projections, we believe that during the same period, demand in North America is set to grow at a compound annual growth rate of 5%, demand in Europe is set to grow at 7% and demand in Asia is set to grow at 11%. Automotive demand is expected to be resilient across major markets regardless of elevated interest rates, with pent-up consumer demand driving growth in vehicle build rates. In addition, lightweighting of traditional ICE

| 12 |

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

vehicles to increase fuel efficiency and performance, as well as the switch to EVs, will drive higher aluminum content in vehicles, as well as in new systems like battery enclosures. According to Ducker Carlisle, battery electric vehicle (BEV) growth and a shift to larger vehicles in North America will lead to an increase of aluminum sheet demand of approximately 40% between calendar year 2022 and calendar year 2030. EVs are projected to contain 28% more aluminum sheet per vehicle compared to ICE vehicles in North America in 2030.

| Calendar Year 2023 Global Automotive Demand (kt)

Source: Novelis Management Estimates |

Calendar Year 2023 Global Automotive Aluminum Market Shares

Source: Novelis Management Estimates Share based on approximate capacity |

We believe Novelis is the worlds largest supplier of aluminum sheet to the automotive industry, with a global market share of 36% and finishing capacity of approximately 1mt. Novelis leverages aluminums properties to deliver safer, more sustainable, and more cost-effective solutions for OEMs to lightweight their fleets, improving fuel efficiency and vehicle performance. Our automotive products, including our high-performing Advanz alloys, are featured across hundreds of models on the road today. Novelis provides high-strength aluminum sheet for EVs, enabling increased battery range while giving automakers the ability to add in-vehicle content that enhances the user experience. A lighter EV requires a smaller battery for the same range, which significantly reduces the vehicle cost and the demand for rare elements. Continuously innovating, Novelis has dedicated automotive R&D centers in Sierre, Switzerland and Shanghai, China, as well as CSCs in Detroit, Michigan, Stuttgart, Germany, and Shanghai, China. We enjoy long-standing partnerships with automotive customers globally, including Ford, Jaguar Land Rover, Hyundai, Volvo, Nissan, BMW, Daimler, GM, NIO and Toyota.

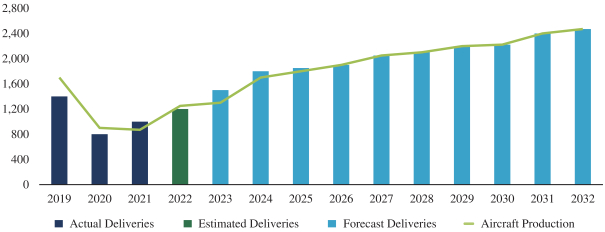

Aerospace. The aerospace industry is building new aircraft to serve a growing number of air passengers and to replace older, less efficient planes with newer, more fuel-efficient models. Aluminum offers a high strength-to-weight ratio, energy efficiency, and high tolerance to extreme temperatures, making it an ideal material for the manufacturing of aircraft. According to Oliver Wymans Global Fleet & MRO Forecast 2023-2032, aircraft production and delivery will remain strong through the end of the forecast in 2032. Based on management estimates, we believe aerospace aluminum demand will grow at a compound growth rate of 5% between 2023 and 2030. Aluminum demand is expected to be above pre-COVID levels in 2024 based on management estimates. In particular, we believe Novelis and aluminum are well positioned with a large share of supply on single-aisle aircraft, which is the fastest growing aerospace segment and today has a significant backlog. According to Boeings Commercial Market Outlook, 76% of aircraft needed over the next 20 years will be single aisle.

| 13 |

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

Source: Oliver Wymans Global Fleet & MRO Forecast 2023-2032

Based on management estimates, we believe Novelis is a leading supplier of aluminum sheet to the aerospace industry. Novelis specializes in the production of aluminum plate and sheet materials for fuselage and wing structure components, and we are qualified at all major aerospace OEMs. Novelis can produce very wide and ultra-thick plates, either heat-treated or non-heat treated. We have also introduced new low-density alloys that translate into better fuel efficiency and lower operating costs for the airline industry. The Aleris acquisition has given us outstanding innovation centers geared specifically toward aerospace solutions in both Koblenz, Germany and Zhenjiang, China. Our Koblenz, Germany plant has been serving the aerospace industry for over 40 years and acted as a technical enabler for the Zhenjiang plant during its ramp-up. Our plant in Zhenjiang allows Novelis to hold the position of being, we believe, the only western aluminum supplier to the aerospace industry with domestic production capabilities in China. We continue to strengthen our relationships with global customers like Airbus, Boeing, Bombardier, and Embraer.

Specialties. Aluminums applications are present in many components of our everyday lives. Aluminum is relied on to create sustainable solutions across markets, including building and construction, commercial transportation, foil & packaging, and commercial & consumer products. These industries continue to increase aluminum material adoption due to its many desirable characteristics. This diverse market is poised for growth due to a fundamentally undersupplied U.S. housing market, growing medium-duty van production driven by e-commerce growth, and consumer demands in coffee capsule and container packaging. In this category, we provide a variety of products across various market segments:

| | Building & Construction. Anodized and pre-painted aluminum designed to meet the exacting requirements of the construction industry, while enabling architects to bring their most innovative and ambitious designs to life in an eco-friendly and cost-effective way. We believe Novelis is a leading supplier of aluminum sheet to the North American building and construction aluminum market. |

| | Signage. Commercial signs, license plates and traffic and road signs. |

| | Foil & Packaging. Containers and lids, trays and complementary accessories, converter foil, bottles, caps & closures, and cartridges. |

| | Commercial Transportation. Mass transportation, such as rail and commercial truck and trailer. We believe Novelis is a leading supplier of aluminum sheet to the commercial transportation industry. |

| | Commercial & Consumer. Durable and attractive finishes on goods ranging from smartphones to appliances. |

| 14 |

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

Our Competitive Strengths

A Leading, High-Value Added, Global Aluminum Solutions Provider and Aluminum Recycler

Novelis is a leading global provider of aluminum solutions for the beverage packaging and automotive markets and holds leading positions in global aerospace and the diverse specialties markets (e.g., building & construction, commercial transportation, foil & packaging, and commercial & consumer products). Our integrated network of 32 production plants strategically located across North America, South America, Europe, and Asia, 14 of which are enabled with recycling capabilities, support approximately 4.2 mt of rolling capacity, which is approximately double the capacity of the next largest producer. We believe our global footprint positions us as the largest flat-rolled products producer and pre- and post-consumer aluminum recycler, driving our industry-leading recycled content levels.

We believe our scale gives us the widest reach and penetration across our end-markets, allowing us to invest in developing unique solutions in collaboration with customers and others in the value chain. We do this through our leading R&D platform, sourcing economies of scale, a reliable and proven supply chain to secure recycled aluminum, attracting and retaining excellent talent and expertise, and being a valued partner to our customers.

We protect our leadership position by striving to deliver best-in-class customer service with high-quality, sustainable, and innovative solutions. Additionally, our strong balance sheet supports strategic investments to accommodate rapidly increasing demand across our product portfolio.

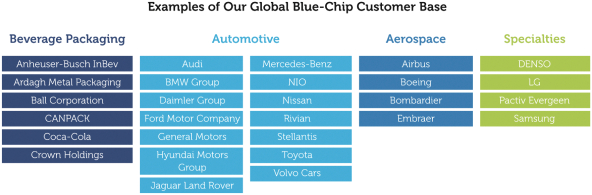

Essential, Long-Standing Partner to Premium Global Manufacturing Corporations

Through strategic partnerships with our global blue-chip customer base, we have innovated and developed industry-leading solutions that are critical to our customers needs. Importantly, we also help our customers achieve their announced sustainability goals, which are extremely important to end-consumers. Our expansive recycling network and comprehensive solutions make us the partner of choice for companies pursuing ambitious sustainability goals and developing products for the circular economy. Our sophisticated R&D capabilities and innovation featured in our customer partnerships require meaningful time and investment, resulting in increased customer retention. These collaborative efforts have led to industry-defining breakthroughs in beverage packaging, automotive, and recycling.

We co-design and innovate with our customers through R&D centers on all our operating continents, which are differentiated through superior design capabilities, pilot lines, CSCs for beverage packaging and automotive, and a dedicated group focused on recycling and casting advancements.

| 15 |

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

Premier Recycling Footprint Driving Lower CO2 Emissions and Reduced Waste to Landfills

We are at the forefront of the sustainability shift, increasing the average recycled content in our products to approximately 61% across our entire portfolio. We continue to actively invest in and expand our recycling footprint to enhance our leadership position in the circular economy. Our largest end-markets have industry-leading recycled content rates: approximately 82% in beverage packaging, 36% in automotive, and more than 90% in North American building & construction. By investing approximately $800 million in recycling capacity over the past 10 years, we increased our recycling capacity and capabilities and doubled the average amount of recycled aluminum in our products. Utilizing recycled material ensures we have highly sustainable metal inputs for our products and reduces our CO2 footprint and the CO2 footprint of our customers and end-consumers. This is because using recycled aluminum reduces the CO2 footprint by 95% compared to using primary aluminum, due to the avoidance of carbon intensive smelting.

We believe that the most sustainable product lifecycle is one based on a circular recycling process. Aluminums circular recycling properties positions us, as compared to producers of other materials, to achieve a circular business model. We partner with customers, suppliers, governments, nonprofits, and communities to reduce the amount of aluminum going into landfills by improving end-of-life recycling rates, especially as it relates to UBCs. We recycled more than 82 billion UBCs in fiscal 2023, and, based on management estimates, anticipate that this number will increase to more than 95 billion once our Bay Minette, Alabama plant is fully operational. We have extensive closed-loop-recycling systems with beverage packaging customers and several automakers. In advance of aluminum-intensive vehicles starting to reach the end of their lifecycle, we are actively developing solutions to increase end-of-life automotive aluminum sheet recycling. We will continue to invest in solutions to meet the growing demand for low CO2 products from our customers, their consumers and the world.

Examples of Our Circular Business Model:

Diversified Portfolio Growth Driven by Under-Supplied Markets and Sustainability Trends

We believe our product portfolio is the broadest in the industry and penetrates a wide range of end-markets particularly in the premium, high-value-added space. While current economic conditions, including inflationary cost pressures on consumers and high interest rates, may impact our growth, our broad end-market participation creates a diversified portfolio of sustainable aluminum solutions, which we believe makes our product offering

| 16 |

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

resilient against periods of macroeconomic volatility. Beverage packaging sheet provides a historically stable revenue stream given the relatively inelastic demand for canned beverages due to customer consumption dynamics. Coupled with our beverage packaging business, we have strong positions in premium end-markets, such as automotive (both ICE and EVs) and aerospace, which both have near-and long-term secular growth trends. Novelis has a diverse customer mix and high share of luxury vehicles and classes of vehicles that are less impacted by market downturns and that are experiencing higher growth. Commercial aerospace companies have multi-year backorders fueled by increasing air-passenger traffic and a need for new aircraft to modernize their fleets. Our specialties end-markets are diverse and cover a wide range of industries from building and construction, signage, foil and packaging, commercial transportation and commercial and consumer products, among others. The U.S. building and construction market is structurally undersupplied and has a favorable long-term demand outlook.

Since inception, we have invested to match the growth of our end-markets and needs of our customers. All our end-markets are forecasted to continue to grow, propelled mainly by the secular shift in consumer demand for sustainable materials like virtually infinitely recyclable, lightweight aluminum. The global FRP aluminum market has grown more than 70% in the past 15 years and is forecasted to grow at a healthy 4% compounded annual growth rate between 2023 and 2028, according to CRU.

Our largest end-market, beverage packaging, is structurally under-supplied today in key geographies, including North America and Europe. North America has been a net importer of beverage packaging sheet since at least 2015, leading to a supply shortfall of approximately 650 kt in 2022, per CRU. At the same time, our customers have announced and begun implementing significant capacity expansions. Ball, Crown, and Ardagh Metal Packaging have announced new beverage packaging manufacturing expansion investments in North America in light of consumption trends. Considering geo-political instability, supply chain disruptions, long lead times, quality concerns, and the higher carbon footprint of imports, beverage packaging makers prefer domestic supply, which supports our investment in Bay Minette, Alabama. We have materially contracted or committed our beverage packaging capacity that will be available in North America through the ramp-up of operations of our Bay Minette, Alabama plant, including with decades-long customer partners such as Ball Corporation and Coca-Cola, underscoring the strong demand for high-recycled-content beverage packaging sheet.

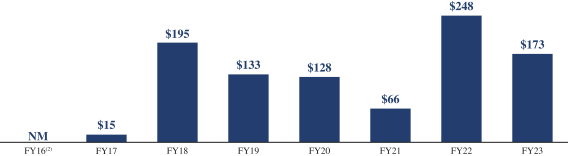

Proven Track Record of Portfolio Reinvention, Recycling Investments, and Operational Excellence

We continue to drive operational efficiencies in our inorganic and organic capacity expansions, enabled by broad operational excellence, and digital and advanced analytics initiatives. We believe these efficiencies, along with shifting our portfolio to premium applications and making investments in recycling, contribute to industry-leading shipments, financial performance, and margins as our net income expanded to $657 million, or $173 per tonne, and our Adjusted EBITDA per tonne expanded to $478 in fiscal 2023, from a net loss of $38 million and Adjusted EBITDA per tonne of $308 in fiscal 2016, enabled by broad operational excellence and our digital/advanced analytics teams.

Our acquisition of Aleris in 2020 further underscores our ability to identify and successfully integrate inorganic capacity, enhance our sustainability efforts, expand our product portfolio with additional high-value solutions, and achieve above expected cost synergies.

| 17 |

Table of Contents

Index to Financial Statements

Confidential Treatment Requested by Novelis Inc.

Pursuant to 17 C.F.R. Section 200.83

Net Income per Tonne(1)

| (1) | Net income per tonne is calculated by dividing net income by rolled product shipments (in tonnes) for the corresponding period. Net income for certain years presented in the chart above includes charges and expenses that management believes are not part of normal day-to-day operations of our business. |

| (2) | Not meaningful because we had a net loss of $38 million for fiscal 2016, or $(12) per tonne. |

Adjusted EBITDA per Tonne(1)